The best income stocks are not necessarily ones that pay the highest dividend, but those that build a bigger cash machine over time.

My way of finding that kind of consistency often starts with the Dividend Kings list, companies that have consistently raised their dividends for over 50 consecutive years.

However, many investors today aren’t satisfied with longevity alone. That’s why I like to pair it with strong earnings growth since dividends are ultimately anchored on rising profits, which hopefully translate to future dividend hikes, even through rough markets.

With that, I’ll focus on resilient companies that don’t just look good on paper, but are also backed by a deep bench of Wall Street analysts who follow them closely and still rate them a clear “Strong Buy”.

How I came up with the following stocks

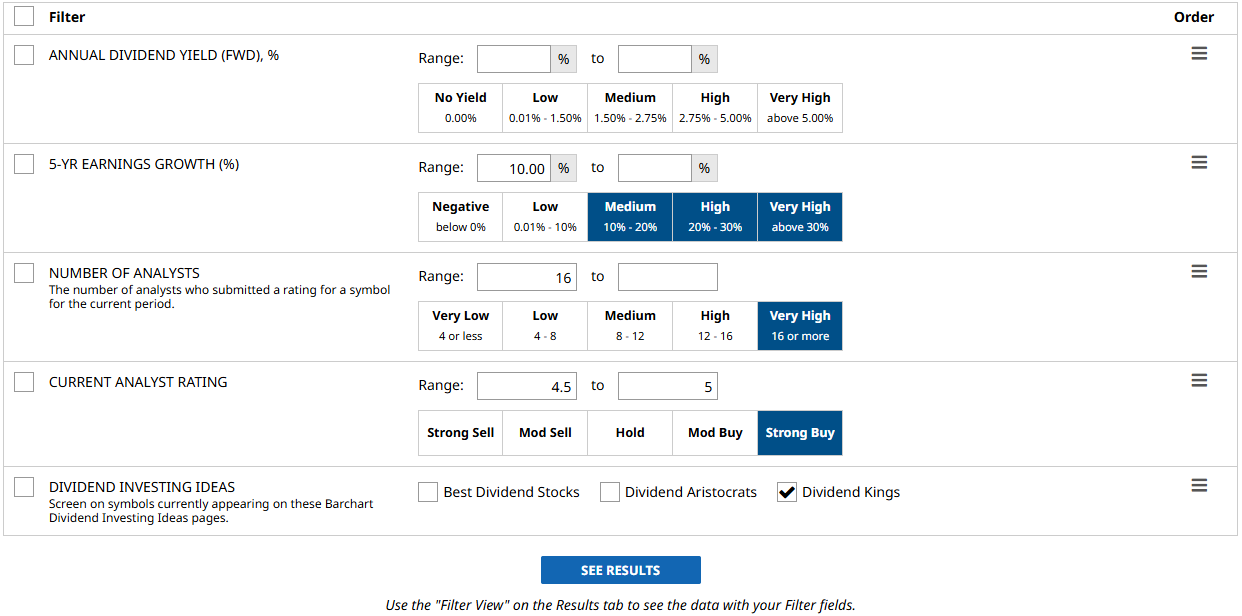

I used Barchart’s Stock Screener to find the highest-yielding companies on my watchlist.

- Annual Dividend Yield (FWD), %: I left it blank so that I can sort the results from highest to lowest

- 5-YR Earnings Growth (%): Above 10%: Companies that have the highest earnings growth in the past five years are likely to continue increasing their dividend.

- Number of Analysts: 16 or more. A high number of analysts tells a stronger conviction.

- Current Analyst Rating: 4.5 – 5. “Strong Buy” suggests quality stocks. These are the best of the best according to Wall Street.

- Dividend Investing Ideas: Dividend Kings.

