Valued at $51.5 billion by market cap, San Jose, California-based Western Digital Corporation (WDC) operates as one of the largest data storage device and solutions companies in the world. It designs, develops, manufactures, and markets a broad range of HDDs used in desktops, servers, network-attached storage devices, video game consoles, etc.

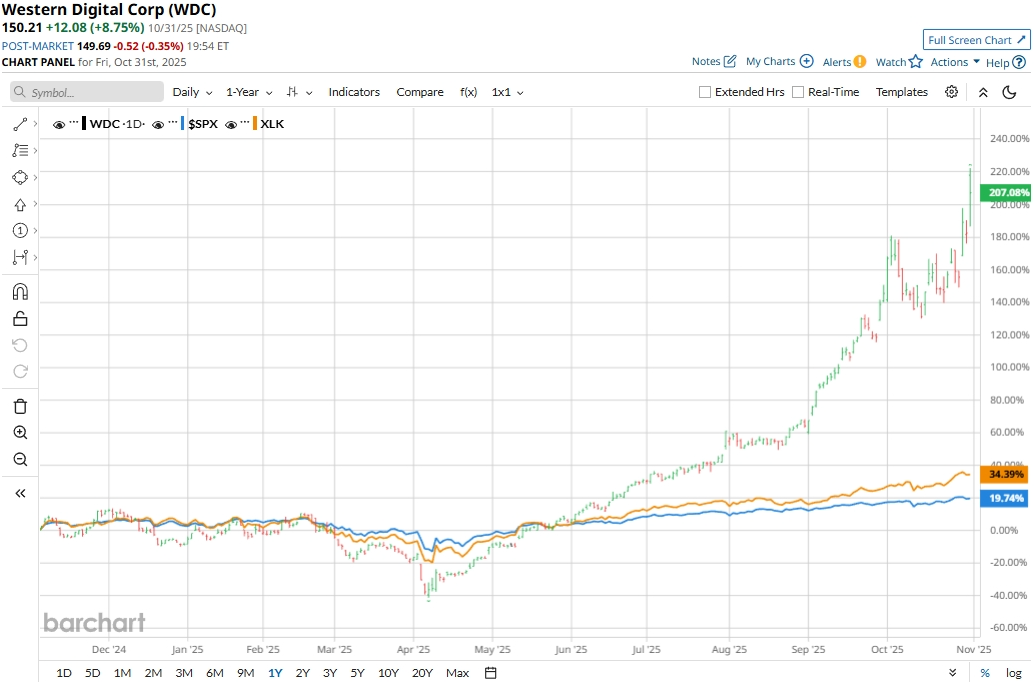

The HDD giant has significantly outperformed the broader market over the past year. WDC stock prices have soared 235.9% on a YTD basis and 198.8% over the past 52 weeks, notably outpacing the S&P 500 Index’s ($SPX) 16.3% gains in 2025 and 17.7% returns over the past year.

Zooming in further, the stock has also outpaced the sector-focused Technology Select Sector SPDR Fund’s (XLK) 29.3% gains in 2025 and 31% surge over the past year.

Western Digital’s stock prices soared 8.8% in the trading session following the release of its robust Q1 results on Oct. 30. Q1 marked a solid start for fiscal 2026. Driven by the strong demand for its data storage products and solutions in the cloud space, the company’s topline has observed a continued surge in recent quarters. Further, the constant increase in usage of AI is expected to continuously push the demand for storage solutions, creating a major tailwind for WDC.

Its revenues for the quarter jumped 8.2% sequentially and 27.4% compared to the year-ago quarter to $2.8 billion, beating the Street’s expectations by 3.5%. Meanwhile, its EPS skyrocketed 137.3% year-over-year to $1.78, surpassing the consensus estimates by a large margin.

For the full fiscal 2026, ending in June, analysts expect WDC to deliver an EPS of $7.55, up 53.2% year-over-year. On an even more positive note, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

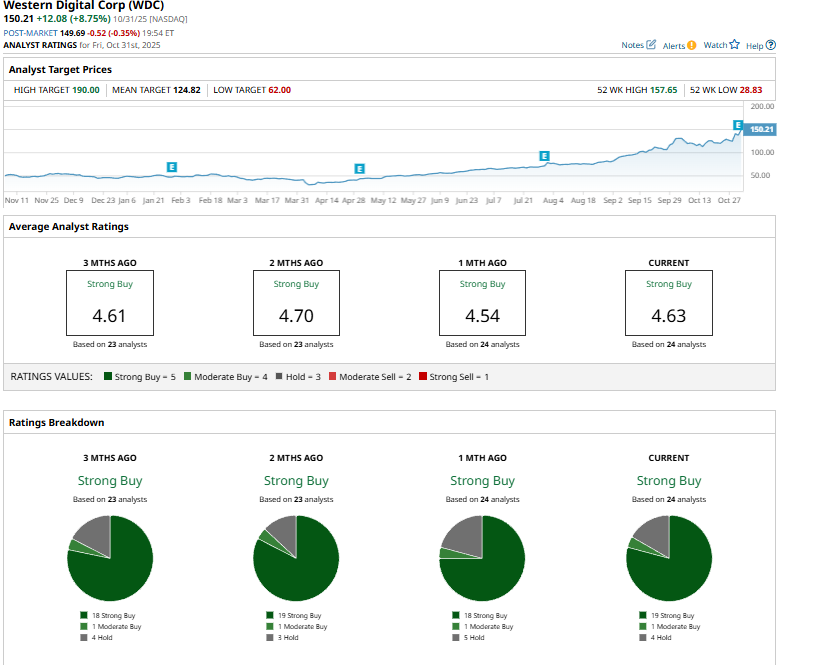

Among the 24 analysts covering the WDC stock, the consensus rating is a “Strong Buy.” That’s based on 19 “Strong Buys,” one “Moderate Buy,” and four “Holds.”

This configuration is slightly more optimistic than a month ago, when 18 analysts gave “Strong Buy” recommendations.

On Nov. 1, Wells Fargo (WFC) analyst Aaron Rakers reiterated an “Overweight” rating on WDC and raised the price target from $150 to $180.

As of writing, WDC is trading above its mean price target of $124.82. Meanwhile, its street-high target of $190 suggests a 26.5% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart