Valued at a market cap of $13.9 billion, Allegion plc (ALLE) is a prominent Ireland-based security-products company specializing in mechanical and electronic access solutions. Its portfolio includes locks, door controls, electronic smart-access systems, and security software used in homes, businesses, schools, and institutions.

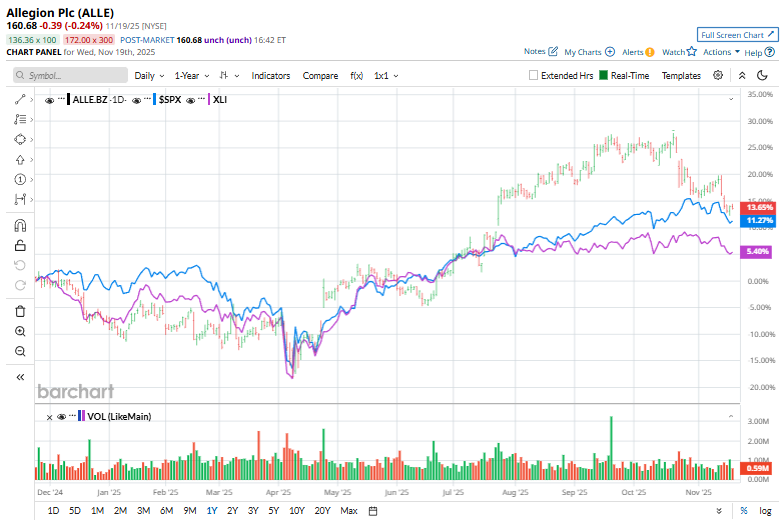

Shares of ALLE have outpaced the broader market over the past 52 weeks. ALLE has climbed 16.3% over this time frame, while the broader S&P 500 Index ($SPX) has gained 12.3%. Moreover, shares of ALLE are up 23% on a YTD basis, compared to SPX’s 12.9% rise.

Zooming in further, Allegion has outperformed the Industrial Select Sector SPDR ETF Fund’s (XLI) 8.3% return over the past 52 weeks and 14.1% rise on a YTD basis.

Despite posting better-than-expected third-quarter results on Oct. 23, its shares dropped 2.4% as investors reacted cautiously to the company’s mixed underlying metrics. Allegion reported $1.07 billion in revenue, up 10.7% year over year, with 5.9% organic growth, and posted solid profitability with adjusted EPS growth of 6.5% to $2.30. Regional performance was strong, particularly in the Americas, and acquisitions helped drive international gains.

Margins remained healthy, though slightly softer than last year, which may have contributed to the market’s muted reaction. Still, the company raised its full-year revenue and EPS guidance, signaling confidence in its operational momentum despite the stock’s immediate pullback.

For the fiscal year ending in December 2025, analysts expect ALLE’s adjusted EPS to increase 8.9% year-over-year to $8.20. The company's earnings surprise history is solid. It beat the consensus estimates in the past four quarters.

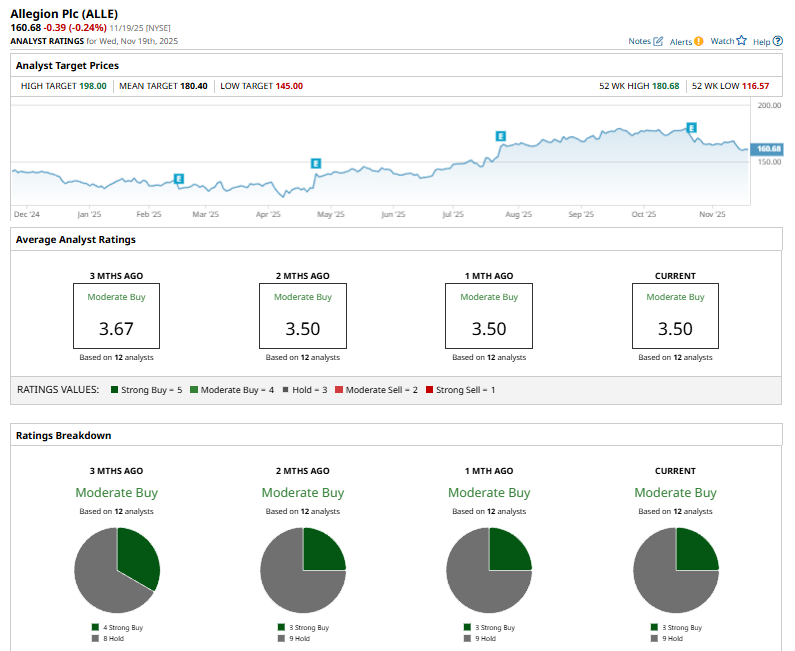

Among the 12 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on three “Strong Buy” ratings and nine “Holds.”

The current consensus is bearish than three months ago, when the stock had four “Strong Buy” suggestions.

On Oct. 16, J.P. Morgan’s Tomohiko Sano reaffirmed his “Buy” rating on Allegion and set a $190 price target.

Allegion’s mean price target of $180.40 represents a premium of 12.3% over the current price. The Street-high price target of $198 implies a potential upside of 23.2%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- IonQ Stock is on Discount: Here’s How to Tackle It From a Quantitative Angle

- Burry Calls ‘Fraud’ on Hyperscalers: 4 Pins Set to Pop the AI Bubble and the ‘Big Short’ Math on Big Tech

- The Dow Jones Looks Ready for Death, But These 3 Blue-Chip Stocks Have More Life (and Gains) Ahead

- Jensen Huang Says ‘Blackwell Sales Are Off the Charts, and Cloud GPUs Are Sold Out’ as Nvidia Crushes Q3 Earnings and Beats Analyst Expectations