Investing in cannabis stocks is back in focus as regulatory progress and expanding medical use steadily lift demand. The sector still mixes high upside with policy and execution risk, so being picky matters.

Barchart's screener shows these three cannabis names stand out for 2026. WM Technology (MAPS) offers exposure to clinical-stage pipelines and potential regulatory catalysts, Green Thumb Industries (GTBIF) provides retail and wholesale growth with improving margins as operations scale, and Corbus Pharmaceuticals (CRBP) delivers agricultural scale and branded-product leverage as adult-use markets stabilize. Together, these selections balance near-term operational gains with long-term commercial upside, offering a practical approach to cannabis exposure for the new year.

Cannabis Stock #1: WM Technology (MAPS)

WM Technology is a leading online cannabis marketplace and business-to-business (B2B) platform for licensed retailers. The Irvine, California–based company offers an integrated e-commerce directory and subscription services for legal cannabis products. The firm would be well placed to scale, if federal legalization expands.

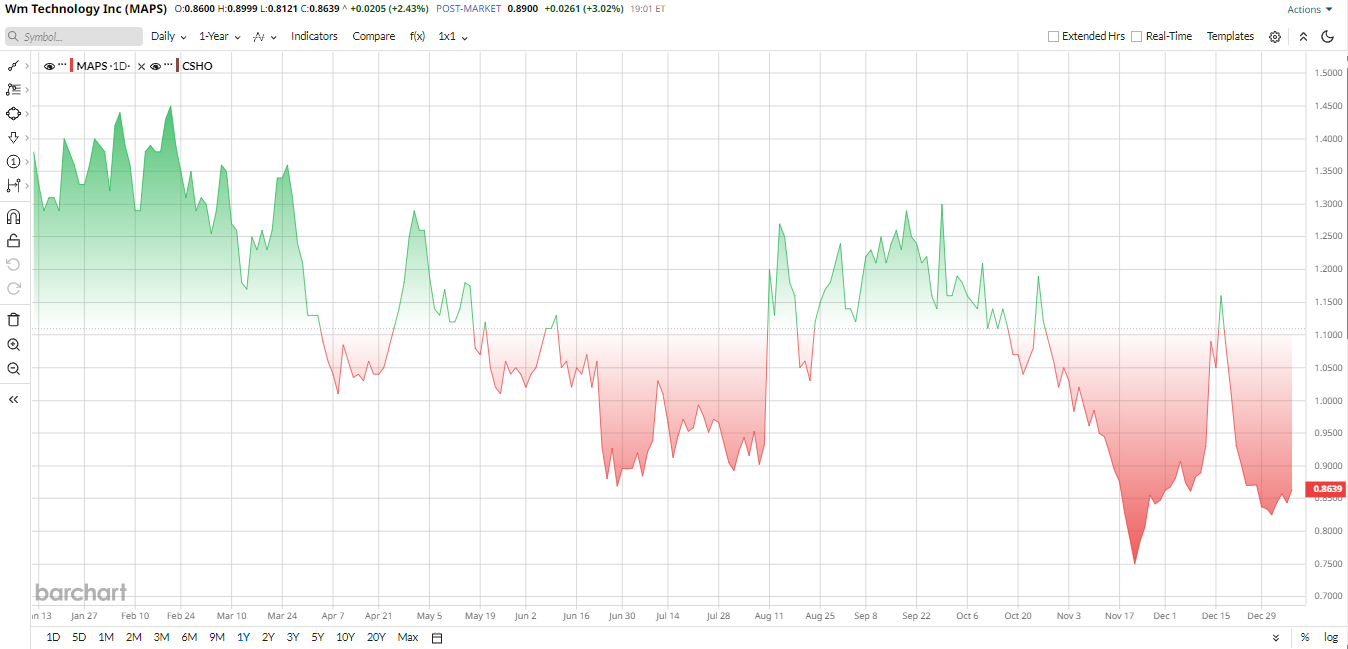

That potential has drawn investor interest. MAPS stock has surged on regulatory optimism. In late 2025, shares ran up sharply, jumping about 17% in November after President Donald Trump signaled support for marijuana rescheduling. Investors treated that as a potential policy catalyst for Weedmaps’ business. Despite this surge, however, MAPS stock is still down 37% over the past year, underperforming the sector.

Thanks to its underperformance, MAPS is now trading at an attractively priced level with its price-to-sales ratio at 0.51, which is below the sector median. This indicates a lower cost of entry compared to its cannabis peers.

WM Technology’s latest quarter showed disciplined execution amid softness. Revenue was $42.2 million versus $46.6 million a year earlier. Monthly paying subscribers rose modestly to 5,221 from 5,100. Meanwhile, net income fell to $3.6 million from $5.3 million, and adjusted EBITDA dropped to $7.6 million from $11.3 million. However, cash increased to $62.6 million from $52 million.

Looking ahead, analysts remain cautiously optimistic. Skeptics say the firm needs sustained revenue growth and consistent execution. For now, the company’s cash cushion and niche marketplace suggest upside if the regulatory backdrop improves. Analysts expects WM Technology to post about $174 million in revenue and roughly $0.15 in EPS for fiscal 2025.

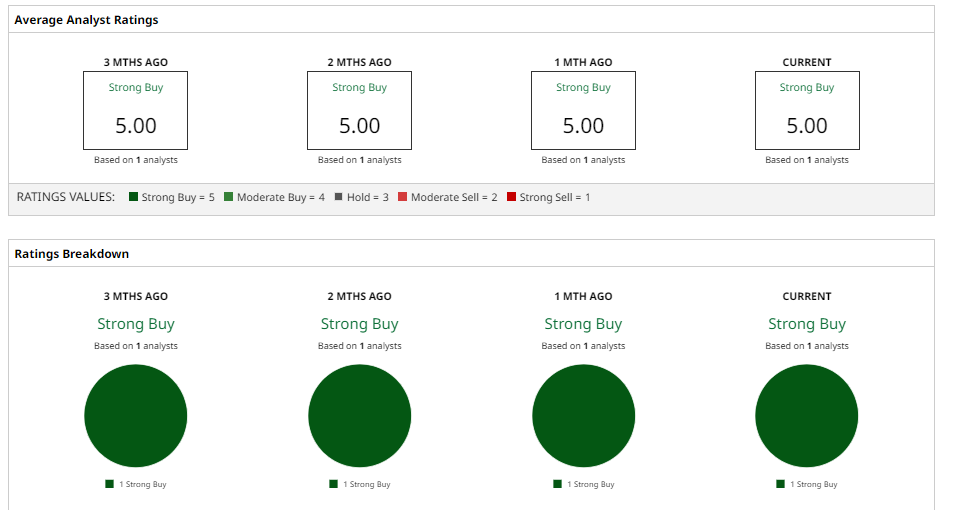

The one analyst with coverage of MAPS stock gives it a “Strong Buy” rating. MAPS has an average price target of $2.61, suggesting more than 200% upside potential from current levels.

Cannabis Stock #2: Green Thumb Industries (GTBIF)

Green Thumb Industries is a U.S. multi-state cannabis operator and packaged-goods company. It grows, processes and sells branded cannabis and CBD products through its Rise dispensary chain and wholesale channels, giving it a diversified footprint across key markets.

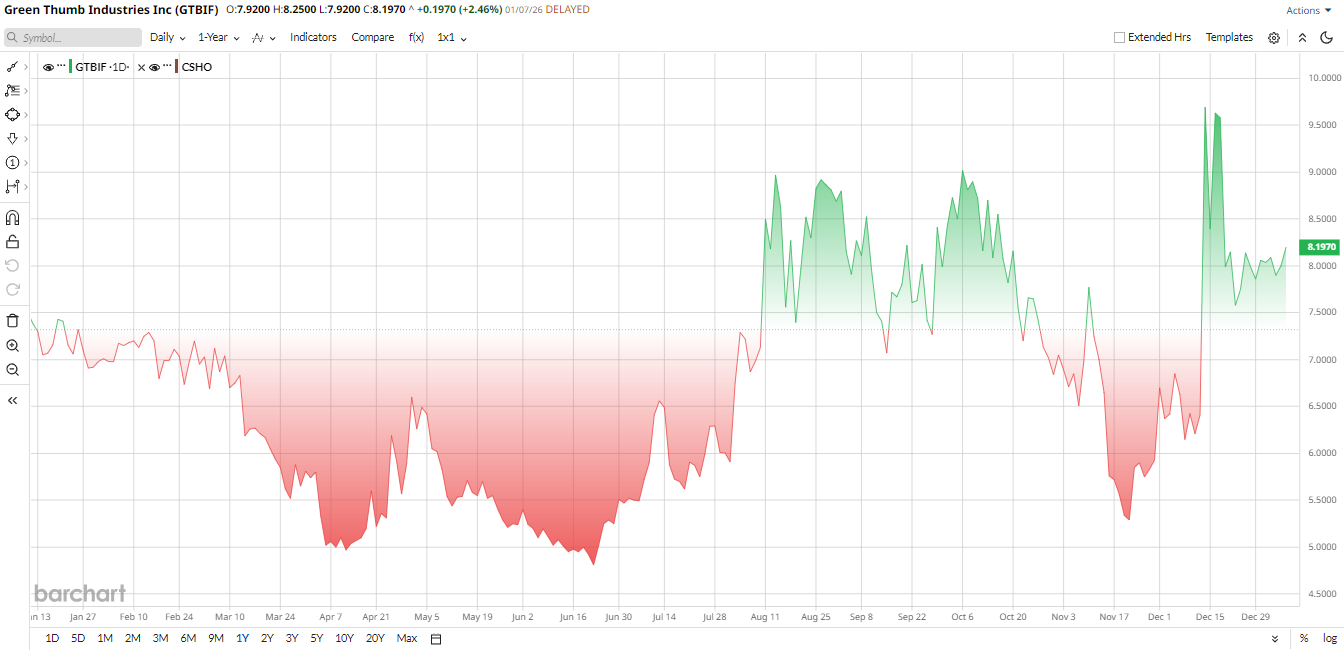

After underperforming in the first half of 2025, shares of GTBIF rebounded in late 2025. Previously trading under $6 in late 2025, GTBIF stock has climbed 44% over the past six months as investors have returned to the sector on legalization optimism. This recovery has outpaced some peers but follows a volatile two-year stretch.

From a valuation perspective, analysts see GTBIF stock as fairly priced for the industry. The name trades at an EV/EBITDA multiple typical of mid-cap cannabis operators and remains well below pandemic-era peaks, reflecting both progress and lingering sector headwinds.

Recent results point to operational resilience. In Q3 2025, revenue rose to $291.4 million, up about 1.6% year-over-year (YOY). The company’s product mix shifted, its cannabis products grew roughly 8% (helped by new adult-use markets), while retail sales fell about 1% amid price pressure. GAAP net income jumped to $23.3 million from $8.6 million, driven in part by a one-time gain on an asset sale.

Balance sheet strength remains a plus. Green Thumb ended the quarter with about $226 million in cash, supporting flexibility for investment and returns. Since late 2023, the firm has repurchased roughly $107 million of stock and has approved an additional $50 million buyback.

On the corporate front, Green Thumb closed its RYTHM deal and rolled out adult-use sales at all eight Rise stores in Minnesota. Management also cited favorable political signals — notably November’s Virginia elections — as potential tailwinds for federal and state reform.

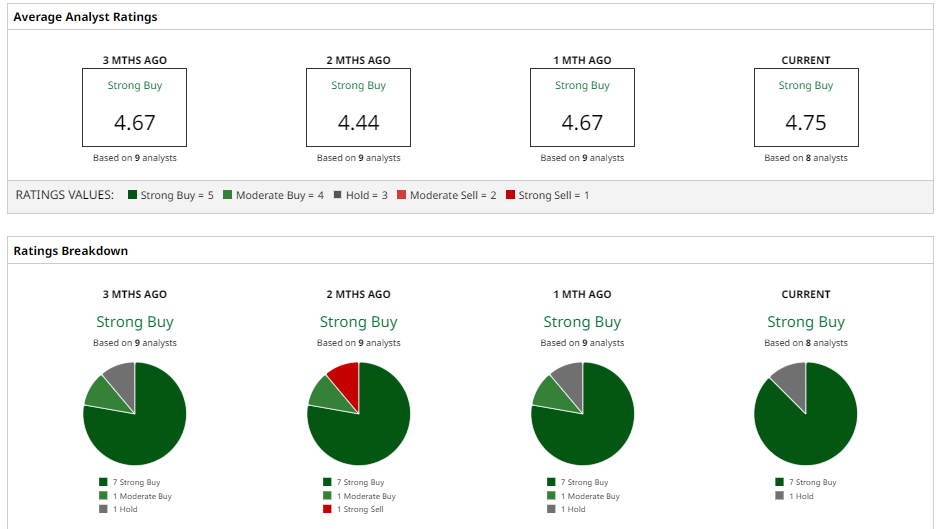

Analyst sentiment is moderately bullish. Out of eight analysts covering the stock, seven rate GTBIF as a “Strong Buy,” pointing to steady cash flow and shareholder returns as reasons for cautious optimism. The mean price target of $14.04 implies as much as 70% upside from current levels.

Cannabis Stock #3: Corbus Pharmaceuticals (CRBP)

Corbus Pharmaceuticals is a clinical-stage biotech focused on endocannabinoid-related therapies for cancer and metabolic diseases. The company’s pipeline centers on CRB-701, an antibody-drug conjugate for Nectin-4-expressing solid tumors, and CRB-913, a peripherally restricted CB1 inverse agonist for obesity. Corbus also has CRB-601, another solid tumor treatment, in its pipeline.

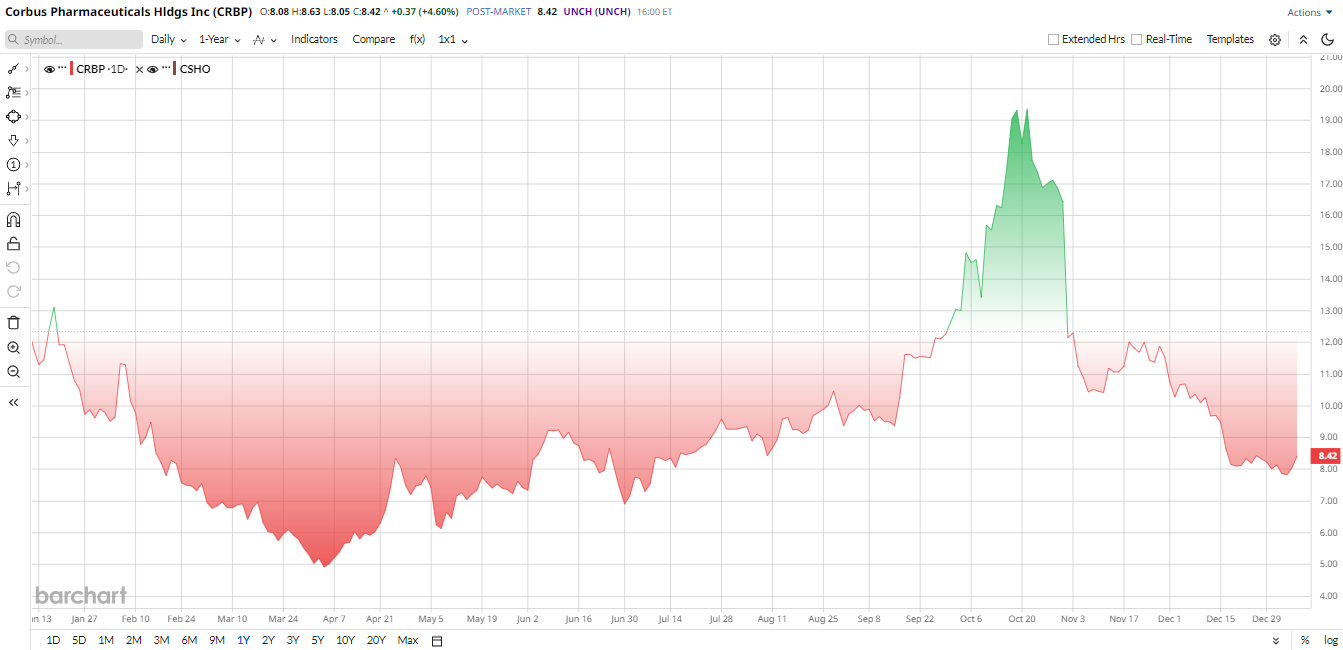

CRBP stock trades near $8 in early January 2026, down about 33% over the past year after sliding from the $13 level in mid-2025.

Corbus has no approved products and carries substantial R&D spend. In Q3 2025, the company posted a net loss of $23.3 million. Operating expenses ran about $24.4 million for the quarter, driven by roughly $20.9 million in R&D and $3.6 million in G&A. The company reported no revenue for the period. However, Corbus did strengthen its balance sheet. Cash, equivalents and investments stood near $104 million as of Sept. 30 after a $75 million public offering. Management believes runway should extend into 2028.

Recent clinical progress offers the main upside when it comes to CRBP stock. In October 2025, Corbus presented Phase 1 data for CRB-701 showing promising response rates in certain head/neck and cervical cancer cohorts. Management plans a registrational CRB-701 study by mid-2026 and reported CRB-913 safety results in December. Those milestones are de-risking steps, but not guarantees.

In short, Corbus is a high-risk, high-reward play. Clinical validation would likely re-rate the stock materially. Trial setbacks or funding shortfalls, however, could push shares sharply lower. Investors should treat CRBP as a speculative biotech bet tied closely to upcoming trial readouts.

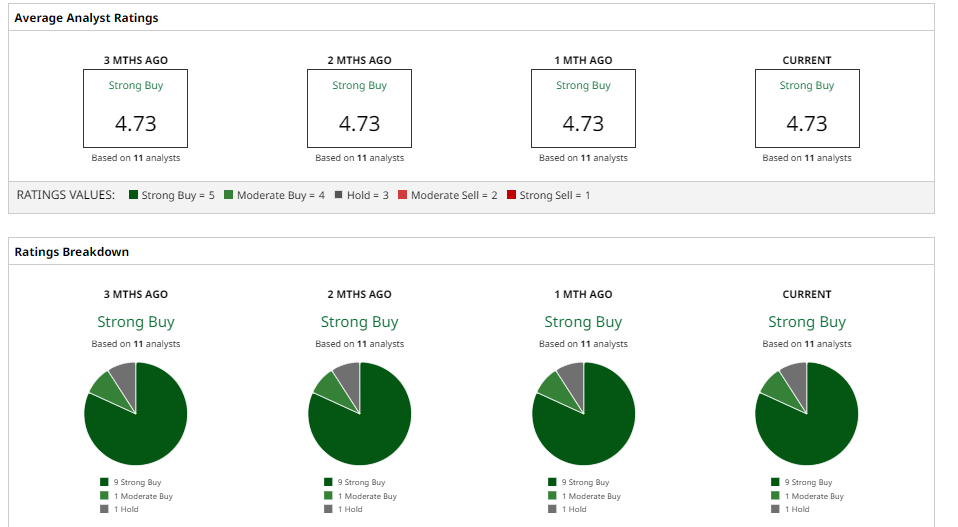

Valuation is speculative. Corbus has a price-to-book ratio of 1.1 times, reflecting tangible asset backing. The Wall Street consensus is a “Strong Buy" rating with an average price target of $42.33, implying immense upside of 400% if multiple trials succeed.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 1 Analyst Is Betting That Palantir Stock Can Gain Another 20% in 2026

- Missed the AI Rally? Jefferies Says CrowdStrike and These 3 Other Cybersecurity Stocks Could Be Next

- Nvidia Is Giving Tesla a Run for Its Money with Robotaxis. Which Is the Better Stock to Buy Now?

- The 3 Best Cannabis Stocks to Buy for 2026