FORT WORTH, TEXAS / ACCESSWIRE / August 1, 2022 / Trinity Bank N.A. (OTC PINK:TYBT) today announced operating results for the three months ending June 30, 2022 and YTD results for the six months ending June 30, 2022.

Results of Operations

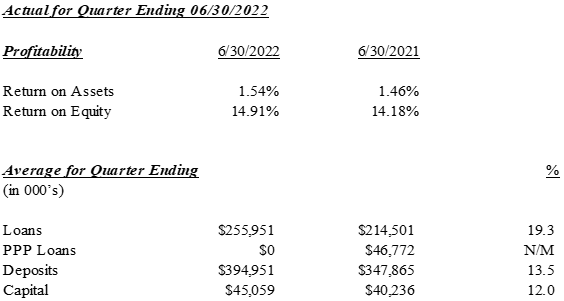

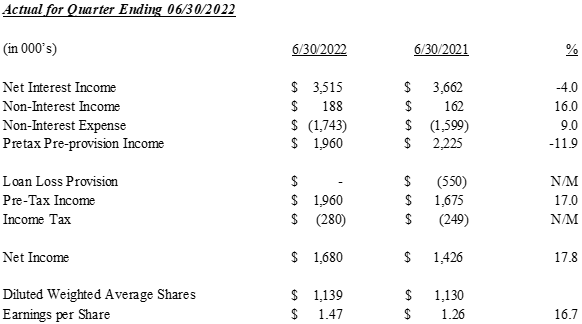

Trinity Bank, N.A. reported Net Income after Taxes of $1,680,000 or $1.47 per diluted common share for the first quarter of 2022, compared to $1,426,000 or $1.26 per diluted common share for the second quarter of 2021, an increase of 16.7%.

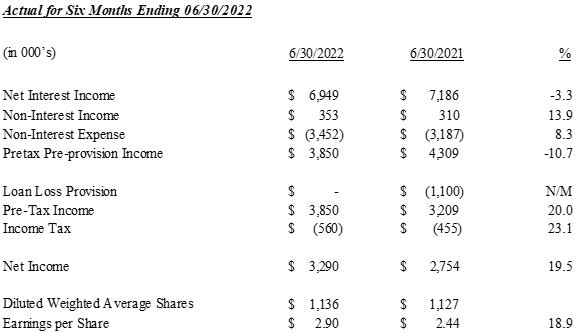

For the first six months of 2022, Net Income after Taxes amounted to $3,290,000, an increase of 19.5% over the first half of 2021 results of $2,754,000. Earnings per diluted common share for the first half of 2022 were $2.90, an increase of 18.9% over the first half of 2021 results of $2.44 per diluted common share

Jeffrey M. Harp, Chairman, stated, "We are pleased to announce that 2Q 2022 performance produced the best quarterly profit for Trinity Bank since inception in 2003. Loans and Deposits continue to grow. Return on Assets and Return on Equity remain well above both national and local peer groups. Our borrowers continue to perform well in an unsettled economic environment."

"After many years of maintaining artificially low interest rates, the Federal Reserve has embarked on a program to rapidly raise interest rates to combat the inflation that we all see on a daily basis. We have had four prime rate increases in four months (from 3.25% to 5.50%). While this helps our interest income, we also must increase deposit rates in line with our philosophy to pay as much as we can instead of as little as we can get by with. For example, we are offering one-year CD's at a 2.40% rate - well above the local market."

"In my 51 years in this business in this market, I can only say that we are in unprecedented times. Our goal remains to ADAPT, IMPROVISE, and OVERCOME. We strive to provide exceptional service to existing customers and attract new relationships with quality people. We intend to continue to maintain a strong capital base with above-average profitability and efficiency as we prepare for whatever the future holds."

Trinity Bank, N.A. is a commercial bank that began operations May 28, 2003. For a full financial statement, visit Trinity Bank's website: www.trinitybk.com Regulatory reporting format is also available at www.fdic.gov.

For information contact:

Richard Burt

Executive Vice President

Trinity Bank

817-763-9966

This Press Release may contain certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 regarding future financial conditions, results of operations and the Bank's business operations. Such forward-looking statements involve risks, uncertainties and assumptions, including, but not limited to, monetary policy and general economic conditions in Texas and the greater Dallas-Fort Worth metropolitan area, the risks of changes in interest rates on the level and composition of deposits, loan demand and the values of loan collateral, securities and interest rate protection agreements, the actions of competitors and customers, the success of the Bank in implementing its strategic plan, the failure of the assumptions underlying the reserves for loan losses and the estimations of values of collateral and various financial assets and liabilities, that the costs of technological changes are more difficult or expensive than anticipated, the effects of regulatory restrictions imposed on banks generally, any changes in fiscal, monetary or regulatory policies and other uncertainties as discussed in the Bank's Registration Statement on Form SB‑1 filed with the Office of the Comptroller of the Currency. Should one or more of these risks or uncertainties materialize, or should these underlying assumptions prove incorrect, actual outcomes may vary materially from outcomes expected or anticipated by the Bank. A forward-looking statement may include a statement of the assumptions or bases underlying the forward‑looking statement. The Bank believes it has chosen these assumptions or bases in good faith and that they are reasonable. However, the Bank cautions you that assumptions or bases almost always vary from actual results, and the differences between assumptions or bases and actual results can be material. The Bank undertakes no obligation to publicly update or otherwise revise any forward‑looking statements, whether as a result of new information, future events or otherwise, unless the securities laws require the Bank to do so.

TRINITY BANK N.A.

(Unaudited)

(Dollars in thousands, except per share data)

| Quarter Ended | Six Months Ending | |||||||||||||||||||

| June 30 | % | June 30 | % | |||||||||||||||||

EARNINGS SUMMARY | 2022 | 2021 | Change | 2022 | 2021 | Change | ||||||||||||||

Interest income | $ | 3,763 | $ | 3,806 | -1.1 | % | $ | 7,363 | $ | 7,462 | -1.3 | % | ||||||||

Interest expense | 248 | 144 | 72.2 | % | 414 | 276 | 50.0 | % | ||||||||||||

Net Interest Income | 3,515 | 3,662 | -4.0 | % | 6,949 | 7,186 | -3.3 | % | ||||||||||||

Service charges on deposits | 62 | 58 | 6.9 | % | 123 | 115 | 7.0 | % | ||||||||||||

Other income | 126 | 104 | 21.2 | % | 230 | 195 | 17.9 | % | ||||||||||||

Total Non Interest Income | 188 | 162 | 16.0 | % | 353 | 310 | 13.9 | % | ||||||||||||

Salaries and benefits expense | 1,096 | 1,080 | 1.5 | % | 2,095 | 2,039 | 2.7 | % | ||||||||||||

Occupancy and equipment expense | 111 | 114 | -2.6 | % | 221 | 238 | -7.1 | % | ||||||||||||

Other expense | 536 | 405 | 32.3 | % | 1,136 | 910 | 24.8 | % | ||||||||||||

Total Non Interest Expense | 1,743 | 1,599 | 9.0 | % | 3,452 | 3,187 | 8.3 | % | ||||||||||||

Pretax pre-provision income | 1,960 | 2,225 | -11.9 | % | 3,850 | 4,309 | -10.7 | % | ||||||||||||

Gain on sale of securities | 0 | 0 | N/M | 0 | 0 | N/M | ||||||||||||||

Gain on sale of foreclosed assets | 0 | 0 | N/M | 0 | 0 | N/M | ||||||||||||||

Gain on sale of assets | 0 | 0 | N/M | 0 | 0 | N/M | ||||||||||||||

Provision for Loan Losses | 0 | 550 | -100.0 | % | 0 | 1,100 | -100.0 | % | ||||||||||||

Earnings before income taxes | 1,960 | 1,675 | 17.0 | % | 3,850 | 3,209 | 20.0 | % | ||||||||||||

Provision for income taxes | 280 | 249 | N/M | 560 | 455 | 23.1 | % | |||||||||||||

Net Earnings | $ | 1,680 | $ | 1,426 | 17.8 | % | $ | 3,290 | $ | 2,754 | 19.5 | % | ||||||||

Basic earnings per share | 1.54 | 1.32 | 16.8 | % | 3.02 | 2.55 | 18.5 | % | ||||||||||||

Basic weighted average shares | 1,093 | 1,084 | 1,090 | 1,081 | ||||||||||||||||

outstanding | ||||||||||||||||||||

Diluted earnings per share - estimate | 1.47 | 1.26 | 16.7 | % | 2.90 | 2.44 | 18.9 | % | ||||||||||||

Diluted weighted average shares outstanding | 1,139 | 1,130 | 1,136 | 1,127 | ||||||||||||||||

| Average for Quarter | Average for Six Months | |||||||||||||||||||

| June 30 | % | June 30 | % | |||||||||||||||||

BALANCE SHEET SUMMARY | 2022 | 2021 | Change | 2022 | 2021 | Change | ||||||||||||||

Total loans | $ | 255,951 | $ | 261,273 | -2.0 | % | $ | 249,955 | $ | 262,025 | -4.6 | % | ||||||||

Total short term investments | 30,993 | 28,242 | 9.7 | % | 29,696 | 19,931 | 49.0 | % | ||||||||||||

Total investment securities | 142,743 | 96,153 | 48.5 | % | 142,526 | 95,251 | 49.6 | % | ||||||||||||

Earning assets | 429,687 | 385,668 | 11.4 | % | 422,177 | 377,207 | 11.9 | % | ||||||||||||

Total assets | 437,237 | 391,571 | 11.7 | % | 429,441 | 383,478 | 12.0 | % | ||||||||||||

Noninterest bearing deposits | 164,965 | 136,853 | 20.5 | % | 159,530 | 142,334 | 12.1 | % | ||||||||||||

Interest bearing deposits | 229,986 | 211,012 | 9.0 | % | 225,947 | 197,935 | 14.2 | % | ||||||||||||

Total deposits | 394,951 | 347,865 | 13.5 | % | 385,477 | 340,269 | 13.3 | % | ||||||||||||

Fed Funds Purchased and Repurchase Agreements | 0 | 0 | N/M | 0 | 122 | N/M | ||||||||||||||

Shareholders' equity | $ | 45,059 | $ | 40,236 | 12.0 | % | $ | 44,475 | $ | 39,713 | 12.0 | % | ||||||||

TRINITY BANK N.A.

(Unaudited)

(Dollars in thousands, except per share data)

| Average for Quarter Ending | ||||||||||||||||

| June 30, | March 31, | Dec 31, | Sept. 30, | June 30, | ||||||||||||

BALANCE SHEET SUMMARY | 2022 | 2022 | 2021 | 2021 | 2021 | |||||||||||

Total loans | $ | 255,951 | $ | 240,831 | $ | 236,698 | $ | 222,400 | $ | 214,501 | ||||||

Total PPP loans | 0 | $ | 3,062 | 11,585 | 27,071 | 46,772 | ||||||||||

Total short term investments | 30,993 | 28,809 | 33,497 | 26,122 | 28,242 | |||||||||||

Total investment securities | 142,743 | 142,717 | 128,283 | 113,914 | 96,153 | |||||||||||

Earning assets | 429,687 | 415,419 | 410,063 | 389,507 | 385,668 | |||||||||||

Total assets | 437,237 | 421,711 | 416,766 | 395,762 | 391,571 | |||||||||||

Noninterest bearing deposits | 164,965 | 154,029 | 170,822 | 143,056 | 136,853 | |||||||||||

Interest bearing deposits | 229,986 | 221,868 | 215,287 | 207,369 | 211,012 | |||||||||||

Total deposits | 394,951 | 375,897 | 386,109 | 350,425 | 347,865 | |||||||||||

Fed Funds Purchased and Repurchase Agreements | 0 | 0 | 0 | 0 | 0 | |||||||||||

Shareholders' equity | $ | 45,059 | $ | 44,456 | $ | 43,113 | $ | 41,723 | $ | 40,236 | ||||||

| Quarter Ended | ||||||||||||||||

| June 30, | March 31, | Dec 31, | Sept. 30, | June 30, | ||||||||||||

HISTORICAL EARNINGS SUMMARY | 2022 | 2022 | 2021 | 2021 | 2021 | |||||||||||

Interest income less PPP | $ | 3,763 | $ | 3,321 | $ | 3,302 | $ | 3,162 | $ | 3,021 | ||||||

PPP interest and fees | 0 | 278 | 245 | 530 | 785 | |||||||||||

Interest expense | 248 | 165 | 159 | 150 | 144 | |||||||||||

Net Interest Income | 3,515 | 3,434 | 3,388 | 3,542 | 3,662 | |||||||||||

Service charges on deposits | 62 | 59 | 58 | 56 | 58 | |||||||||||

Other income | 126 | 106 | 108 | 111 | 104 | |||||||||||

Total Non Interest Income | 188 | 165 | 166 | 167 | 162 | |||||||||||

Salaries and benefits expense | 1,096 | 999 | 1,009 | 1,127 | 1,080 | |||||||||||

Occupancy and equipment expense | 111 | 110 | 108 | 121 | 114 | |||||||||||

Other expense | 536 | 600 | 540 | 430 | 405 | |||||||||||

Total Non Interest Expense | 1,743 | 1,709 | 1,657 | 1,678 | 1,599 | |||||||||||

Pretax pre-provision income | 1,960 | 1,890 | 1,897 | 2,031 | 2,225 | |||||||||||

Gain on sale of securities | 0 | 0 | 0 | 0 | 0 | |||||||||||

Gain on sale of foreclosed assets | 0 | 0 | 0 | 0 | 0 | |||||||||||

Gain on sale of other assets | 0 | 0 | 0 | 0 | 0 | |||||||||||

Provision for Loan Losses | 0 | 0 | 0 | 290 | 550 | |||||||||||

Earnings before income taxes | 1,960 | 1,890 | 1,897 | 1,741 | 1,675 | |||||||||||

Provision for income taxes | 280 | 280 | 305 | 265 | 249 | |||||||||||

Net Earnings | $ | 1,680 | $ | 1,610 | $ | 1,592 | $ | 1,476 | $ | 1,426 | ||||||

Diluted earnings per share | $ | 1.47 | $ | 1.42 | $ | 1.41 | $ | 1.30 | $ | 1.26 | ||||||

TRINITY BANK N.A.

(Unaudited)

(Dollars in thousands, except per share data)

| Ending Balance | ||||||||||||||||||||

| June 30, | March 31, | Dec 31, | Sept. 30, | June 30, | ||||||||||||||||

HISTORICAL BALANCE SHEET | 2022 | 2022 | 2021 | 2021 | 2021 | |||||||||||||||

Total loans | $ | 267,163 | $ | 247,358 | $ | 240,283 | $ | 228,976 | $ | 215,085 | ||||||||||

Total PPP loans | 0 | - | 9,380 | 20,911 | 34,305 | |||||||||||||||

Total short term investments | 19,635 | 39,776 | 41,153 | 34,818 | 31,247 | |||||||||||||||

Total investment securities | 142,834 | 138,793 | 137,387 | 117,844 | 100,499 | |||||||||||||||

Total earning assets | 429,632 | 425,927 | 428,203 | 402,549 | 381,136 | |||||||||||||||

Allowance for loan losses | (4,314 | ) | (4,314 | ) | (4,306 | ) | (4,306 | ) | (4,016 | ) | ||||||||||

Premises and equipment | 2,019 | 2,065 | 2,118 | 2,179 | 2,218 | |||||||||||||||

Other Assets | 11,260 | 10,557 | 5,802 | 6,803 | 10,507 | |||||||||||||||

Total assets | 438,597 | 434,235 | 431,817 | 407,225 | 389,845 | |||||||||||||||

Noninterest bearing deposits | 170,661 | 158,072 | 167,497 | 148,238 | 149,049 | |||||||||||||||

Interest bearing deposits | 226,141 | 233,142 | 218,611 | 214,162 | 196,355 | |||||||||||||||

Total deposits | 396,802 | 391,214 | 386,108 | 362,400 | 345,404 | |||||||||||||||

Fed Funds Purchased and Repurchase Agreements | 0 | 0 | 0 | 0 | 0 | |||||||||||||||

Other Liabilities | 1,474 | 2,033 | 1,181 | 1,834 | 1,539 | |||||||||||||||

Total liabilities | 398,276 | 393,247 | 387,289 | 364,234 | 346,943 | |||||||||||||||

Shareholders' Equity Actual | 45,830 | 44,093 | 43,113 | 41,465 | 40,957 | |||||||||||||||

Unrealized Gain/Loss - AFS | (5,509 | ) | (3,105 | ) | 1,415 | 1,526 | 1,945 | |||||||||||||

Total Equity | $ | 40,321 | $ | 40,988 | $ | 44,528 | $ | 42,991 | $ | 42,902 | ||||||||||

| Quarter Ending | ||||||||||||||||||||

| June 30, | March 31, | Dec 31, | Sept. 30, | June 30, | ||||||||||||||||

NONPERFORMING ASSETS | 2022 | 2022 | 2021 | 2021 | 2021 | |||||||||||||||

Nonaccrual loans | $ | 211 | $ | 239 | $ | 259 | $ | 279 | $ | 297 | ||||||||||

Restructured loans | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | ||||||||||

Other real estate & foreclosed assets | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | ||||||||||

Accruing loans past due 90 days or more | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | ||||||||||

Total nonperforming assets | $ | 211 | $ | 239 | $ | 259 | $ | 279 | $ | 297 | ||||||||||

Accruing loans past due 30-89 days | $ | 0 | $ | 0 | $ | 0 | $ | 600 | $ | 0 | ||||||||||

| Total nonperforming assets as a percentage | ||||||||||||||||||||

of loans and foreclosed assets | 0.08 | % | 0.10 | % | 0.11 | % | 0.12 | % | 0.12 | % | ||||||||||

TRINITY BANK N.A.

(Unaudited)

(Dollars in thousands, except per share data)

| Quarter Ending | ||||||||||||||||||||

ALLOWANCE FOR | June 30, | March 31, | Dec 31, | Sept. 30, | June 30, | |||||||||||||||

LOAN LOSSES | 2022 | 2022 | 2021 | 2021 | 2021 | |||||||||||||||

Balance at beginning of period | $ | 4,314 | $ | 4,306 | $ | 4,306 | $ | 4,016 | $ | 3,466 | ||||||||||

Loans charged off | 0 | 0 | 0 | 0 | 0 | |||||||||||||||

Loan recoveries | 0 | 8 | 0 | 0 | 0 | |||||||||||||||

Net (charge-offs) recoveries | 0 | 8 | 0 | 0 | 0 | |||||||||||||||

Provision for loan losses | 0 | 0 | 0 | 290 | 550 | |||||||||||||||

Balance at end of period | $ | 4,314 | $ | 4,314 | $ | 4,306 | $ | 4,306 | $ | 4,016 | ||||||||||

Allowance for loan losses | 1.61 | % | 1.74 | % | 1.72 | % | 1.88 | % | 1.61 | % | ||||||||||

as a percentage of total loans | ||||||||||||||||||||

Allowance for loan losses net of PPP Loans | 1.61 | % | 1.74 | % | 1.79 | % | 1.94 | % | 1.86 | % | ||||||||||

as a percentage of total loans | ||||||||||||||||||||

Allowance for loan losses | 2045 | % | 1805 | % | 1663 | % | 1543 | % | 1352 | % | ||||||||||

as a percentage of nonperforming assets | ||||||||||||||||||||

Net charge-offs (recoveries) as a | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | ||||||||||

percentage of average loans | ||||||||||||||||||||

Provision for loan losses | 0.00 | % | 0.00 | % | 0.00 | % | 0.13 | % | 0.21 | % | ||||||||||

as a percentage of average loans | ||||||||||||||||||||

| Quarter Ending | ||||||||||||||||||||

| June 30, | March 31, | Dec 31, | Sept. 30, | June 30, | ||||||||||||||||

SELECTED RATIOS | 2022 | 2022 | 2021 | 2021 | 2021 | |||||||||||||||

Return on average assets (annualized) | 1.54 | % | 1.53 | % | 1.53 | % | 1.49 | % | 1.46 | % | ||||||||||

Return on average equity (annualized) | 15.92 | % | 15.71 | % | 14.60 | % | 13.50 | % | 13.51 | % | ||||||||||

Return on average equity (excluding unrealized gain on investments) | 14.91 | % | 14.61 | % | 15.06 | % | 14.15 | % | 14.18 | % | ||||||||||

Average shareholders' equity to average assets | 10.31 | % | 10.54 | % | 10.34 | % | 10.54 | % | 10.28 | % | ||||||||||

Yield on earning assets (tax equivalent) | 3.68 | % | 3.64 | % | 3.95 | % | 3.97 | % | 4.11 | % | ||||||||||

Effective Cost of Funds | 0.23 | % | 0.16 | % | 0.15 | % | 0.16 | % | 0.14 | % | ||||||||||

Net interest margin (tax equivalent) | 3.45 | % | 3.48 | % | 3.80 | % | 3.81 | % | 3.97 | % | ||||||||||

Efficiency ratio (tax equivalent) | 44.9 | % | 45.2 | % | 44.5 | % | 43.3 | % | 40.5 | % | ||||||||||

End of period book value per common share | $ | 36.89 | $ | 37.50 | $ | 41.12 | $ | 39.66 | $ | 39.47 | ||||||||||

End of period book value (excluding unrealized gain on investments) | $ | 41.93 | $ | 40.34 | $ | 39.81 | $ | 38.25 | $ | 37.68 | ||||||||||

End of period common shares outstanding (in 000's) | 1,093 | 1,093 | 1,083 | 1,084 | 1,087 | |||||||||||||||

TRINITY BANK N.A.

(Unaudited)

(Dollars in thousands, except per share data)

| Quarter Ending | ||||||||||||||||||||||||||||||||

| June 30,2022 | June 30,2021 | |||||||||||||||||||||||||||||||

| Average | Tax Equivalent | Average | Tax Equivalent | |||||||||||||||||||||||||||||

YIELD ANALYSIS | Balance | Interest | Yield | Yield | Balance | Interest | Yield | Yield | ||||||||||||||||||||||||

Interest Earning Assets: | ||||||||||||||||||||||||||||||||

Short term investment | $ | 30,574 | 58 | 0.76 | % | 0.76 | % | $ | 27,838 | 11 | 0.16 | % | 0.16 | % | ||||||||||||||||||

FRB Stock | 419 | 6 | 6.00 | % | 6.00 | % | 404 | 6 | 6.00 | % | 6.00 | % | ||||||||||||||||||||

Taxable securities | 1,297 | 0 | 0.00 | % | 0.00 | % | 2,198 | 0 | 0.00 | % | 0.00 | % | ||||||||||||||||||||

Tax Free securities | 141,446 | 734 | 2.08 | % | 2.63 | % | 93,955 | 605 | 2.58 | % | 3.26 | % | ||||||||||||||||||||

Loans | 255,951 | 2,965 | 4.63 | % | 4.63 | % | 261,273 | 3,184 | 4.87 | % | 4.87 | % | ||||||||||||||||||||

Total Interest Earning Assets | 429,687 | 3,763 | 3.50 | % | 3.68 | % | 385,668 | 3,806 | 3.95 | % | 4.11 | % | ||||||||||||||||||||

Noninterest Earning Assets: | ||||||||||||||||||||||||||||||||

Cash and due from banks | 6,061 | 5,510 | ||||||||||||||||||||||||||||||

Other assets | 5,803 | 4,095 | ||||||||||||||||||||||||||||||

Allowance for loan losses | (4,314 | ) | (3,702 | ) | ||||||||||||||||||||||||||||

Total Noninterest Earning Assets | 7,550 | 5,903 | ||||||||||||||||||||||||||||||

Total Assets | $ | 437,237 | $ | 391,571 | ||||||||||||||||||||||||||||

Interest Bearing Liabilities: | ||||||||||||||||||||||||||||||||

Transaction and Money Market accounts | 185,133 | 186 | 0.40 | % | 0.40 | % | 159,448 | 90 | 0.23 | % | 0.23 | % | ||||||||||||||||||||

Certificates and other time deposits | 32,091 | 41 | 0.51 | % | 0.51 | % | 41,564 | 41 | 0.39 | % | 0.39 | % | ||||||||||||||||||||

Other borrowings | 12,762 | 21 | 0.66 | % | 0.66 | % | 10,000 | 13 | 0.52 | % | 0.52 | % | ||||||||||||||||||||

Total Interest Bearing Liabilities | 229,986 | 248 | 0.43 | % | 0.43 | % | 211,012 | 144 | 0.27 | % | 0.27 | % | ||||||||||||||||||||

Noninterest Bearing Liabilities: | ||||||||||||||||||||||||||||||||

Demand deposits | 164,965 | 136,853 | ||||||||||||||||||||||||||||||

Other liabilities | 1,607 | 1,484 | ||||||||||||||||||||||||||||||

Shareholders' Equity | 40,679 | 42,222 | ||||||||||||||||||||||||||||||

Total Liabilities and Shareholders Equity | $ | 437,237 | $ | 391,571 | ||||||||||||||||||||||||||||

Net Interest Income and Spread | 3,515 | 3.07 | % | 3.25 | % | 3,662 | 3.67 | % | 3.84 | % | ||||||||||||||||||||||

Net Interest Margin | 3.27 | % | 3.45 | % | 3.80 | % | 3.97 | % | ||||||||||||||||||||||||

TRINITY BANK N.A.

(Unaudited)

(Dollars in thousands, except per share data)

| June 30 | June 30 | |||||||||||||||

| 2022 | % | 2021 | % | |||||||||||||

| LOAN PORTFOLIO | ||||||||||||||||

Commercial and industrial | $ | 158,935 | 59.49 | % | $ | 147,373 | 59.09 | % | ||||||||

Real estate: | ||||||||||||||||

Commercial | 64,560 | 24.17 | % | 61,051 | 24.48 | % | ||||||||||

Residential | 18,396 | 6.89 | % | 17,149 | 6.88 | % | ||||||||||

Construction and development | 25,001 | 9.36 | % | 23,476 | 9.41 | % | ||||||||||

Consumer | 271 | 0.10 | % | 341 | 0.14 | % | ||||||||||

Total loans (gross) | 267,163 | 100.00 | % | 249,390 | 100.00 | % | ||||||||||

Unearned discounts | 0 | 0.00 | % | 0 | 0.00 | % | ||||||||||

Total loans (net) | $ | 267,163 | 100.00 | % | $ | 249,390 | 100.00 | % | ||||||||

| June 30 | June 30 | |||||||

| 2022 | 2021 | |||||||

| REGULATORY CAPITAL DATA | ||||||||

Tier 1 Capital | $ | 45,830 | $ | 40,955 | ||||

Total Capital (Tier 1 + Tier 2) | $ | 49,565 | $ | 42,900 | ||||

Total Risk-Adjusted Assets | $ | 298,259 | $ | 236,963 | ||||

Tier 1 Risk-Based Capital Ratio | 15.37 | % | 17.28 | % | ||||

Total Risk-Based Capital Ratio | 16.62 | % | 18.54 | % | ||||

Tier 1 Leverage Ratio | 10.48 | % | 10.54 | % | ||||

OTHER DATA | ||||||||

Full Time Equivalent | ||||||||

Employees (FTE's) | 24 | 23 | ||||||

Stock Price Range | ||||||||

(For the Three Months Ended): | ||||||||

High | $ | 88.75 | $ | 75.00 | ||||

Low | $ | 80.01 | $ | 61.31 | ||||

Close | $ | 88.75 | $ | 75.00 | ||||

SOURCE: Trinity Bank N.A.

View source version on accesswire.com:

https://www.accesswire.com/710430/Trinity-Bank-Reports-Return-On-Assets-154-Return-on-Equity-1491