Waltham, Massachusetts-based Thermo Fisher Scientific Inc. (TMO) provides life sciences solutions, analytical instruments, specialty diagnostics, laboratory products and biopharma services. Valued at $218.2 billion by market cap, the company provides a portfolio of reagents, instruments, and consumables for research, drug development, and disease diagnosis, along with laboratory products and biopharma services. The leading scientific research services and products provider is expected to announce its fiscal fourth-quarter earnings for 2025 before the market opens on Thursday, Jan. 29, 2026.

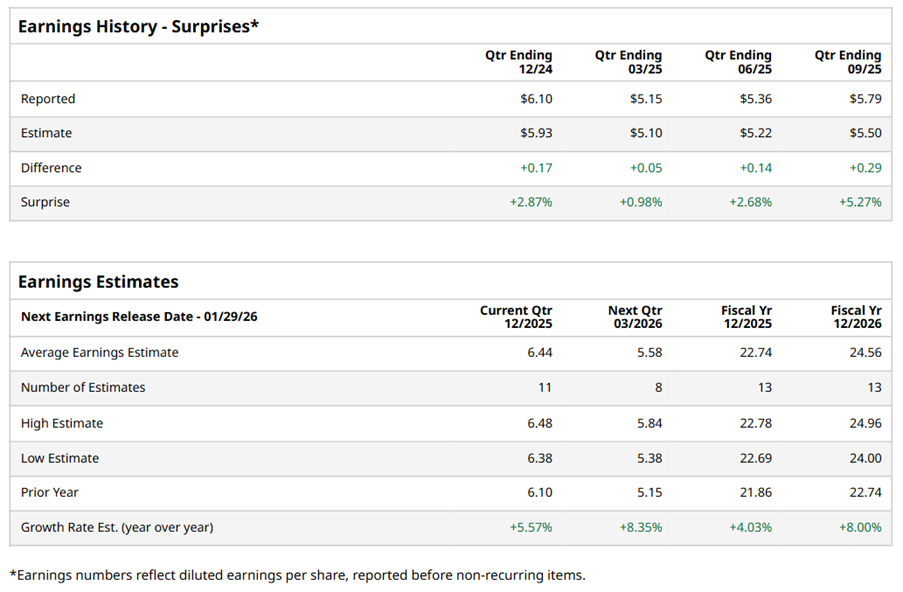

Ahead of the event, analysts expect TMO to report a profit of $6.44 per share on a diluted basis, up 5.6% from $6.10 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect TMO to report EPS of $22.74, up 4% from $21.86 in fiscal 2024. Its EPS is expected to rise 8% year over year to $24.56 in fiscal 2026.

TMO stock has underperformed the S&P 500 Index’s ($SPX) 15.7% gains over the past 52 weeks, with shares up 11.2% during this period. Similarly, it underperformed the Health Care Select Sector SPDR Fund’s (XLV) 12.1% returns over the same time frame.

TMO's underperformance is due to China’s weakness, pricing pressures, and cautious academic or government spending. China diagnostics are still struggling, while Europe shows modest improvement, and the U.S. is stable but uncertain.

On Oct. 22, TMO shares closed up by 1.7% after reporting its Q3 results. Its adjusted EPS of $5.79 topped Wall Street expectations of $5.50. The company’s revenue was $11.1 billion, beating Wall Street's $10.9 billion forecast.

Analysts’ consensus opinion on TMO stock is bullish, with a “Strong Buy” rating overall. Out of 23 analysts covering the stock, 18 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and three give a “Hold.” TMO’s average analyst price target is $636.90, indicating a potential upside of 8.9% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Dividend-Yielding Gold Stock Is Up 184% in 2025. Should You Bet on Higher Gold Prices in 2026?

- The Next Two Years Will Belong To Breakups: Investors Who Miss It Will Miss the Cycle

- As Mortgage Rates Remain High, This 1 Stock Has Been a Big Winner in 2025

- Robinhood Stock Was Red Hot in 2025. Should You Keep Buying Shares in 2026?