Quantum computing stocks are back in play to start 2026, and once again D-Wave Quantum (QBTS) is right at the center of it all. This time, the attention is on a deal to purchase Quantum Circuits for a total of $550 million via a mix of both stock and cash. As far as QBTS stock investors are concerned, this is a play that's about so much more than size.

The buyout comes at a time when the governments, companies, and research facilities are shifting focus from the experimental stages of quantum computing to implementation. D-Wave is trying to do something that few other companies in the same league can lay claim to: staying relevant in the current era and having something in the pipeline for the future. D-Wave's quantum cloud platform is already earning revenue with production-level technology that is expanding to gate-model systems.

This ambition has not escaped the notice of the market, either. The share price of QBTS stock has jumped considerably over the last year, showing renewed faith in the belief that quantum computing adoption is finally crossing from theory into practice.

About D-Wave Quantum Stock

D-Wave Quantum is a quantum computing company headquartered in Palo Alto, California, specializing in developing, operating, and managing commercial quantum computing systems, software, and cloud-based services. D-Wave is primarily recognized as a manufacturer of annealing-based quantum computing systems, which are already in use by various firms, governments, and research bodies across the world. D-Wave is currently valued at a market capitalization of $10.6 billion.

The shares of QBTS stock have been very volatile. Currently, the stock trades around the $30 mark, following a multi-week rally, and is well above the 52-week low price of $3.74 (although QBTS remains lower than the 52-week high of $46.75). QBTS has performed considerably better than the market as a whole over the last year.

The valuation is still aggressive, however. D-Wave remains unprofitable with negative margins and returns, and it has an elevated price-to-sales ratio of 364 times. This is not unusual for early-stage leaders in the quantum space; valuation is usually less dependent on earnings and much more dependent on balance-sheet strength, customer adoption, and technology. On these dimensions, having $836 million in cash is an extremely important factor for D-Wave.

D-Wave Quantum Expands Its Technology Stack

The Quantum Circuits acquisition is significant to D-Wave's management. This is because it involves gate-model superconducting quantum technology and error correction capability. This technology will now sit alongside D-Wave’s solution platform, allowing clients to solve various computational problems.

It is equally important, however, to consider the human capital in regard to this deal. The agreement brings in top quantum experts, such as Dr. Rob Schoelkopf, and will help open a new R&D center in New Haven, Connecticut. The agreement improves the reputation of D-Wave in the field of gate model development — a field in which the competition had traditionally had the narrative upper hand.

Operationally, the company has been making positive progress. In the third quarter, revenue doubled from a year ago to reach $3.7 million. Gross margins grew materially as a result of more system sales as well. In the first nine months of fiscal 2025, revenue grew by 235% compared to a year ago, while the GAAP gross margin reached almost 85%. Although the company has large losses, the rate of loss has eased.

What Do Analysts Expect for D-Wave Quantum Stock?

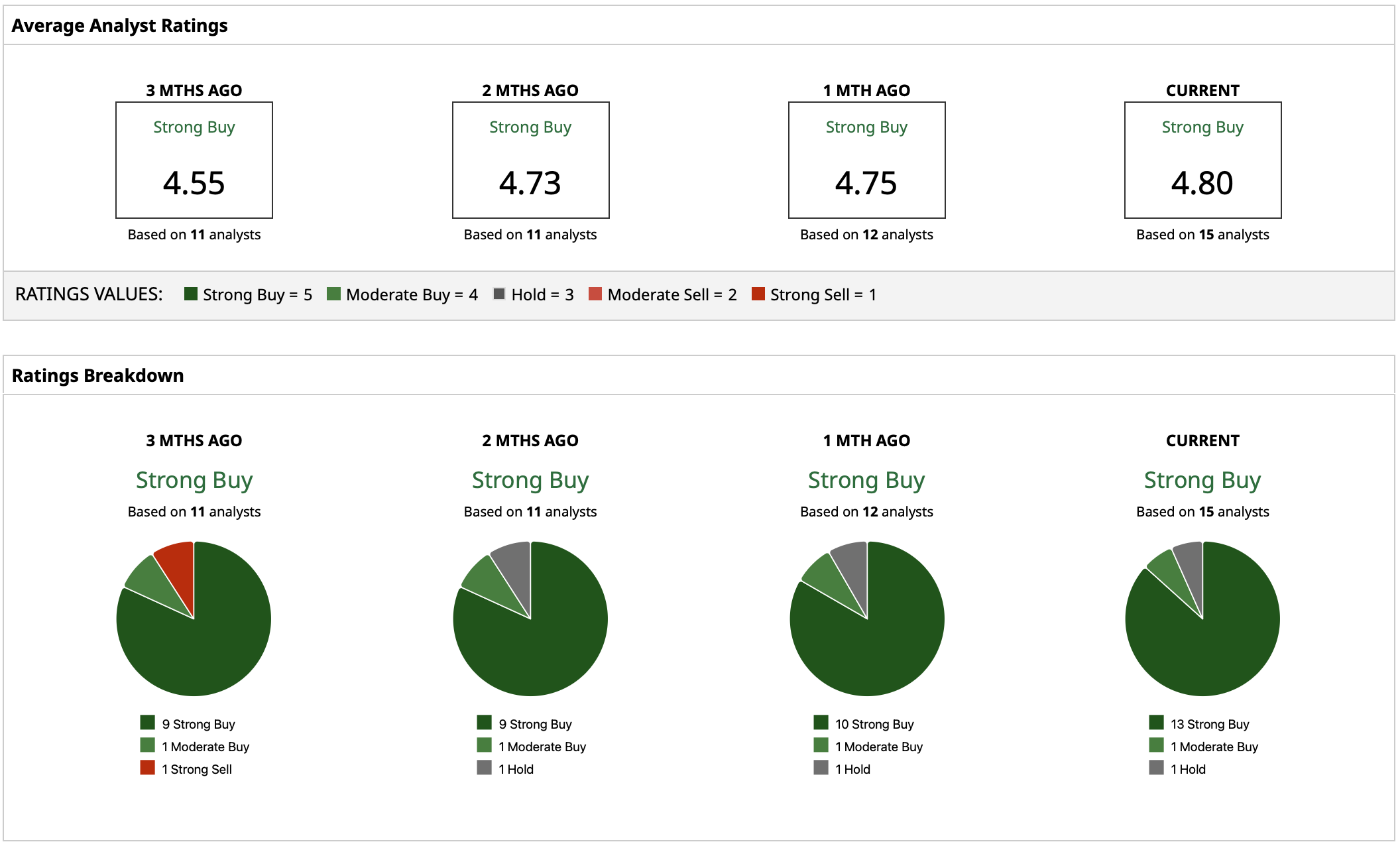

Analysts covering QBTS stock tend to see the company as a high-risk/high-reward play on the potential for the adoption of quantum technology, assigning a “Strong Buy” consensus rating for the stock. Current price targets vary from a low of $22 to a high target of $48, with an average price target of $38.71. At the current price, that mean target implies a potential gain of about 29%. This positivity stems from D-Wave's robust cash position, increasing customer base, and early monetizing advantage in the field of quantum computing.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 1 Analyst Is Betting That Palantir Stock Can Gain Another 20% in 2026

- Missed the AI Rally? Jefferies Says CrowdStrike and These 3 Other Cybersecurity Stocks Could Be Next

- Nvidia Is Giving Tesla a Run for Its Money with Robotaxis. Which Is the Better Stock to Buy Now?

- The 3 Best Cannabis Stocks to Buy for 2026