Salesforce, Inc. (CRM) generated free cash flow (FCF) that was 22% higher YoY in its fiscal Q3 ending Oct. 31. Its FCF margins for the latest quarter, and trailing 12 months (TTM) increased as well. This implies that CRM stock could be 23% too cheap.

CRM is trading at $261.08 in midday trading on Friday, Dec. 5, but it could be worth $321 per share over the next year. This is based on its strong 32% TTM FCF margin. This article will show how this works.

Salesforce's Strong Free Cash Flow (FCF)

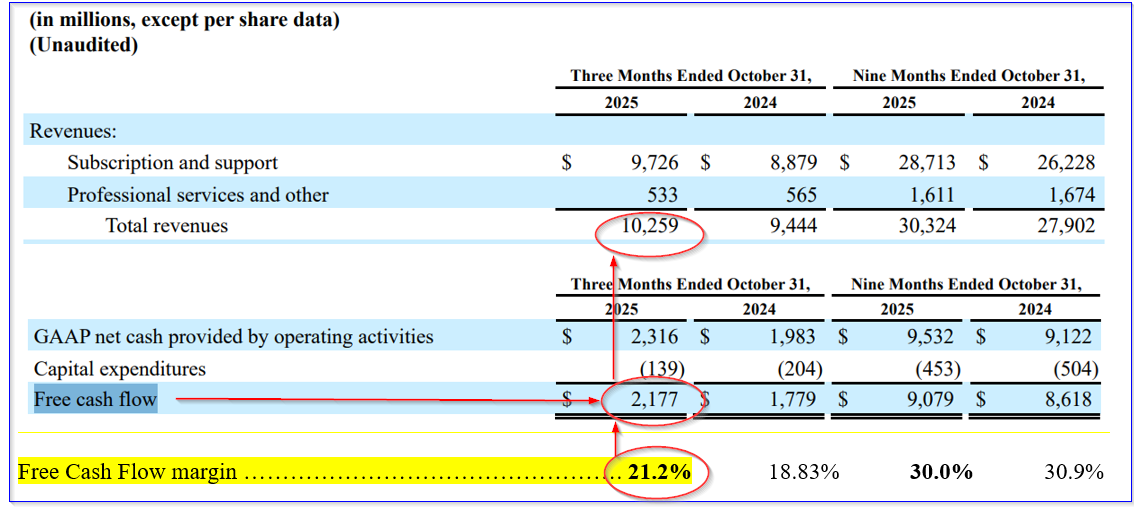

Salesforce's Q3 revenue rose 8.63% YoY to $10.259 billion, and its 9-month revenue gained 8.68% to $30.324 billion. Most of Salesforce's revenue (94.8%) is from subscription and support services.

So, that makes its recurring sales, and resulting free cash flow (FCF) very strong. For example, FCF was $2.177 billion in Q3, up +22.4% YoY, and for the 9-months it was up +5.35% to $9.079 billion. (This can be seen on page 14 of its press release.)

As a result, FCF rose as a proportion of its revenue, i.e., its FCF margins. For example, the Q3 FCF margin was 21.2%, up from 18.4% a year ago, as reported by Stock Analysis.

Moreover, for the trailing 12 months (TTM), the FCF rose to about 32% (31.98%), up from the TTM margin of 31.64% last quarter, as reported by Stock Analysis. This is important because clients resubscribe typically once a year, mostly in Q1. So, it's better to look back on a full-year basis.

In other words, as revenue rises, Salesforce squeezes out more cash from its sales, thereby increasing FCF margins. That is a sign of operating leverage.

Moreover, this means that the value of CRM stock will rise as analysts project higher sales over the next year.

Forecasting Higher FCF and Price Targets (PT)

For example, 50 analysts now project that next year sales will rise by 10.5% from management's recently raised guidance of $41.55 billion to $45.80 billion, according to Seeking Alpha. Yahoo! Finance has a similar forecast from 51 analysts for a $45.81 billion forecast.

So, if we apply a 32% FCF margin (even though it is likely to be higher in a year):

$45.8 billion x 0.32 = $14.656 billion FCF next 12 months (NTM)

That NTM FCF figure will be +21% higher than the run rate $12.105 billion in FCF the market is expecting this year (i.e., $9.079b 9-mo FCF / 0.75 = $12.105b).

As a result, this could lead to a higher stock price target (PT).

For example, given the market cap today of $249.516 billion, according to Yahoo! Finance, CRM has an implied run rate FCF yield of 4.85%:

$12.105b run rate FCF / $249.516b = 0.0485

That is the same as multiplying FCF by 20.6x (i.e., 1/0.0485). Let's assume that the market eventually raises that multiple to 21x. Here is how that works:

$14.656b NTM FCF x 21 = $307.776 billion market cap

That is 23.3% higher than today's market cap. In other words, CRM stock's price target (PT) is 23% higher:

$261.08 x 1.23 = $321 PT

Analysts Agree CRM is Too Low

For example, Yahoo! Finance reports that 55 analysts have an average PT is $327.38. Similarly, Barchart's mean PT is $328.52. Both of these are higher than my FCF-based PT of $321 per share.

Meanwhile, AnaChart.com, which tracks recent analysts' write-ups, shows that the average PT from 36 analysts is $283.36 per share.

So, the mean of these three surveys is $313.08, and the median is $327.38. This is exactly the range in which my PT of $321 falls.

The bottom line here is that CRM stock looks like it's too cheap, by at least 23%.

Shorting OTM Puts

One way to play this is to set a lower buy-in point by selling short out-of-the-money (OTM) puts in nearby expiry periods.

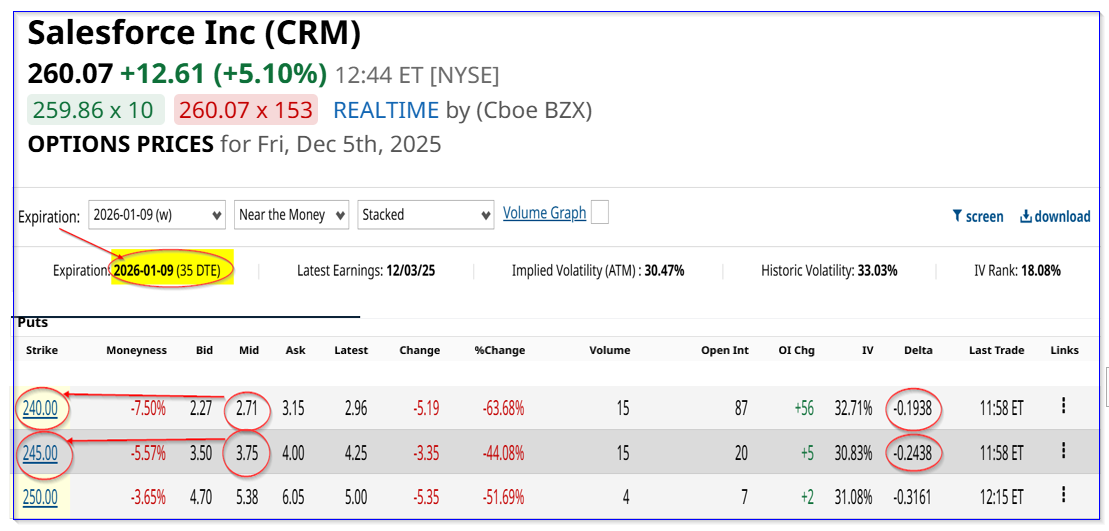

For example, the $240.00 strike price put option contract expiring on Jan. 9, 2026, has a midpoint premium of $2.71 per put contract.

This strike price is over 7.5% or more below today's trading price. But the income provides an immediate yield of 1.13% (i.e., $2.71/$240.00 = 0.01129) for the next month (35 days from now).

That strike price has a very low delta ratio of -.019, implying less than a 20% chance that CRM will fall to $240.00 by Jan. 9.

Therefore, less risk-averse investors might want to short the $245.00 strike price put. That has a midpoint premium of $3.75.

This means an investor who secures $24,500 with their brokerage firm will make $375.00. That is an immediate yield of 1.53% (i.e., $375/$24,500).

Moreover, the breakeven point is just $241.25 (i.e., $245-$3.75), or 7.2% below today's price. That also provides 33% upside for the investor over the next year, should CRM fall to the strike price:

$321 PT / $241.25 = 1.33 -1 = +33% upside

The bottom line here is that Salesforce's stock is too cheap. Shorting out-of-the-money puts is a good way to set a potential buy-in point and make income while waiting.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart