Cathie Wood is trimming her Tesla (TSLA) stake, yet her expectations have rarely been higher. She still sees the company ultimately earning 70%-80% gross margins on the back of robotaxis and software. That confidence comes just as pressure builds on the core EV story, with Tesla’s sales slide in key European markets deepening, price cuts chipping away at profitability, and fresh competition from Chinese brands tightening the screws.

The picture is not one‑sided, though. Tesla just climbed the ranks in a major annual automaker survey, which reinforces its brand strength and perceived technological edge. At the same time, Morgan Stanley recently shifted to a more cautious stance on the stock. Wood, for her part, is leaning hard into the bullish narrative, and in a recent interview, she doubled down on a robotaxi‑driven future, arguing that deflationary tech forces and autonomous networks can support those outsized margins over time.

The tension is clear now. Is Tesla quietly setting up for the kind of margin story Wood envisions, or has the share price already granted it too much benefit of the doubt? Let’s dive in.

Tesla’s Rich Valuation Keeps Wood’s Margin Dream Alive

Tesla, based in Austin, Texas, designs and manufactures electric vehicles, energy storage systems, and AI‑driven software, with a market value near $1.46 trillion. Its share price stands at $427.05 as of Jan. 20, with a year‑to‑date (YTD) return of -5.4% and a 52‑week decline of -0.25%.

This equity trades at a premium trailing P/E of 302.46x and a forward P/E of 255.11x against sector medians of 16.74x and 18.18x, while its 16.12x price‑to‑sales multiple sits far above a sector median of 1.00x.

Tesla’s latest reported quarter ended in September 2025, and the earnings print did little to change that narrative. Their Q3 2025 EPS came in at $0.37 versus a $0.41 consensus estimate, producing a -$0.04 miss and a -9.76% negative surprise that reminded the market how bumpy the transition from hardware to higher‑margin software can look in the near term.

This result still rode on top‑line strength, as TSLA generated about $28.1 million in quarterly sales, representing sales growth of 24.89% year-over-year (YoY) and reinforcing why long‑term bulls like Cathie Wood remain comfortable. It also indicated that net income reached roughly $1.37 million, translating into 17.15% growth, which indicates management is not simply buying growth at any price but slowly rebuilding profitability after aggressive pricing and investment phases.

Operating cash flow tells an even more dramatic story that fits Wood’s thesis. This line item surged to about $10.9 million, up 132.84%, suggesting that the core business is throwing off significantly more cash that can be reinvested into full self‑driving, AI models, and the robotaxi infrastructure. That momentum carried through to the bottom of the cash flow statement, as net cash flow jumped to around $2.55 million with a 943.38% increase.

Tesla’s Fundamentals Lean Hard Into Wood’s Robotaxi Bet

Tesla’s recent moves line up almost perfectly with Cathie Wood’s view that the real money will come from autonomous services and high‑margin software. The company has secured a key Cybercab patent, a step that formalizes its ambition to operate a dedicated robotaxi fleet and strengthens its IP around autonomous ride‑hailing. This patent ties directly into the plan to monetize self‑driving capability at scale.

That same pivot shows up in how Tesla is gearing its capital allocation. The firm is reportedly set to buy roughly $2 billion worth of energy storage system batteries under a multi‑year supply agreement, aimed at feeding its Megapack and broader grid‑scale storage business rather than just its vehicle lineup. This is an attempt to deepen a segment that pairs naturally with a robotaxi world.

The clearest tell, though, may be in how aggressively Tesla is preparing to test full autonomy in the real world. Tesla has already begun removing safety drivers from parts of its robotaxi testing, moving beyond small, tightly controlled trials into more advanced autonomous operations.

Analysts Temper Tesla’s Margin Hopes

Analysts are walking a tightrope on Tesla right now. The next earnings release is scheduled for Jan. 28 after the market close, and for the current quarter ended December 2025, the average earnings estimate is $0.32 per share, down from $0.66 a year earlier, implying a -51.52% YoY decline. For the next quarter, March 2026, the Street is looking for $0.30 in EPS, exactly double the $0.15 reported in the prior year, translating to a projected growth rate of +100%.

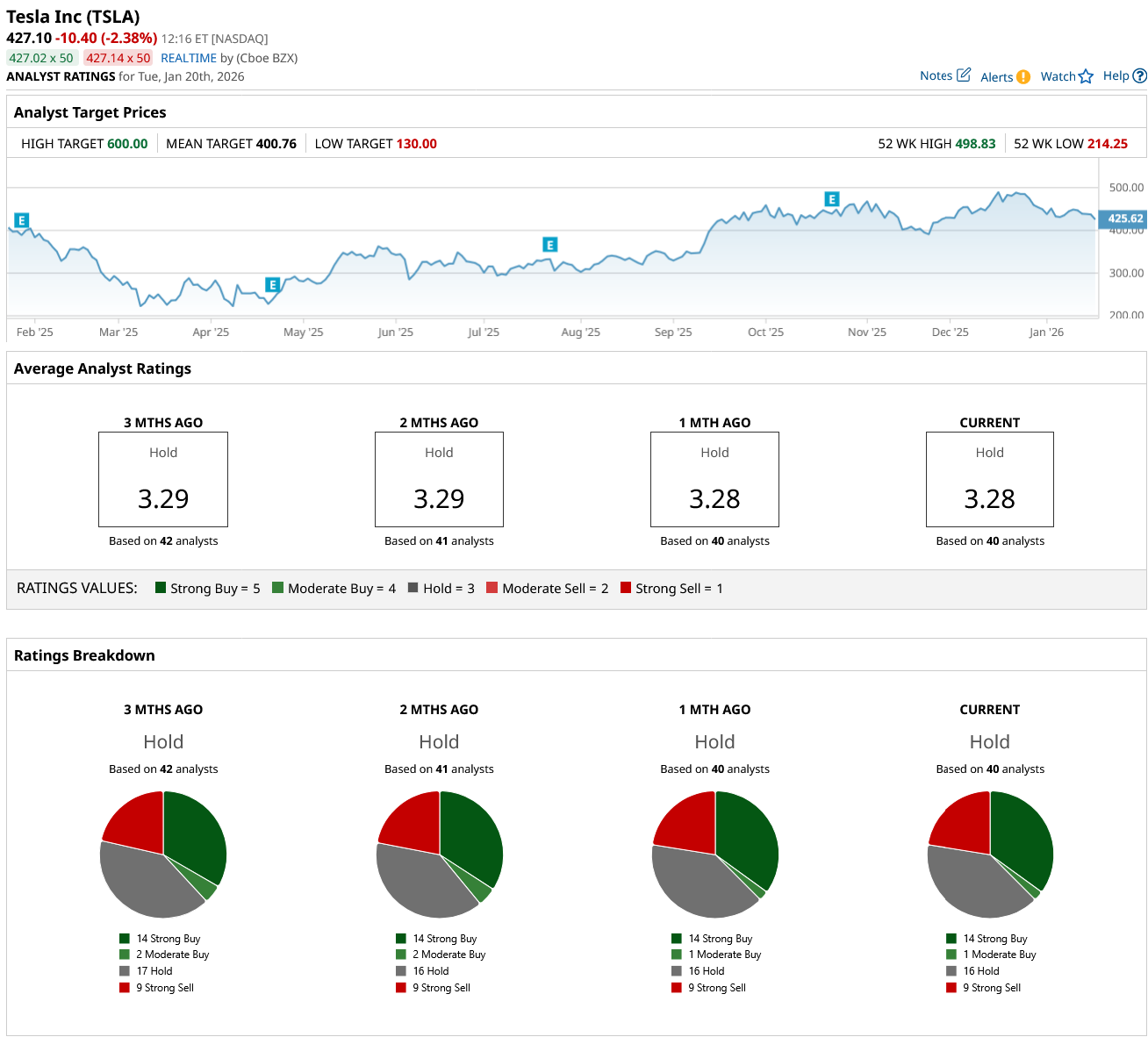

The consensus view from 40 analysts comes in at a “Hold” rating, signaling that, as a group, they are not ready to fully buy into Tesla’s structural growth story. Their average price target of $400.76 sits below the current share price, implying roughly -8.4% downside rather than upside at this level. That disconnect is important, because it shows how far Wood’s conviction is from the Street’s baseline.

Conclusion

Tesla, right now, looks like a tug‑of‑war between a stretched present and a very ambitious future. Cathie Wood is clearly still betting that robotaxis and software can eventually push gross margins toward that 70%–80% band, but the near‑term numbers, the consensus “Hold” stance, and a target below the current price say most pros are not ready to follow her that far yet. If Tesla proves out fully driverless services and real monetization, shares can re‑rate higher; otherwise, they are more likely to grind sideways.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Why Cloudflare (NET) Stock Options Could Be Due for a Comeback Trade

- Is Amazon Too Cheap Ahead of Earnings? Put Yields are High, Implying AMZN Stock Could Rally

- Cathie Wood May Be Trimming Her Tesla Stake, But She Still Thinks the Company Is on Track for 70%-80% Gross Margins

- Lockheed Martin Stock Hits New 52-Week High as the Greenland Crisis Heats Up