Sonder (SOND) shares more than doubled on Nov. 20 as trading volume soared to over 5x the daily average despite no material news from the hospitality company. Shares appear set for delisting from the Nasdaq Exchange.

The explosive move to the upside, therefore, appears driven by speculative momentum and retail enthusiasm only, not fundamentals.

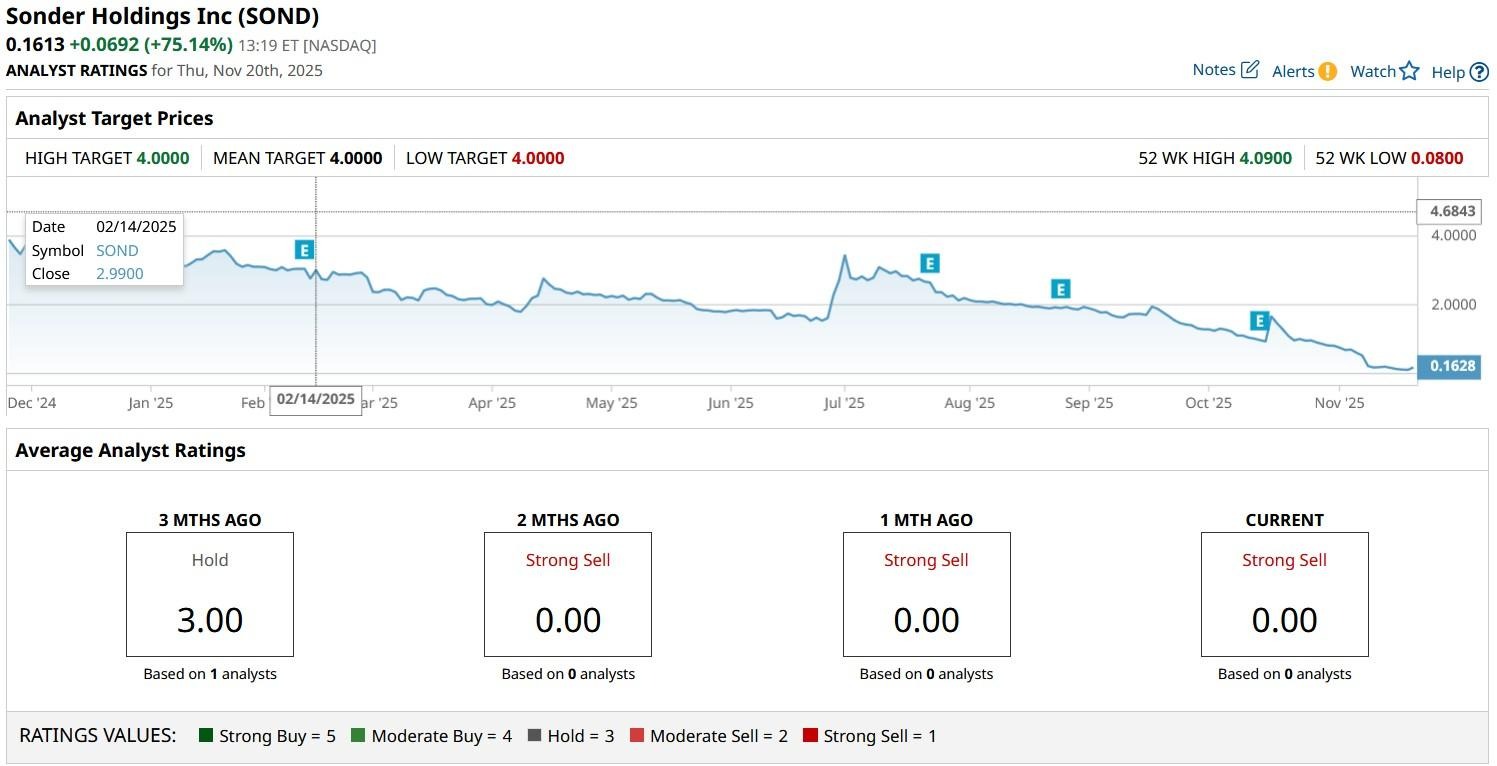

Despite the massive surge, SOND stock is trading only at a fraction of its price at the start of 2025.

Why Sonder Stock Isn’t Safe to Own

Investors are cautioned against chasing the rally Sonder Holdings Inc primarily because it remains a deeply distressed company.

The San Francisco-headquartered firm has already filed for Chapter 7 bankruptcy in Delaware following a licensing rift with Marriott (MAR) and warned investors that trading in its shares is “highly speculative.”

SOND has ceased operations, its liabilities far exceed its assets, and with no clear path to recovery, equity holders are unlikely to see residual value.

The company’s legal battle with Marriott International and a class action from employees only add to its financial challenges.

Therefore, the risks of owning Sonder stock far outweigh the upside potential at this stage.

Why SOND Shares Could Reverse Gains Quickly

Despite a meteoric rally, SOND continues to trade decisively below the $1 mark, which classifies it as a penny stock, a category known for extreme volatility and limited institutional support.

More important, the Nov. 20 rally bears all the hallmarks of a meme stock surge: massive volume, no news, and social media hype.

These types of rallies are typically short-lived and prone to sharp reversals as gains are unlikely to hold without a fundamental catalyst. This often leaves latecomers with steep losses.

In short, the penny stock status and a meme stock rally in SOND shares make them more warning than opportunity for seasoned investors.

Sonder Doesn’t Receive Coverage from Wall Street

What’s also worth mentioning is that Wall Street analysts have stopped covering Sonder shares.

That means no updated earnings estimates, no price targets, and no institutional guidance, leaving retail investors flying blind. In this environment, caution is paramount.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Wall Street Sees a ‘Buying Opportunity’ in This Rare Earths Stock. Should You Snap Up Shares Now?

- Billionaire Gina Rinehart Is Now the Top Investor in MP Materials. Should You Follow the Money and Buy MP Stock Too?

- Can Nvidia Stock Test Wall Street’s Price Target of $350?

- A Fannie Mae IPO Is ‘Far From Ready.’ What Does That Mean for FNMA Stock Here?