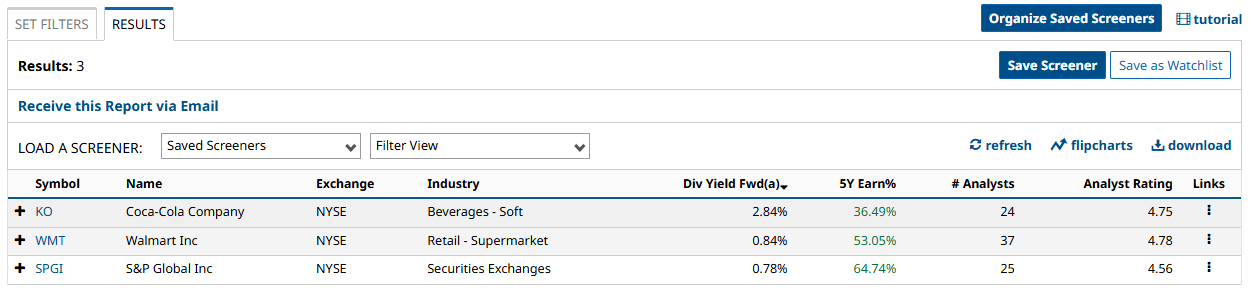

The screen returned three results, so I’ll cover them all, sorted by yield from highest to lowest, to get my list of the best-rated Dividend Kings to buy now.

Let’s kick off this list with the first Dividend King:

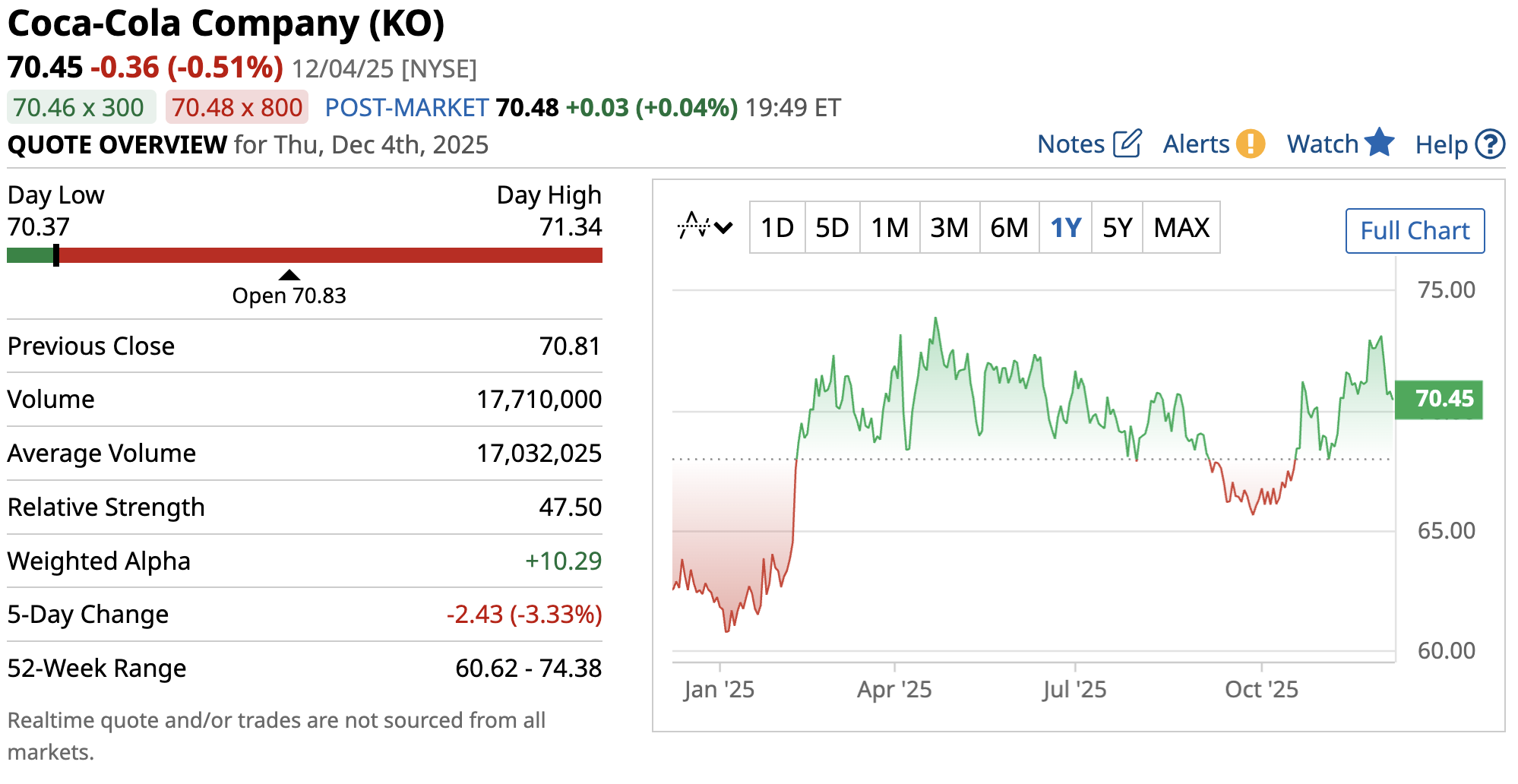

Coca-Cola Company (KO)

Coca-Cola is a company that probably doesn’t need much introduction. It manufactures and supplies an extensive product portfolio, including Coke, Sprite, and Fanta. Founded in 1892, it now serves over 2.2 billion drinks daily in over 200 countries. Today, the company is advancing its sustainability efforts through the Coca-Cola Foundation, including water projects that use AI-based leak detection to reduce water loss and improve access in communities worldwide.

In its recent financials, the company reported sales rose 5.1% YOY to $3.70 billion, while net income increased 30% to $3.70 billion. Looking at the bigger picture, Coca-Cola’s five-year earnings growth is 36.49%, suggesting strong and consistent earnings performance.

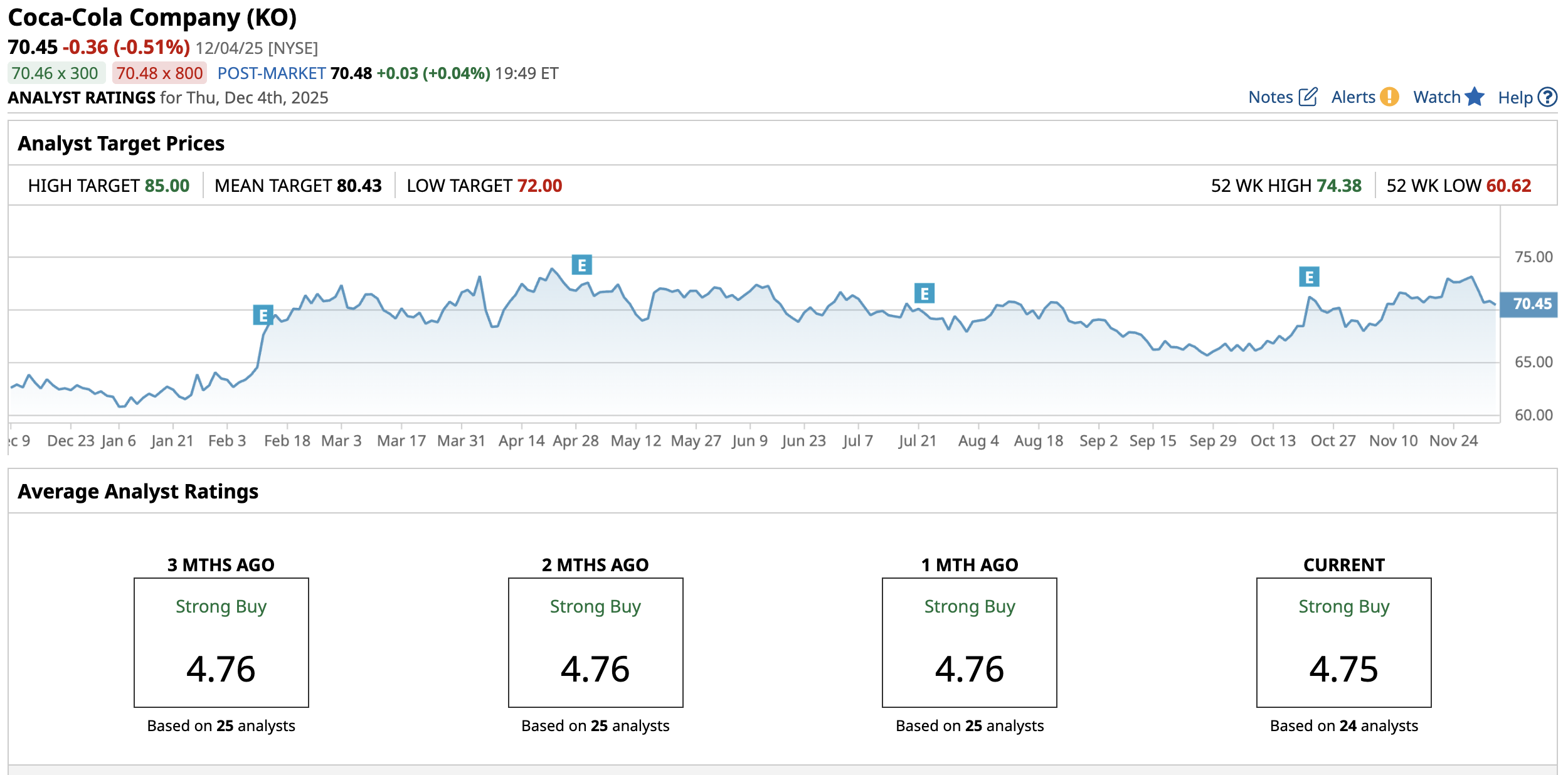

The company also pays a forward annual dividend of $2.04, translating to a yield of around ~2.9%. With that, a consensus among 24 Wall Street analysts rate the stock a “Strong Buy” with a near-perfect 4.75 score out of five. Not only that, the stock has a high target price of $85, suggesting there’s approximately 20% upside over the next year.

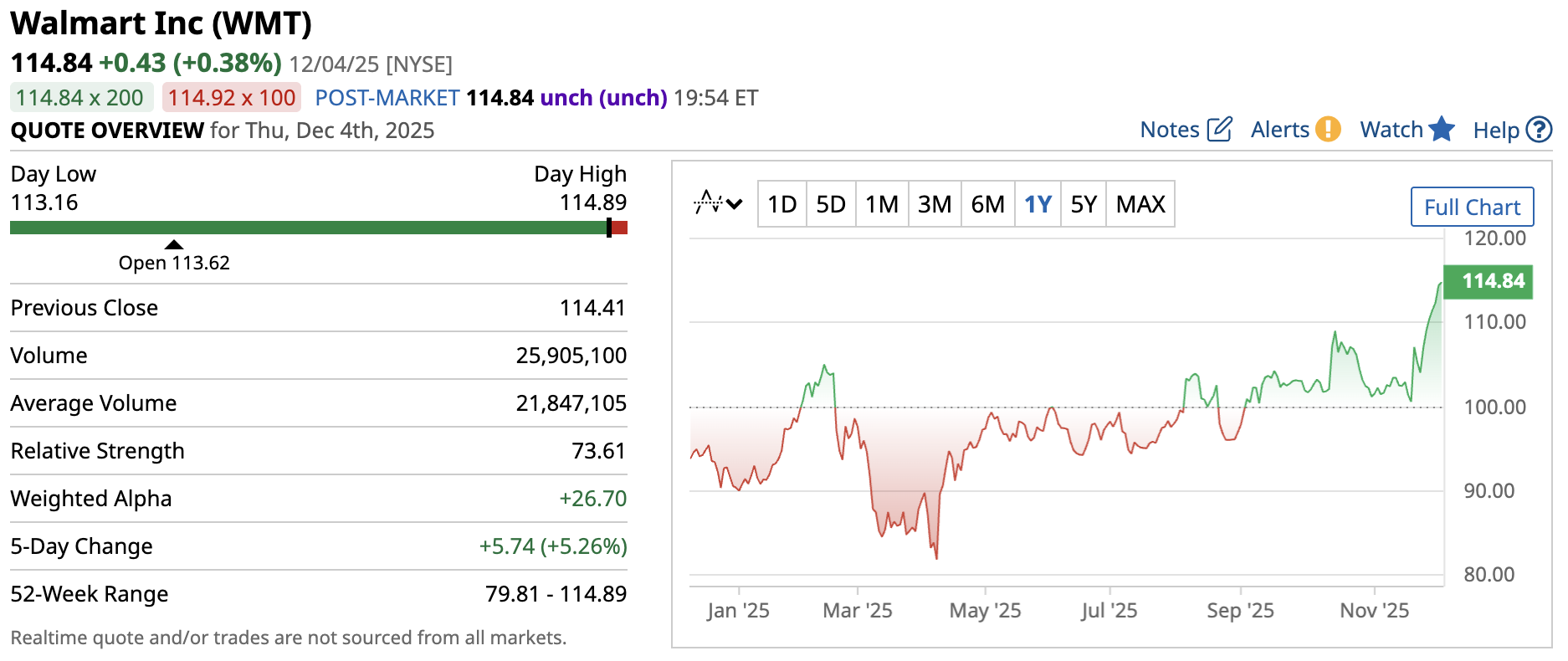

Walmart Inc (WMT)

The second Dividend King on my list is Walmart Inc., one of the world's largest retailers, famously known for “everyday low prices”. Similar to Coca-Cola, Walmart has a diverse product portfolio ranging from groceries, electronics, to apparel and other home goods. Founded in 1962, Walmart now has over 10,000 hypermarkets worldwide, including its second newly opened Milk Processing Facility that improves the company’s supply chain.

The company’s recent financials reported that sales grew almost 5% year-over-year to $177 billion, and its net income rose over 56% to $7 billion. Certainly, this is not a fluke, as Walmart's earnings have grown 53.05% over the last five years.

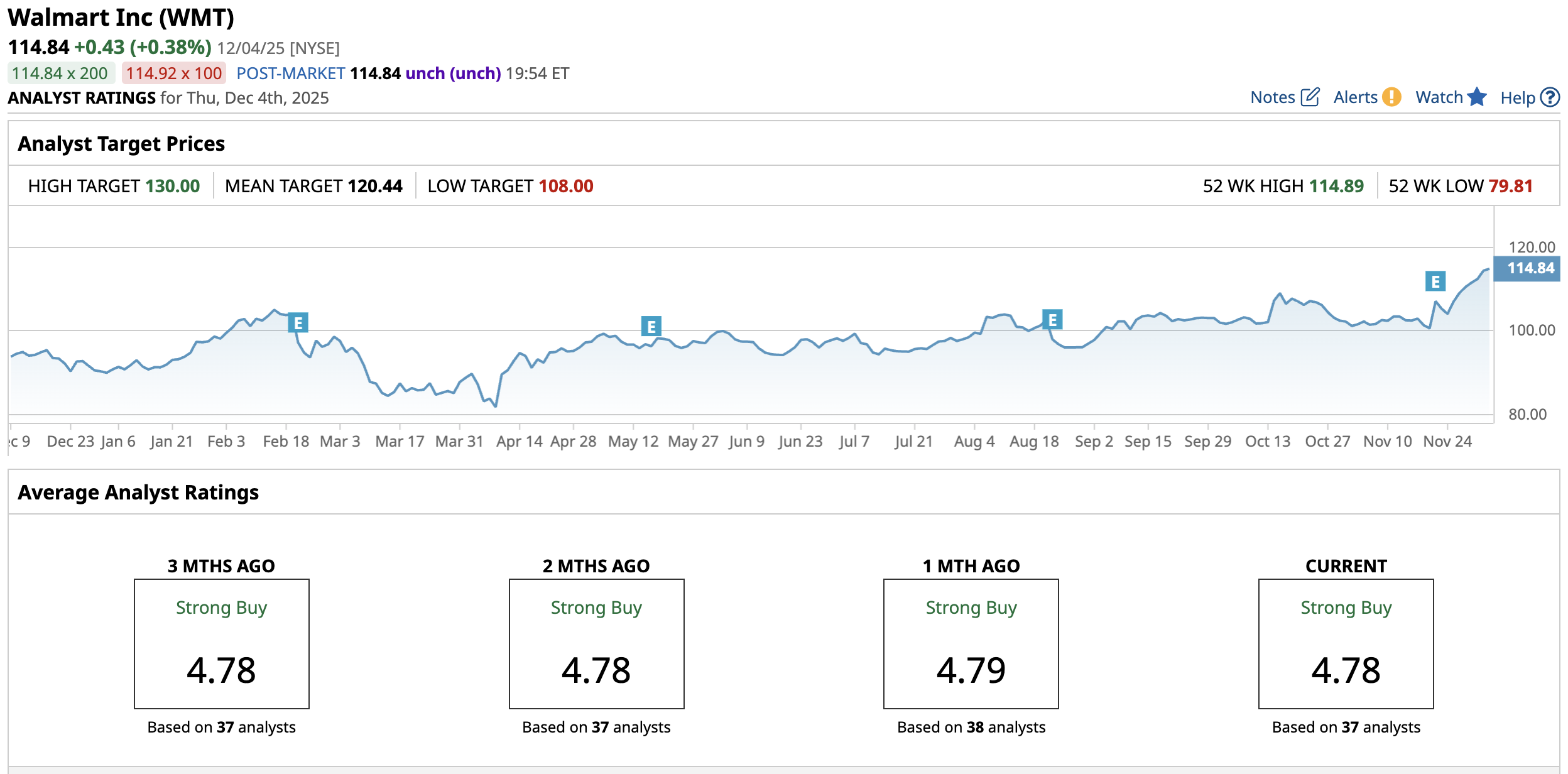

Walmart pays a forward annual dividend of $0.94, translating to a yield of approximately 0.82%. Further, a consensus among 37 analysts rates the stock a “Strong Buy”, making it one of the highest-rated stocks with the strongest analyst conviction. Aside from that, there’s also some upside at today's prices: as much as 14% should the stock hit its high target price of $130.

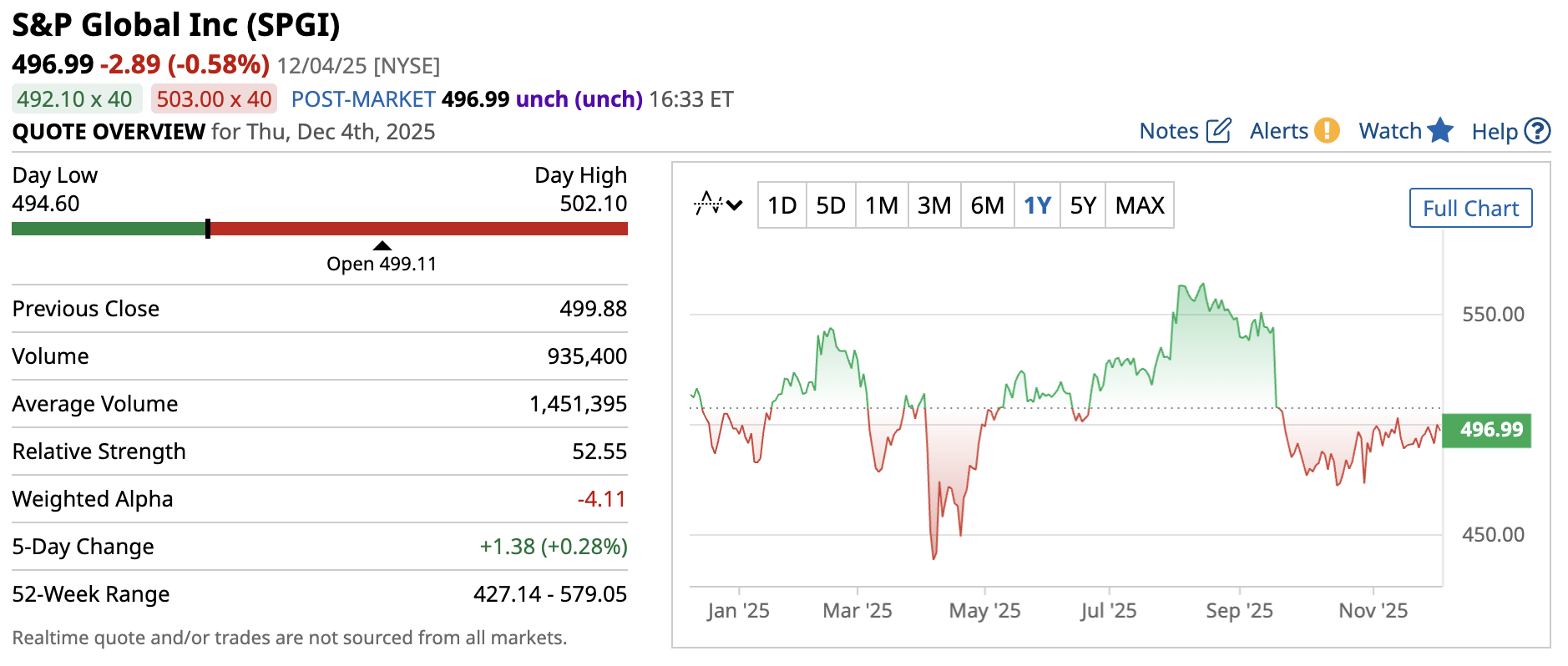

S&P Global Inc (SPGI)

The last Dividend King on my list is S&P Global Inc., a company that provides comprehensive financial data for traders and investors worldwide. Founded in 1917, S&P Global has integrated its market intelligence through well-known businesses such as S&P Ratings and the S&P Dow Jones Indices. Aside from that, S&P Global is expanding through its agreement with AWS, which lets customers use S&P Global’s trusted financial and energy data directly within its AI tools.

In its recent quarterly financials, the company reported sales were up ~9% year-over-year to $3.9 billion, and its net income also grew over 21% to $1.2 billion. Even though its number may look modest compared to the previous companies, S&P Global’s earnings have grown 64.74% over the past five years, the highest among the list.

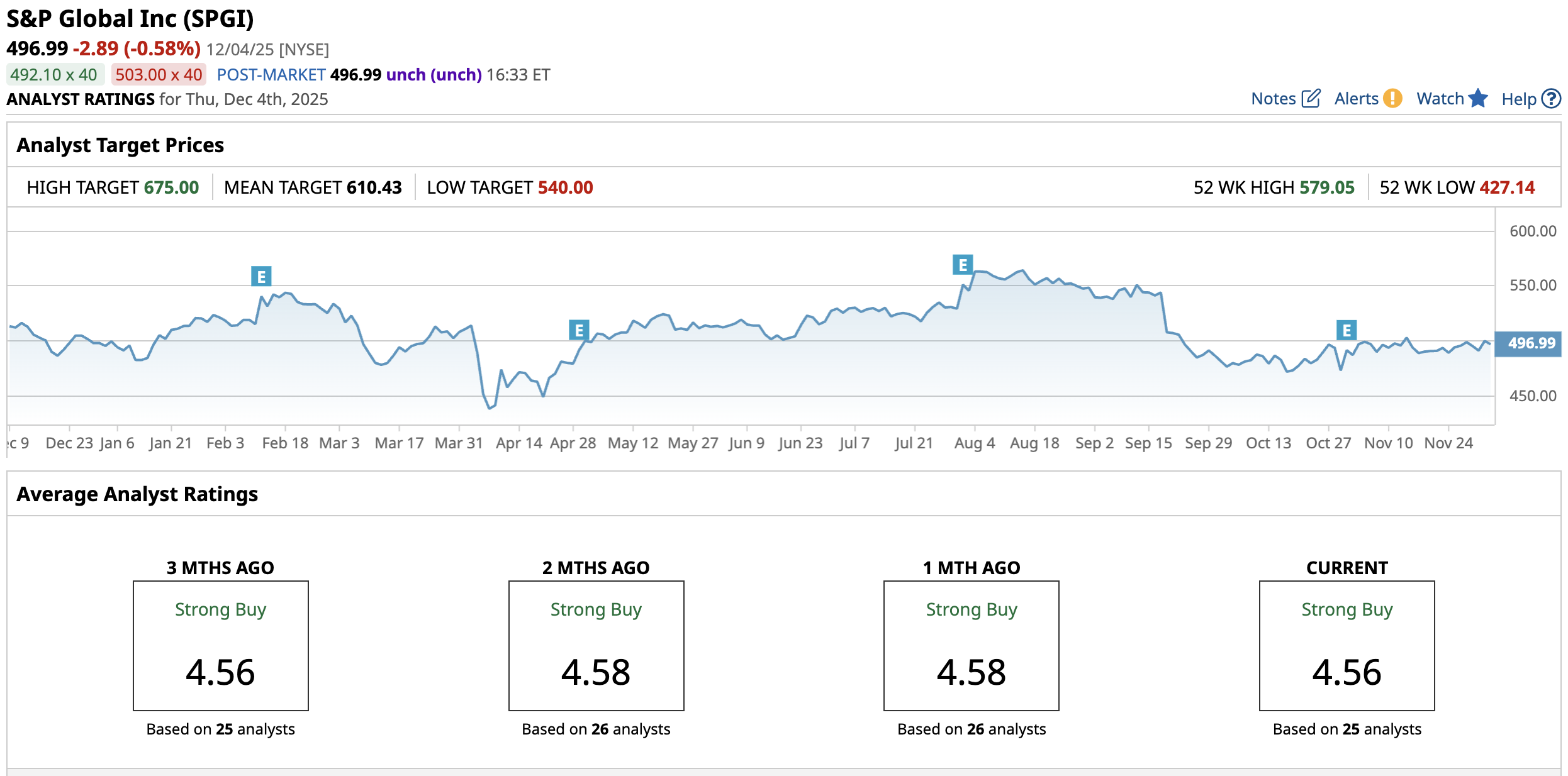

The company pays a forward annual dividend of $3.84, yielding around 0.8%. At the same time, a consensus among 25 analysts rates the stock a “Strong Buy”, a rating that has been consistent over the past three months. Furthermore, with a high target of $675, there could be as much as 35% upside in the stock over the next 12 months.

Final thoughts on these three Dividend Kings

So, there you have it, the three of the highest-rated Dividend Kings that have each grown their earnings the most over the last five years. While these companies do not have the most attractive yield, those who own them over the next decade will likely find them to become cash machines in the future. Indeed, these stocks have weathered volatility and market crashes for over five decades, highlighting their worth for those seeking long-term, stable, passive additions to portfolios.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Most “Safe” Dividend Stocks Don’t Grow Like This… But These 3 Did

- Legendary Investor Muddy Waters Is Making a Rare Bullish Bet on This Gold Stock. Should You Buy It Too?

- TD Cowen Says This Memory Chip Maker Is One of the Best Stocks to Buy for 2026

- SoFi Stock Breaks Below Key Moving Averages on $1.5B Offering. Should You Buy the Dip?