VANCOUVER, BC / ACCESSWIRE / July 24, 2023 / Mawson Gold Limited ("Mawson" or the "Company") (TSX:MAW)(Frankfurt:MXR)(OTC PINK:MWSNF) announces its 51% owned ASX-listed subsidiary, Southern Cross Gold ("SXG"), has acquired both:

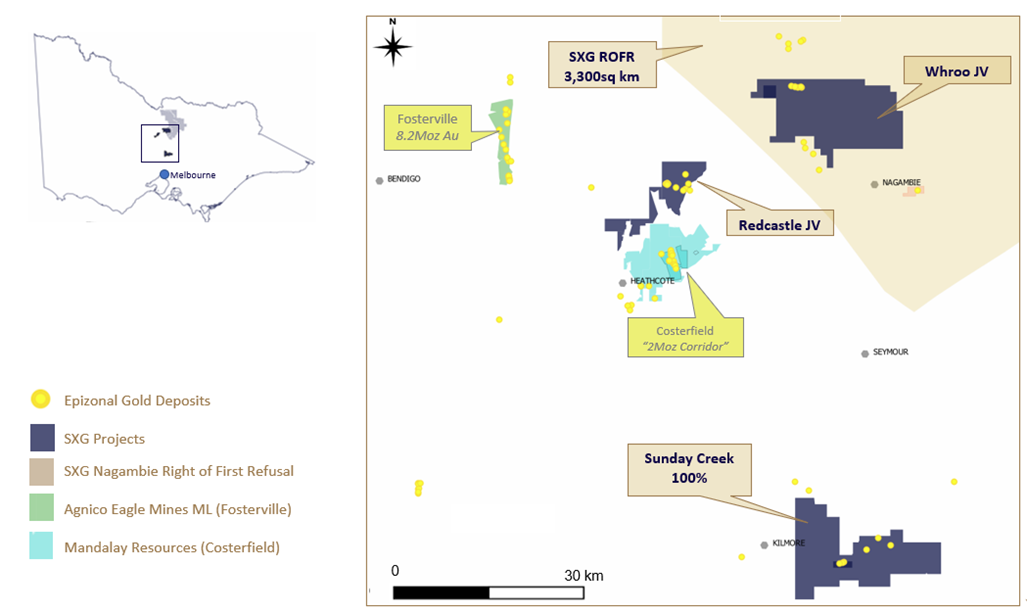

- The Prospecting Licence PL6415 ("Laura") located within the 70% owned Redcastle JV in the Victorian goldfields; and

- Further freehold land within the 100%-owned Sunday Creek epizonal-style gold project.

The strategic acquisition of the Laura prospecting licence completely secures one of the higher-grade parts of the Redcastle goldfield, where recent drilling has identified very high grades (up to 704 g/t Au and 24.7% Sb) within continuous and targetable structures above a 1.3 km long and a coherent IP anomaly.

The new freehold land package purchased at Sunday Creek lies adjacent to both the main access and current freehold ownership at the project.

Highlights:

- SXG expands its epizonal gold-antimony search in Victoria, Australia with the 100% purchase of the Laura PL6415 prospecting licence for A$300,000:

- Provides an immediate and extremely high-grade drill discovery to expand upon and to build another project of scale for SXG.

- Consolidates SXG's extensive ground holding and best drill grades at the Redcastle gold and antimony field.

- Laura is located entirely within SXG's 70% owned Redcastle JV, 2 km immediately north of Mandalay Resources' exploration properties which contain the Costerfield Mine (Figure 1).

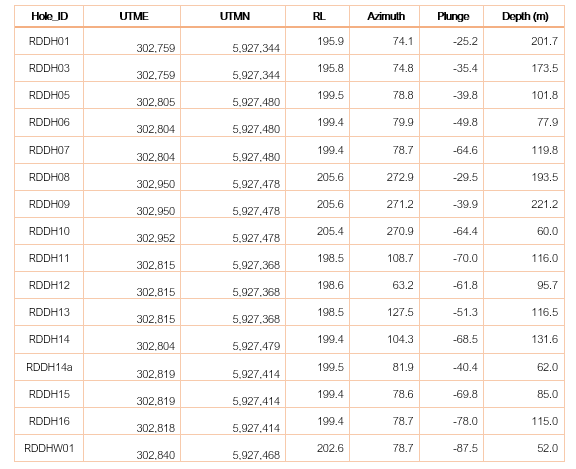

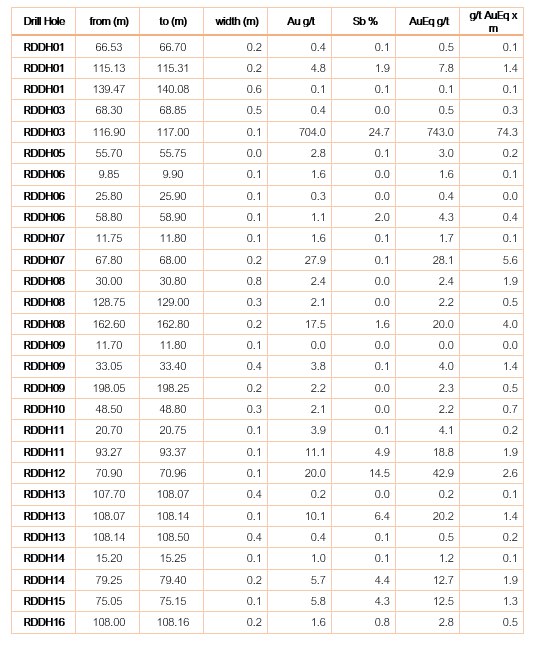

- Laura's previous owners drilled 16 diamond holes for 1,923.2 m (Table 1 and 2) during 2019 below the historic Laura mine, with multiple, thin and continuous high grades. Significant results include:

- RDDH03: 0.1 m @ 743.0 g/t AuEq (704.0 g/t Au, 24.7 %Sb) from 116.9 m

- RDDH07: 0.2 m @ 28.1 g/t AuEq (27.9 g/t Au, 0.1 %Sb) from 67.8 m

- RDDH08: 0.2 m @ 20.0 g/t AuEq (17.5 g/t Au, 1.6 %Sb) from 162.6 m

- RDDH12: 0.1 m @ 42.9 g/t AuEq (20.0 g/t Au, 14.5 %Sb) from 70.9 m

- RDDH13: 0.1 m @ 20.2 g/t AuEq (10.1 g/t Au, 6.4 %Sb) from 108.1 m

- RDDH15: 0.1 m @ 12.5 g/t AuEq (5.8 g/t Au, 4.3 %Sb) from 75.1 m

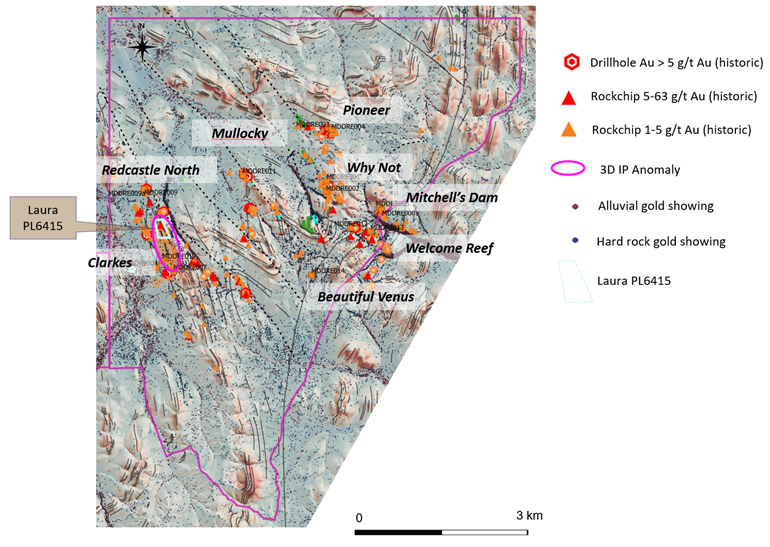

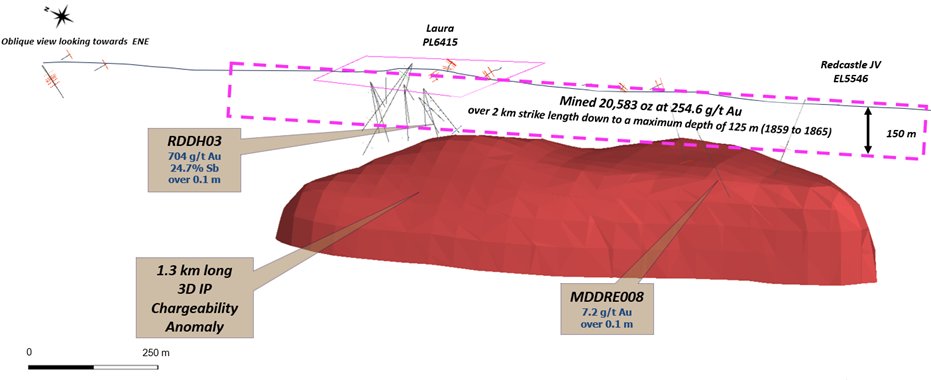

- The Laura project also forms a key geophysical target within the Redcastle goldfield, with a 1.3 km-long coherent induced polarization ("IP") chargeability anomaly underlying the Laura PL6415. The IP anomaly also sits below historic mines that produced 20,583 oz at 254.6 g/t Au over 2 km strike length down to a maximum depth of 125 m during 1859 to 1865.

- Next steps are to progressively drill beyond the high-grade intercepts within the Laura area, into the 17 km of untested reef systems at Redcastle.

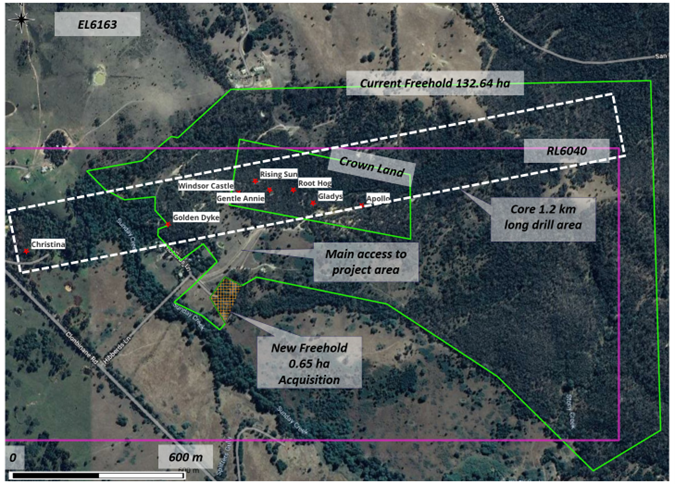

- Southern Cross Gold finalises purchase of 0.65 hectares of freehold land that is located adjacent to both the main access and current freehold ownership to the Sunday Creek Project (Figure 1).

- Freehold ownership further secures surface access and provides additional area for any potential future gold operation.

- Diamond drilling continues at Sunday Creek with four diamond rigs now focused on testing gold structures down to 800 m depth and 1.2 km along strike at Sunday Creek.

Noora Ahola, Mawson Interim CEO, states: "These acquisitions have consolidated ownership at both the Redcastle and Sunday Creek projects. The purchase of the Laura prospect has brought under its control the best-drilled gold and antimony grades at Redcastle. SXG have bought a 16-hole drill discovery for less than the cost to drill and an extremely high-grade area from which to expand and build another project of scale. Additionally, the purchase of additional freehold land at the Sunday Creek gold-antimony project locks in land access and continues to derisk and secure future success for the project."

