At the end of the day, options trading on the retail side typically comes down to narrowing uncertainty as much as possible. It’s similar to an SAT question. While you may not know the answer directly, you can try to eliminate one or two of the false answers. With this simple approach, you can dramatically improve your chance of success.

One of the most important mechanisms that traders have at their disposal is volatility skew. This screener — which is one of the many you can enjoy access to with a Barchart Premier membership — allows traders to understand smart money positioning based on the premium structure of implied volatility (IV). A measurement of a stock’s potential kinetic output, IV is important because it’s a residual value from actual order flows.

With volatility skew, the idea is that we can see the curvature of this premium across the entire strike price spectrum. How the curve ebbs and flows — and the relative distance between calls and puts — provides clues regarding hedging urgency among smart money traders.

Combined with the Black-Scholes-derived Expected Move calculator, the IV fluctuations for a given options chain provide a likely framework of where the target security is likely to land. Mathematically, Black-Scholes asserts that most of the time (68% to be exact), we would expect a stock to land within one standard deviation from the spot price (while accounting for volatility and days to expiration).

Essentially, the skew and Black-Scholes help identify where a distress signal has pinged and establishes a search radius. From there, other tools — and perhaps good old-fashioned intuition — can help narrow the probability space further.

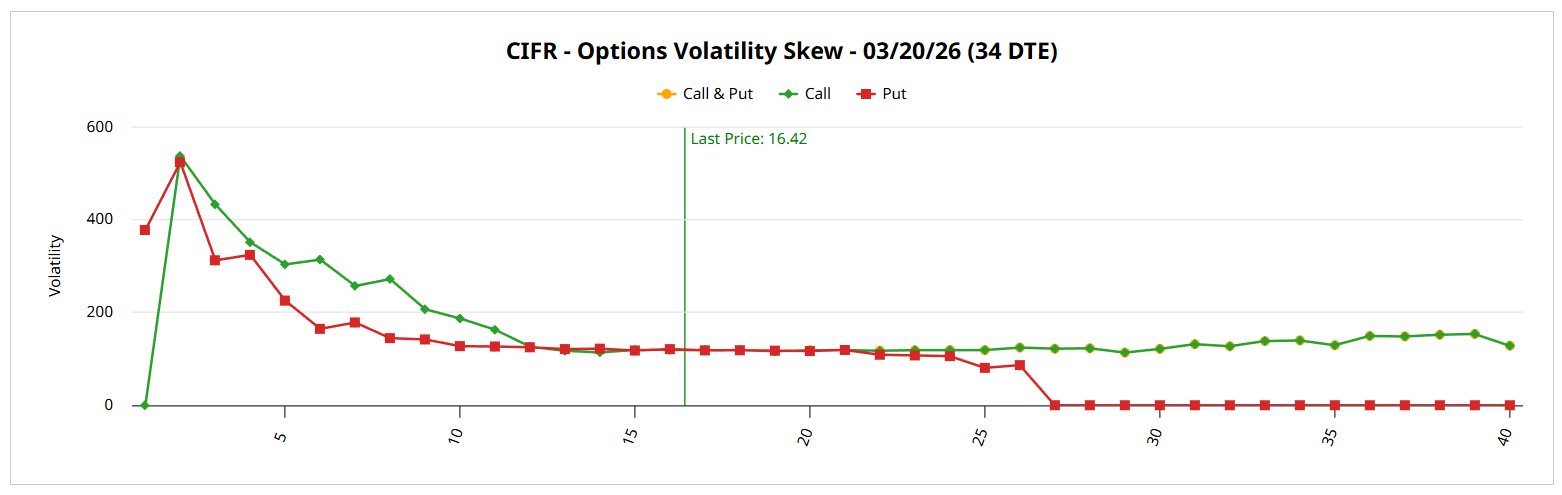

Cipher Mining (CIFR)

As a cryptocurrency miner, Cipher Mining (CIFR) offers a lot of promise but also carries plenty of risk. With questions surrounding the blockchain ecosystem — particularly an icy winter impacting digital assets — CIFR stock has had some trouble with sustained momentum. However, a recent resurgence in the space could be beneficial for the mining specialist.

According to the volatility skew for the March 20 expiration date, downside hedging activity is relatively relaxed. True, put IV rises in the lower strike price boundaries but the same can be said for call IV — and for the most part, the premiums for calls stand above puts in the lower extremities. On the upper boundaries, the curvature for both sets of IV is relatively flat, suggesting a lack of urgency.

