Tesla (TSLA) CEO tempers investor expectations ahead of earnings, signaling "agonizingly slow" early production for key future products. Tesla's CEO Elon Musk on Tuesday sought to manage investor expectations around two of the company's most anticipated future products, warning that early production of the Cybercab robotaxi and Optimus humanoid robot will be significantly slower than many anticipate.

"The speed of the production ramp is inversely proportionate to how many new parts and steps there are," Musk wrote on X (formerly Twitter). He emphasized that for Cybercab and Optimus, “almost everything is new,” so the early production rate will be agonizingly slow before ramping up.

The comments come at a critical juncture for Tesla, with the EV maker down about 1% year-to-date (YTD) and set to report fourth-quarter earnings on Jan. 28. Cybercab production is slated to begin in April at the company's Texas Gigafactory, while Optimus is expected to enter low-volume output in 2026, with mass production not anticipated until 2027 or later.

The cautious tone is a notable shift for Musk, who has previously outlined ambitious production targets, including one Cybercab every 10 seconds.

All Eyes on Tesla’s Q4 Numbers

Tesla investors witnessed a dramatic turnaround in 2025, even as the EV maker continues to wrestle with tepid sales. After TSLA stock fell 36% in Q1 of 2025, it rebounded in the following months, reaching a record high last month.

The recovery came despite mounting business challenges. Tesla delivered 1.64 million vehicles in 2025, down 8.6% from the previous year and falling short of Wall Street expectations.

Fourth-quarter deliveries of 418,227 vehicles missed analyst estimates of 426,000, marking a 16% decline from the same period in 2024. Chinese rival BYD (BYDDY) overtook Tesla as the world's top electric vehicle seller, reporting 2.26 million units sold.

The first half of 2025 proved difficult for Tesla:

- Automotive revenue dropped 20% in Q1 and 16% in Q2 amid consumer backlash linked to Musk's political activities.

- Musk’s role leading the Department of Government Efficiency (DOGE) under President Trump, combined with endorsements of controversial political figures in Germany and Britain, damaged the brand's reputation and sales.

In Q3 of 2025, Tesla’s sales rose by 12% as buyers rushed to claim federal tax credits before they expired in September. However, that policy shift simply pulled sales forward, leaving fourth-quarter results weaker.

Sales in November hit a four-year low, according to Cox Automotive, and the stripped-down versions of the Model Y and Model 3 released in October appeared to cannibalize higher-priced models rather than attract new customers.

Despite operational struggles, investor enthusiasm centered on Musk's vision for robotaxis and humanoid robots. TSLA stock surged when Musk announced testing of fully driverless vehicles in Austin without safety operators on board.

What Is the TSLA Stock Price Target?

Analysts at Mizuho raised their TSLA price target to $530, citing improvements to Tesla's Full Self-Driving technology that could accelerate robotaxi expansion.

However, not everyone shares the optimism. Investor Michael Burry called Tesla's valuation "ridiculously overvalued," criticizing the company's 3.6% annual shareholder dilution through stock-based compensation and Musk's $1 trillion pay package approved by shareholders in November.

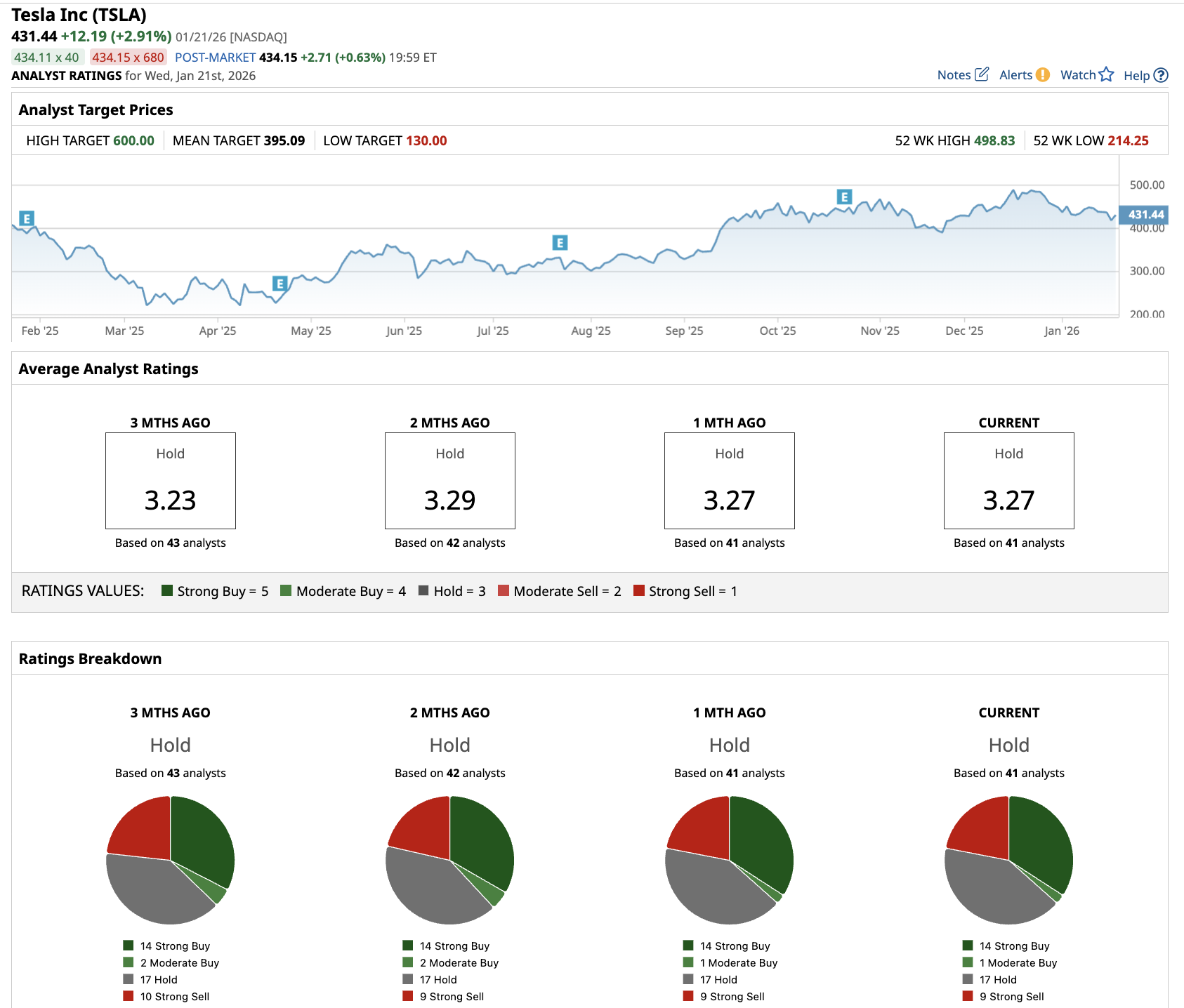

Out of the 41 analysts covering TSLA stock, 14 recommend “Strong Buy,” one recommends “Moderate Buy,” 17 recommend “Hold,” and nine recommend “Strong Sell.” The average TSLA stock price target is $395.09, below the current price of $431.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- UnitedHealth Announces Plans to Rebate ACA Profits. What Does That Mean for UNH Stock as Trump Takes Aim at Insurers?

- As Jensen Huang Preps to Visit China, How Should You Play Nvidia Stock?

- Dear Tesla Stock Fans, Mark Your Calendars for January 28

- Elon Musk Warns of Slow Cybercab, Optimus Production. What Does That Mean for the TSLA Stock Bull Case?