While tobacco giant Altria Group (MO) understandably may not be everyone’s cup of tea, its relevance cannot be denied. Despite challenges to the mainline tobacco industry, Altria has been pivoting toward e-cigs and other product categories. Perhaps most importantly to investors, MO stock presently commands an annual dividend yield of 8.99%.

With President Donald Trump applying relentless pressure on the Federal Reserve to lower the benchmark interest rate — and the central bank embarking on a more dovish policy route — that high yield is going to look increasingly attractive. Again, tobacco is a risky sector but the fundamental incentive to consider MO stock for the long haul will likely continue rising.

Even better for options traders, Altria could offer something interesting for near-term profit extraction.

A big clue comes from recent unusual options activity. Based on the totality of the transactions, it appears that traders are generally engaging in yield-protecting strategies — which isn’t at all surprising given the robust dividend — but with an open door for possible controlled upside.

First, the puts generally are placed near at-the-money (ATM) strikes, typically $57 and $58. In other words, there doesn’t appear to be much in the way of deep out-the-money (OTM) “panic” strikes indicative of a perceived downside threat. Instead, the way the puts are presently structured, it appears the motif is downside insurance.

Second, on the call side, these contracts feature deltas in the range of 0.25 to 0.45. As such, there is little indication of meaningful high-delta call buying, implying covered-call overwrite adjustments or upside insurance.

At the same time, you do see repeated $60 strike call engagement across multiple expiries. Plus, the underlying volume doesn’t seem to be trivial, suggesting that $60 is a plausible target. In other words, the smart money is leaving room for this price target to be achieved.

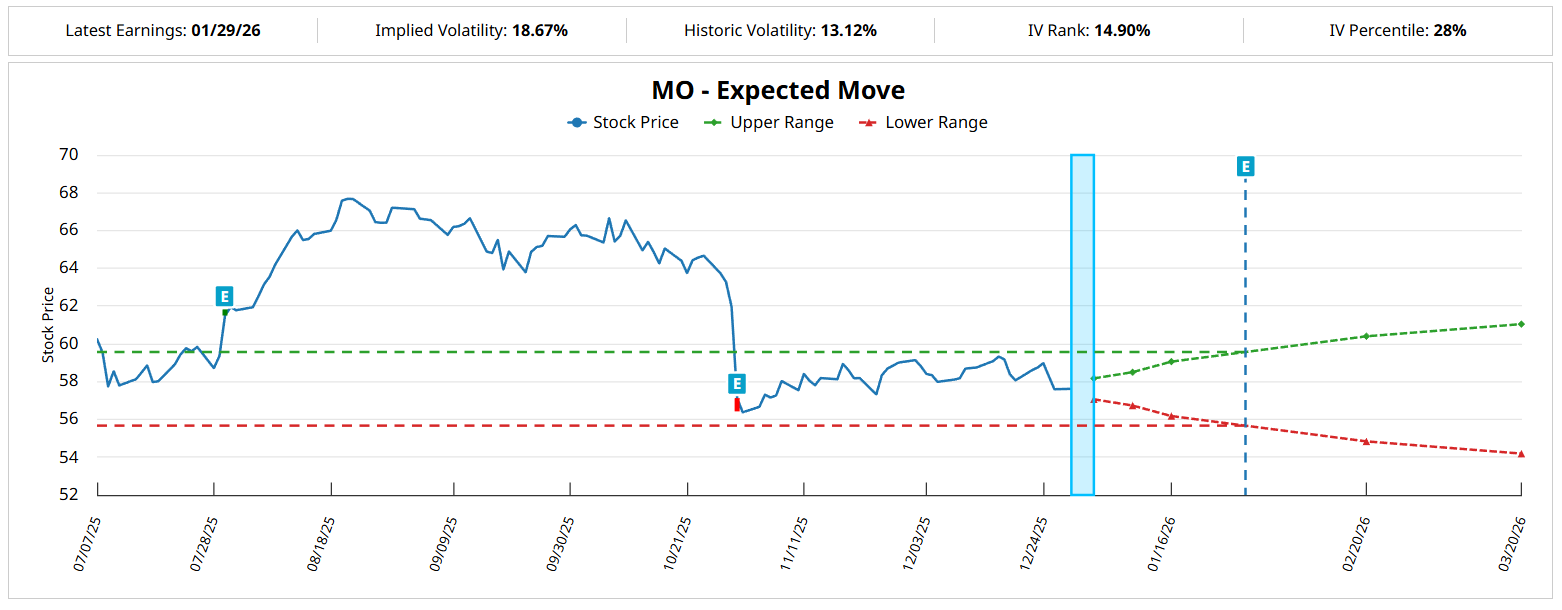

Sure enough, implied volatility statistics integrated into the Black-Scholes model suggest that $60 is one of the possibilities within the projected dispersion for the February options chain and beyond.

Using Risk Topography to Narrow Down a Likely Range for MO Stock

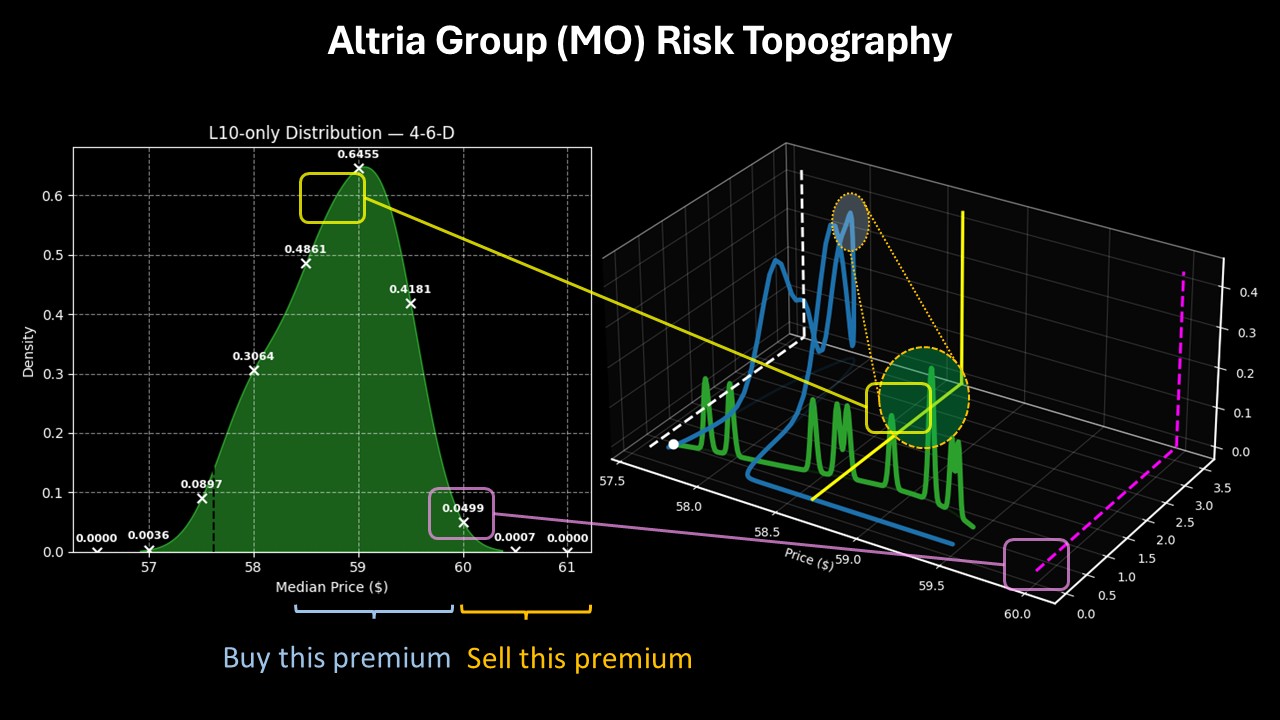

While we do know from options data what is possible, as options traders, we need to know what is likely. To do that, I propose upgrading our analytical framework to a higher dimension. Invariably, stocks and especially options live in a three-dimensional probability space. To stay consistent with Ashby’s Law of Requisite Variety, we’re now going to navigate the MO stock options market in multi-dimensional form.

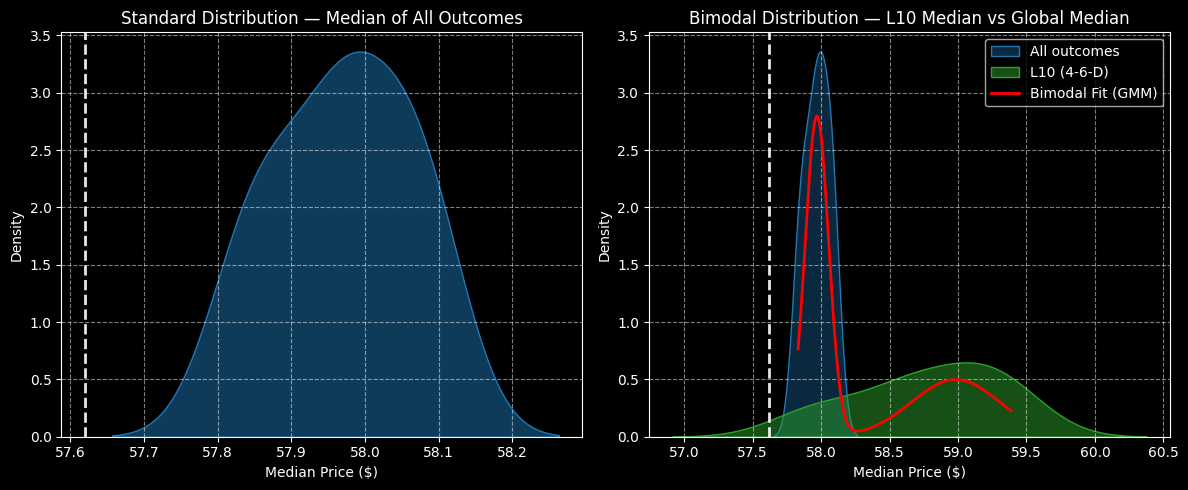

Using a discretized, iterated quantitative model under a hierarchical framework, the forward 10-week returns of MO stock would typically range between $57.65 and $58.30 (assuming an anchor price of $57.62, Monday’s close). Further, price clustering would likely occur around $58, thus indicating an upward bias. This aggregate data was compiled starting from January 2019.

However, we’re most interested in the statistical response to the current quantitative signal, which is the 4-6-D sequence. In the past 10 weeks, MO stock only printed four up weeks, leading to an overall downward slope. Under this setup, the forward 10-week returns would likely range between $57 and $60.40, with price clustering predominant at around $59.

Based on the analysis above, the $59 target would seem like a natural target. However, for monthly options, the strike prices occur in $2.50 increments. As such, in a vertical spread strategy, the $57.50 second-leg strike would likely incur an opportunity cost. Subsequently, the most palatable idea for aggressive speculators would be to stretch for the $60 price.

Using risk topography, which shows a three-dimensional view of the structure of risk and reward, the frequency of traversing is elevated between $59 and $59.50, with the probability of terminal price movement again landing near $59. Therefore, settling for the $57.50 strike is out of the question for perhaps most speculators.

But going for $60 imposes risks because, in the dataset going back to January 2019, the traversing to $60 is presently a non-existent phenomenon. I’m not necessarily saying that to discourage targeting this strike price. Still, you should be aware that certain bull trades would effectively be unprecedented.

Going for a High-Risk Wager

After assessing the strategic landscape of MO stock, I believe that the 57.50/60.00 bull call spread expiring Feb. 20, 2026, represents an intriguing proposition. For this trade to be fully profitable, the security must rise through the $60 strike price at expiration. As I mentioned earlier, there is no statistical precedent for this higher swing coming off the back of the 4-6-D sequence in the underlying dataset.

Of course, this raises the obvious inquiry, why?

Primarily, the breakeven price for the above spread lands at $58.66. This is represented by the yellow line in the risk topography chart and it sits well within the projected range of likely forward outcomes over the next 10 weeks. So, you stand a good chance of not losing money — and may even make some money. The only substantive question is whether $60 could be reached or not.

Moreover, just because a swing to $60 hasn’t happened under the defined time and context doesn’t mean it can never happen. Clearly, the unusual options activity screener is pricing in the possibility that MO stock can reach this threshold. Combined with some psychological reflexiveness, there could be an intriguing opportunity here.

On the date of publication, Josh Enomoto had a position in: MO . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is One Asset Screaming that Stocks are Cheap Going into 2026? Can the S&P 500 Reach 10,000 in 2026?

- Worried About a Bust? 3 Old ETFs That Could Have New Appeal in 2026.

- Electronic Arts Is Going Private. Is It Too Late to Buy EA Stock?

- Another Red Flag Is Waving for Tesla Stock. How Should You Play TSLA Heading Into 2026?