Houston, Texas-based Halliburton Company (HAL) operates as one of the world’s largest oilfield service providers. With a market cap of $22.9 billion, the company’s offerings include equipment, maintenance, engineering, and construction services to the energy sector, ensuring efficient and sustainable energy extraction.

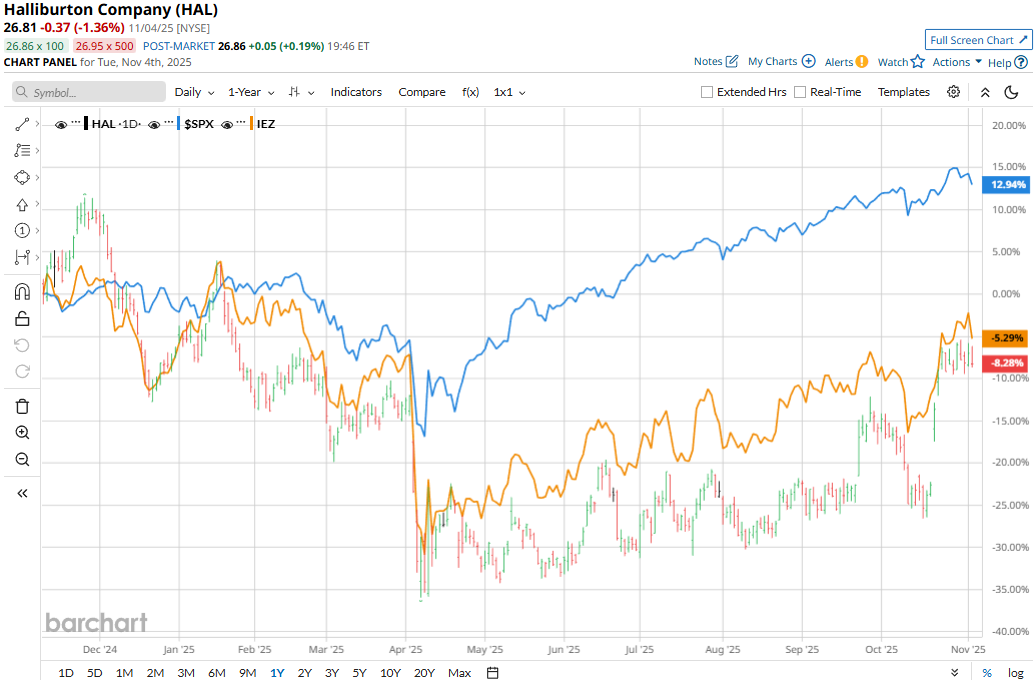

The energy sector major has notably lagged behind the broader market over the past year. HAL stock prices have dipped 1.4% on a YTD basis and declined 4.7% over the past 52 weeks, lagging behind the S&P 500 Index’s ($SPX) 15.1% gains in 2025 and 18.5% surge over the past year.

Narrowing the focus, Halliburton has also underperformed the industry-focused iShares U.S. Oil Equipment & Services ETF’s (IEZ) 2.2% uptick in 2025 and 2.9% gains over the past year.

Haliburton’s stock prices soared 11.6% in a single trading session following the release of its better-than-expected Q3 results on Oct. 21. The company made notable progress on improving its operational efficiency, which is expected to deliver $100 million per quarter in cost savings. Its topline for the quarter decreased 1.7% year-over-year to $5.6 billion, but surpassed the Street’s expectations by a notable 4%. Meanwhile, its adjusted net income declined 22.6% year-over-year to $496 million, but its adjusted EPS of $0.58 exceeded the consensus estimates by 16%.

For the full fiscal 2025, ending in December, analysts expect HAL to deliver an adjusted EPS of $2.16, down 27.8% year-over-year. On a positive note, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line projections in each of the past four quarters.

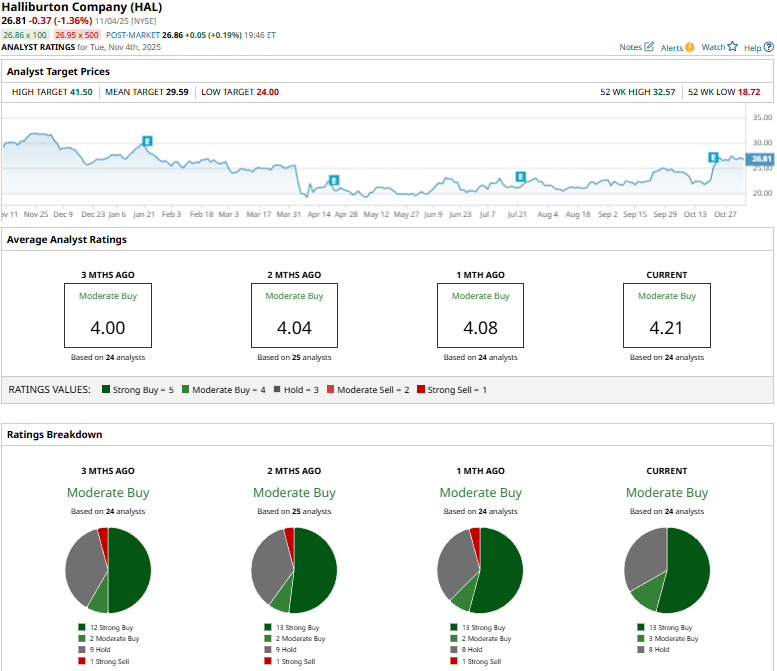

Among the 24 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 13 “Strong Buys,” three “Moderate Buys,” and eight “Holds.”

This configuration is notably more optimistic than a month ago, when the stock had a “Strong Sell” rating on it.

On Nov. 3, Rothschild & Co analyst Sebastian Erskine initiated coverage on HAL with a “Buy” rating and set a price target of $35.

HAL’s mean price target of $29.59 represents a 10.4% premium. Meanwhile, the Street-high target of $41.50 suggests a staggering 54.8% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart