VANCOUVER, BC / ACCESSWIRE / February 22, 2022 / Northern Lights Resources Corp. ("Northern Lights" or the "Company") (CSE:NLR)(OTCQB:NLRCF) is pleased to announce the assay results from the first two drill holes (TC21-02 and TC21-03) completed at the Tin Cup prospect at the Company's 100% owned Secret Pass Gold Project in Mohave County, Arizona.

Assays received for TC21-02 and TC21-03 indicate wide zones of near surface gold mineralization are present at Tin Cup.

- TC21-02 Intersections*:

- 1.61g/t gold over 66.15m from 64.00m, including

- 10.07g/t gold over 7.41m from 117.04m and

- 22.00g/t gold over 2.07m from 122.38m and

- 29.90g/t gold over 0.65m from 123.30m

- TC21-03 Intersections*:

- 0.80g/t gold over 170.57m from 59.55m, including

- 2.32g/t gold over 23.50m from 95.40m

* Intersections are downhole widths as there is insufficient information to calculate true widths at this time.

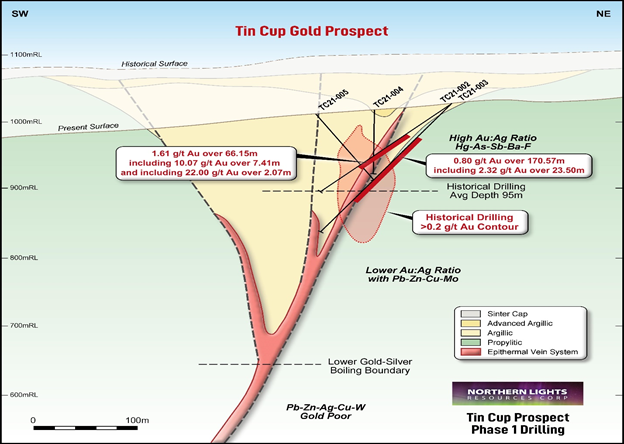

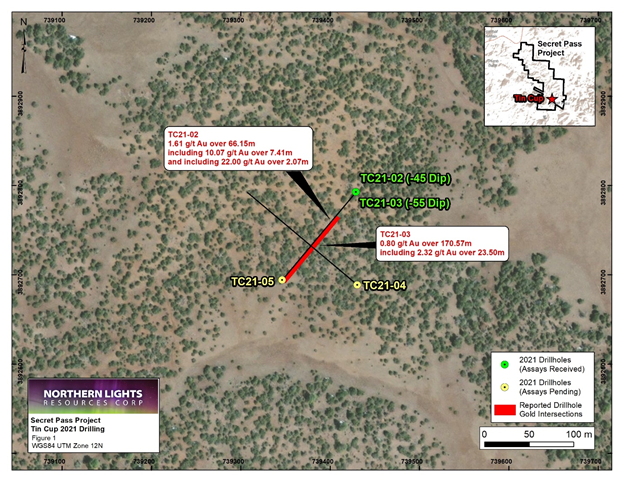

Northern Lights CEO, Jason Bahnsen, commented "The assays received for the first two diamond drill-holes (TC21-02 and TC21-03) at the Tin Cup prospect encountered wide zones of gold mineralization. The holes were drilled across the Tin Cup structure at dips of -45 degrees and -55 degrees respectively. The top of the gold mineralization occurs at a relatively shallow depth of less than 40 metres below surface. Drill hole TC21-02 intersected 66 meters at 1.61 g/t including a higher grade zone of over 7 meters at 10g/t gold. TC21-03 intersected a wider zone of 170 metres averaging 0.80g/t gold including 2.32g/t gold over 23.50m. The drilling returned consistent gold grades over wide zones at shallow depth in the first two drill holes at Tin Cup. We expect to announce the results for the remaining two drill holes at Tin Cup in the near future."

The Tin Cup prospect is fully permitted for drilling and Northern Lights is expediting an aggressive drill program to delineate further gold mineralization. Northern Lights has completed four diamond core drill-holes at Tin Cup, totalling 610 metres. The Company has permits in place to drill three additional holes at Tin Cup and plans to apply for further drill-hole permits following the analysis of the first four drill holes. The gold mineralization at Tin Cup is open at depth and has not yet been tested below the level of historical Reverse Circulation ("RC") drilling (the average depth of the historic RC drilling is approximately 95 metres). The focus of this initial drill program is to confirm the gold mineralization that was previously identified by reverse circulation drilling in the 1980s and to provide additional geological information on the style of gold mineralization. The drill-hole statistics and hole orientations are found in Table 1 and Figures 1 and 2.

All four drill holes intercepted zones of moderate to strong mineralization hosted by strongly altered andesite. Gold primarily occurs as disseminated to fracture-controlled, low temperature mineralization with a moderate to high pyrite/hematite content. The alteration assemblage includes sericite, quartz, chlorite and carbonate. Brecciated and gouge-filled fault zones were encountered in both drill holes and contained disseminated pyrite. Gold mineralization at the Tin Cup is associated with northwest trending structures and splays, predominantly in the andesite and along the margins of the rhyolite dikes.

Table 1: Completed Phase 1 Drill Holes at Tin Cup

Hole No. | Location | Azimuth (o) | Dip (o) | Length (m) |

TC21-01 | Tin Cup | abandoned | ||

TC21-02 | Tin Cup | 220 | -45 | 175 |

TC21-03 | Tin Cup | 220 | -55 | 230 |

TC21-04 | Tin Cup | 310 | -50 | 103 |

TC21-05 | Tin Cup | 040 | -60 | 102 |

Total | 610 |

Figure 1: Tin Cup Phase 1 Drilling Cross Section

Figure 2 - Tin Cup Phase 1 Drilling Plan View

About the Tin Cup Prospect

The Tin Cup Prospect is localized along the steeply northeast-dipping Frisco Mine Fault. The gold mineralization is hosted by Tertiary andesite and associated with the margins of rhyolite dykes that occur as lenses within the Frisco Mine Fault. A few of the deepest historic drill holes intersected gold mineralization in the Proterozoic basement granite.

The mineralized zone at Tin Cup has a drill indicated depth of 180 metres and is open along strike and depth. Higher grademineralization (greater than 10 g/t Au), is localized in narrow sub-vertical structures developed within broader zones of lower grade mineralization ranging up to 86 metres in width. The mineralization plunges to the northwest at 50 degrees. Surface oxidation is variable extending to a maximum depth of up to120 metres based on historical drilling.

Tin Cup is located in the Frisco-Catherine Gold district of Northwest Arizona, approximately 8 kilometres Northeast of the Moss Mine operated by Elevation Gold (TSX:ELVT). The Moss Mine is a heap leach open pit gold mine operating at an average mined grade of 0.45g/t gold (see ELVT Sept 30, 2021, Quarterly Report announced November 26, 2021). Note, the reference to the Elevation Gold or the Moss Mine is for illustration purposes only and should not be compared to the Tin Cup Prospect. There is no certainty that the Tin Cup Prospect contains economic gold mineralization or will develop into an operating gold mine.

QA/QC Statement

Diamond Core (HQ size) was drilled by Godbe Drilling LLC under the supervision of Mr. Lee Beasley, QP for Northern Lights Resources. The core was split with the half core transported to Skyline Assayers and Laboratories (Skyline) in Tucson, AZ. Field control QA/QC samples, including standards, blanks, and field duplicates, were inserted into the sample stream at a rate of one field control sample every 20 regular samples. Samples received by the lab are logged, weighted and assigned into batches. Sample preparation begins with crushing samples to 75% passing -10 mesh. From this sample, 250 grams of material is separated using a riffle splitter which is then further pulverized to at least 95% - 150 mesh resulting in a pulp that is ready for analysis. Gold was determined by fire assay fusion of a 30 gram sub-samples with atomic absorption spectroscopy (method FA-01). Overlimit samples of gold ( greater than 5 g/t) were assayed by gravimetric means (FA-02). Skyline Laboratories is accredited in accordance with ISO/IEC 17025:2017 and ISO 9001:2015.

Competent Persons Statement

Information in this report relating to Exploration Results is based on information reviewed by Mr. Lee R. Beasley, a Certified Professional Geologist who is a Member of the American Institute of Professional Geologists, and a consultant to Northern Lights Resources. Mr. Beasley has sufficient experience which is relevant to the style of mineralization and type of deposit under consideration and to the activity which he is undertaking to qualify as a Qualified Person for the purposes of NI43-101 Standards of Disclosure for Mineral Projects. Mr. Beasley consents to the inclusion of the data in the form and context in which it appears.

For further information, please contact:

Albert Timcke, Executive Chairman and President

Email: rtimcke@northernlightsresources.com

Tel: +1 604 608 6163

Jason Bahnsen, Chief Executive Officer

Email: Jason@northernlightsresources.com

Tel: +1 604 608 6163

Shawn Balaghi, Investor Relations

Email: shawn@northernlightsresources.com

Tel: +1 604 773 0242

About Northern Lights Resources Corp.

Northern Lights Resources Corp is a growth-oriented exploration and development company that is advancing two projects: The 100% owned, Secret Pass Gold Project located in Arizona; and the Medicine Springs silver-zinc-lead Project located in Elko County Nevada where Northern Lights, in joint venture with Reyna Silver are earning 100% ownership. Northern Lights Resources is a member of the Arizona Mining Association.

Northern Lights Resources trades under the ticker of "NLR" on the CSE and "NLRCF" on the OTCQB. This and other Northern Lights Resources news releases can be viewed at www.sedar.com and www.northernlightsresources.com.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements with respect to: the terms and conditions of the proposed private placement; use of funds; the business and operations of the Company after the proposed closing of the Offering. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: general business, economic, competitive, political and social uncertainties; delay or failure to receive board, shareholder or regulatory approvals; and the uncertainties surrounding the mineral exploration industry. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

SOURCE: Northern Lights Resources Corp.

View source version on accesswire.com:

https://www.accesswire.com/689690/Tin-Cup-Drill-Holes-Intercept-Wide-Zones-of-Gold-Mineralization