Dividend Aristocrats and perhaps to a lesser extent, the Dividend Kings often get all the attention when it comes to income investing... but focusing only on those groups could lead to missing out on other bigger opportunities.

Before actually increasing their dividends consistently for decades, these companies also had to start from somewhere. And some of the most exciting dividend growers are the ones “flying” under the radar. They are also riskier plays. But investors who find these types of companies before they become Aristocrats could end up with a significantly higher yield-on-cost in the future.

For that reason, today, I’m not focusing on the usual “popular” names. Instead, I'll share with you some high-risk, high-yielding dividend stocks that have the backing of Wall Street analysts; qualities that these companies need to become a Dividend Aristocrat eventually.

How I Came Up With The Following Stocks

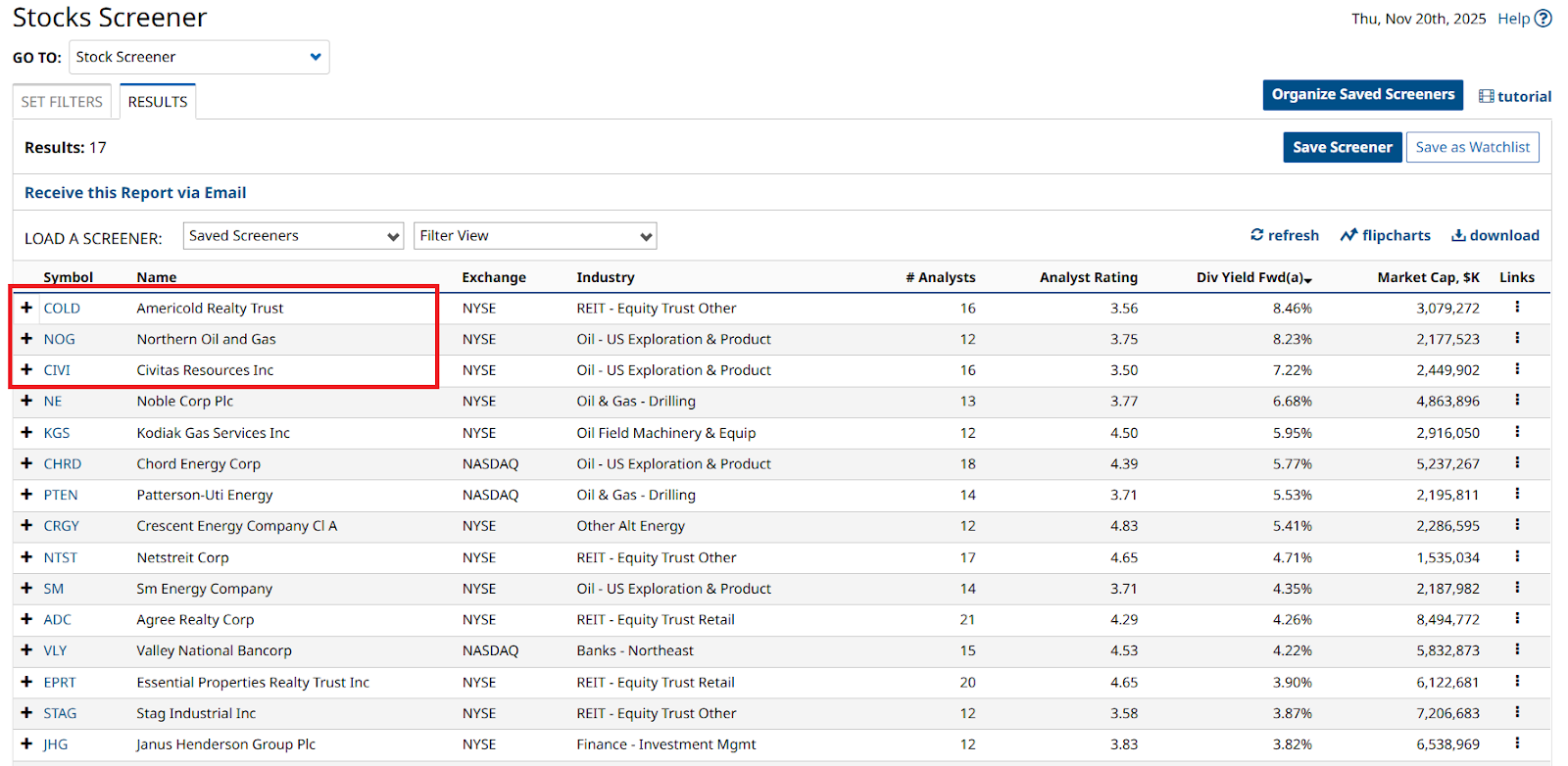

I used Barchart’s Stock Screener to find the highest-yielding companies on my watchlist.

- Number of Analysts: 12 or higher. A higher consensus suggests more confidence.

- Current Analyst Rating: 3.5 – 5. Companies that have average “Moderate” to “Strong Buy” ratings suggest quality.

- Annual Dividend Yield (FWD),%: Left blank so I can use it later to sort the results from highest to lowest.

- Market Cap ($K): $300M - $10B. “Small” to “mid-sized” companies- names that are usually missed.

- Dividend Investing Ideas: Best Dividend Stocks, those that could be the next Dividend Aristocrats.

17 results match the screen, so I’ll sort them by highest yield to get my list of highest-yielding dividend stocks.

Let’s start with the first dividend stock:

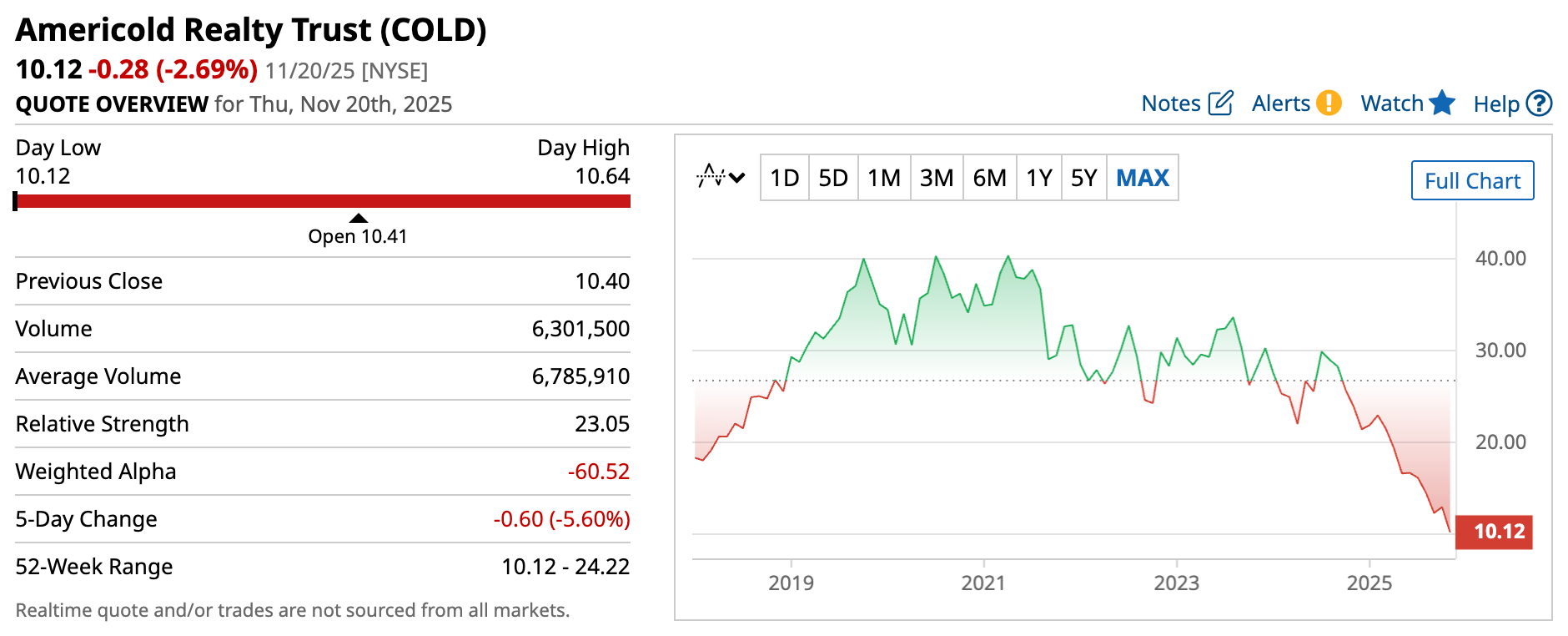

Americold Realty Trust (COLD)

Americold Realty Trust is a real estate investment trust (REIT), a company that owns income-producing real estate, allowing individuals to buy shares instead of directly owning the property. Founded in 1903, Americold owns and operates one of the world’s largest networks of food industry warehouses. And the company continues to expand. For example, just last month, Americold secured exclusive rights to export Irish meat to the U.S., making it the only third-party cold storage provider with this approval.

In its most recent financials, Americold reported that sales declined 1% YOY to $664 million, with its net loss growing almost 205% to $11 million. This is due to rising operating costs and softening demands. Despite this, Americold maintains a market cap of roughly $3 billion, a relatively small company with potential to scale.

The company pays a forward annual dividend of $0.92, translating to a yield of approximately 9%. This makes Americold the highest-yielding dividend stock on the list today, and with a consensus among 16 analysts rating the stock a “Moderate Buy”, it might be worth considering as a spec play. The stock has a high target price of $18, suggesting up to 80% upside over the next year.

Northern Oil and Gas (NOG)

The second dividend stock on my list is Northern Oil and Gas, an energy company that acquires and develops oil and natural gas properties. Founded in 2006, Northern Oil and Gas became the largest publicly traded, non-operated, upstream energy owner in the country.

In its recent financials, Northern Oil and Gas reported sales were down over 25% YOY to $557 million, while it also incurred a net loss of over 140% to $129 million due to lower energy prices and shrinking production volume. Even so, the company got its main credit line extended through 2030 and even had the interest rate lowered, highlighting the lender's trust in NOG.

NOG pays a forward annual dividend of $1.80, translating to a yield of around 8.4%. Further, a consensus among 12 analysts rates the stock a “Moderate Buy,” which has increased over the last three months. There is also considerable upside: as much as 144% should the stock hit its high target price of $52.

