With a market cap of $25.3 billion, Cincinnati Financial Corporation (CINF) provides a broad range of property casualty, life, and specialty insurance products in the United States. The company operates through five segments: Commercial Lines; Personal Lines; Excess and Surplus Lines; Life Insurance; and Investments, supported by its insurance and financial subsidiaries.

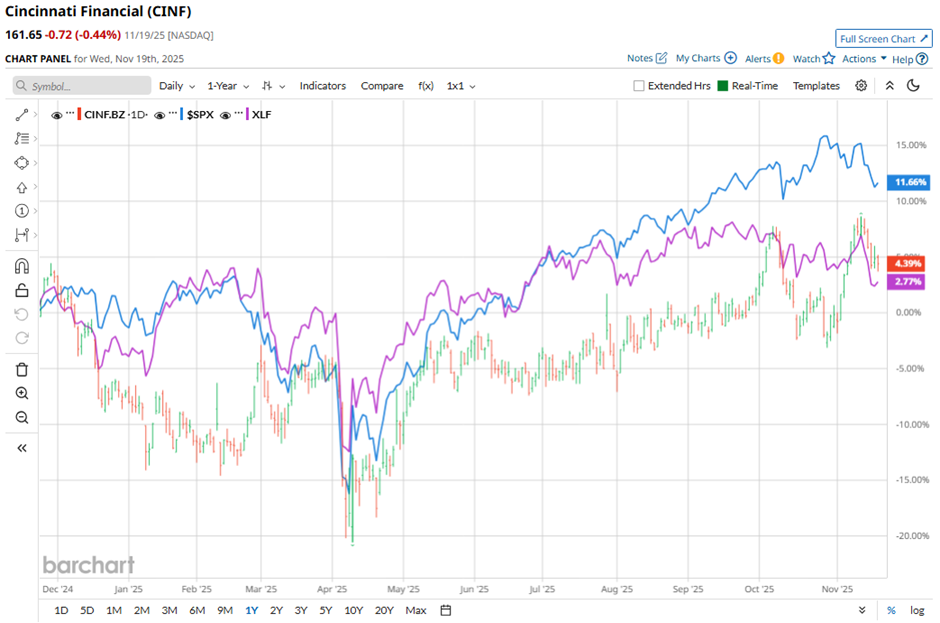

Shares of the Fairfield, Ohio-based company have lagged behind the broader market over the past 52 weeks. CINF stock has risen 7.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 12.3%. In addiiton, shares of the company are up 12.5% on a YTD basis, compared to SPX’s 12.9% gain.

However, the insurer stock has outperformed the Financial Select Sector SPDR Fund’s (XLF) 3.8% return over the past 52 weeks.

Cincinnati Financial delivered a stronger-than-expected Q3 2025 adjusted EPS of $2.85 on Oct. 27. Net income surged to $1.12 billion, boosted by a $675 million after-tax increase in the fair value of equity securities and a $152 million decrease in after-tax catastrophe losses. However, the stock fell 3.7% the next day.

For the fiscal year ending in December 2025, analysts expect CINF’s adjusted EPS to decline over 5% year-over-year to $7.20. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

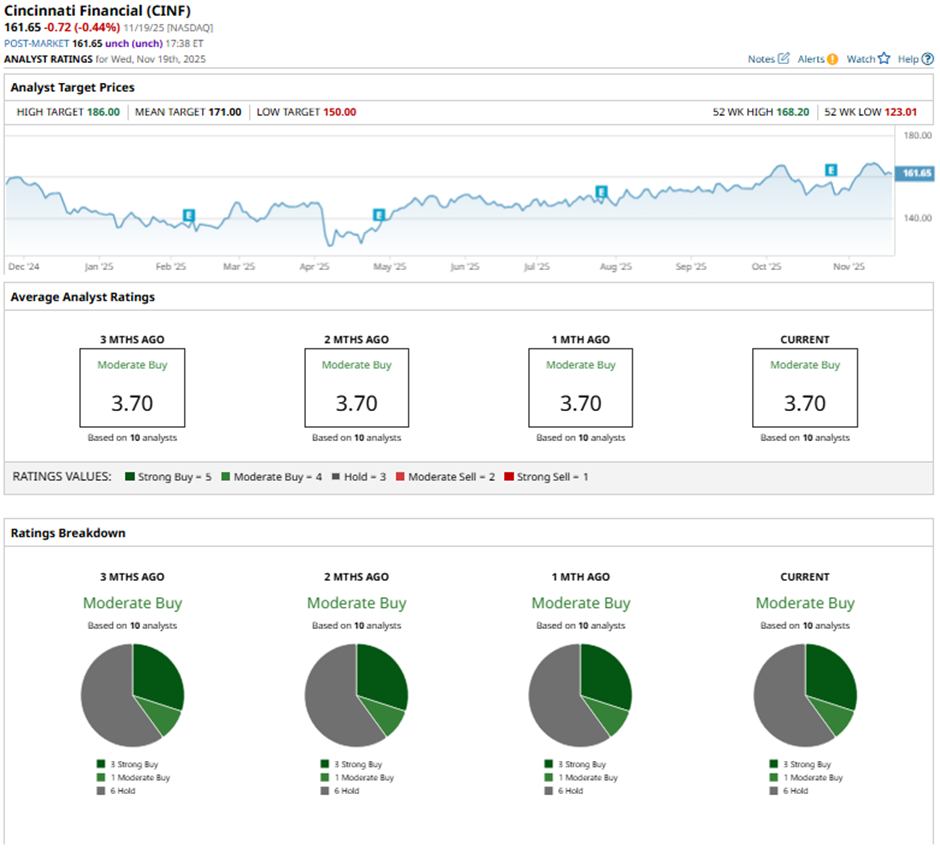

Among the 10 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on three “Strong Buy” ratings, one “Moderate Buy,” and six “Holds.”

On Oct. 28, BofA analyst Joshua Shanker raised Cincinnati Financial’s price target to $186 and maintained a Buy rating.

The mean price target of $171 represents a 5.8% premium to CINF’s current price levels. The Street-high price target of $186 suggests a 15.1% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart