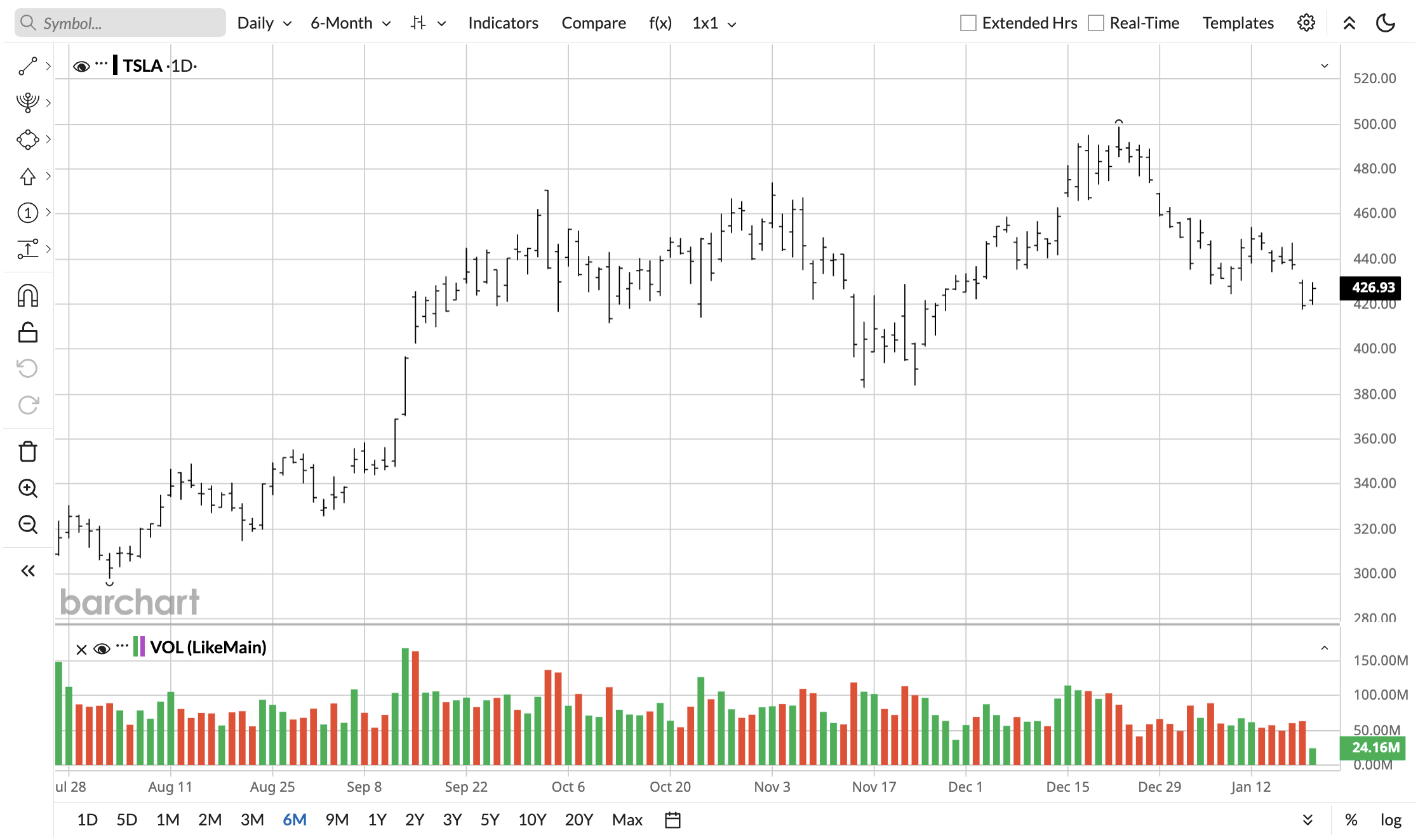

Tesla's (TSLA) next big, scheduled catalyst is its fourth-quarter 2025 earnings release and management webcast on Wednesday, Jan. 28. That day will also bring a volatility bonus, as the Federal Reserve's January meeting will conclude the same day. A policy statement is expected to be released, so both developments could coincide to make for a very green day, or douse TSLA stock in red ink.

TSLA stock rarely lacks drama, but some dates do especially stand out. Jan. 28 is one of those dates. Tesla has already reported Q4 2025 production, deliveries, and energy storage deployments. Now, the market is awaiting the full story so that Wall Street can confirm where the needle is moving.

The upcoming earnings date is also very important since Tesla is at a crossroads. The company has shown signs that its financials are finally recovering. The question is whether or not Tesla is now building on that momentum or struggling to grow despite the environment getting more favorable due to interest rate cuts.

What to Expect Heading Into Tesla's Earnings Day

Let's begin with what we already know. In Q4 2025, Tesla produced 434,358 vehicles and delivered 418,227 vehicles. For the full year 2025, Tesla reported 1,654,667 vehicles produced and 1,636,129 delivered. On the energy side, Tesla said Q4 energy storage deployments were 14.2 GWh (a record) and full-year 2025 deployments were 46.7 GWh.

However, Tesla warned that its deliveries won't be a clean proxy for quarterly financial results due to reported performance depending on items like average selling price, cost of sales, and foreign exchange, among other factors. Analysts expect a 32% EPS decline for the full year and a 3% revenue decline. For 2026, they expect a 33% EPS recovery to $2.17 and 13% revenue growth to $107.4 billion.

Thus, earnings day is when the market finds out whether those delivery totals translated into healthier or weaker profitability, and whether the energy momentum is meaningfully lifting the overall earnings mix.

Investors will also be watching for management commentary on major forward-looking initiatives that can drive valuation sentiment. Bulls have their eyes set on robotaxis and progress on the Optimus robot. They've also been looking for updates regarding full self-driving (FSD) being changed to a subscription model. If this can convince millions of new users to join in, it's a step in the right direction.

The Federal Reserve's Decision Is Key

Interest rates and demand for electric vehicles (EVs) are interconnected. A lower interest rate will allow customers to purchase EVs more cheaply, in turn helping drive demand. It's no coincidence that Tesla performed significantly better when interest rates were lower.

The Federal Open Market Committee (FOMC) is scheduled to meet on Jan. 27 to Jan. 28, and it is customary for the Fed to release its policy statement on the second day of the meeting. Market calendars commonly anticipate the statement at 2:00 p.m. Eastern and a press conference roughly 30 minutes later.

If the Fed looks dovish and Tesla releases positive numbers, TSLA stock could make a big move to the upside. Conversely, bad earnings results from Tesla and a hawkish Fed will invite more skepticism from the Street and send the stock down.

What Should Tesla Investors Do Now?

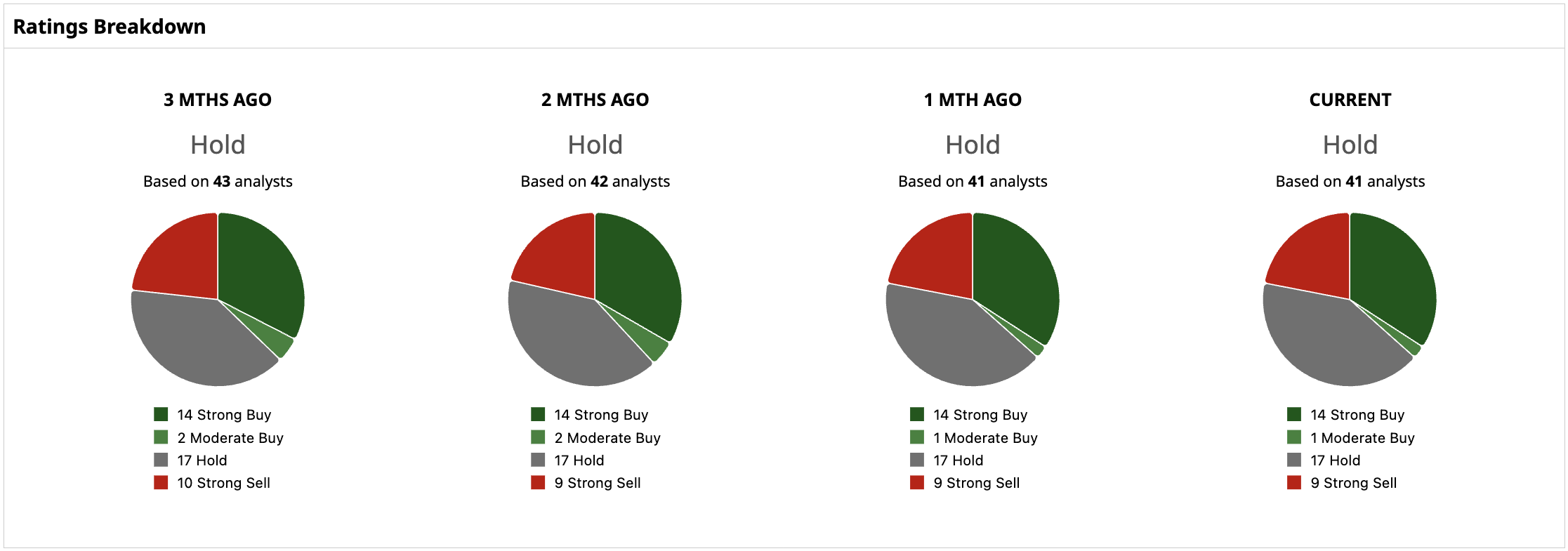

If you're a long-term holder, I wouldn't panic trade on the day. Bulls have been sticking along for the ride, and their stubbornness makes Tesla one of the most unpredictable stocks. That's why most analysts are on the fence, with the average price target for TSLA stock at $400.65 currently.

Even a bad earnings report may not end up sending the stock down if CEO Elon Musk swears that robotaxis are about to take off and that Optimus robots are just around the corner. Plenty of bulls are willing to buy that promise and drive TSLA stock higher.

On the date of publication, Omor Ibne Ehsan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- UnitedHealth Announces Plans to Rebate ACA Profits. What Does That Mean for UNH Stock as Trump Takes Aim at Insurers?

- As Jensen Huang Preps to Visit China, How Should You Play Nvidia Stock?

- Dear Tesla Stock Fans, Mark Your Calendars for January 28

- Elon Musk Warns of Slow Cybercab, Optimus Production. What Does That Mean for the TSLA Stock Bull Case?