Undoubtedly, the world is changing fast. Artificial intelligence, generative AI, and machine learning are reforming how we live and work, and have already had a dramatic impact on the stock market and the economy.

Now, we may be on the verge of yet another fundamental shift, according to Melius Research analyst Rob Wertheimer. He says that “hundreds of billions in value” will shift to Tesla (TSLA) in the next five years because of the company’s improved full self-driving (FSD) software.

The analyst points out that less than 1% of Americans have ridden in a self-driving car, and the rollout “will still shock most people,” when Tesla’s FSD software rolls out to the masses. He warns that legacy automakers will be left in the dust because of outdated architecture and weak supplier systems. “Our point is not that Tesla is at risk, it’s that everybody else is,” he wrote in a research note.

TSLA stock is a “must own” stock, Wertheimer says, because “the world is about to change dramatically.” He points specifically to the A15 chip for FSD software that Tesla is due to release next year as a massive catalyst.

Is he right? Let’s take a closer look at Tesla today.

About Tesla Stock

Tesla is the world's largest automaker, with a market cap of $1.4 trillion. The Texas-based company gets most of its automotive sales from its Model Y electric SUV and its Model 3 electric sedan. Other models include the luxury Model S sedan, the luxury Model X SUV, and the Cybertruck.

Tesla vehicles include advanced technology, including large, centralized touchscreens, autopilot features, and over-the-air software updates.

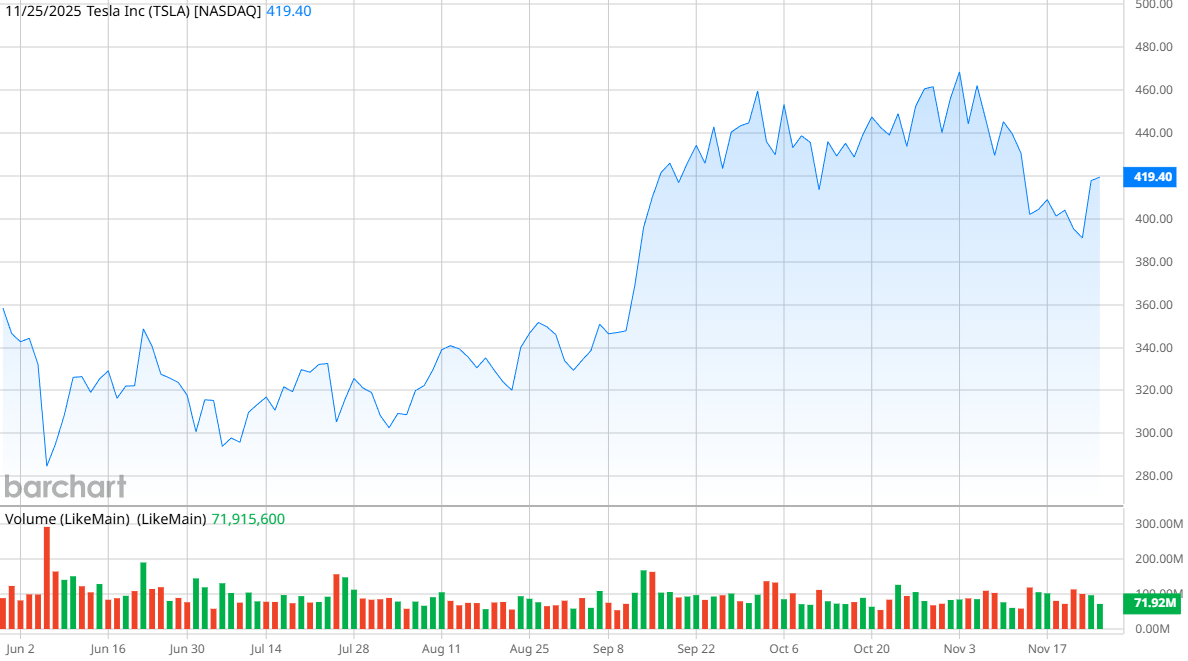

Shares are up over 4% this year, which is about in the middle of the pack compared to other automakers. General Motors (GM) has the best performance of the year, up 36%, while Toyota (TM) and Honda (HMC) are up less than 5% and Stellantis NV (STLA) is down nearly 20% on the year.

But TSLA stock stands out when you look at its price-to-earnings ratio, which is a whopping 280 when none of the other automakers listed have a P/E above 15. So, investors are paying a massive premium for Tesla stock right now in hopes that it will provide larger gains down the road.

Tesla Misses on Earnings

Tesla had an interesting third quarter. Faced with the expiration of the federal tax credit on EVs, the company pushed hard for customers to finalize their sales before the end of the quarter — and that worked, because the company reported revenue of $28.09 billion, which was up from $25.18 billion a year ago. However, margins sank — from 10.8% a year ago to 5.8% in the current quarter — and net income of $1.95 billion was down from $2.18 billion in Q3 2024. Tesla missed on earnings per share, posting $0.37 per share, when analysts were expecting $0.41 per share.

The EV maker reported it set company records for deliveries with 497,099 vehicles — 481,166 of them being their popular Model 3 and Model Y. It also set a record for deploying 12.5 gigawatt hours of energy storage products.

Tesla also noted that the company began deploying version 14 of its FSD in October, and made its Robotaxi iOS app available to download throughout the U.S. and Canada. Both are in preparation for introducing FSD to the masses, and for allowing Tesla owners to earn money by remotely renting out their cars as robotaxis.

The company did not issue specific guidance for Q4. “It is difficult to measure the impacts of shifting global trade and fiscal policies on the automotive and energy supply chains, our cost structure and demand for durable goods and related services,” management said. “While we are making prudent investments that will set up our vehicle, energy and other future businesses for growth, the actual results will depend on a variety of factors, including the broader macroeconomic environment, the rate of acceleration of our autonomy efforts, and production ramp at our factories.”

What Do Analysts Expect for TSLA Stock?

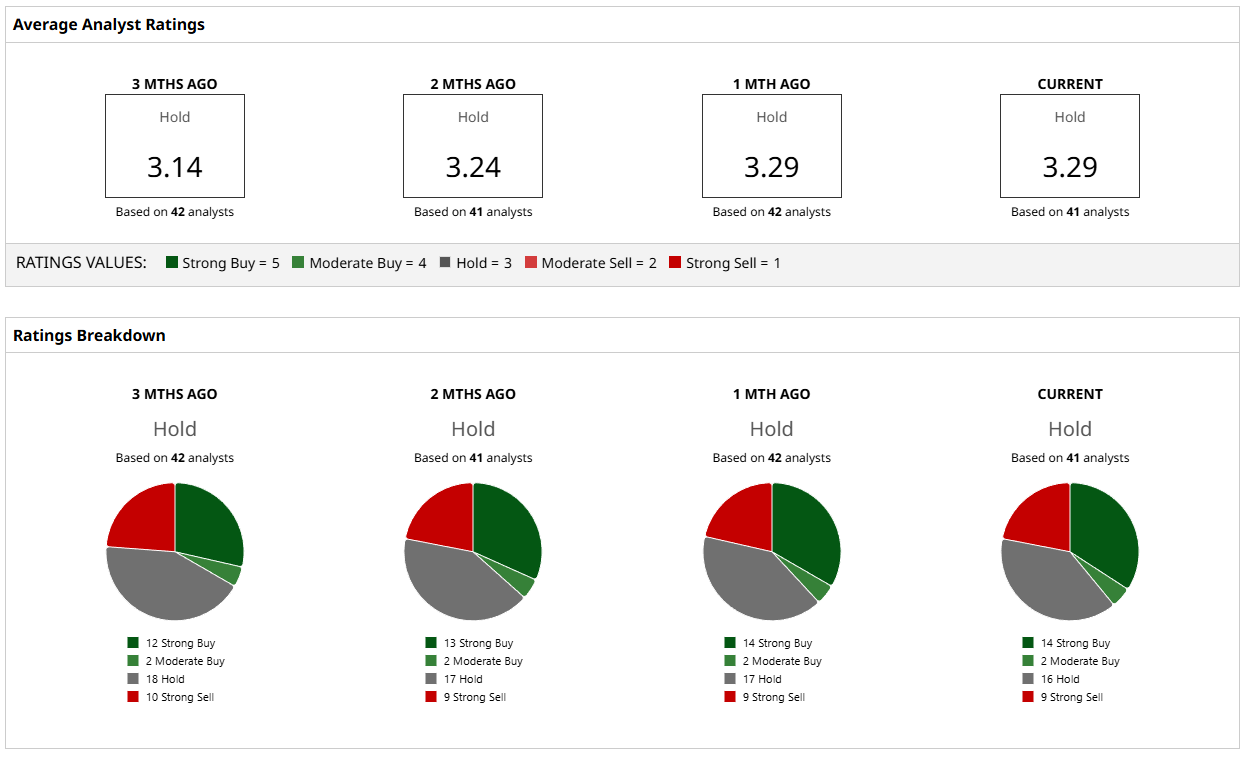

Analyst sentiment on Tesla is largely unchanged, and suggests that caution is warranted. Of 41 analysts covering the stock, 16 have “Buy” ratings, nine have “Sell” ratings, and the rest recommend holding. The mean price target for TSLA stock is around 7% lower than the current stock price, which is troubling. A high price target of $600 suggests a potential 43% gain, and a low price target of $120 warns of a potentially harmful collapse of 71% in stock price.

Tesla, to be sure, is a divisive stock and people have strong opinions. But it should be noted that there are a lot of analysts who echo Wertheimer’s bullishness. Cathie Wood of Ark Invest has notably predicted that TSLA stock will be worth $2,900 by 2029, with FSD generating as much as 90% of the company’s revenue. But she also recently trimmed her company’s investment in Tesla.

And Dan Ives of Wedbush Securities has called Tesla the “most undervalued AI name” in the market, predicting that AI and robotics will power Tesla to $600 per share.

The bullish sentiment explains why TSLA stock trades at such a high valuation. But if the bulls like Wertheimer are correct, Tesla could be a value for a long-term investor.

On the date of publication, Patrick Sanders did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ‘These Chips Will Profoundly Change the World’ and ‘Save Lives.’ Elon Musk Doubles Down on AI Chips as TSLA Stock Stagnates YTD.

- This Undiscovered Biotech Stock Has Quintupled in a Year and Just Hit New Highs

- Oppenheimer Thinks Investors Are Missing Out on IBM Stock

- Wedbush Just Raised Its Fannie Mae Price Target 1,050%. Should You Buy FNMA Stock Here?