Global RTD cocktail market expands on premiumization, convenience demand, regulatory shifts, and scalable can-led production across key global markets.

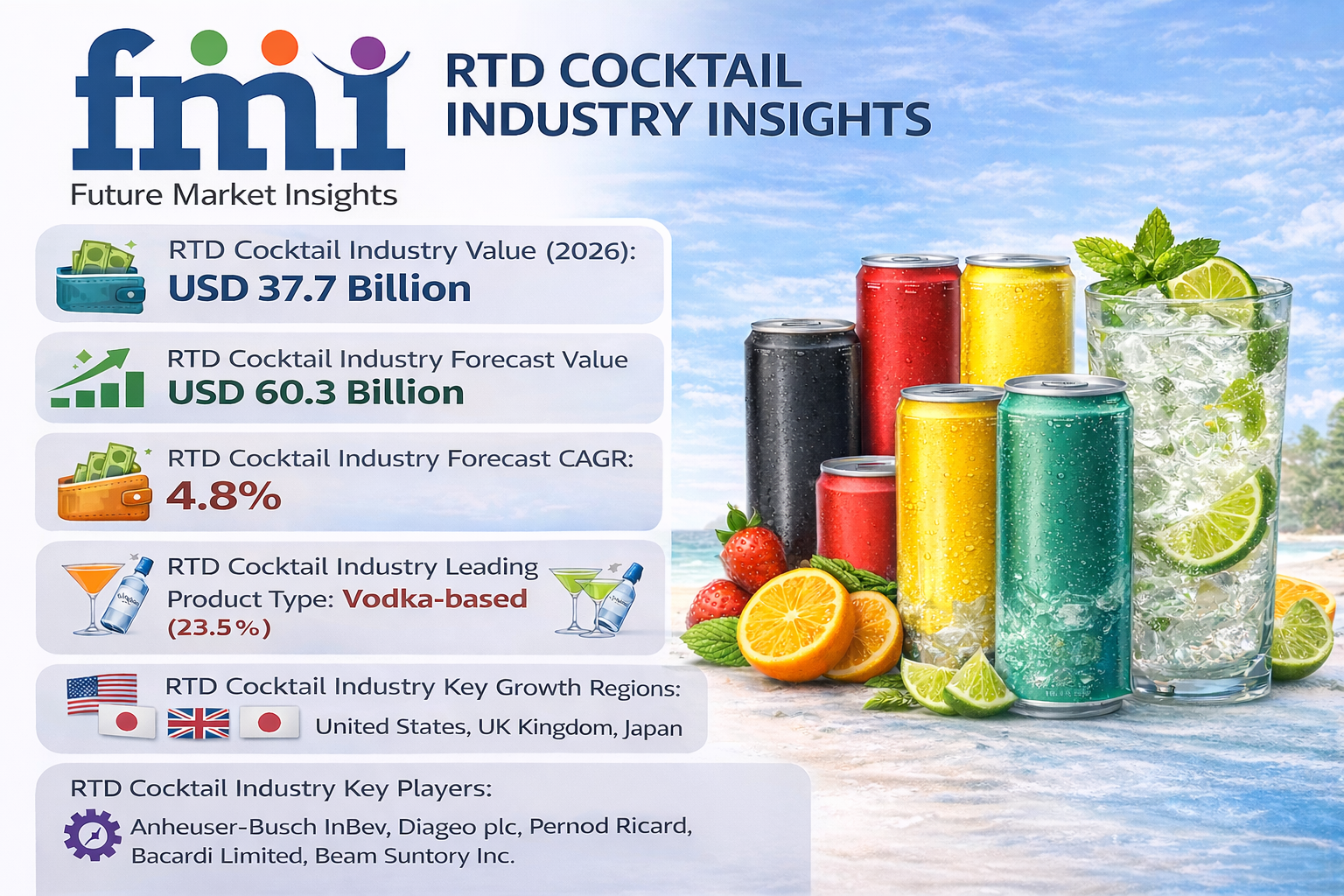

NEWARK, DELAWARE / ACCESS Newswire / February 20, 2026 / The global Ready-to-Drink (RTD) cocktail industry is entering a structurally decisive decade. Valued at USD 37.7 billion in 2026, the market is projected to exceed USD 60.3 billion by 2036, expanding at a CAGR of 4.8%. Growth is being fueled not simply by flavor innovation, but by deeper structural shifts across regulation, retail access, premiumization, and industrial-scale production.

According to Future Market Insights (FMI), the RTD category is transitioning from experimentation-driven expansion to economics-led portfolio optimization. Convenience, compliance readiness, and scalable manufacturing are increasingly defining competitive advantage.

Structural Expansion: From Novelty to Industrial Scale

The RTD cocktail market is no longer a niche adjunct to spirits. It has evolved into a standardized, packaged alcohol format engineered for portability, rapid chilling, and consistent flavor replication.

In the United States, RTDs are increasingly replacing casual mixed drinks with flavor-led, spirits-based offerings suited to convenience retail and at-home consumption. Taste reliability and established brand equity now drive repeat purchase more than novelty.

In Europe, growth is anchored in lower-alcohol and sweeter premix formats aligned with moderation norms and historical alcopop consumption patterns rather than full-strength cocktail replication.

Across Asia, behavioral adaptation defines category structure:

Japan emphasizes lower-sugar, lower-ABV formats designed for routine consumption.

South Korea uses whisky highballs as a convenience-led upgrade from beer and soju.

India sees urban Gen Z consumers adopting RTDs and mocktail-style formats as an accessible entry into alcohol.

China localizes RTDs around fruit-forward and culturally familiar bases, including baijiu-inspired formulations.

To Explore Detailed Market Data, Segment-Wise Forecasts, and Competitive Insights, Request Sample Report-https://www.futuremarketinsights.com/reports/sample/rep-gb-12994

Quick Stats: RTD Cocktail Market (2026-2036)

Metric |

Value |

|---|---|

Industry Size (2026) |

USD 37.7 Billion |

Forecast Value (2036) |

USD 60.3 Billion |

CAGR |

4.8% |

Leading Product Type |

Vodka-based (23.5% Share) |

Dominant Packaging |

Cans (39.2% Share) |

Key Growth Regions |

United States, United Kingdom, Japan |

As noted by Chris Swonger, President & CEO of the Distilled Spirits Council of the United States (DISCUS):

"Consumers are seeking equal access to these spirits-based RTD products in the marketplace, and states are responding."

Why Vodka-Based RTDs Maintain Leadership

Vodka-based cocktails command 23.5% of product type share in 2026, supported by unmatched mixability and industrial scalability.

Large spirits groups are anchoring RTD growth around vodka platforms:

Pernod Ricard partnered with The Coca-Cola Company to launch Absolut Vodka & Sprite RTDs across Europe.

Diageo plc expanded its Cocktail Collection with Ketel One and Cosmopolitan variants.

Suntory Global Spirits treats RTD as a structural pillar of its spirits growth strategy.

Vodka's neutrality allows it to scale across mixers, flavors, and markets with minimal reformulation friction, making it the default industrial base for RTD replication of classic serves.

Can Packaging: The Industrial Advantage

Cans hold 39.2% share in 2026, reflecting structural alignment with single-serve consumption and high-speed filling lines.

Investment patterns reinforce this dominance:

Diageo plc expanded its Plainfield, Illinois facility with high-speed can lines exceeding 25 million cases annually.

Major RTD launches are increasingly can-native rather than multi-format.

Lightweight transport, rapid chilling, and cost-efficient throughput make cans the operational backbone of the category.

Regional Outlook: Execution Over Access

United States (CAGR 5.9%)

The U.S. market shifts post-2026 from capacity creation to portfolio economics. Premium and super-premium premix products reached 41.5% of volume in 2024, indicating mix-driven growth rather than incremental case expansion.

Channel reform, including expanded grocery and convenience permissions, has widened access-but shelf competition is intensifying. Growth now favors suppliers with compliant pack sizes and national distributor reach.

United Kingdom (CAGR 7.6%)

The UK alcohol duty reform ties taxation directly to ABV, making alcohol strength a cost variable. Higher-ABV RTDs face structural margin pressure, pushing producers toward duty-efficient formulations.

Japan (CAGR 6.7%)

Japan evolves from alcohol reduction to consumption design. Lower-ABV RTDs and controlled drinking formats are structured around inclusive occasions. The country increasingly serves as a global test bed for exportable RTD architectures.

India (CAGR 7.8%)

India emerges as the fastest-growing major market, driven by urban experimentation and premium convenience formats.

South Korea (CAGR 6.1%)

Convenience retail chains act as category architects, launching highball SKUs and accelerating repeat-purchase cycles through fast SKU rotation.

Key Growth Constraints

Despite strong momentum, scaling faces structural limits:

Higher excise burden versus beer and wine at equivalent ABV

Expanding labeling mandates and health warnings

State-level tax fragmentation in key markets

Pricing sensitivity in value-driven channels

Regulatory fluency and operational depth increasingly separate scalable leaders from regional participants.

Competitive Landscape: Consolidation and Manufacturing Commitment

The RTD cocktail market is consolidating around global spirits groups integrating RTD into long-term portfolio architecture.

Key players include:

Anheuser-Busch InBev SA/NV

Diageo plc

Pernod Ricard

Bacardi Limited

Suntory Global Spirits

Brown-Forman Corporation

Davide Campari-Milano N.V.

Constellation Brands, Inc.

Heineken N.V.

Molson Coors Beverage Company

The Outlook: From Growth to Governance

By 2036, RTD cocktails will no longer be evaluated as an emerging sub-category of spirits but as an institutionalized beverage architecture aligned with convenience, compliance, and premiumized moderation.

Expansion is being driven less by flavor experimentation and more by structural alignment across regulation, retail control, industrial capacity, and brand leverage.

As shelf space tightens and portfolio economics sharpen, the next decade will reward companies capable of scaling repeatable, regulation-resilient SKUs across markets with precision.

For the complete strategic forecast and country-level breakdown of the RTD Cocktail Market through 2036, full report access is available upon request. https://www.futuremarketinsights.com/reports/rtd-cocktails-market

Related Reports:

RTD Cocktail Shots Market: https://www.futuremarketinsights.com/reports/rtd-cocktail-shots-market

RTD Canned Cocktail Market: https://www.futuremarketinsights.com/reports/rtd-canned-cocktail-market

RTD Bottled Cocktail Market: https://www.futuremarketinsights.com/reports/rtd-bottled-cocktails-market

Demand for RTD Cocktail Shots in USA: https://www.futuremarketinsights.com/reports/united-states-rtd-cocktail-shots-market

Pre-mixed/RTD Alcoholic Drink Market: https://www.futuremarketinsights.com/reports/pre-mixed-rtd-alcoholic-drinks-market

About Future Market Insights (FMI)

Future Market Insights (FMI) is a leading provider of market intelligence and consulting services, serving clients in over 150 countries. Headquartered in Delaware, USA, with a global delivery center in India and offices in the UK and UAE, FMI delivers actionable insights to businesses across industries including automotive, technology, consumer products, manufacturing, energy, and chemicals.

An ESOMAR-certified research organization, FMI provides custom and syndicated market reports and consulting services, supporting both Fortune 1,000 companies and SMEs. Its team of 300+ experienced analysts ensures credible, data-driven insights to help clients navigate global markets and identify growth opportunities.

For Press & Corporate Inquiries:

Rahul Singh

AVP - Marketing and Growth Strategy

Future Market Insights, Inc.

+91 8600020075

For Sales - sales@futuremarketinsights.com

For Media - Rahul.singh@futuremarketinsights.com

For web - https://www.futuremarketinsights.com/

SOURCE: Future Market Insights, Inc.

View the original press release on ACCESS Newswire