After spending the last few years in the red, PepsiCo (PEP) is finally turning to cutting-edge technology to spark a comeback. At CES 2026, the beverage giant unveiled a multi-year partnership with artificial intelligence (AI) superstar Nvidia (NVDA) and industrial software giant Siemens aimed at supercharging its manufacturing plants and supply chain through advanced AI and physics-based digital twin technology. This collaboration will start with pilot facilities in the U.S. and scale globally over time.

This partnership uses Siemens’ new Digital Twin Composer, built on Nvidia’s Omniverse platform, to create detailed 3D models of every machine, conveyor belt, pallet route, and worker path within PepsiCo’s plants. With these virtual copies, PepsiCo can design, test, and improve layouts on a computer before making real-world changes. These industrial metaverse environments combine 2D and 3D digital twin data with live operational data, allowing AI to spot up to 90% of possible problems ahead of time, speed up design work, and find extra production capacity that would otherwise be missed.

In fact, the early results are already encouraging. Initial rollouts have led to a 20% increase in throughput, nearly 100% design accuracy, and 10%-15% savings in capital spending by checking investments in a virtual environment rather than through slow, costly physical changes. The partnership was officially announced during the opening keynote at CES 2026, highlighting PepsiCo’s focus on digital transformation and supply-chain innovation.

So, with this blue-chip company now tapping AI, digital twins, and the industrial metaverse, is this tech-driven shift the catalyst PEP investors have been waiting for?

About PepsiCo Stock

New York-based PepsiCo is a true global giant, with its products enjoyed more than one billion times every day in over 200 countries and territories worldwide. In 2024, the company generated nearly $92 billion in net revenue, powered by its perfectly balanced mix of beloved beverages and convenient foods, including Pepsi, Mountain Dew, Gatorade, SodaStream, Lay’s, Doritos, Cheetos, and Quaker.

What makes PepsiCo especially formidable is the depth of its brand lineup. The company owns a portfolio of iconic household names, many of which deliver more than $1 billion each in annual retail sales, giving PepsiCo one of the strongest and most dependable consumer-brand platforms on the planet. The company’s market capitalization currently stands at about $187.34 billion.

Despite PepsiCo’s massive global footprint and brand power, its stock hasn’t exactly been a crowd-pleaser in recent years. Inflation, shifting consumer preferences toward healthier options, and rising costs have weighed on its beverage business, while snacks and commodity-based foods have been hit even harder by macroeconomic pressures.

That weakness showed up clearly again in 2025. PEP shares finished the year at $143.52, or -0.44%, extending a streak of lackluster price action. While the broader market pushed higher, PepsiCo’s stock remained stuck in low gear, still searching for a catalyst to turn things around.

Even though PEP’s stock hasn’t thrilled investors lately, PepsiCo has continued to shine where it matters most for income-focused shareholders. On Jan. 6, the company paid a quarterly dividend of $1.4225 per share, reflecting a 5% year-over-year (YOY) increase. That brings PepsiCo’s forward annual dividend to roughly $5.60 per share, yielding an enticing 3.96%.

What truly sets PepsiCo apart is its remarkable consistency. The company has paid dividends every quarter since 1965, and 2025 marked its 53rd straight year of dividend increases, securing its place among the elite Dividend Kings.

PepsiCo’s Q3 Earnings Snapshot

In early October, PepsiCo delivered a better-than-expected fiscal 2025 third-quarter earnings report, giving investors a rare bright spot after a tough stretch for the stock. Net revenue climbed 2.6% YOY to $23.94 billion, beating Wall Street’s estimate of $23.88 billion. Even after adjusting for acquisitions, divestitures, and currency swings, the company still produced 1.3% organic revenue growth, showing that the core business continues to move forward.

Still, PepsiCo is feeling the impact of changing consumer habits. As shoppers increasingly rethink what they eat and drink, global volumes for both food and beverages slipped 1% during the quarter. That pressure showed up in the bottom line as well, with net income falling to $2.6 billion, or $1.90 per share, from $2.93 billion, or $2.13 per share, a year earlier.

Yet once one-time items are removed, PepsiCo’s earnings picture looks far healthier. Adjusted earnings came in at $2.29 per share, topping Wall Street’s $2.27 forecast. This modest beat highlighted the company’s ability to protect profitability through pricing, cost controls, and operational discipline, even in a tougher consumer environment. CEO Ramon Laguarta said the quarter reflected the strength of PepsiCo’s global footprint and strategic changes.

The CEO noted that revenue growth was driven by a resilient international business, improving momentum in North America beverages, and the benefits of PepsiCo’s portfolio reshaping efforts. Looking ahead, management is focused on speeding up growth while cutting costs, using new product innovation, smarter pricing and packaging, and a leaner cost structure to fund future investments.

For 2025, PepsiCo maintained a steady, shareholder-friendly outlook. The company expects low-single-digit organic revenue growth, core constant-currency EPS roughly in line with last year. Most importantly for investors, PepsiCo plans to return around $8.6 billion in cash to shareholders, including $7.6 billion in dividends and $1 billion in share buybacks, reinforcing its role as a reliable income and capital-return machine.

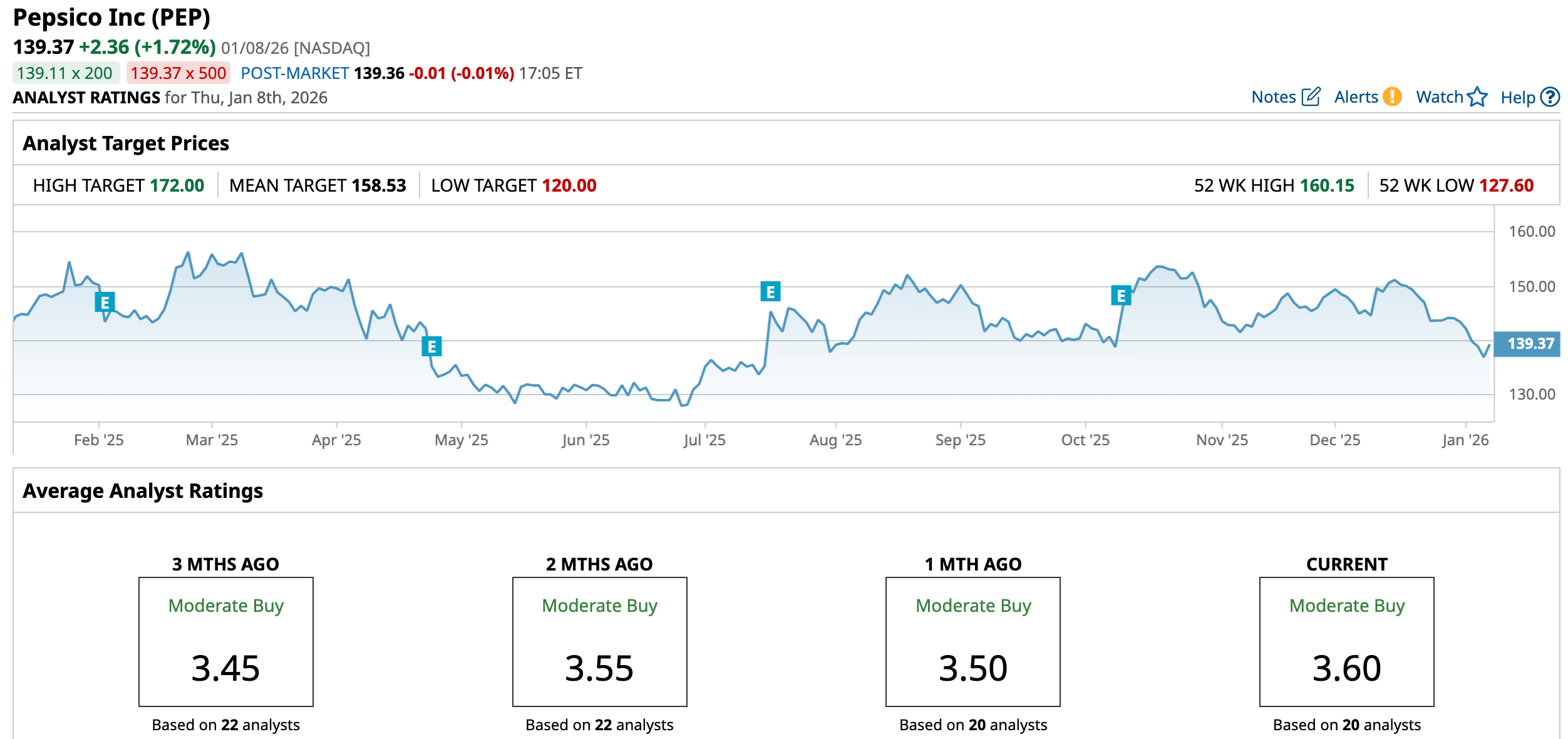

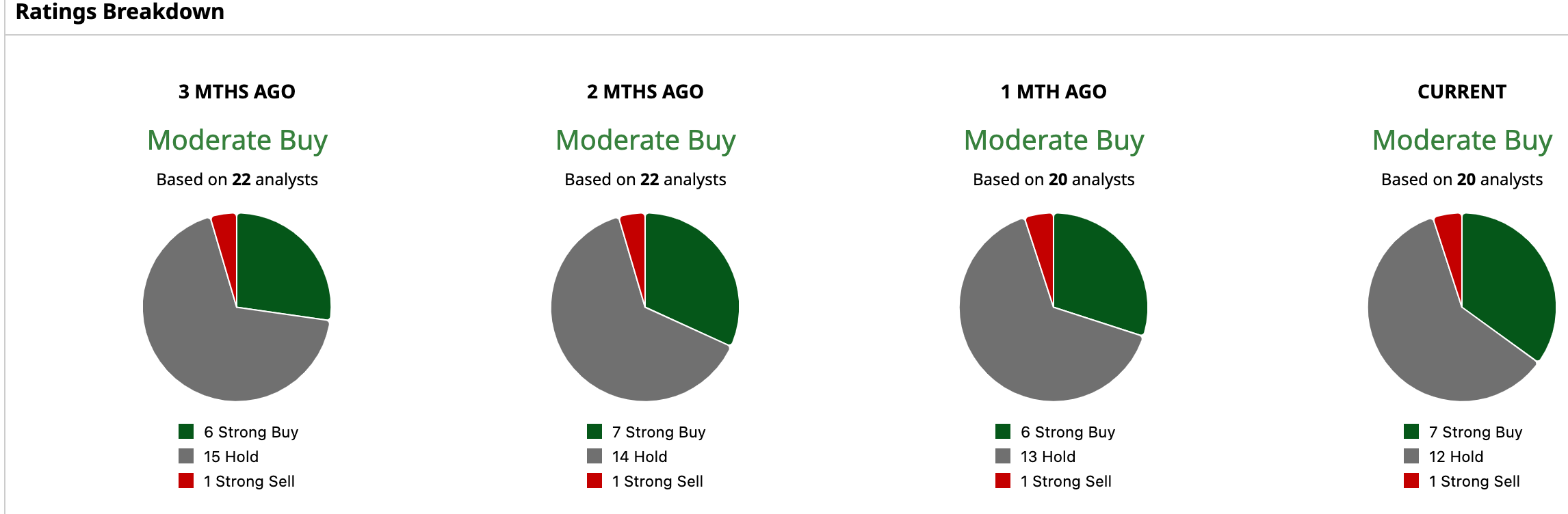

How Are Analysts Viewing PepsiCo Stock?

Wall Street, for the most part, is still on PepsiCo’s side. PEP currently carries a “Moderate Buy” consensus rating, indicating that analysts remain cautiously optimistic about the outlook. Of the 20 analysts covering the stock, seven rate it a “Strong Buy,” 12 are on a “Hold,” and just one has gone all the way to a “Strong Sell.” The upside case is also hard to ignore.

The average analyst price target of $158.53 suggests PEP could climb about 13.75% from current levels, while the most bullish target on the Street, $172, implies a 23.4% rally. In other words, while PepsiCo may not be a flashy growth stock, Wall Street clearly sees room for this blue-chip name to grind higher as its tech-driven turnaround begins to take shape.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 1 Analyst Is Betting That Palantir Stock Can Gain Another 20% in 2026

- Missed the AI Rally? Jefferies Says CrowdStrike and These 3 Other Cybersecurity Stocks Could Be Next

- Nvidia Is Giving Tesla a Run for Its Money with Robotaxis. Which Is the Better Stock to Buy Now?

- The 3 Best Cannabis Stocks to Buy for 2026