A strong resurgence in investment banking and trading activities resulted in a strong showing for the banks in the December 2025 quarter. Notably, even amid this robust performance, Goldman Sachs (GS) stood out in particular. Not only did its earnings handily beat Street expectations, but the banking major also increased its quarterly dividend by 12.5% to $4.50 per share. The increased dividend will be paid on March 30 to shareholders of record on March 2.

Notably, the company has been raising dividends consecutively over the past 14 years, and its current dividend yield is 1.64%. Moreover, with a payout ratio of just 27.3%, the headroom for further growth remains.

About Goldman Sachs

Founded in 1869 as a small brokerage in New York City, Goldman Sachs has gone on to become a financial behemoth over the years, with a presence in investment banking and advisory, asset and wealth management, trading and securities services, and consumer and wealth solutions. The firm serves corporations, institutions, governments, and high-net-worth clients with a broad suite of advisory, financing, trading, and investment solutions.

Valued at a market cap of $288.5 billion, the GS stock is up 52% over the past year.

So, post its Q4 results, what to make of the GS stock now? Can the stock be a sound investment, or is it an avoid now? Let's find out.

Earnings Beat, Revenues Miss Estimates (But That Is Not The Whole Story)

On the surface, Goldman Sachs' numbers reflected a mixed bag, marked by an earnings beat but a revenue miss. In fact, net revenues at $13.45 billion were down 3% on an annual basis. However, this was due to a $2.26 billion hit taken by the company due to discarding its Apple (AAPL) Card portfolio. Thus, while this resulted in a significant reserve release, it significantly boosted the bottom line and simplified their balance sheet. A 25% jump in investment banking fees revenues to $2.58 million was particularly noteworthy, signifying recovering M&A activity, as the company maintained its number one position in the space. Also, revenues from equity trading grew by 25% as well in the same period to $4.31 billion as markets continued to touch record highs.

Net interest income, furthermore, saw a leap of 58.1% from the previous year to $3.71 billion as the company's banking services certainly benefited from the cut in interest rates by the Federal Reserve. Yet, with a lot of noise surrounding the same, net interest income may turn out to be a volatile segment soon.

Meanwhile, earnings increased by 17% from the previous year to $14.01 per share, surpassing the consensus estimate of $11.70 per share. Further, this was the ninth consecutive quarter of earnings beat from the company as it ended 2025 with a book value per share of $357.60 (+6% YoY).

Deposits and loans rose by 15.7% and 21.4% to $501 billion and $238 billion, respectively, as the company improved its return on equity (ROE) to 16% from 14.6% in the year-ago period, a positive indicator that the company is deploying capital efficiently and productively. Overall, the company closed the quarter with a cash balance of $164 billion, much higher than its short-term debt levels of $70 billion.

Amid all this, the stock is trading just above the sector median with a forward P/B of 2.69 versus 1.32 for the sector.

Go for Goldman

Goldman's position at the apex of the global investment banking business certainly makes for good headlines, but it is in the more boring businesses where Goldman's strong performance is praiseworthy. Goldman Sachs has been shifting more of its earnings toward steady, fee-based lines like asset management and wealth advisory, while its top-tier investment banking and trading operations remain well positioned to take advantage of favorable market and economic trends.

The firm is also making solid progress on AI adoption. Its multi-year program, OneGS 3.0, focuses on rolling out artificial intelligence to streamline workflows, boost productivity, and support continued growth in its main divisions. Leadership expects the effort to deliver meaningful improvements in client service, operating margins, employee efficiency, system reliability, scalability, and risk controls. In essence, Goldman is weaving AI into its everyday operations to lift shareholder returns while keeping expense growth in check.

Beyond technology, the company is pursuing steady expansion across its businesses. In investment banking, Goldman is working to turn cyclical advisory and trading activity into more reliable fee income by capturing a larger share of high-margin M&A deals and building out electronic and flow-trading platforms. In asset management, the firm is growing its ETF offerings and distribution channels to lock in longer-duration fee streams. During 2025, Goldman completed several mutual fund-to-ETF conversions and closed the $2 billion acquisition of Innovator Capital Management, adding roughly $28 billion in assets under supervision and 159 defined-outcome ETF strategies. These steps aim to move Goldman into the top tier of ETF providers and significantly increase recurring, fee-based revenue. A larger ETF platform also creates opportunities to cross-sell into wealth-management channels and institutional accounts.

Finally, Goldman is investing in international distribution capabilities, particularly in India and Europe, while expanding third-party placement networks to reach more institutional and retail clients globally. Recent hires, regional platform builds, and new distribution agreements are designed to grow assets under management, broaden alternative-product access, and reduce client-acquisition costs, which are classic drivers of long-term margin improvement in asset and wealth management.

Analyst Opinion on GS Stock

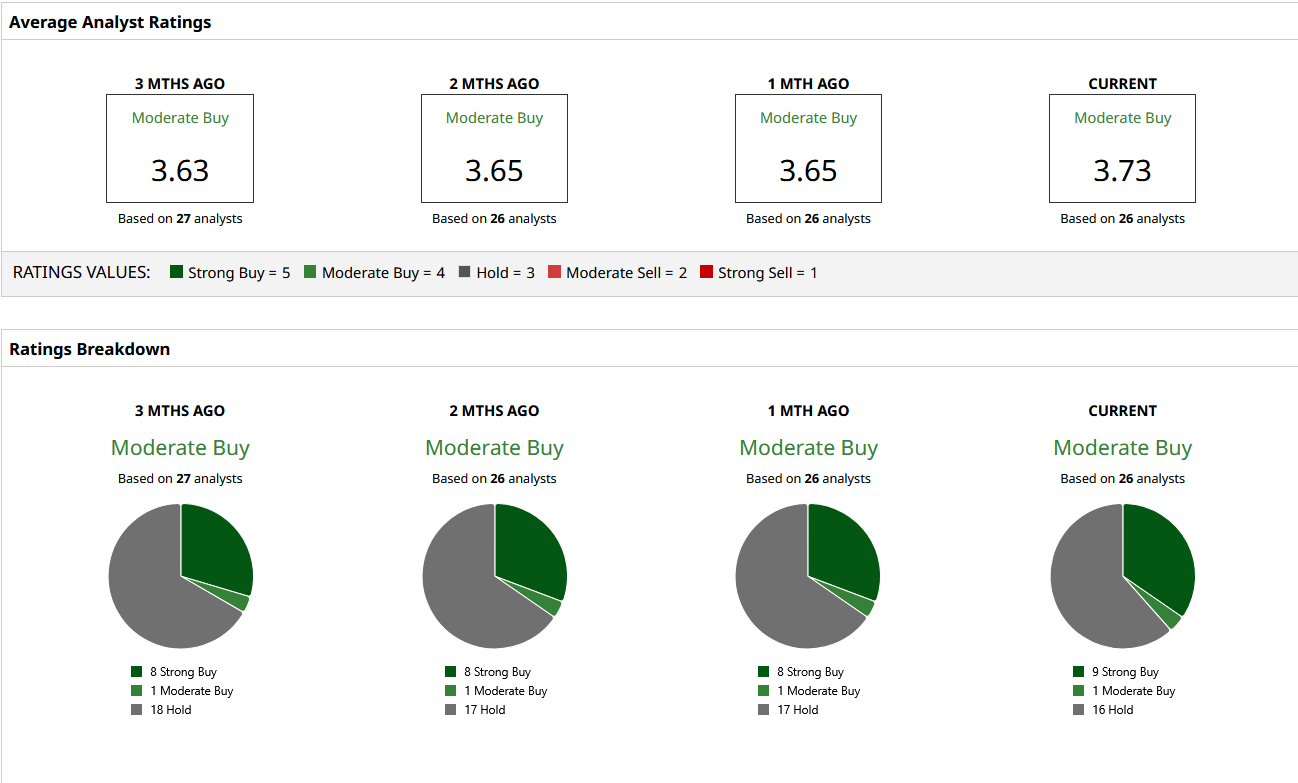

Considering this, analysts have deemed GS stock to be a consensus “Moderate Buy,” with a mean target price that has already been surpassed. The high target price of $1,125 indicates an upside potential of about 17% from current levels. Out of 26 analysts covering the stock, nine have a “Strong Buy” rating, one has a “Moderate Buy” rating, and 16 have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart