It looks like after a string of losses, cloud and software services provider Oracle (ORCL) has finally scored a win. According to various reports, the company will be a part of a set of investors that will own the US operations of TikTok, the popular social media platform used by about 170 million Americans daily. Purported to be a deal worth $14 billion, Oracle is expected to partner with Silver Lake and Abu Dhabi-based MGX to own TikTok U.S. through a joint venture.

It is expected that each of Oracle, MGX, and Silver Lake will own 15% each of TikTok, with ByteDance retaining a 20% minority ownership, and the rest will go to some particular investors of ByteDance. Notably, Oracle will handle data security, U.S. user data hosting, and algorithm oversight as part of meeting U.S. national security requirements. However, it must be kept in mind that the deal is yet to be ratified by Chinese regulators.

So, assuming it gets through, will the turnaround story for Oracle start with it owning a stake in TikTok? Or are the recently highlighted factors too big to ignore for investors? Let's find out.

Financials Not Concerning at the Moment Despite a Huge Debt Pile

Oracle's fiscal Q2 numbers, especially its revenue miss, sent alarm bells ringing on Wall Street, leading to a severe decline in the company's share price. However, it was not as bad as it was made out to be.

Oracle posted a respectable set of numbers for the quarter, with revenue landing at $16.1 billion, good for a 14% gain over last year. The cloud business, now the biggest piece of the pie, pulled in close to $8 billion and grew 34% from the year-before period. Overall sales came in a touch light against the $16.21 billion consensus mark.

EPS checked in at $2.26, a strong 54% jump year-over-year (YoY) and well clear of the $1.64 the Street had lined up. Oracle's recent history on earnings has been fairly even, with roughly half beats and half misses across the last eight reports.

However, the real eye-catcher was the explosion in remaining performance obligations, which rocketed 438% to $523 billion. That kind of backlog growth speaks volumes about locked-in demand, clearer revenue visibility ahead, and customers digging in deeper with Oracle's stack.

Cash from operations stayed healthy, clocking $10.2 billion for the first half of fiscal 2026 (through Nov. 30), ahead of the $8.7 billion from a year earlier. Free cash flow, though, swung to a negative $394 million from a positive $11.3 billion earlier in the year, which is a red flag when the company is having north of $100 billion in debt.

Overall, the company exited the quarter with $19.2 billion in cash on hand, easily covering the $8.1 billion in short-term obligations and keeping any near-term liquidity worries at bay.

Meanwhile, with a market cap of $551.5 billion, the ORCL stock is up 19% on a year-to-date (YTD) basis.

TikTok, AI & More

Apart from the stated reasons of national security and American pride, Oracle has two primary strategic reasons to own a piece of TikTok. Firstly, the arrangement secures a massive, multi-year cloud tenant in TikTok's U.S. operations, converting its data and AI processing needs into steady, recurring revenue for Oracle Cloud Infrastructure (OCI) while serving as tangible validation for the platform's capabilities.

Beyond that, Oracle views the partnership as a marquee reference for security and AI-scale infrastructure that can open doors with other large enterprises and public-sector clients.

On the reputational side, managing TikTok's American user data under a tightly controlled “trusted partner” framework publicly proves Oracle can operate at consumer-scale volumes with rigorous, auditable safeguards in place. Companies in regulated industries such as banking, healthcare, and government agencies, and even other digital platforms, weigh cloud choices heavily on proven security track records and independent certifications. Successful execution here would give Oracle credible talking points to pitch managed AI services, database tools, and full application stacks to media firms, advertising technology players, and similar platform operators.

Meanwhile, Oracle has more going for it than just TikTok, and the recent share price slide can be a good opportunity to load up on the company's stock, as I had highlighted in my previous analysis. Another, often overlooked strength for Oracle remains its legacy database franchise, which tends to get less attention amid the excitement around AI infrastructure buildout. These databases already store vast amounts of structured enterprise data accessed by countless applications. As AI adoption shifts toward corporate environments, privacy and compliance concerns will push more organizations to train models on internal datasets rather than public web sources that dominate today's consumer LLMs. Oracle is well-placed to capitalize on this trend through its established position as a neutral database provider, complemented by vertically integrated offerings running natively on OCI.

Analyst Opinion on ORCL Stock

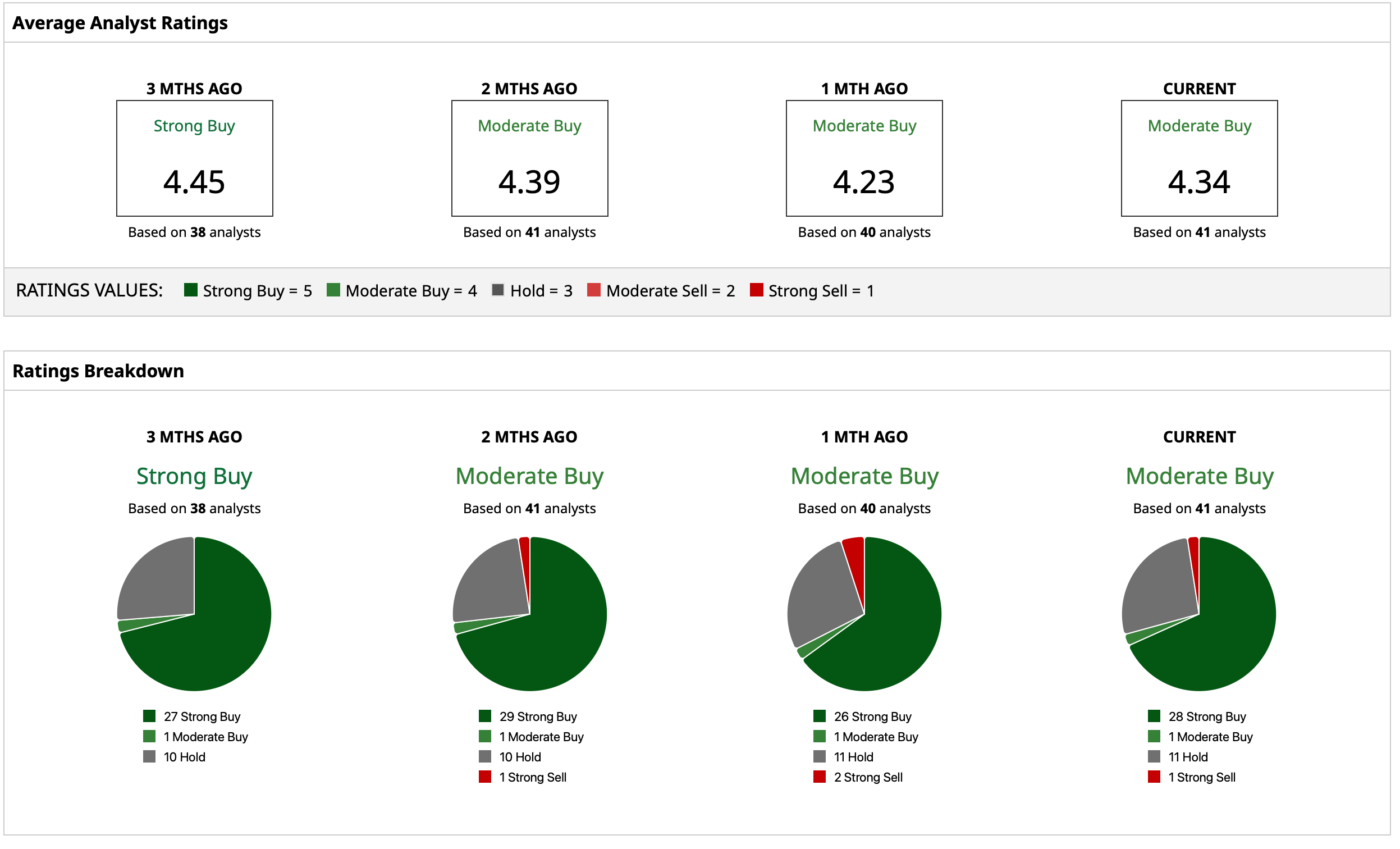

Overall, analysts have attributed to the ORCL stock a rating of “Moderate Buy,” with a mean target price of $306.19. This indicates an upside potential of about 59.5% from current levels. Out of 41 analysts covering the stock, 28 have a “Strong Buy” rating, one has a “Moderate Buy” rating, 11 have a “Hold” rating, and one has a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy the Bad News for This Michael Burry Stock Pick?

- Analysts Are Betting Big on Rivian Stock Ahead of 2026. Should You Get In on RIVN Here Too?

- DraftKings Just Launched Its Prediction Market App. Should You Make a Bet on DKNG Stock Here?

- Dear Opendoor Stock Fans, Mark Your Calendars for December 22