Digital Telematics, Intelligent Automation, and Distributed Manufacturing Accelerate Operational Efficiency and Asset Optimization

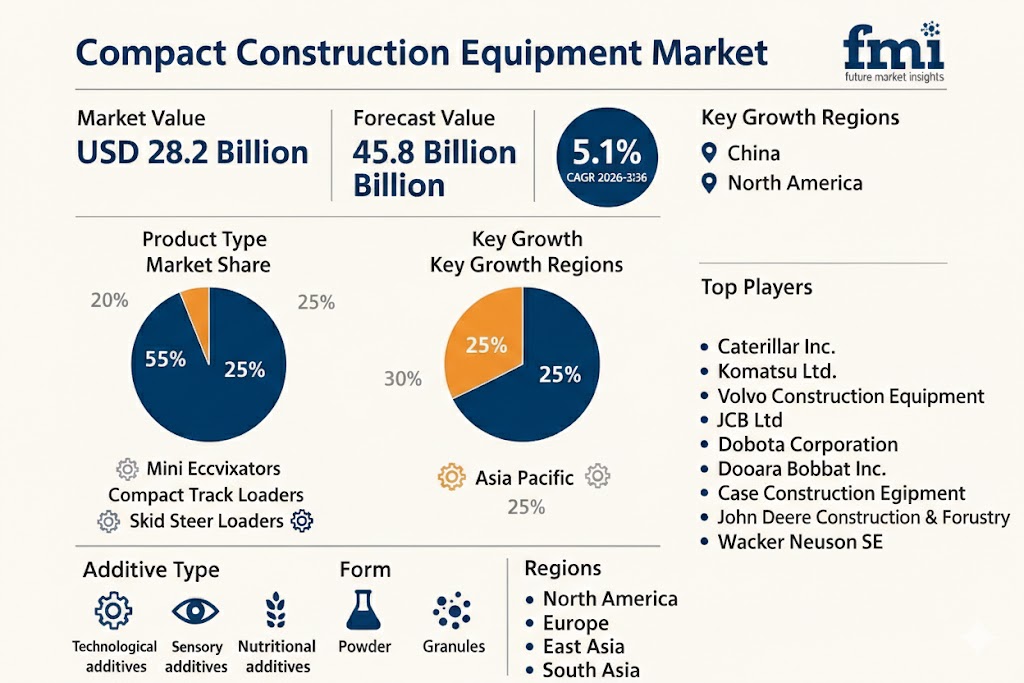

NEWARK, DE / ACCESS Newswire / February 19, 2026 / The global construction ecosystem is entering a new era of compact efficiency. According to the latest analysis by Future Market Insights (FMI), the Compact Construction Equipment Market is projected to grow from USD 28.2 billion in 2026 to USD 45.8 billion by 2036, expanding at a CAGR of 5.1%.

This growth reflects accelerating urban densification, stricter emissions mandates, and the rapid electrification of compact machinery across residential, commercial, and infrastructure projects worldwide.

Urban Densification Reshaping Compact Equipment Demand

Rapid urban densification is fundamentally transforming construction equipment requirements. As metropolitan spaces become tighter and project footprints shrink, contractors are shifting away from conventional heavy machinery toward compact, highly maneuverable equipment. Smaller residential lots and infill developments now dominate urban housing projects, demanding machines that ensure operational efficiency while complying with strict noise, safety, and emissions regulations.

Get Access of Report Sample: https://www.futuremarketinsights.com/reports/sample/rep-gb-53

Key Points:

Growing preference for compact, space-efficient construction machinery

Over two-thirds of urban residential builds occurring on smaller plots

Rising need for low-noise, regulation-compliant equipment

Higher productivity in confined job-site environments

Strong demand from metropolitan housing and infrastructure projects

Electrification Gains Momentum Under Emission Mandates

The electrification of compact construction machinery has accelerated significantly since 2024, driven by tightening environmental regulations and sustainability mandates. Standards such as the EU Stage V and U.S. EPA Tier 4 Final are compelling OEMs to rapidly expand battery-powered and hybrid equipment portfolios. Industry leaders are investing in electrified mini excavators and compact loaders capable of full-day operation, aligning with municipal procurement policies favoring low-emission construction fleets.

Key Points:

Regulatory pressure accelerating battery-powered equipment adoption

Compliance with EU Stage V and EPA Tier 4 Final standards

Increased OEM investment in electrified compact platforms

Growing municipal preference for low-emission public works equipment

Structural shift toward electric and hybrid compact machinery solutions

Market Value Snapshot (2026-2036)

Metric |

Value |

|---|---|

Market Size (2026) |

USD 28.2 Billion |

Forecast Value (2036) |

USD 45.8 Billion |

CAGR (2026-2036) |

5.1% |

Leading Product |

Mini Excavators (38% Share) |

Fastest-Growing Region |

India (7.3% CAGR) |

Mini Excavators Lead Market with 38% Share

Mini excavators remain the dominant segment, accounting for approximately 38% of total market share. Their versatility across excavation, demolition, grading, and utility installation continues to drive adoption. With compact designs under 10,000 pounds, they enable high productivity in confined spaces while minimizing surface damage. Manufacturers are integrating fuel-efficient engines and smart operator-assist technologies to enhance performance and reduce operational costs.

Key Highlights:

38% total market share dominance

Operate efficiently in restricted-access and urban sites

Weigh under 10,000 pounds for minimal ground impact

Advanced hydraulics improve precision and productivity

Reduced fuel consumption lowers total cost of ownership

Strong demand across infrastructure and residential projects

Compact Track Loaders Capture 24% Market Share

Compact track loaders hold nearly 24% of the market, gaining momentum due to superior traction and reduced ground disturbance. Their ability to operate across multi-terrain environments makes them highly preferred for landscaping, construction, and agricultural tasks. Continuous innovation in visibility systems, joystick controls, and higher rated operating capacities is strengthening their position among contractors seeking versatility and efficiency.

Key Highlights:

24% global market share

Enhanced traction on soft and uneven terrain

Reduced soil disturbance for sensitive job sites

Improved operator visibility and control systems

Higher load capacities for diverse applications

Growing adoption in landscaping and agriculture

Rental Penetration Reshapes Equipment Purchasing

The rental segment now accounts for over 65% of compact equipment utilization in the United States, significantly influencing purchasing behavior. Contractors increasingly prefer flexible, capital-efficient access to advanced machinery rather than large upfront investments. Expansion of rental fleets in 2025 reflects strong demand for scalable equipment solutions, particularly among small and mid-sized contractors managing variable project workloads.

Key Highlights:

65%+ equipment utilization through rentals in the U.S.

Capital-light access model supports cash flow management

Strong fleet expansion in 2025

Higher equipment accessibility for small contractors

Encourages faster adoption of advanced machinery

Reduces maintenance and ownership risks

Regional Growth Outlook: India and China Lead Acceleration

Growth trajectories vary significantly across global markets:

United States: 4.8% CAGR, supported by infrastructure modernization and residential demand.

China: 6.2% CAGR, driven by urbanization and electrification mandates.

India: 7.3% CAGR, the fastest-growing market due to Smart City initiatives and construction mechanization.

Germany: 4.1% CAGR, anchored in emissions leadership and renovation demand.

United Kingdom: 4.6% CAGR, influenced by net-zero construction mandates.

Brazil: 5.7% CAGR, supported by mining and secondary-city infrastructure development.

Japan: 3.9% CAGR, fueled by disaster resilience and infrastructure maintenance.

Manufacturers such as Kubota Corporation and JCB Ltd. are expanding electric and hydrogen-powered compact platforms to meet regional regulatory expectations.

Technology Integration Redefines Productivity

Digital transformation is becoming a core competitive differentiator across equipment-driven industries. Advanced telematics and operator-assistance technologies are enabling real-time visibility, performance optimization, and predictive maintenance, helping companies reduce downtime and improve asset utilization. Simultaneously, distributed manufacturing strategies are strengthening supply chain resilience while supporting localized production and faster response to regional demand shifts.

Key Highlights

JDLink by John Deere enables real-time diagnostics, equipment tracking, and predictive maintenance scheduling.

Advanced grading systems from Volvo Construction Equipment enhance precision and reduce rework costs on job sites.

Telematics integration improves fleet visibility, fuel efficiency, and lifecycle management.

Distributed manufacturing models mitigate supply chain disruptions and enable regional customization.

Data-driven insights support proactive service strategies and long-term productivity gains.

Competitive Landscape: Electrification & AI Investment Intensifies

The competitive environment is increasingly defined by:

Battery-electric and hybrid platform expansion

AI-integrated job-site automation

Regionalized production facilities

Aftermarket digital service ecosystems

In late 2025, JCB Ltd. announced a £100 million investment in its UK headquarters to scale production of its E-Tech electric range. Meanwhile, Kubota Corporation confirmed its upcoming German excavator facility to localize European production beginning in 2026.

Market Definition

Compact construction equipment includes mobile machinery designed for excavation, material handling, grading, and site preparation in space-constrained environments. Core categories include:

Mini Excavators

Compact Track Loaders

Skid Steer Loaders

Compact Wheel Loaders

Compact Backhoe Loaders

Compact Telehandlers

Both diesel and electric powertrains fall within the scope, reflecting the industry's dual-path evolution toward sustainability and performance optimization.

The Outlook: From Compact to Critical

By 2036, compact construction equipment will no longer be viewed as supplemental machinery but as a central pillar of urban development strategy. Electrification, telematics integration, and regulatory alignment are collectively reshaping the competitive landscape.

As infrastructure modernization and urban renewal intensify globally, compact equipment is positioned not merely as a convenience but as a necessity for the next generation of construction efficiency.

For an in-depth analysis of evolving formulation trends and to access the complete strategic outlook for the Compact Construction Equipment Market through 2036, Full Report Request: https://www.futuremarketinsights.com/reports/global-compact-construction-equipment-market

Related Reports:

USA Compact Construction Equipment Market- https://www.futuremarketinsights.com/reports/united-states-compact-construction-equipment-market

Japan Compact Construction Equipment Market- https://www.futuremarketinsights.com/reports/japan-compact-construction-equipment-market

Germany Compact Construction Equipment Market- https://www.futuremarketinsights.com/reports/germany-compact-construction-equipment-market

About Future Market Insights (FMI)

Future Market Insights (FMI) is a leading provider of market intelligence and consulting services, serving clients in over 150 countries. Headquartered in Delaware, USA, with a global delivery center in India and offices in the UK and UAE, FMI delivers actionable insights to businesses across industries including automotive, technology, consumer products, manufacturing, energy, and chemicals.

An ESOMAR-certified research organization, FMI provides custom and syndicated market reports and consulting services, supporting both Fortune 1,000 companies and SMEs. Its team of 300+ experienced analysts ensures credible, data-driven insights to help clients navigate global markets and identify growth opportunities.

For Press & Corporate Inquiries

Rahul Singh

AVP - Marketing and Growth Strategy

Future Market Insights, Inc.

+91 8600020075

For Sales - sales@futuremarketinsights.com

For Media - Rahul.singh@futuremarketinsights.com

For web - https://www.futuremarketinsights.com/

SOURCE: Future Market Insights, Inc.

View the original press release on ACCESS Newswire