The North American Tech-Software iShares ETF (IGV) has hit a rough patch in early 2026. What’s the cause? A classic case of expectation meeting reality.

For two years, the software sector bid up on the promise of artificial intelligence (AI) integration. Now, in the first earnings season of 2026, investors are demanding to see the receipts. The result has been a violent rotation away from general software providers and toward hardware and specialized AI winners.

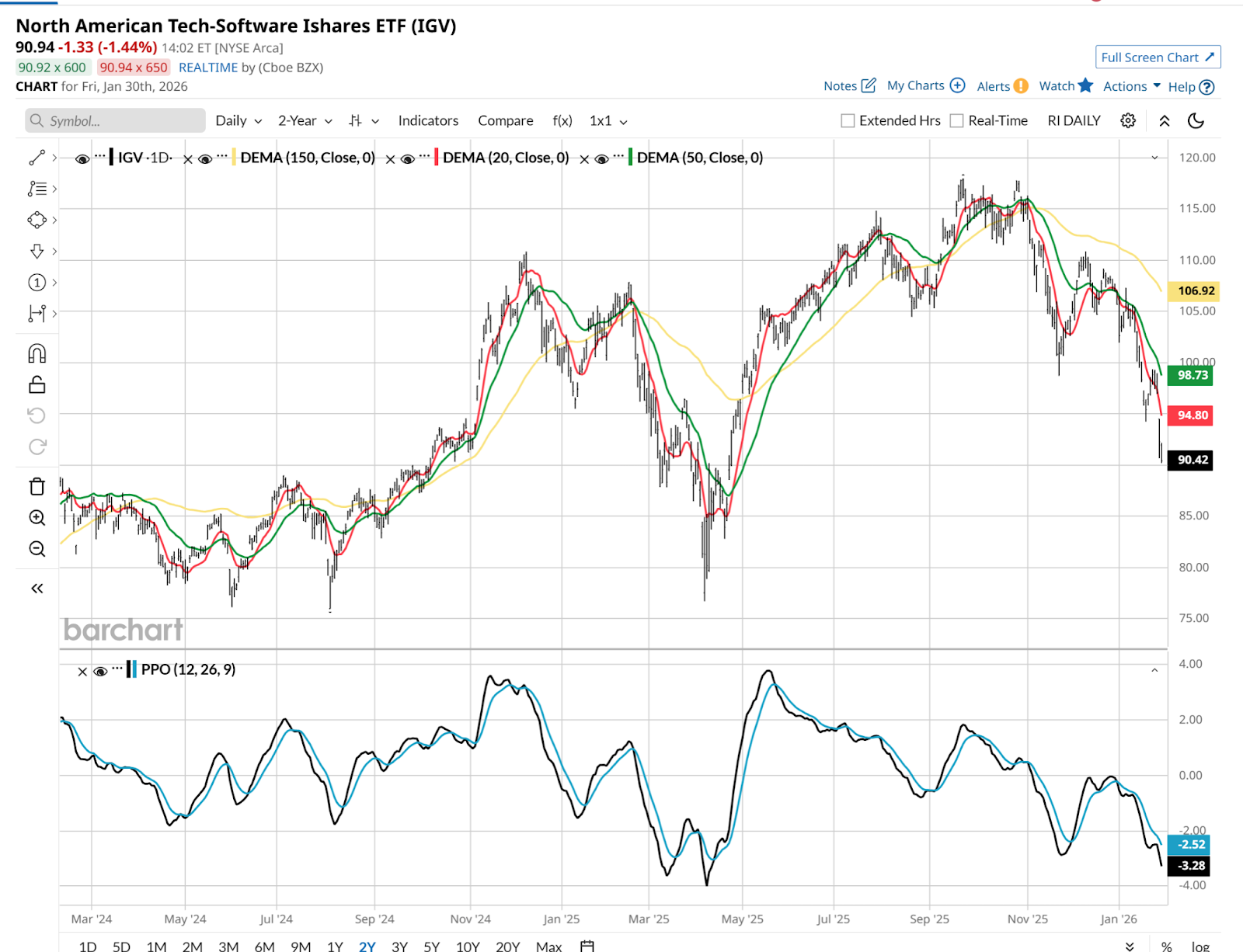

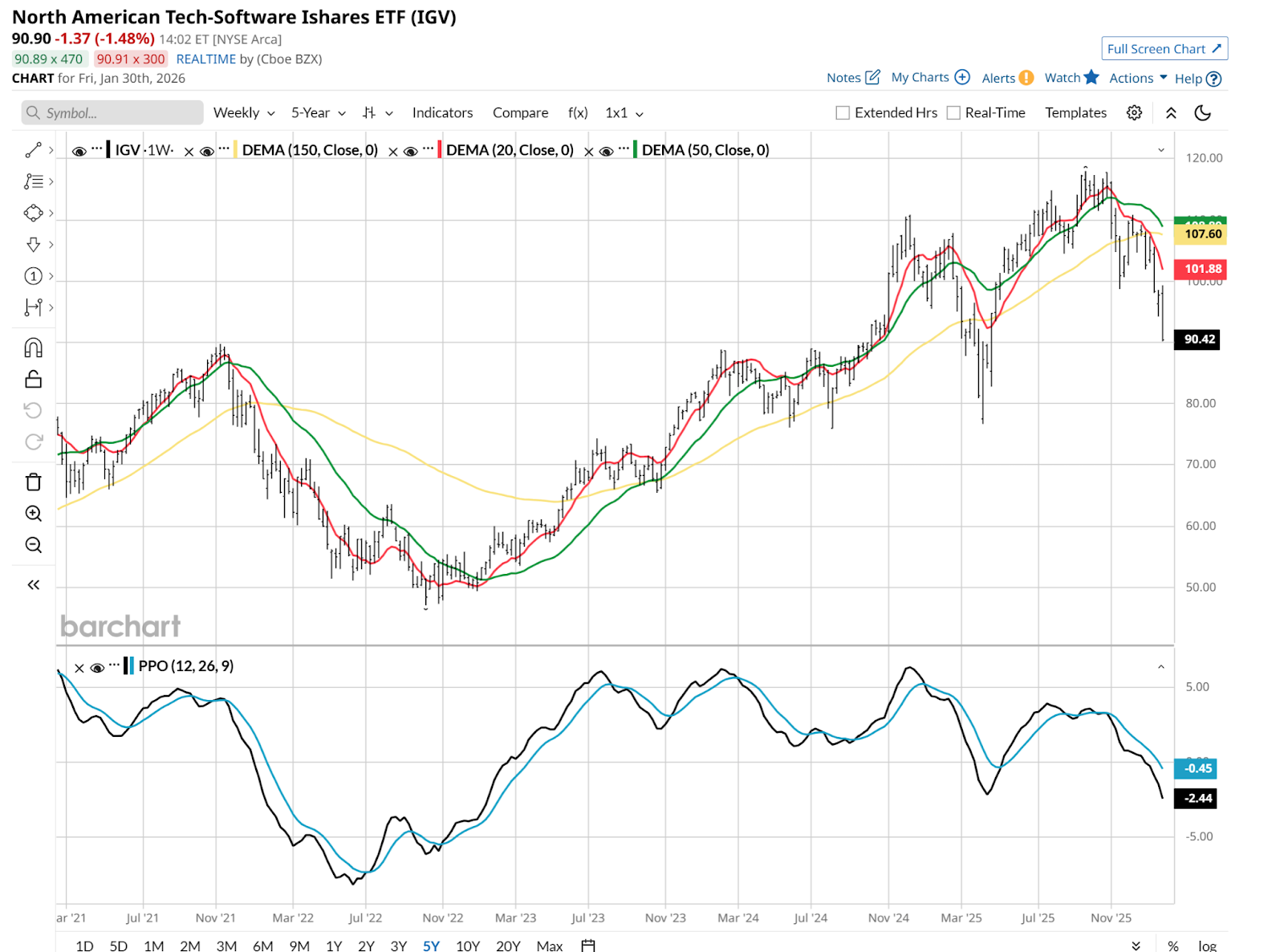

As of late January, IGV has entered a technical bear market, dropping more than 20% from its recent peak. The fund’s price action has turned decidedly bearish, with its 50-day moving average crossing below the 200-day moving average — a "death cross" that has trend-followers heading for the exits.

While the broader market has been flirtatious with new highs, software has been the heavy anchor dragging on tech performance.

Why Is IGV Down So Much?

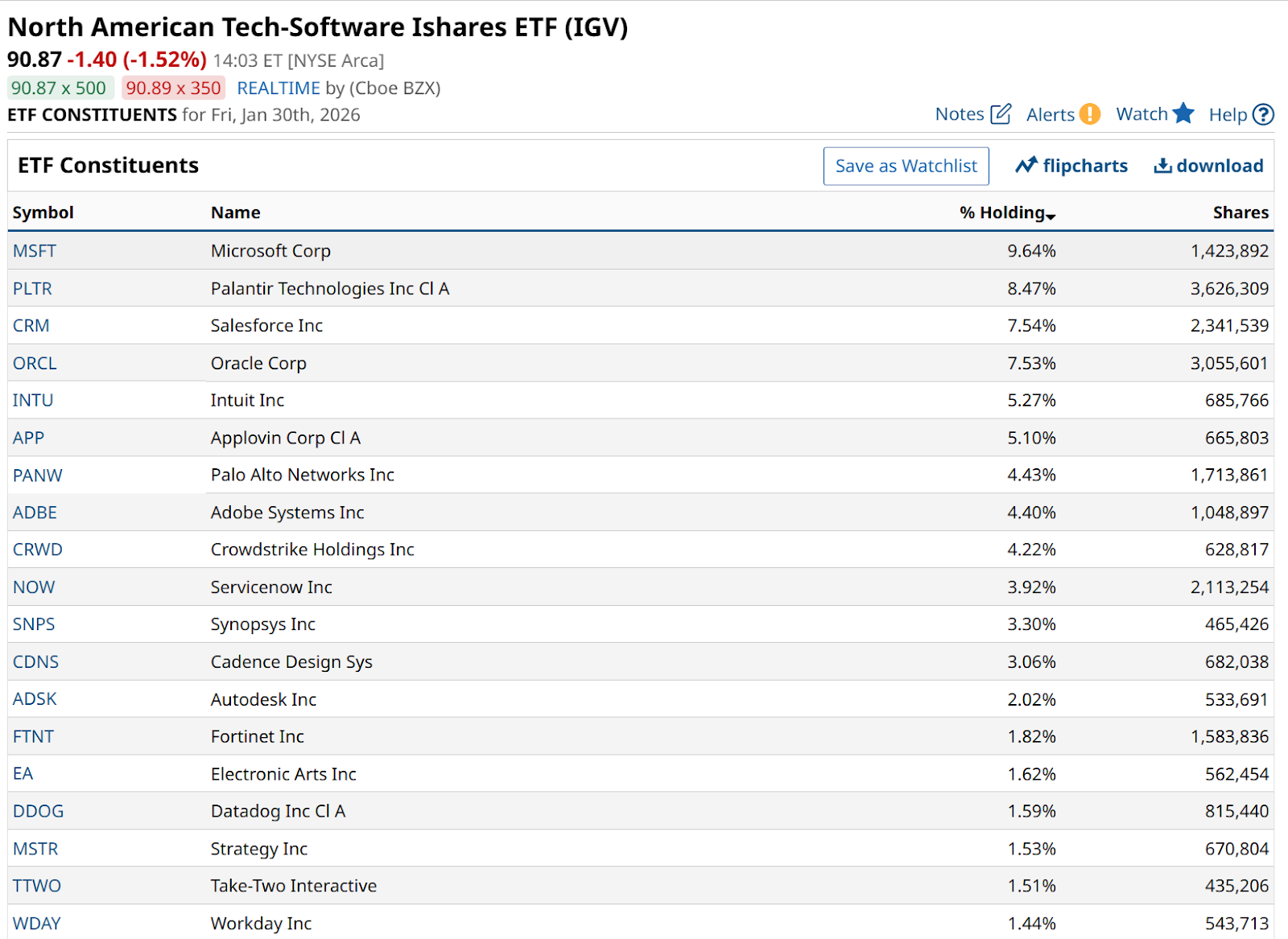

The news from the frontlines of software is a mixed bag of record revenues and shrinking confidence. Microsoft (MSFT), the king of the IGV hill at more than a 9% weight, recently reported a massive $81 billion quarter.

On paper, Microsoft beat expectations on both top and bottom lines. However, the stock plunged 10% after the report because Azure’s cloud growth showed a slight deceleration (from 40% to 39%). In the 2026 market, “beating” isn't enough; you have to accelerate, or the valuation multiple gets chopped.

We are seeing a structural shift in how software is priced. About 70% of software providers now admit that the cost of delivering AI features is eating into their profitability. The era of "infinite margins" for SaaS (software as a service) is being challenged by the high cost of GPU compute. As a result, companies like Salesforce (CRM) and Adobe (ADBE) are being forced to pivot from traditional subscriptions to usage-based pricing models just to keep up with their rising cloud bills.

The daily chart below shows indications of the price being washed out. But that may not be for long. This is a good exchange-traded fund (ETF) to watch for signs of the infamous “dead cat bounce,” which doesn’t last, but suckers people in.

I say that because I see a weekly chart that could still have some work to do. To the downside, that is. The last IGV plunge back in 2022 cut it in half. It is only halfway to halfway down (25%) so far.

The Risk Manager’s Perspective

From a fundamental standpoint, software isn't broken. But it is being repriced for a world where AI is a cost of doing business rather than just a high-margin add-on. If you are looking to bottom-fish in IGV, you are fighting a very strong downtrend. But momentum indicators of all types turned negative a few weeks ago, and a bounce is more obligatory than sustainable, until proven otherwise.

Rob Isbitts is a semi-retired fiduciary investment advisor and fund manager. Find his investment research at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app. His new blog on racehorse ownership as an alternative asset is at HorseClaiming.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Up 77% in the Past Year, This Analyst Says More Upside Is Still in Store for Applied Materials Stock

- This Trump Stock Just Announced a $100 Million Catalyst. Should You Buy Its Shares Now?

- Apple Is Reportedly Looking to Partner with Intel Foundry. Does That Make INTC Stock a Buy Here?

- Dear Disney Stock Fans, Mark Your Calendars for February 2