The prestigious Dow Jones Industrial Average ($DOWI), home to 30 blue-chip leaders across tech, finance, healthcare, and consumer goods, remains a key pulse check on corporate America's performance. And while it hasn’t matched the stronger gains of the S&P 500 Index ($SPX) or the tech-heavy Nasdaq Composite ($NASX) this year, the Dow is far from struggling. In fact, the index is still up a modest 12.78% in 2025, proving it’s doing just fine despite the comparisons.

Still, the strength of the index doesn’t mean every Dow component is enjoying the ride. Twenty-two of its 30 members are in the green this year, yet software giant Salesforce (CRM) has tumbled into double-digit losses as questions swirl around the slow adoption of its artificial intelligence (AI) offerings and intensifying competition. That makes it the second-worst performer in the entire Dow, trailing only UnitedHealth (UNH).

With Salesforce shares stuck deep in the red this year, does this pullback present an opportunity for investors, or a warning sign?

About Salesforce Stock

San Francisco-based Salesforce is the world’s leading customer relationship management (CRM) platform, built to help businesses strengthen and grow their customer relationships. Since pioneering cloud-based CRM back in 1999, the company has continued to reinvent the operations of organizations, now ushering them into the era of AI.

Its most significant AI innovation, Agentforce, introduces autonomous AI agents that can step in to handle tasks for employees and customers, making everyday work faster and smoother. Salesforce also brings together data from across a company’s systems so every team has a full 360-degree view of each customer, and its tools for sales, service, marketing, commerce, and IT help teams stay aligned and informed.

Altogether, Salesforce offers a more intuitive, intelligent way for organizations to manage relationships and adapt to a rapidly changing digital world. The company’s subsidiaries include Slack Technologies, Tableau, and MuleSoft. Despite being a major force in enterprise software, Salesforce has run into some unexpected bumps in 2025.

Revenue growth has cooled more than investors would like, and its big swing into AI with Agentforce hasn’t sparked the instant excitement many anticipated. While Salesforce is pushing hard to lead in the AI era, the market remains unconvinced, especially amid growing chatter about an AI bubble and rising fears that powerful AI tools could one day undercut the very software platforms Salesforce builds. All of this caution has kept investors on the sidelines, and it shows in the numbers.

Salesforce, with a market capitalization of roughly $235.6 billion, has seen its stock tumble nearly 22% in 2025. That drop doesn’t just put CRM behind the Dow Jones’ double-digit gains. It also leaves the company trailing its own tech peers by a wide margin. The technology S&P 500 Technology Select Sector SPDR (XLK), a popular benchmark for the sector, is up an impressive 21.92% this year, highlighting just how sharply Salesforce has fallen out of step with the broader tech rally.

Inside Salesforce’s Latest Earnings Report

But despite a rocky year for the stock, Salesforce managed to grab investors’ attention on Dec. 3 after delivering an upbeat fiscal 2026 third-quarter earnings report, and the market responded quickly. The raised full-year outlook further helped spark a 3.7% jump in the shares on Dec. 4, giving CRM a much-needed boost after months of sluggish performance. The numbers offered a mix of positives and near-misses.

Revenue came in at $10.26 billion, up 9% year-over-year (YOY), though it landed just shy of Wall Street’s expectations. But earnings were a different story. Adjusted EPS of $3.25 surged an impressive 35% YOY, easily beating the Street’s forecast of $2.86. Salesforce showed healthy momentum in its backlog, with current remaining performance obligation (cRPO) rising to $29.4 billion, up 11% annually. Total RPO also climbed to $59.5 billion, up 12%, reflecting solid demand across the business.

Meanwhile, its core engine, subscription and support revenue, grew 10% YOY to $9.7 billion, reinforcing the strength and consistency of its recurring revenue model. CEO Marc Benioff highlighted the momentum behind Agentforce, Salesforce’s AI platform for building custom autonomous agents, calling it a major growth driver alongside the company’s expanding data products.

Annual recurring revenue (ARR) from Agentforce and Data 360 soared a stunning 114% YOY to $1.4 billion. Agentforce alone crossed half a billion dollars in ARR in Q3, rising a whopping 330% YOY. Since launch, Salesforce has closed more than 18,500 Agentforce deals, including over 9,500 paid deals, a 50% quarter-over-quarter (QOQ) increase.

Additionally, the software giant continued rewarding shareholders. The company returned $4.2 billion through $3.8 billion in share buybacks and $395 million in dividends, reinforcing its commitment to capital returns. Free cash flow remained strong as well, growing 22% to reach $2.18 billion for the quarter.

Looking ahead, Salesforce struck an optimistic tone with updated guidance for fiscal 2026. The company now expects full-year adjusted EPS of $11.75 to $11.77 and revenue between $41.45 billion and $41.55 billion. Both ranges come in above its prior forecast of EPS of $11.33 to $11.37 on revenue of $41.1 billion to $41.3 billion.

How Are Analysts Viewing Salesforce Stock?

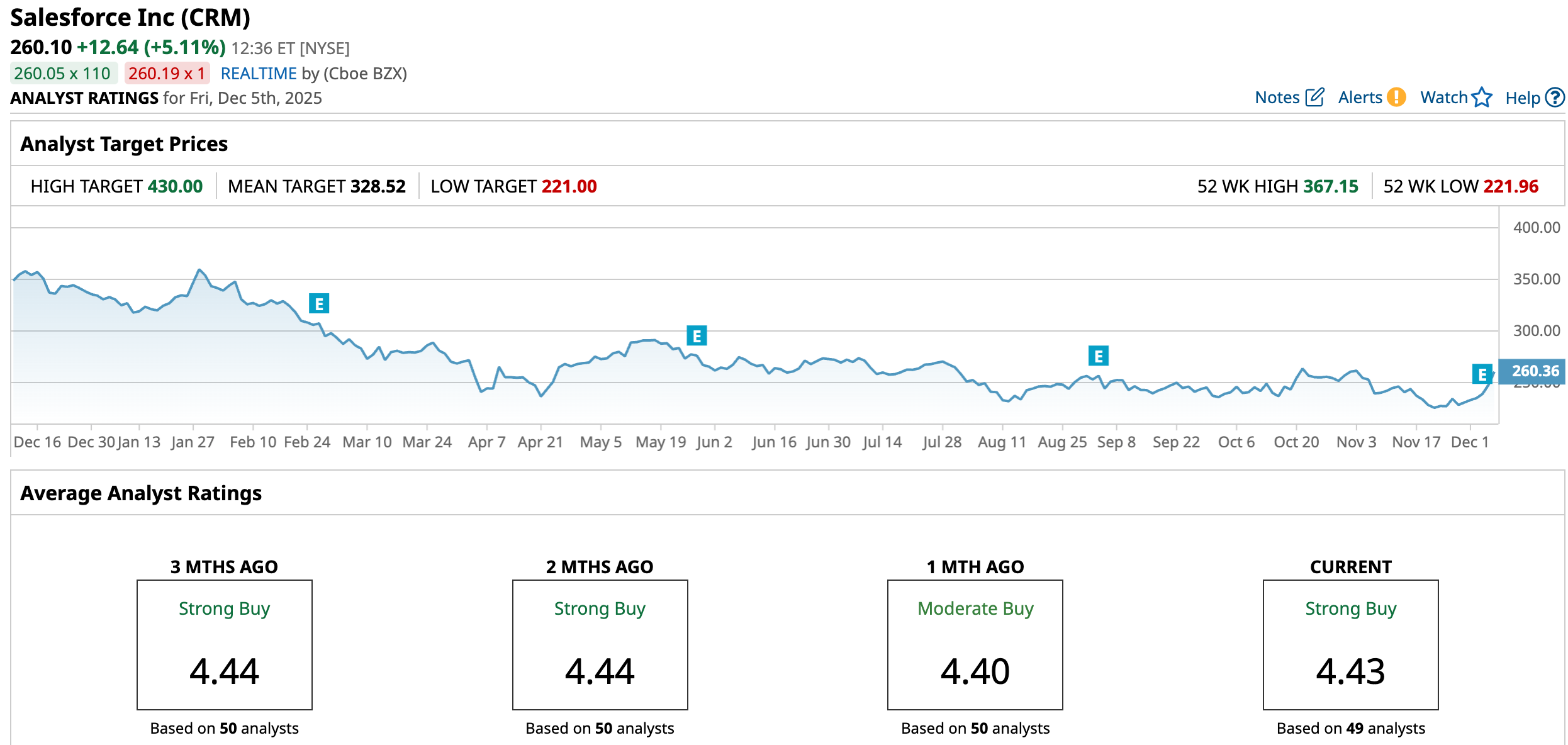

Analysts broadly welcomed Salesforce’s latest results and growing AI momentum, though opinions varied on how quickly the upside will show up in the stock. Wedbush reiterated its “Outperform” rating and $375 target, pointing to the strong earnings beat and upbeat guidance as signs that Agentforce is beginning to drive real momentum.

Evercore (EVR) also kept its “Outperform” rating but lowered its price target to $340, highlighting the company’s solid cRPO growth and strong bookings, and even elevating CRM into its “Top Five Ideas for 2026.” Morgan Stanley (MS) leaned even more bullish, reaffirming its “Overweight” rating and a $405 target, citing accelerating cRPO and the rapid Agentforce ramp as clear signs of growing momentum.

Wells Fargo (WFC), on the other hand, stayed cautious with an “Equal Weight” rating and a $265 target, saying it wants to see more proof that Agentforce can drive the meaningful acceleration expected over the next year or so. Even though Salesforce hasn’t been winning over investors this year, Wall Street’s confidence in the company is still surprisingly strong.

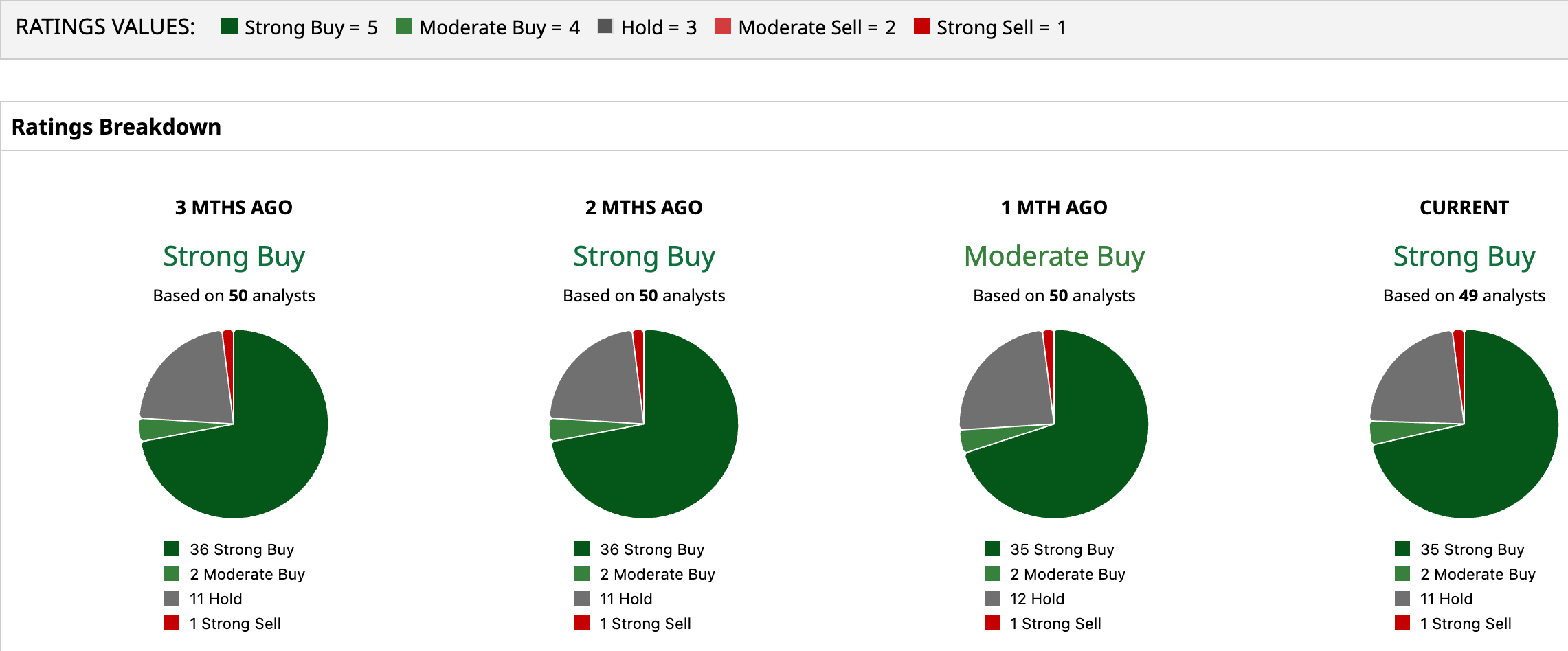

Among the 49 analysts covering CRM, the consensus rating still lands at a “Strong Buy.” Of these, 35 analysts are firmly in the “Strong Buy” camp, two recommend a “Moderate Buy,” 11 suggest “Hold,” and just one analyst has issued a “Strong Sell.” The optimism shows up in the price targets, too.

Analysts, on average, see the stock heading to $328.52, suggesting about 26% upside from current levels. And for the most bullish voices on the Street, the potential is even bigger. The highest target of $430 implies Salesforce could surge nearly 65% if the company regains momentum.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The Saturday Spread: 3 Stocks Flashing High-Probability Trading Setups to Consider This Week

- As D-Wave Launches a New Government Unit, Should You Buy, Sell, or Hold the Quantum Computing Stock Here?

- Salesforce Is One of the Dogs of the Dow. Should You Buy the Dip in CRM Stock Now?

- Most “Safe” Dividend Stocks Don’t Grow Like This… But These 3 Did