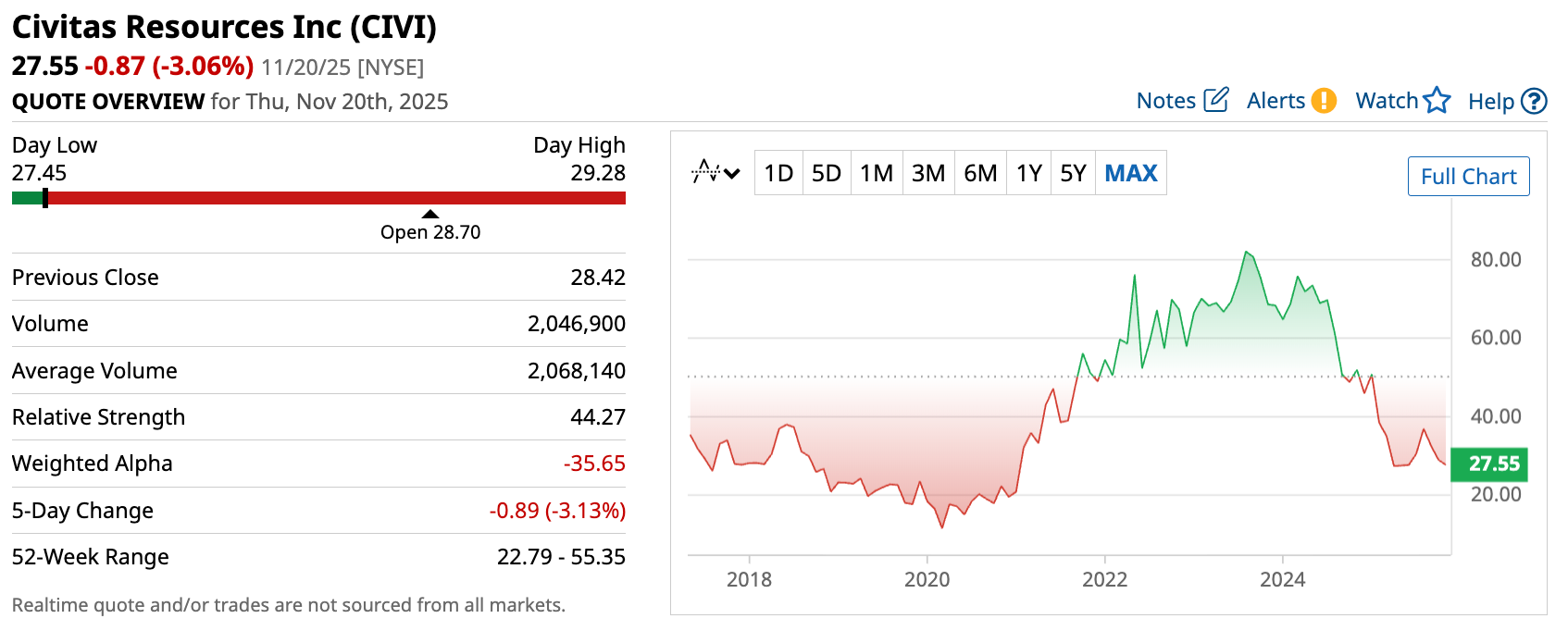

Civitas Resources Inc (CIVI)

The last dividend stock on my list is Civitas Resources Inc., another oil & gas company. Civitas was founded in 1999 and today is one of the leaders in its peer group. Recently, Civitas and SM Energy unveiled plans to merge with SM Energy, which should save $200-300 million in annual costs, and to sell over $1 billion in assets to shore up capital.

In its recent financials, Civitas Resources reported sales are down over 8% YOY to $1.17 billion with a net loss of approximately 40% to $177 million as a result of falling output, lower oil prices, and increasing production costs- all of which squeeze margins. Still, the company maintains a market cap of $2.45 billion, in a position for growth relative to its industry peers.

The company pays a forward annual dividend of $2.00, translating to a yield of around 7.2%. At the same time, 16 analysts rate the stock a “Moderate Buy,” a sentiment that has been consistent over the previous three months. Also, with a high target price of $55, analysts suggest there’s as much as 99% upside potential in the stock over the next 12 months.

Final Thoughts

So there you have it, the three highest-yielding “best dividend stocks” today. These may not be as established or safe as you might expect from the Dividend Aristocrats or Kings, but these companies offer high yields, backing from multiple analysts, and a potential for growth that could later become the foundation for becoming a consistent dividend powerhouse.

However, these stocks are volatile, and investors with a low tolerance for risk might want to do some additional due diligence before hitting the buy button. Regardless, these under-the-radar candidates could make a nice addition to one's income portfolio.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Elon Musk Says the Job of the Future is No Longer Coding, It’s ‘No Job’ At All. Here’s How Investors Can Prepare.

- 3 High-Yield Dividend Gambles Paying Up to 9%- And Wall Street Says ‘Buy’

- With Earnings Behind It, Nvidia Stock Looks Ripe for Covered Calls

- Bitcoin Prices Are Falling, But MicroStrategy Is Not Sweating the Selloff. MSTR Stock Has a 71-Year Runway, According to Management.