Electric vehicle (EV) industry leader Tesla (TSLA) saw its sales drop to a three-year low of 26,006 vehicles in October in China. The Chinese EV market has become highly competitive, which has affected Tesla’s demand in the country. The EV giant’s share in the Chinese market dropped from 8.7% in September to just 3.2% in October, marking another three-year low.

Tesla also made headlines when it was reported that its shareholders had approved CEO Elon Musk’s staggering $1 trillion pay package. In addition to this, shareholders also approved a resolution allowing Tesla to invest in Musk’s artificial intelligence (AI) project, called xAI.

Should you consider ditching Tesla now?

About Tesla Stock

Tesla stands at the forefront of electric mobility and sustainable energy solutions. It develops and produces electric vehicles, battery storage systems, and solar energy technologies that aim to transform the world's power generation. With a mission to promote the adoption of clean energy, Tesla integrates innovation across various sectors.

The company is also investing in self-driving technologies and global infrastructure to support widespread EV use. Headquartered in Austin, Texas, Tesla continues to redefine industry standards and push the world closer to a sustainable, zero-emission future. The company has a market capitalization of $1.48 trillion.

While Tesla’s stock is down from its highs, it has still held up well over the past year. Over the past 52 weeks, the stock has gained 24.78%. It had reached a 52-week high of $488.54 in December 2024, but is down 10.6% from this level. Despite some weakness noticed in the stock’s trajectory, it has gained 46.43% over the past six months, while the broader S&P 500 Index ($SPX) has gained 21.03% over the same period.

Tesla’s stock is trading at an eye-watering valuation. Its price is sitting at 234.33 times trailing non-GAAP earnings, which is significantly higher than the industry average of 15.51 times.

Tesla’s Top Line Is Growing, But Bottom-Line Financials Show Weakness

For the third quarter of fiscal 2025, Tesla reported a drop in its production numbers. The company produced 447,450 vehicles for the quarter, representing a 5% year-over-year (YOY) decrease. On the other hand, Tesla delivered 497,099 vehicles, representing a 7% increase from the prior year’s period and exceeding the analyst estimate of 471,057.

The carmaker’s total revenues for the quarter grew by 12% YOY to $28.10 billion, beating the analyst estimate of $26.59 billion. The company’s total automotive revenues climbed 6% from the year-ago value to $21.21 billion, surpassing the estimated figure of $19.83 billion.

However, this growth is seemingly slow by Tesla’s standards and has affected the company’s bottom line. The company’s operating margin dropped by 501 basis points to 5.8%. Tesla’s non-GAAP EPS for the quarter was $0.50, reflecting a drop of 31% YOY and missing the $0.56 analyst estimate.

The company revealed that its revenue and operating margin were impacted by lower revenue recognition from one-time FSD related to the Cybertruck release and certain feature releases in Q3 2024. Profitability was also affected by higher average cost per vehicle due to lower fixed cost absorption for certain models, an increase in tariffs, and an unfavorable sales mix.

Nonetheless, the quarter was also characterized by product expansion. Tesla launched the Model YL and Model Y Performance. The product offerings also expanded with the addition of Model 3 and Model Y Standard, which are the company’s most affordable vehicles. Tesla also unveiled the Megapack 3 and Megablock storage solutions.

Wall Street analysts are not optimistic about Tesla’s bottom-line growth trajectory. For Q4, analysts expect the company’s EPS to decline by 50% YOY to $0.33. For the current year, Tesla’s EPS is projected to decrease by 43.6% annually to $1.15, followed by a 68.7% YOY improvement to $1.94 in the following year.

What Do Analysts Think About Tesla’s Stock?

Recently, Wedbush analyst Dan Ives maintained an “Outperform” rating on the stock, with a Street-high $600 price target. Ives sees approval of Musk’s pay package as a sign that the company’s CEO will be at the center of the company’s next growth phase, with the “AI valuation” beginning to unlock.

Last month, analysts at Bank of America raised the price target on Tesla’s stock from $341 to $471. However, they also maintained a “Neutral” rating. While analysts believe the company’s valuation remains stretched, it remains a leader in “physical AI.”

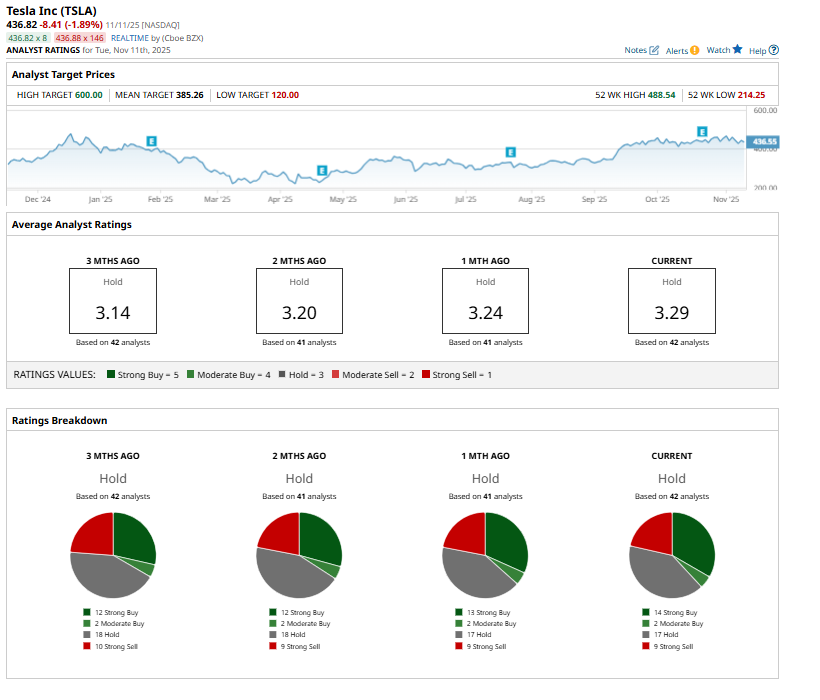

Wall Street analysts are taking a cautious stance on Tesla’s stock now, with a consensus “Hold” rating overall. Of the 42 analysts rating the stock, 14 analysts gave a “Strong Buy” rating, two analysts gave a “Moderate Buy” rating, while a majority of 17 analysts are playing it safe with a “Hold” rating, and nine analysts gave a “Strong Sell” rating. The consensus price target of $385.26 represents 12% downside from current levels. However, the Wedbush-given Street high price target of $600 indicates 37% upside from current levels.

Key Takeaways

Despite the domestic sales hitting a three-year low in China, Tesla’s exports of China-made vehicles increased to a two-year high of 35,491 units last month. Moreover, the company is investing in expanding its lineup. However, the bottom-line pressure remains. Therefore, it might be wise to observe the stock for now.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 4 Reasons to Roll Your Covered Call Option and Keep Your Income Strategy Alive

- AMD Says Data Center Revenue Could Jump 60% Annually from Here. Should You Buy AMD Stock Now?

- Circle Stock Enters Oversold Territory on Earnings Plunge. Should You Buy the Dip?

- Is It Too Late to Buy Palantir Stock in November 2025?