With a market cap of $63.1 billion, American Electric Power Company, Inc. (AEP) is a major U.S. electric utility holding company engaged in the generation, transmission, and distribution of electricity to retail and wholesale customers. It serves 5.6 million customers across 225,000 circuit miles of distribution lines and operates a diverse energy portfolio including coal, natural gas, nuclear, hydro, solar, and wind.

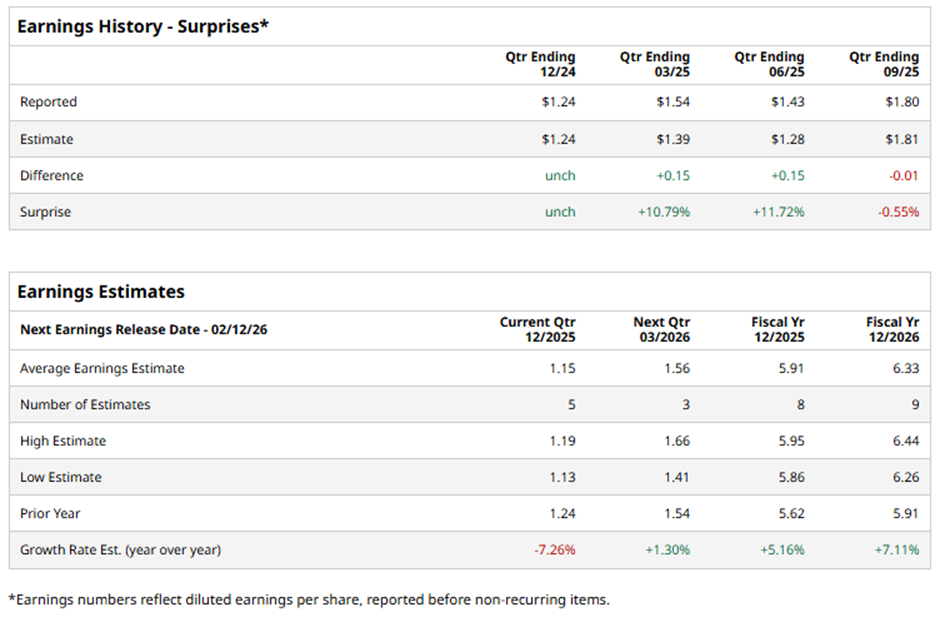

The Columbus, Ohio-based company is expected to unveil its fiscal Q4 2025 results soon. Before the event, analysts anticipate AEP to report an adjusted EPS of $1.15, down 7.3% from $1.24 in the year-ago quarter. It has surpassed or met Wall Street's bottom-line estimates in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts expect the utility company to report adjusted EPS of $5.91, up 5.2% from $5.62 in fiscal 2024.

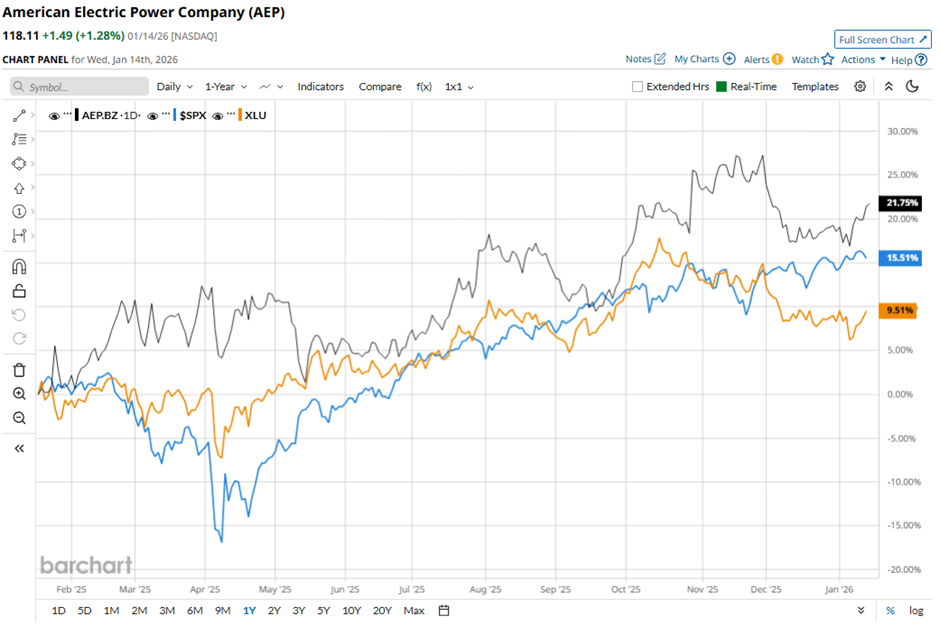

American Electric Power's shares have increased nearly 25% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 18.6% gain and the State Street Utilities Select Sector SPDR ETF's (XLU) 14.1% return over the same period.

Despite reporting weaker-than-expected Q3 2025 adjusted EPS of $1.80, shares of AEP climbed 6.1% on Oct. 29 after the company announced a sharply expanded $72 billion five-year capital plan supported by 28 GW of new customer-backed load and projected 10% annual rate base growth to $128 billion by 2030. Investors were encouraged by AEP’s new 7% - 9% long-term operating earnings growth target through 2030 and management’s outlook for 2026 operating EPS of $6.15 - $6.45. The stock was further supported by strong quarterly revenue of $6.01 billion, which topped Wall Street forecasts.

Analysts' consensus rating on AEP stock is cautiously optimistic, with a "Moderate Buy" rating overall. Out of 22 analysts covering the stock, opinions include seven "Strong Buys," one "Moderate Buy," 13 "Holds," and one "Strong Sell." This configuration is slightly more bullish than three months ago, with six analysts suggesting a "Strong Buy."

The average analyst price target for American Electric Power is $128.56, indicating a potential upside of 8.8% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Trump Spats With Exxon CEO Darren Woods Over Venezuela, Should You Take a Risk and Buy XOM Stock?

- Is This Nvidia-Backed AI Stock a Buy Before It Soars 177%?

- Analyzing a Butterfly Spread on Marvell Technology

- Stocks Climb Before the Open as TSMC Reignites AI Optimism, U.S. Economic Data and Earnings in Focus