PL6415 Laura Drilling

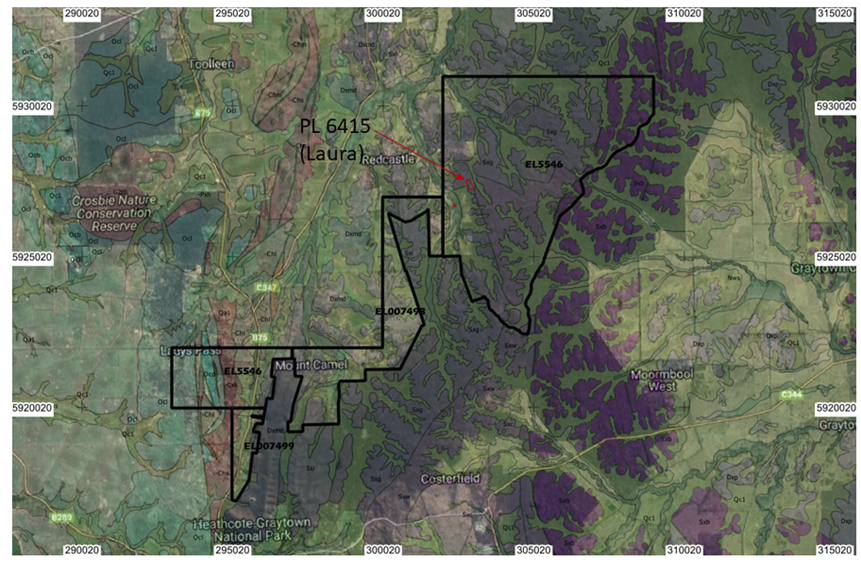

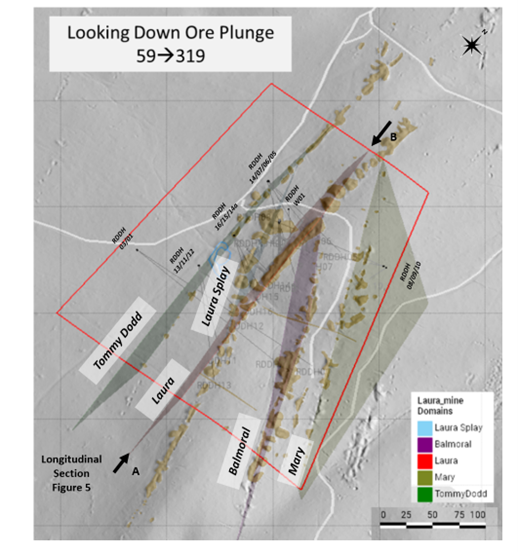

PL6415 extends over 310 m strike length by 160 m width and contains five quartz reefs with extensive historic workings at surface (Figure 4), the principle being Laura (Figure 5). The historic Laura mine was one of the more productive reefs mined in the north-western part of the Redcastle goldfield. PL6415 is located wholly within the Redcastle JV EL5546 (Figures 1 and 2), held 70% by Southern Cross Gold, in joint venture with Nagambie Resources Ltd (ASX:NAG).

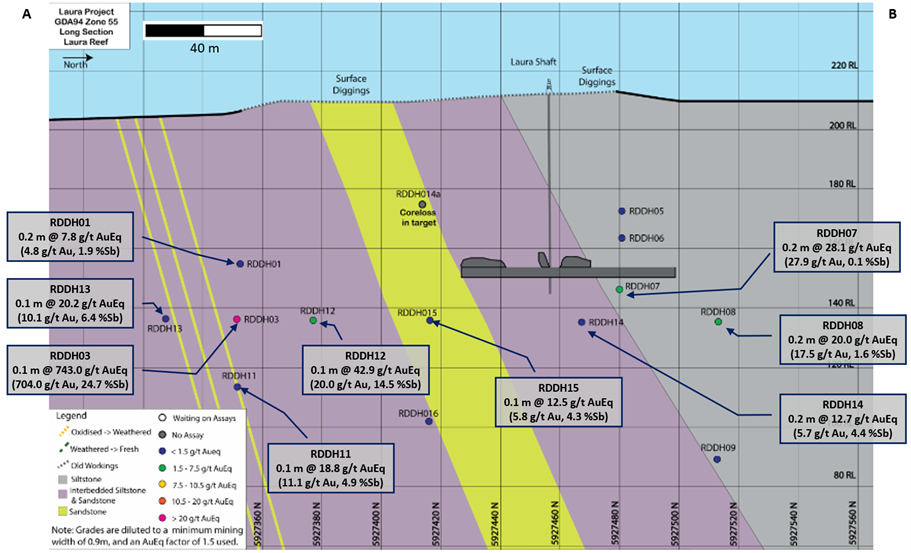

The previous owners of Laura (Core Prospecting Pty Ltd and Starwest Ltd) drilled 16 holes for 1,923.2 m in 2019, in the vicinity of the old Laura mine. This work returned some narrow intervals of high-grade gold and antimony, with significant results including:

- RDDH01: 0.2 m @ 7.8 g/t AuEq (4.8 g/t Au, 1.9 %Sb) from 115.1 m

- RDDH03: 0.1 m @ 743.0 g/t AuEq (704.0 g/t Au, 24.7 %Sb) from 116.9 m

- RDDH07: 0.2 m @ 28.1 g/t AuEq (27.9 g/t Au, 0.1 %Sb) from 67.8 m

- RDDH08: 0.2 m @ 20.0 g/t AuEq (17.5 g/t Au, 1.6 %Sb) from 162.6 m

- RDDH11: 0.1 m @ 18.8 g/t AuEq (11.1 g/t Au, 4.9 %Sb) from 93.3 m

- RDDH12: 0.1 m @ 42.9 g/t AuEq (20.0 g/t Au, 14.5 %Sb) from 70.9 m

- RDDH13: 0.1 m @ 20.2 g/t AuEq (10.1 g/t Au, 6.4 %Sb) from 108.1 m

- RDDH14: 0.2 m @ 12.7 g/t AuEq (5.7 g/t Au, 4.4 %Sb) from 79.3 m

- RDDH15: 0.1 m @ 12.5 g/t AuEq (5.8 g/t Au, 4.3 %Sb) from 75.1 m

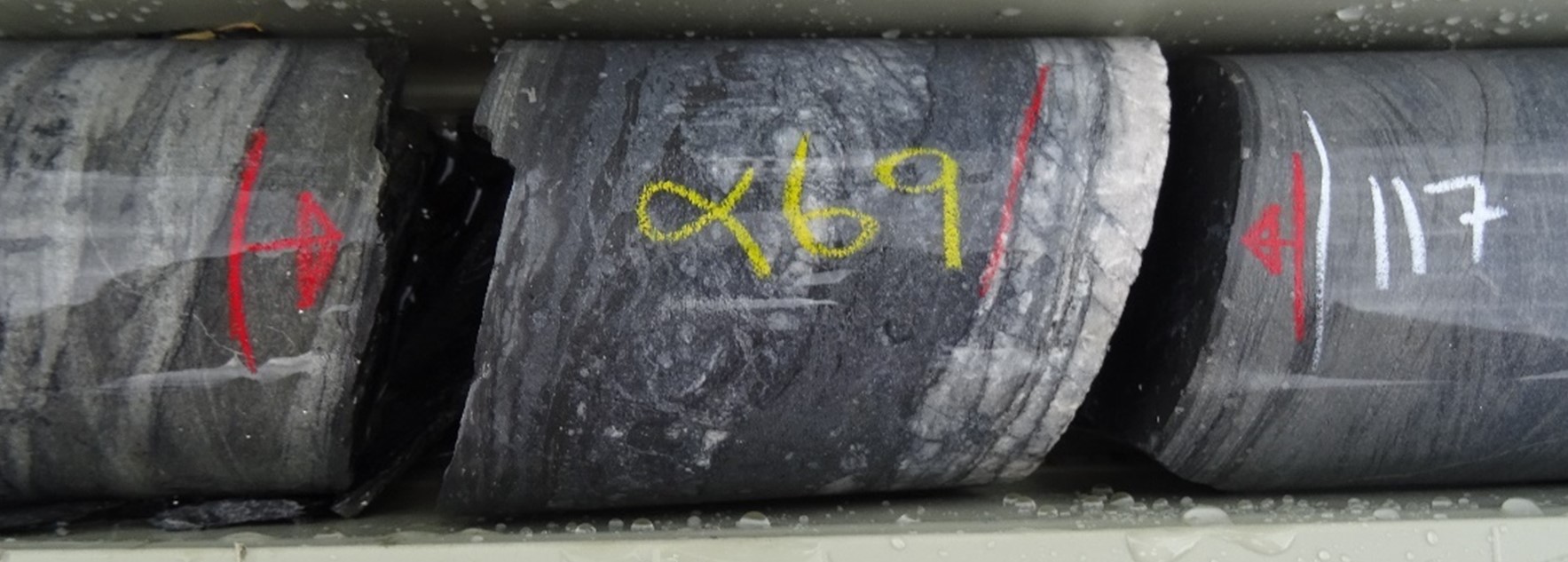

This drilling data compares favorably with the Redcastle drilling data (from outside PL6415) held by SXG. Intervals in the Laura data are narrow compared with the other Redcastle data but the grades are higher, with five of the assay grades from Laura equaling or exceeding the highest Au-equivalent assays within the entire SXG Redcastle dataset. This partly reflects the 1 or 2 m sampling in the historic reverse circulation drill data, which makes up the majority of the latter, but it also demonstrates the consistent higher grade in the Laura Reef. These higher grades are also demonstrated in the Figure 5 longitudinal section, which shows consistent high-grade mineralization from drill intersections of the Laura Reef. The lateral continuity of the reef is supported by drill core observations which confirm that the reef is a laminated quartz vein, parallel to bedding with stylolitic inclusions throughout and stibnite occurring on or close to the vein margins.

Local Geology and Structural Setting

The PL6415 Laura prospecting licence is located entirely within SXG's 70% owned Redcastle EL5546 JV. It is a shallow orogenic (or epizonal) Costerfield-style historic high-grade field. The project is located 2 km north of Mandalay Resources' Costerfield mine and exploration leases and 25 km east of Agnico Eagle's Fosterville mine - two of the world's highest grade gold mines.

The host rocks are finely interbedded turbidite sequences of sandstone and siltstone, the oldest of which is a sequence of early Silurian turbiditic sandstone and siltstone known as the Wapentake Formation which is conformably overlain by the Silurian Dargile Formation, McIvor Sandstone and Mount Ida Formation. Overlying the Palaeozoic basement rocks are Quaternary unconsolidated clays of the Shepparton Formation and alluvial sands of the Coonambidgal Formation.

The goldfield is a structurally controlled system sitting in the western limb of the plunging Redcastle anticline. Host rocks consist of thinly interbedded sandstones and mudstones of the Wapentake and Dargile formations. In the Melbourne Structural Zone, sites of gold deposition on a regional scale appear to favor areas of refolding or interference folding, as seen in the Redcastle Anticline.

Geophysical IP Chargeability Target

The Laura project also forms a key geophysical target within the Redcastle goldfield. Drilling to date has been shallow (<135m vertical). Below the Laura drilling a 1.3 km-long coherent induced polarization ("IP") chargeability anomaly generated by Mawson Victoria's 3D offset array IP geophysical survey underlies the Laura PL6415 (Figure 6). This is considered highly prospective, as there are at least 9 mined structures above the geophysical anomaly (5 within the Laura PL) where the Welcome Group of mines reported to have extracted 20,583 oz at 254.6 g/t Au over 2 km strike length down to a maximum depth of 125 m (in the period 1859 to 1865).

Context with Historic Mining at Redcastle

During the 1800's the average mining width was approximately 1 m on quartz veins with visible gold (individual reef widths were less than 0.6 m). The length of workings combined is 17 km with several reef systems extending for kilometres. Spurs off the main reef systems were recorded to have been worked for distances between 15 m to 33 m. It is a characteristic of Redcastle that reefs are closely spaced. On the western side of the field 14 reefs are recorded to occur in a cross-strike distance of 900 metres.

At Redcastle, the key historic targets were narrow but continuous thin (0.3 m to 1 m) very high-grade structures continuing to depth. Historical records, however, continually reference gold found marginal to reefs in the country rock (wall-rock of quartz-vein structures) with shallow modern-day reverse circulation drilling and trenching confirming that gold extends beyond these high-grade quartz-vein structures. Beyond the high-grade visible gold in quartz-veins, additional targets included vein stockworks in sandstones and dyke-hosted mineralization. The largest dyke was mined to a depth of 27 m and was 11.5 m wide at 25 -120 g/t gold with 160 tonnes of ore extracted suggesting the dyke may have been selectively mined, although the width of the dyke suggests scope for a larger scale and lower grade target. Wider zones in stockworks (2.4 m to 4.8 m wide) and breccia zones at Beautiful Venus have been recorded up to 20 m in width. Mineralization is typically hosted in shear veins striking ~345-360° and dipping steeply westward, containing quartz, carbonate, visible gold and antimony sulphide (stibnite). Surrounding the shear veins are a narrow <5 cm arsenopyrite and pyrite halo within the host rock which are weakly auriferous.

Context with Costerfield Mined Mineralization

Mandalay Resources' Costerfield mine and exploration leases are located 2 km south of SXG's Redcastle JV EL5546. Costerfield is the target model sought at Redcastle. The Costerfield mine corridor contains 2 million ounces of equivalent gold (pers. comm. Mandalay Q3 2021 Results). Average drill hole widths and grades at Costerfield are: Brunswick lode (0.7 m @ 9.0 g/t Au and 4.0% Sb), Youle lode (0.4 m @ 47.7 g/t Au and 11.4% Sb), Kendal Splay (0.3 m @ 92.8 g/t Au and 41.3% Sb) and Peacock lode (0.4 m @ 13.0 g/t Au and 6.0% Sb). The average vein width at Augusta is 0.3 m, while the Cuffley lode averaged 0.4 m. Average mined widths at Costerfield are 2.0 m (Mandalay Technical Report, 2021).

Commercial Terms

The Company purchased 100% of the Prospecting License PL6415 for cash consideration of $300,000 from arm's length Core Prospecting Pty Ltd and Starwest Pty Ltd.

Sunday Creek Land Purchase

SXG already owns 132.64 hectare of freehold property that covers both the Sunday Creek project drill area and areas for potential extension of the zone to the east. The new area lies adjacent to both the main access and current freehold ownership at Sunday Creek. Freehold ownership secures surface access and provides sufficient area for any potential future gold operation (Figure 1). The Company acquired the 0.65 ha freehold for $366,240 and may also consider other uses for the freehold land in the future, such as renewable energy options, livestock grazing or agistment to help maintain the property (although there are no current plans for such additional uses). As the contract was conditional upon satisfying the requirements of the Foreign Acquisitions and Takeovers Act 1975 (Cth), a no objection notification for the freehold acquisition without conditions from the Foreign Investment Review Board ("FIRB") was received before settlement

Further discussion and analysis of the Sunday Creek and Redcastle projects by Southern Cross Gold is available on the SXG website at www.southerncrossgold.com.au

Figures 1 to 6 show project location, plan and longitudinal views, and the 3D IP chargeable anomaly from Laura and Tables 1 and 2 provide collar and assay data. The true thickness of the mineralized intervals reported are interpreted to range approximately between 34% to 93% of the sampled thickness.

Figure 7 shows the location of the new freehold land purchase at Sunday Creek.

Redcastle Joint Venture

A subsidiary of the Company, Mawson Victoria Pty Ltd, is party to an Option and Joint Venture Agreement with Nagambie Resources Limited for the Redcastle Joint Venture tenements. Mawson Victoria has met the obligations to achieve $1,000,000 of exploration commitments over a 5-year period set under the Farm-in Agreements by 25 March 2025, and has earnt a 70% economic interest Redcastle JV. A joint venture between the parties is now in the process of being formed. Nagambie Resources Limited may contribute its 30% share of further exploration expenditures or, if it chooses not to contribute, dilute its interest. Should Nagambie Resource Limited's interest be reduced to less than 5%, it will be deemed to have forfeited its interest in the joint venture to the Company in exchange for a 1.5% net smelter return royalty ("NSR") on gold revenue. Should Nagambie Resources Limited be granted the NSR, the Company will have the right to acquire the NSR for $4,000,000.

Technical Background and Qualified Person

The Qualified Person, Michael Hudson, Executive Chairman and a director of Mawson Gold, and a Fellow of the Australasian Institute of Mining and Metallurgy, has reviewed, verified and approved the technical contents of this release.

Analytical samples are transported to the Bendigo facility of On Site Laboratory Services ("On Site") which operates under both an ISO 9001 and NATA quality systems. Samples were prepared and analyzed for gold using the fire assay technique (PE01S method; 25 gram charge), followed by measuring the gold in solution with flame AAS equipment. Samples for multi-element analysis (BM011 and over-range methods as required) use aqua regia digestion and ICP-MS analysis. The QA/QC program of Southern Cross Gold consists of the systematic insertion of certified standards of known gold content, blanks within interpreted mineralized rock and quarter core duplicates. In addition, On Site inserts blanks and standards into the analytical process.

MAW considers that both gold and antimony that are included in the gold equivalent calculation ("AuEq") have reasonable potential to be recovered at Redcastle, given current geochemical understanding, historic production statistics and geologically analogous mining operations. MAW considers that it is appropriate to adopt the same gold equivalent variables as Mandalay Resources Ltd in its Mandalay Technical Report, 2022 dated 25 March 2022. The gold equivalence formula used by Mandalay Resources was calculated using recoveries achieved at the Costerfield Property Brunswick Processing Plant during 2020, using a gold price of US$1,700 per ounce, an antimony price of US$8,500 per tonne and 2021 total year metal recoveries of 93% for gold and 95% for antimony, and is as follows: 𝐴𝑢𝐸𝑞 = 𝐴𝑢 (𝑔/𝑡) + 1.58 × 𝑆𝑏 (%). MAW therefore considers that a 𝐴𝑢𝐸𝑞 = 𝐴𝑢 (𝑔/𝑡) + 1.58 × 𝑆𝑏 (%) is appropriate to use for the initial exploration targeting of gold-antimony mineralization at Redcastle.

About Mawson Gold Limited (TSX:MAW, FRANKFURT:MXR, OTCPINK:MWSNF)

Mawson Gold Limited is an exploration and development company. Mawson has distinguished itself as a leading Nordic exploration company with its 100% owned flagship Rajapalot gold-cobalt project in Finland, and right to earn into the Skellefteå North gold project in Sweden. Mawson also currently owns 51% of Southern Cross Gold Ltd (ASX:SXG) which in turn owns or controls three high-grade, historic epizonal goldfields covering 470 km2 in Victoria, Australia.

About Southern Cross Gold Ltd (ASX:SXG)

Southern Cross Gold owns 70% of the Redcastle JV in Victoria and Mt Isa project in Queensland, 100% of the Sunday Creek project and is earning into the Whroo joint venture in Victoria, Australia, and a strategic 10% holding in ASX-listed Nagambie Resources Limited (ASX:NAG) which grants SXG a Right of First Refusal over a 3,300 square kilometer tenement package held by NAG in Victoria.

|

On behalf of the Board,

|

Further Information |

Forward-Looking Statement

This news release contains forward-looking statements or forward-looking information within the meaning of applicable securities laws (collectively, "forward-looking statements"). All statements herein, other than statements of historical fact, are forward-looking statements. Although Mawson believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate, and similar expressions, or are those, which, by their nature, refer to future events. Mawson cautions investors that any forward-looking statements are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various factors, including, Mawson's expectations regarding its ownership interest in Southern Cross Gold, capital and other costs varying significantly from estimates, changes in world metal markets, changes in equity markets, the potential impact of epidemics, pandemics or other public health crises, including the current pandemic known as COVID-19 on the Company's business, risks related to negative publicity with respect to the Company or the mining industry in general; exploration potential being conceptual in nature, there being insufficient exploration to define a mineral resource on the Australian-projects owned by SXG, and uncertainty if further exploration will result in the determination of a mineral resource; planned drill programs and results varying from expectations, delays in obtaining results, equipment failure, unexpected geological conditions, local community relations, dealings with non-governmental organizations, delays in operations due to permit grants, environmental and safety risks, and other risks and uncertainties disclosed under the heading "Risk Factors" in Mawson's most recent Annual Information Form filed on www.sedar.com. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Mawson disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

Photo 1: Quartz-Stibnite laminated shear vein with visible gold (not visible at scale of photo) and stibnite from 116.9 m in drillhole RDDH03. This sample assayed 0.1m @ 704 g/t Au & 24.7% Sb

Figure 1: Location of the Redcastle JV project that encompassed the Laura PL6415, along with SXG's other Victoria projects.

Figure 2: Location of Laura PL6415 within SXG's Redcastle JV tenement package with background geological map.

Figure 3: The Redcastle JV EL5546 showing 3D IP chargeability anomaly, anomalous rockchips and drill holes and the Laura PL6415 with LiDAR

Figure 4: Laura PL6415: View looking down interpreted mineralized shoot geometry. PL6415 extends over 310 m strike length by 160 m width and contains five quartz reefs with extensive historic workings at surface (as shown by LiDAR image), the principle being Laura.

Figure 5: Laura PL6415 Longitudinal Section showing continuity of gold-antimony within the plane of the Laura Shoot.

Figure 6: 3D Induced polarization chargeable anomaly that forms a large target at depth beneath Laura high-grade drilling and historic mines.

Figure 7: Location of SXG freehold land and exploration tenure at the Sunday Creek core drill area.

Table 1: Drill collar summary table for Historic drill holes on project. Datum GDA94_Z55.

Table 2: Tables of mineralized drill hole intersections reported from The Laura Project using the cut-off criteria. Lower grades cut at 0.1 g/t AuEq lower cutoff.

SOURCE: Mawson Gold Limited

View source version on accesswire.com:

https://www.accesswire.com/769826/Mawsons-Subsidiary-SXG-Acquires-High-Grade-Laura-Drill-Discovery-at-Redcastle-and-Further-Freehold-at-Sunday-Creek