True, the flat IV for calls and puts near the current spot price reflect that neither the bulls nor the bears have a perceived edge. Still, we could be looking at information by omission. With tech-related names suffering volatility recently, put demand should be sky-high. It’s not and that’s worth keeping in mind.

Looking at the Expected Move calculator, the Black-Scholes model is projecting a dispersion between $12.41 and $20.43 for the March 20 expiration date. Interestingly, Barchart’s Seasonal Returns notes that CIFR stock in its short history tends to enjoy a strong performance in March.

If you think lightning will strike twice, you may consider the 17/18 bull call spread expiring March 20.

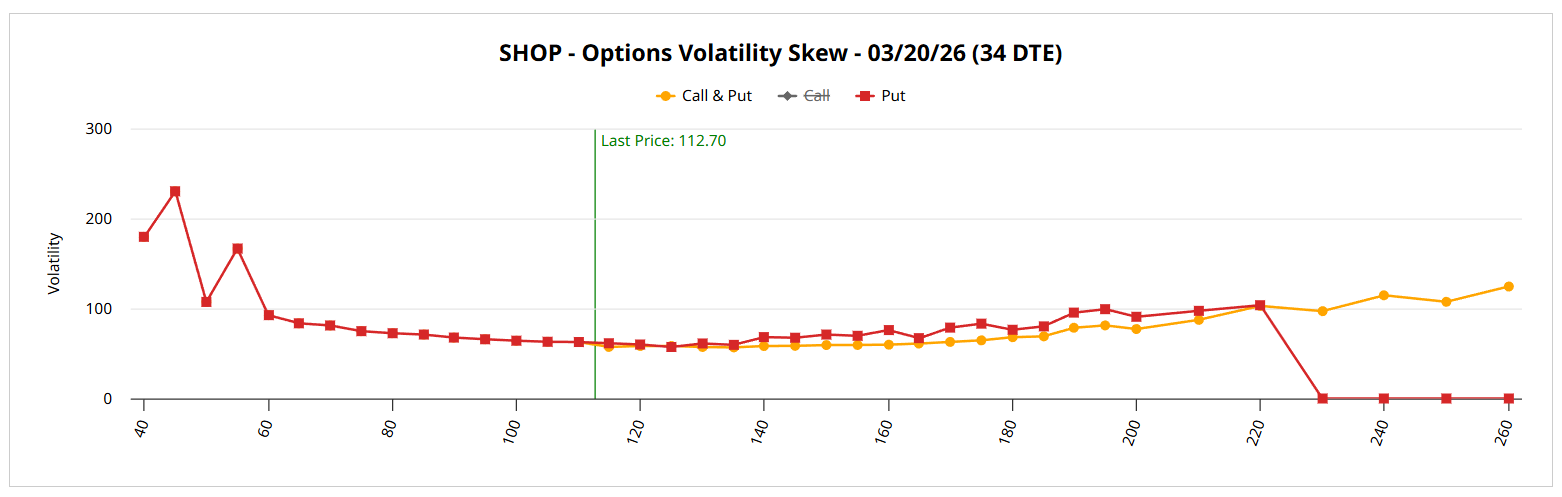

Shopify (SHOP)

A multinational e-commerce company, Shopify (SHOP) is truly off to a horrific start to the new year, with SHOP stock down 30%. Given the severe challenges facing the domestic and global economies — along with the disruption caused by artificial intelligence — the fallout in the broader retail space isn’t shocking.

As Barchart contributor Will Ashworth noted recently, without the performance of the healthcare industry, the latest employment figures don’t look quite so rosy. Still, the tough print doesn’t seem to have disproportionately perturbed the smart money.

I say that because the volatility skew for SHOP stock for the March 20 expiration date is relatively relaxed. Again, it’s not that there isn’t any downside hedging because insurance against that event has been priced in. However, the protection is occurring at the left wing via out-the-money (OTM) puts. On the right wing, the IV curvature for both puts and calls is relatively flat, with calls extending further than puts.

Overall, I believe we’re looking at another example of information by omission. With SHOP stock underperforming so badly, the top priority should be downside protection. However, the lack of urgency is telling.

Black-Scholes via the Expected Move calculator is calling for a dispersion between $98.68 and $126.73. Now, the challenge here is that in March, there seems to be a lot of misses for SHOP stock. However, when it hits, it hits big.

Aggressive speculators may consider the 120/125 bull call spread expiring March 20.

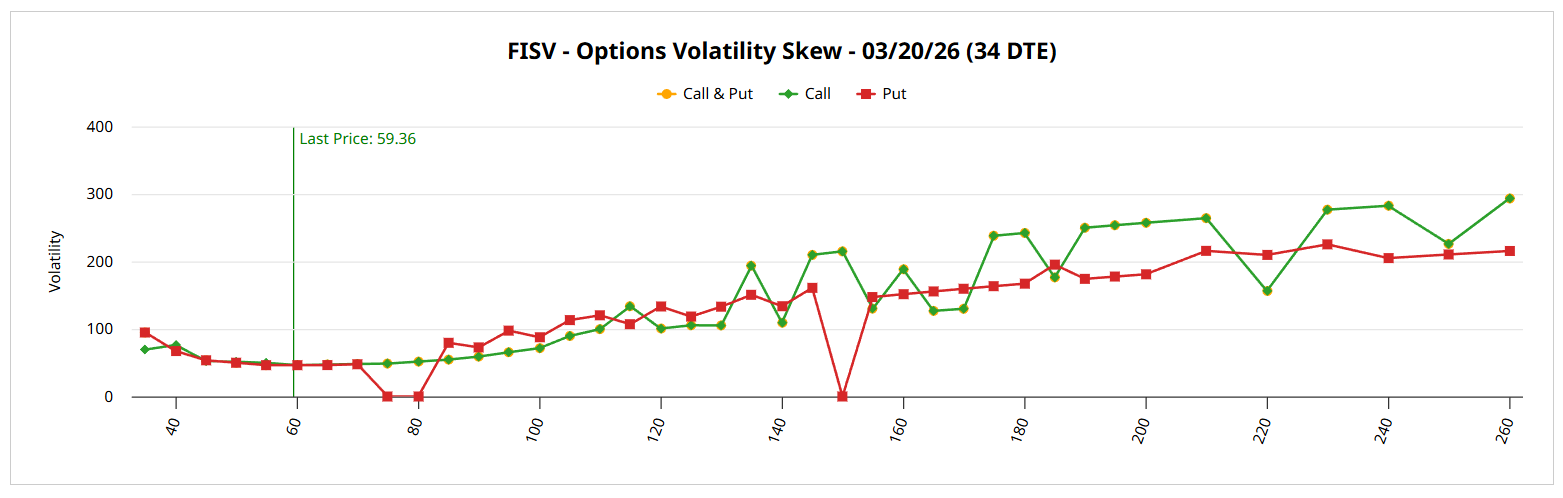

Fiserv (FISV)

A financial technology (fintech) company, Fiserv (FISV) processes debit and credit card transactions, along with a host of other transactional functions. However, given the rough state of the broader economy, the impact on consumption patterns has negatively affected FISV stock. Since the start of the year, the security has lost roughly 12%. Over the past 52 weeks, FISV dropped more than 74%.

Despite the ugliness in the technical chart, the smart money doesn’t appear to be prioritizing downside insurance anymore, which may possibly be a small indication that the price action may stabilize. For the March 20 expiration date, we find that both put and call IV generally curve downward in the lower strike price boundaries, suggesting that protecting against tail risk isn’t a primary concern.

On the upper boundaries, the skew curves upward, with call IV modestly dominating its put equivalent. This setup may suggest that, on a relative basis, sophisticated market participants are positioned for upside convexity. As with the other securities, FISV stock may offer information by omission. That there is a lack of downside insurance after such a terrible performance may represent an important signal.

Referencing the Expected Move calculator, the Black-Scholes model anticipates that FISV stock will land between $53.61 and $65.11 in 34 calendar days. Historically, March tends to be one of the consistently stronger months for the fintech specialist.

While it’s awfully aggressive, one might consider the 60/65 bull call spread expiring March 20.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The Saturday Spread: Maximizing First-Order Analytics to Help Even the Odds

- Intuit Options Activity Signals Potential Bullish Reversal

- Cisco Systems Reports Lower Free Cash Flow - But, Is CSCO Stock a Buy Here?

- How Investors Can Build a Better Stock Portfolio With This Cash-Generating Options Strategy