TORONTO, ON / ACCESSWIRE / February 7, 2023 / Vox Royalty Corp. (TSXV:VOX)(NASDAQ: VOXR) ("Vox" or the "Company"), a returns focused mining royalty company, is pleased to provide recent development and exploration updates from royalty operating partners Silver Mines Limited (ASX: SVL) ("Silver Mines"), Develop Global Limited (ASX: DVP) ("Develop"), Genesis Minerals Ltd. (ASX: GMD) ("Genesis"), and Black Cat Syndicate Limited (ASX: BC8) ("Black Cat").

Kyle Floyd, Chief Executive Officer stated: "Building on the momentum of our recent record 2022 preliminary revenues announcement, we are excited to provide meaningful developments on several royalty assets, including that a final permitting determination at the Bowdens silver project is expected in February 2023. In addition, Sulphur Springs is tracking well to be ‘shovel ready' by mid-2023, the Puzzle North discovery is being fast-tracked towards feasibility by Genesis next quarter and a commercialization decision is expected at the Myhree gold deposit in March 2023. This progress continues to support management's confidence for organic revenue growth in 2023 and beyond."

Key Updates

- Bowdens silver project final determination hearing scheduled in February 2023, as well as the appointment of a General Manager for project development and ongoing gold drilling exploration by Silver Mines;

- Technical analysis work is underway by Develop at Sulphur Springs to redesign development plans, revise project costings and explore numerous funding options with the objective of having Sulphur Springs ‘shovel ready' by the middle of 2023;

- Strong Puzzle North infill drilling results announced by Genesis and a maiden reserve and feasibility study is expected in June 2023, representing only two years from initial discovery to feasibility; and

- Bulong tolling discussions are continuing and a commercialisation decision by Black Cat is expected at the royalty-linked Myhree gold deposit in March 2023.

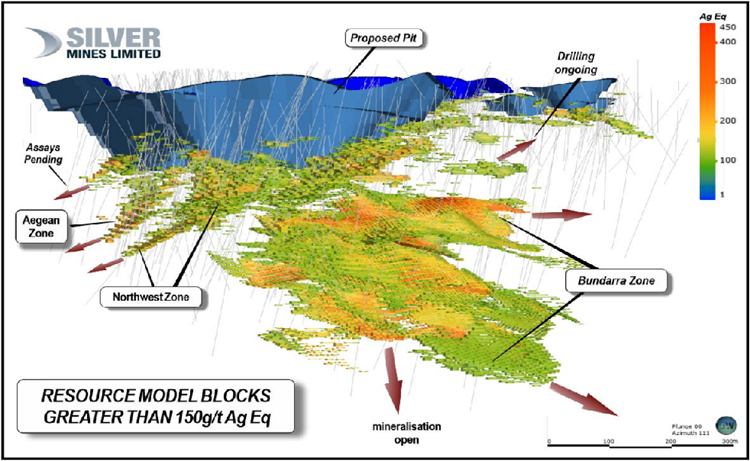

Bowdens (Development - New South Wales, Australia) - Final Permitting, GM Appointment & Drilling Success

- Vox holds a 0.85% gross revenue royalty on the Bowdens silver-lead-zinc project ("Bowdens Silver Project") and a 1% gross revenue royalty over surrounding regional exploration tenure;

- On December 23, 2022, Silver Mines announced:

- The New South Wales Department of Planning and Environment ("DPE") has assessed the Bowdens Silver Project as approvable subject to conditions of consent;

- The DPE has now referred the project to the Independent Planning Commission of New South Wales ("IPC") for final determination;

- The Bowdens Silver Project team has reviewed and has accepted the recommended conditions of consent as provided with DPE's Assessment Report; and

- According to the DPA Assessment Report: "The Bowdens Silver Project is Australia's largest undeveloped silver deposit and one of the largest globally. The mine's 23-year life, including 16.5 years of silver production and by-products of zinc and lead, underpins significant value potential for Bowdens Silver."

- On January 27, 2023, and January 30, 2023, Silver Mines announced:

- The appointment of Mr. Joel Ray as General Manager of the Bowdens Silver Project;

- The IPC has called a Public Hearing for the 15th, 16th and 17th of February 2023 with a final determination to be made soon thereafter;

- The footprint of gold mineralisation has been expanded in the Southern Gold Zone to 300 metres in strike, 200 metres width and between 15 to 85 metres in thickness; and

- The Company is continuing a 15,000 metre program of diamond drilling at the Bowdens Silver Project and 3,000 metres of regional exploration drilling into the first half 2023.

- Vox Management Summary: With the appointment of a General Manager for mine development and final permitting milestones expected this quarter, Bowdens is rapidly moving towards a construction decision. With continued drilling success, including the emerging Southern Gold Zone, Vox management is optimistic that this major silver project has growing potential to generate royalty revenue for over 20 years, assuming it commences and maintains commercial production.

Sulphur Springs (Feasibility - Western Australia) - Ore Reserve Estimation Underway for mid-2023 Shovel Ready Target

- Vox holds a A$2.00/tonne production royalty (capped at A$3.7M) on the Sulphur Springs copper-zinc deposit and an uncapped A$0.80/tonne production royalty on the Kangaroo Caves copper-zinc deposit, which is part of the combined Sulphur Springs Project in Western Australia;

- In November 2022, Develop's company presentation included the following targeted milestones:

- Redesign of the proposed underground mine and open pit using the recently updated resource model to generate an updated reserve by early 2023;

- Update all the project cost inputs (mining, processing and surface infrastructure) by early 2023;

- Produce an updated net present value estimate for the project in the March Quarter 2023;

- To have Sulphur Springs ‘shovel ready' by the middle of 2023; and

- Advance financing options in second half of 2023.

- On January 19, 2023, Develop announced:

- The Sulphur Springs Project has all the required approvals that allow for full regulatory implementation of the mine development and operation;

- The updated Sulphur Springs Resource paves the way for an increased reserve estimate, optimized mine development plan, revised project costings and the ability to explore numerous funding options, which are all currently underway by the recent key personnel appointments; and

- Develop completed a 15-hole (5,584 metres) Reverse-Circulation exploration drilling program at the Sulphur Springs and Kangaroo Caves deposits, with assay results expected in Q1 2023.

- Vox Management Summary: The high-grade Sulphur Springs copper-zinc project has been fundamentally rescoped by Develop's experienced new management team led by Northern Star Resources' founder Bill Beament. The combination of redesigning the mine development plan, revising costings and exploring funding options in the second half of 2023, gives Vox management growing confidence that a construction decision could come as early as the later part of 2023.

Kookynie (Pre-Feasibility - Western Australia) - Puzzle North Infill Drilling Results & Planned Feasibility Study

- Vox holds a A$1.00/tonne production royalty1 on a portion of the Kookynie gold project in Western Australia;

- On December 12, 2022, Genesis' company presentation provided an overview of:

- The merger of St Barbara Limited (ASX: SBM) and Genesis to form "Hoover House";

- Maiden reserve over the Leonora gold project open pits, which includes Puzzle, is expected in June 2023; and

- A feasibility study is also expected in June 2023 over the Leonora Gold Project Open Pits (including Puzzle).

- On January 30, 2023, Genesis announced:

- Infill drilling at Puzzle North was completed during the quarter targeting the Inferred portions of the March 2022 maiden resource; and

- Results have confirmed the width and grade of the shallow mineralization, including:

- 40m @ 1.6g/t from 34m (22USRC1460);

- 64m @ 0.9g/t from 35m (22USRC1461);

- 6m @ 5.5g/t from 35m (22USRC1470);

- 33m @ 1.3g/t from 14m (22USRC1473);

- 39m @ 1.0g/t from 36m (22USRC1476);

- 29m @ 1.1g/t from 111m (22USRC1483);

- 34m @ 1.3g/t from 116m (22USRC1484);

- 51m @ 1.5g/t from 14m (22USRC1488);

- 34m @ 1.9g/t from 172m (22USDH0234);

- 20m @ 3.1g/t from 65m (22USDH0235); and

- 99m @ 1.1g/t from 47m (22USDH0236).

- Vox Management Summary: Vox acquired this gold exploration royalty for less than A$150,000 in 2020 and believes that it continues to appreciate in value with the ongoing expansion and feasibility study expected to be released in June 2023 for the royalty-linked Puzzle North deposit. Genesis has fast-tracked Puzzle North from discovery to expected feasibility within 2 years, which is a remarkable achievement. Vox management believes that the return on investment on this royalty investment has the potential to be significant given the potential size of the reserve relative to the low acquisition cost.

Bulong (Pre-Construction - Western Australia) - Imminent Commercialisation Decision & Toll Discussions Continuing

- Vox holds an uncapped 1% net smelter royalty over part of the Bulong gold project in Western Australia;

- On December 30, 2022, and January 31, 2023 Black Cat announced:

- Myhree grade control drilling has confirmed a robust open pit deposit with commercialisation discussions expected to be finalised in the March 2023 quarter;

- Discussions have continued with a number of parties regarding commercialisation (including toll treatment) of the high grade Myhree open pit deposit; and

- A Myhree commercialisation decision is expected in February 2023.

- Vox Management Summary: The Bulong royalty was acquired from an Australian automotive group in September 2020 and continues to hit major milestones as it progresses closer to tolling production. Black Cat appears to be very close to locking in commercialisation terms on the high grade Myhree deposit and Vox Management is enthusiastic about any upcoming development decision.

Qualified Person

Timothy J. Strong, MIMMM, of Kangari Consulting LLC and a "Qualified Person" under NI 43-101, has reviewed and approved the scientific and technical disclosure contained in this press release.

About Vox

Vox is a returns focused mining royalty company with a portfolio of over 60 royalties and streams spanning eight jurisdictions. The Company was established in 2014 and has since built unique intellectual property, a technically focused transactional team and a global sourcing network which has allowed Vox to target the highest returns on royalty acquisitions in the mining royalty sector. Since the beginning of 2020, Vox has announced over 25 separate transactions to acquire over 50 royalties.

Further information on Vox can be found at www.voxroyalty.com.

For further information contact:

Riaan Esterhuizen |

Kyle Floyd |

Executive Vice President - Australia |

Chief Executive Officer |

Cautionary Statements to U.S. Securityholders

This press release and the documents incorporated by reference herein, as applicable, have been prepared in accordance with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current standards of the U.S. securities laws. In particular, and without limiting the generality of the foregoing, the terms "mineral reserve", "proven mineral reserve", "probable mineral reserve", "inferred mineral resources,", "indicated mineral resources," "measured mineral resources" and "mineral resources" used or referenced herein and the documents incorporated by reference herein, as applicable, are Canadian mineral disclosure terms as defined in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM") - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the "CIM Definition Standards").

For U.S. reporting purposes, the U.S. Securities and Exchange Commission (the "SEC") has adopted amendments to its disclosure rules (the "SEC Modernization Rules") to modernize the mining property disclosure requirements for issuers whose securities are registered with the SEC under the Exchange Act, which became effective February 25, 2019. The SEC Modernization Rules more closely align the SEC's disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including NI 43-101, and replace the historical property disclosure requirements for mining registrants that were included in SEC Industry Guide 7. Issuers were required to comply with the SEC Modernization Rules in their first fiscal year beginning on or after January 1, 2021. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information contained or incorporated by reference herein may not be comparable to similar information disclosed by companies domiciled in the U.S. subject to U.S. federal securities laws and the rules and regulations thereunder.

As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources." In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be "substantially similar" to the corresponding CIM Definition Standards that are required under NI 43-101. While the SEC will now recognize "measured mineral resources", "indicated mineral resources" and "inferred mineral resources", U.S. investors should not assume that all or any part of the mineralization in these categories will be converted into a higher category of mineral resources or into mineral reserves without further work and analysis. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that all or any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable without further work and analysis. Further, "inferred mineral resources" have a greater amount of uncertainty and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of inferred mineral resources will be upgraded to a higher category without further work and analysis. Under Canadian securities laws, estimates of "inferred mineral resources" may not form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms are "substantially similar" to CIM Definitions, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules or under the prior standards of SEC Industry Guide 7.

Cautionary Note Regarding Forward-Looking Statements and Forward-Looking Information

This press release contains "forward-looking statements", within the meaning of the U.S. Securities Act of 1933, the U.S. Securities Exchange Act of 1934, the Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation, concerning the business, operations and financial performance and condition of Vox Royalty Corp. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects" or "does not expect", "is expected", "anticipates" or "does not anticipate" "plans", "estimates" or "intends" or stating that certain actions, events or results " may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be "forward-looking statements". Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking statements.

The forward-looking statements and information in this press release include, but are not limited to, summaries of operator updates provided by management and the potential impact on the Company of such operator updates, statements regarding expectations for the timing of commencement of development, construction at and/or resource production from various mining projects, expectations regarding the size, quality and exploitability of the resources at various mining projects, future operations and work programs of Vox's mining operator partners, the receipt of future royalty payments derived from various royalty assets of Vox, anticipated future cash flows and future financial reporting by Vox, and requirements for and operator ability to receive regulatory approvals.

Should one or more of these risks, uncertainties or other factors materialize, or should assumptions underlying the forward-looking information or statement prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Vox cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

Vox has assumed that the material factors referred to in the previous paragraph will not cause such forward looking statements and information to differ materially from actual results or events. However, the list of these factors is not exhaustive and is subject to change and there can be no assurance that such assumptions will reflect the actual outcome of such items or factors. The forward-looking information contained in this press release represents the expectations of Vox as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While Vox may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Technical and Third-Party Information

Except where otherwise stated, the disclosure in this press release is based on information publicly disclosed by project operators based on the information/data available in the public domain as at the date hereof and none of this information has been independently verified by Vox. Specifically, as a royalty investor, Vox has limited, if any, access to the royalty operations. Although Vox does not have any knowledge that such information may not be accurate, there can be no assurance that such information from the project operators is complete or accurate. Some information publicly reported by the project operators may relate to a larger property than the area covered by Vox's royalty interests. Vox's royalty interests often cover less than 100% and sometimes only a portion of the publicly reported mineral reserves, mineral resources and production from a property.

JORC Code

Certain Resource and Reserve estimates covering properties related to certain mining assets in this press release have been prepared in reliance upon the JORC Code. Estimates based on JORC Code are recognized under NI 43-101 in certain circumstances. In each case, the Mineral Resources and Mineral Reserves included in this presentation are based on estimates previously disclosed by the relevant property owner or operator, without reference to the underlying data used to calculate the estimates. Accordingly, the Company is not able to reconcile the Resource and Reserve estimates prepared in reliance on JORC Code with that of CIM definitions. The Company previously sought confirmation from its Qualified Person who is experienced in the preparation of Resource and Reserve estimates using CIM and JORC Code, of the extent to which an estimate prepared under JORC Code would differ from that prepared under CIM definitions. The Company was advised that, while the CIM definitions are not identical to those of JORC Code, the Resource and Reserve definitions and categories are substantively the same as the CIM definitions mandated in NI 43-101 and will typically result in reporting of substantially similar Reserve and Resource estimates.

References & Notes:

- Kookynie Royalty is split in two separate terms:

- Kookynie (Melita) Royalty - which covers the Puzzle Deposit: A$1.00/t production royalty >650Kt cumulative ore mined and treated.

- Kookynie (Consolidated Gold) Royalty - which covers the Puzzle North Discovery: A$1.00/t (for each Ore Reserve with a gold grade <= 5g/t Au), for grades > 5g/t Au royalty = ((Ore grade per Tonne - 5) x 0.5)+1) .

SOURCE: Vox Royalty Corp.

View source version on accesswire.com:

https://www.accesswire.com/738287/Vox-Provides-Development-and-Exploration-Updates