With a market cap of $14.3 billion, Universal Health Services, Inc. (UHS) is one of the largest hospital and behavioral healthcare operators in the U.S., running a broad network of acute care hospitals, outpatient centers, and behavioral health facilities. The King of Prussia, Pennsylvania-based company focuses on delivering inpatient and outpatient medical services, mental health treatment, and specialty care, supported by a mix of government and commercial payors.

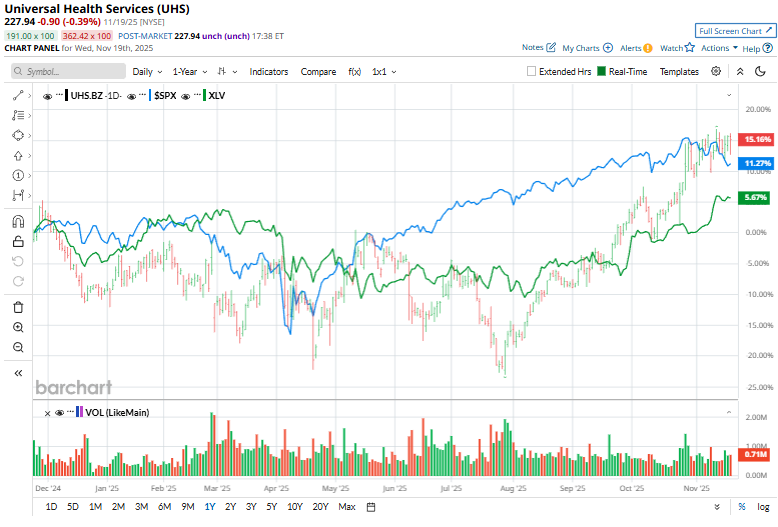

Shares of the company have outperformed the broader market over the past 52 weeks. UHS stock has climbed 15.8% over this time frame, while the broader S&P 500 Index ($SPX) has gained 12.3%. In addition, shares of the company have risen 27% on a YTD basis, compared to SPX's 12.9% increase.

Moreover, the hospital and health facility operator stock has also surpassed the Health Care Select Sector SPDR Fund's (XLV) 7.9% rise over the past 52 weeks and 10.7% rally in 2025.

UHS shares popped 1.6% after the company announced its third-quarter earnings on Oct. 27. The healthcare operator delivered 13.4% year-over-year revenue growth to $4.50 billion, thanks to robust performance across both its acute care and behavioral health segments. Profitability strengthened sharply as adjusted EPS rose to $5.69. The company boosted its full-year guidance for both revenue and earnings and expanded its share-repurchase authorization by $1.5 billion, moves that reinforced management’s confidence and helped drive the stock’s post-earnings bounce.

For the fiscal year ending in December 2025, analysts expect UHS’ adjusted EPS to grow 31.6% year-over-year to $21.85. The company's earnings surprise history is solid. It topped the consensus estimates in all of the last four quarters.

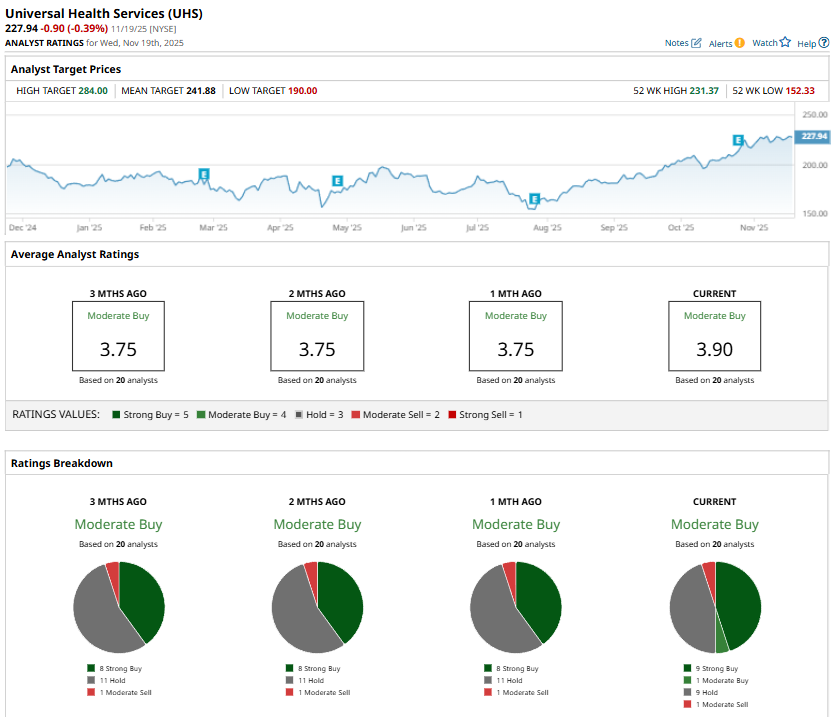

Among the 20 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings, one “Moderate Buy,” nine “Holds,” and one “Moderate Sell.”

The current consensus is bullish than a month ago, when the stock had eight “Strong Buy” suggestions.

On Oct. 10, Barclays analyst Andrew Mok maintained his “Buy” rating on Universal Health Services and set a price target of $250.

The mean price target of $241.88 represents a 6.2% premium to UHS’ current price levels. The Street-high price target of $284 suggests a 24.6% potential upside.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- IonQ Stock is on Discount: Here’s How to Tackle It From a Quantitative Angle

- Burry Calls ‘Fraud’ on Hyperscalers: 4 Pins Set to Pop the AI Bubble and the ‘Big Short’ Math on Big Tech

- The Dow Jones Looks Ready for Death, But These 3 Blue-Chip Stocks Have More Life (and Gains) Ahead

- Jensen Huang Says ‘Blackwell Sales Are Off the Charts, and Cloud GPUs Are Sold Out’ as Nvidia Crushes Q3 Earnings and Beats Analyst Expectations