With a market cap of $13.4 billion, Akamai Technologies, Inc. (AKAM) is a leading provider of internet infrastructure and cloud services that operates one of the world’s largest distributed edge networks. Originally built around content delivery (CDN), the Massachusetts-based company now focuses primarily on three areas, web performance, cybersecurity, and edge cloud computing, serving enterprises across e-commerce, media, financial services, and the public sector.

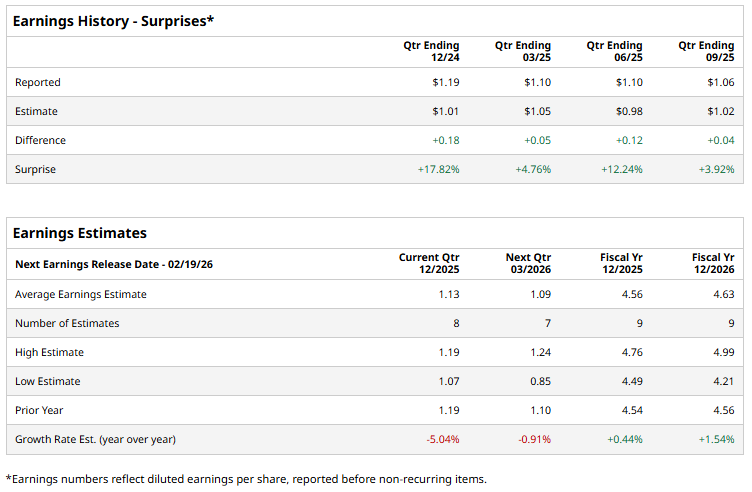

AKAM is slated to announce its fiscal Q4 2025 earnings results after the market closes on Thursday, February 19. Ahead of this event, analysts expect the company to report a profit of $1.13 per share, a 5% drop from $1.19 per share in the year-ago quarter. It has exceeded Wall Street's earnings expectations in each of the past four quarters, which is impressive.

For fiscal 2025, analysts expect the company to report EPS of $4.56, a marginal rise from $4.54 in fiscal 2024. Moreover, EPS is anticipated to grow 1.5% annually to $4.63 in FY2026.

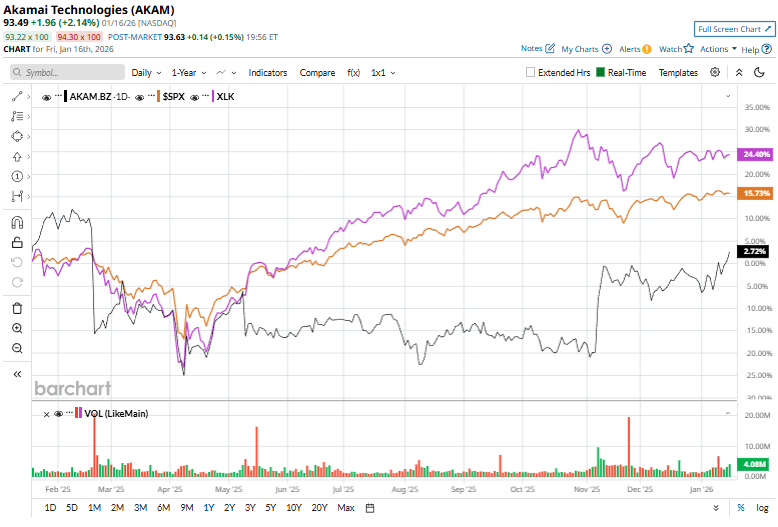

Shares of Akamai Technologies have soared 3.3% over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) 16.9% rise and the Technology Select Sector SPDR Fund's (XLK) 26.4% gain over the same period.

Investor sentiment toward Akamai improved sharply on Jan. 12 after Morgan Stanley (MS) issued a rare double upgrade to “Overweight” and lifted its price target to $115 from $83, citing the company’s strengths in content delivery, cloud security, and edge compute platforms, news that pushed AKAM shares up by 3.5%.

Analysts' consensus view on Akamai Technologies stock remains cautiously bullish, with a "Moderate Buy" rating overall. Out of 22 analysts covering the stock, ten recommend a "Strong Buy," one "Moderate Buy," nine "Holds," and two "Strong Sells." Its mean price target of $99.95 represents a premium of 6.9% from the current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart