McKesson Corporation (MCK), rooted in 1833, has transformed from a modest drug importer into a formidable global healthcare services force. Based in Irving, Texas, it now commands a vast distribution network spanning pharmaceuticals, medical-surgical supplies, and advanced technology solutions for hospitals, pharmacies, and major health systems. Its scale, logistical strength, and deep integration across the healthcare supply chain position McKesson as an indispensable pillar of modern medical infrastructure. Its market capitalization stands at $109.1 billion.

McKesson’s sheer scale secures its “large-cap” status effortlessly, easily surpassing the $10 billion benchmark without breaking a sweat. This size represents decades of built infrastructure, deep distributor relationships, and diversified revenue lines that shield it from volatility in any one business segment. McKesson is big and entrenched, essential, and fully embedded in how the U.S. healthcare system moves, stores, and delivers medicine. Its distribution network alone spans thousands of facilities, making it one of the few players capable of handling high-volume pharmaceutical demand at a national scale.

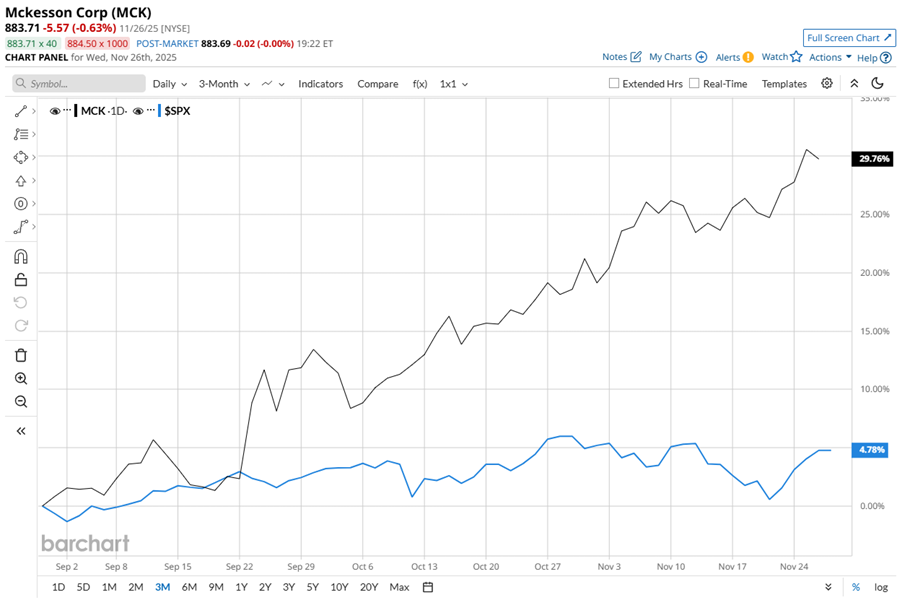

That dominance has turned into strong market traction lately. Shares of the healthcare giant hit a record high of $895.58 on Nov. 26 before easing 1.3%. Even with that minor pullback, the stock has been a standout performer. MCK has surged nearly 30% over the past three months, crushing the S&P 500 Index’s ($SPX) 5.1% gain in the same period.

And the long-term picture is even brighter. McKesson’s shares have climbed 55.1% year-to-date (YTD) and 41.4% over the past 52 weeks, doubling and even tripling the broader market’s momentum. By comparison, the SPX is up just 15.8% YTD and 13.6% over the past 52 weeks.

The technical picture strongly supports that strength. MCK has traded above its 200-day moving average throughout the past year. Its 50-day moving average has also acted like a supportive trendline, cracked a bit in July, but the stock snapped back above it by September. Since then, MCK has marched higher, confirming a bullish setup with both key moving averages trending firmly upward.

Fueling that rally is a powerful mix of operational execution and financial momentum. On Nov. 6, shares jumped nearly 1.7% after the company delivered robust fiscal Q2 results the day before. Revenue rose 10.1% year over year (YoY) to $103.2 billion, supported by higher prescription volumes and increased distribution of oncology and multispecialty drugs – two categories with steady, long-term demand.

EPS surged 377% YoY to $8.92, helped by lapping divestiture-related charges, and management lifted its adjusted EPS outlook to $38.35 to $38.85 range for fiscal 2026. McKesson’s deeper push into specialty pharmaceuticals and its expanding partnerships with major healthcare providers are also strengthening investor confidence.

While competition remains intense in the medical distribution area, rival Cencora, Inc. (COR) rose 48.3% over the past 52 weeks and jumped 67% on a YTD basis, outperforming MCK’s double-digit rallies.

Yet Wall Street remains firmly in McKesson’s corner. Among 16 analysts covering MCK, the stock has a “Strong Buy” rating, with a mean price target of $936.80, implying 6% upside potential from current levels.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This AI Dividend Stock Is a Buy Even as the S&P 500’s Yield Falls to Dot-Com Lows

- Have You Heard of the ‘Wheel’ Strategy? These 3 Unusually Active Stocks to Buy Can Get You Started

- 3 Buy-Rated Dividend Aristocrats Easily Beating Inflation

- ‘Insatiable’ Demand Is Powering This ‘Picks and Shovels’ AI Stock up 245%. Should You Buy It Here?