With a market cap of $23.5 billion, Insulet Corporation (PODD) is a leading medical device company specializing in innovative insulin-delivery technology based in Acton, Massachusetts. Its flagship product, the Omnipod system, is a tubeless, wearable patch pump that provides continuous insulin delivery without the need for traditional tubes or multiple daily injections.

Shares of PODD have significantly outpaced the broader market over the past 52 weeks. PODD stock has soared 32.2% over this period, while the broader S&P 500 Index ($SPX) has gained 14.3%. However, shares of PODD are up 6.3% on a YTD basis, compared to SPX’s 9.5% rise.

Zooming in further, Insulet has also outperformed the iShares U.S. Medical Devices ETF’s (IHI) 3.3% rise over the past year and 6.1% return in 2025.

Insulet released its third-quarter earnings on Nov. 6, and its shares climbed 2.9% after the company posted better-than-expected results. Revenue came in at $706.3 million, up 29.9% year over year. Omnipod revenue reached $699.2 million, rising 31.0%, with U.S. Omnipod sales at $497.1 million, up 25.6% growth and international sales growing 46.5% to $202.1 million.

Gross margin improved to 72.2%, expanding by 290 basis points, while net income increased to $87.6 million, or $1.24 per diluted share. The strong performance and momentum across markets led management to raise full-year guidance, which helped fuel the stock’s post-earnings uptick.

For the current fiscal year 2025, ending in December, analysts expect PODD's adjusted EPS to increase 50.9% year-over-year to $4.89. The company has a robust earnings surprise history. It beat the Street's bottom-line estimates in each of the past four quarters.

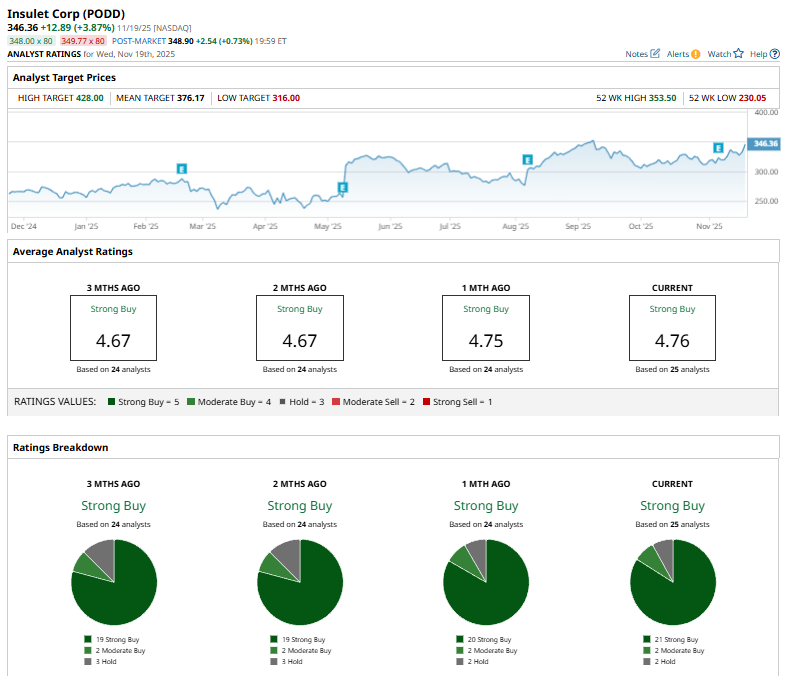

Among the 25 analysts covering PODD stock, the consensus rating is a “Strong Buy.” That’s based on 21 “Strong Buy” ratings, two “Moderate Buys,” and two “Holds.”

The current configuration is bullish than a month ago when 20 analysts had suggested a “Strong Buy” rating for the stock.

On Oct. 14, Leerink Partners’ Mike Kratky reaffirmed his “Buy” rating on Insulet and set a price target of $355.

Insulet’s mean price target of $376.17 implies a modest 8.6% premium to its current price. The Street-high target of $428 indicates the stock could soar by 23.6% from current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- IonQ Stock is on Discount: Here’s How to Tackle It From a Quantitative Angle

- Burry Calls ‘Fraud’ on Hyperscalers: 4 Pins Set to Pop the AI Bubble and the ‘Big Short’ Math on Big Tech

- The Dow Jones Looks Ready for Death, But These 3 Blue-Chip Stocks Have More Life (and Gains) Ahead

- Jensen Huang Says ‘Blackwell Sales Are Off the Charts, and Cloud GPUs Are Sold Out’ as Nvidia Crushes Q3 Earnings and Beats Analyst Expectations