With a market cap of $27.8 billion, DTE Energy Company (DTE) generates, distributes, and sells electricity and natural gas to millions of residential, commercial, and industrial customers across Michigan. Through its Electric, Gas, DTE Vantage, and Energy Trading segments, the company delivers power from coal, nuclear, wind, and solar sources, manages extensive transmission and distribution networks, and provides industrial energy and infrastructure services.

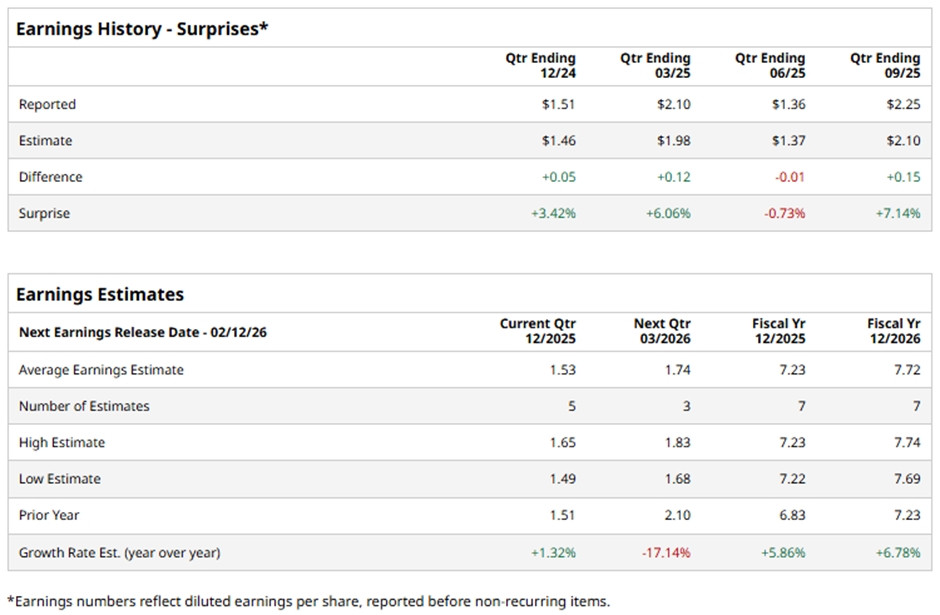

The Detroit, Michigan-based company is expected to unveil its fiscal Q4 2025 results soon. Before the event, analysts anticipate DTE to report an adjusted EPS of $1.53, up 1.3% from $1.51 in the year-ago quarter. It has exceeded Wall Street's bottom-line estimates in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts predict DTE Energy to report adjusted EPS of $7.23, a rise of 5.9% from $6.83 in fiscal 2024. Moreover, adjusted EPS is projected to grow 6.8% year-over-year to $7.72 in fiscal 2026.

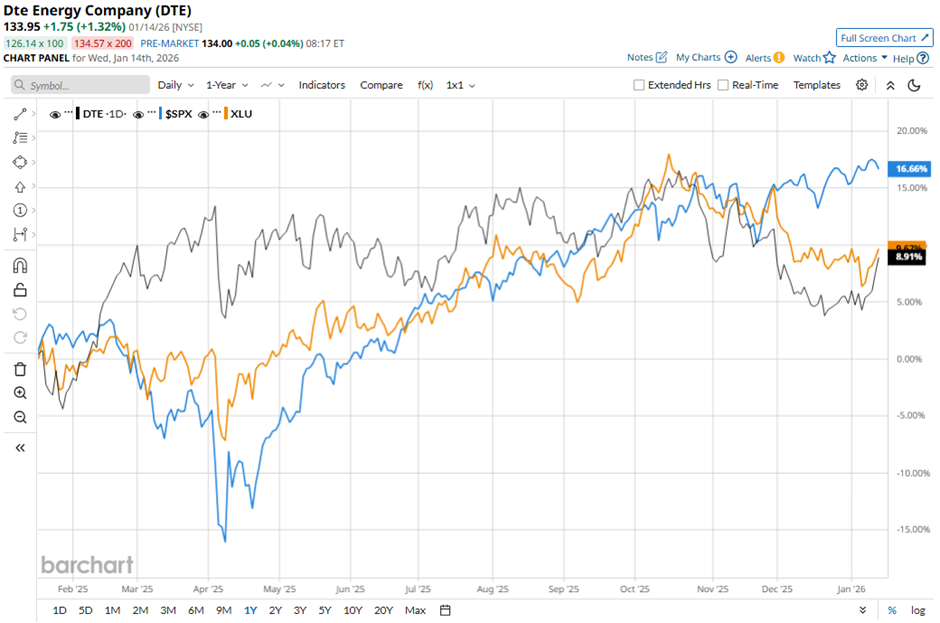

DTE stock has gained 12.2% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 18.6% return and the State Street Utilities Select Sector SPDR ETF's (XLU) 14.1% rise over the same period.

DTE Energy reported Q3 2025 results on Oct. 30, with adjusted earnings of $468 million ($2.25 per share) and reaffirmed its 2025 adjusted EPS guidance of $7.09 - $7.23, while also issuing a positive 2026 early outlook of $7.59 - $7.73. The management also announced a 1.4 GW data center agreement that will be fully paid for by the customer and is expected to generate significant affordability benefits for existing customers. However, the stock fell marginally on that day as reported earnings of $419 million ($2.01 per share) were lower than last year’s $477 million ($2.30 per share).

Analysts' consensus rating on DTE stock is cautiously optimistic, with a "Moderate Buy" rating overall. Out of 16 analysts covering the stock, opinions include seven "Strong Buys," one "Moderate Buy," and eight "Holds." The average analyst price target for DTE Energy is $148.29, indicating a potential upside of 10.7% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Trump Spats With Exxon CEO Darren Woods Over Venezuela, Should You Take a Risk and Buy XOM Stock?

- Is This Nvidia-Backed AI Stock a Buy Before It Soars 177%?

- Analyzing a Butterfly Spread on Marvell Technology

- Stocks Climb Before the Open as TSMC Reignites AI Optimism, U.S. Economic Data and Earnings in Focus