The world's largest sovereign wealth fund has placed its chips on quantum computing, and analysts think it could change everything for the industry. Norges Bank, which manages roughly $2 trillion for Norway, disclosed positions worth $200 million in IonQ (IONQ), $39 million in Rigetti Computing (RGTI), and $4 million in D-Wave Quantum (QBTS) in its recent 13-F filing for the fourth quarter, according to Wedbush Securities.

These positions might seem small compared to Norges Bank's total assets. However, Wedbush analyst Antoine Legault views the fund as a "sophisticated" asset manager making a significant bet on the long-term potential of quantum computing.

"In addition to meaningfully increasing its initial position in IONQ, we would note Norges also made new investments in RGTI and D-Wave in CQ4, suggesting it sees more than one quantum winner," Legault wrote in a note to clients.

The move is significant because quantum stocks have largely been the domain of retail investors and passive ETF providers. Big active asset managers have mostly stayed on the sidelines. Norway's decision could signal the start of broader institutional interest.

Legault believes Norges Bank's multi-company approach makes sense. The fund appears to be betting that different quantum technologies will succeed for different applications, rather than trying to pick a single winner. Wedbush agrees with this view. Let's dig into this a little further.

IonQ's Aggressive Expansion

IonQ has been on an acquisition tear in 2026, building what it calls the world's only full-stack quantum platform.

Last month, IonQ announced the acquisition of Skyloom Global, a U.S.-based developer of optical communications technology for secure, high-performance connectivity. The deal, originally, strengthens IonQ's quantum networking capabilities.

"Completing the Skyloom acquisition is another important step as we build the foundation for scalable quantum networking," said Niccolo de Masi, IonQ's Chairman and CEO.

IonQ also announced plans to acquire Seed Innovations, a Colorado software firm specializing in machine learning and cloud architecture. Seed's team will help develop AI-driven software layers for managing complex quantum workloads.

The SkyWater Game Changer

But the headline deal came on Jan. 26. IonQ announced it would acquire SkyWater Technology (SKYT), the largest exclusively U.S.-based semiconductor foundry, for $1.8 billion in cash and stock.

The acquisition gives IonQ embedded access to a trusted U.S. foundry with end-to-end manufacturing capabilities, from design and prototyping through packaging and deployment.

The combination is expected to significantly accelerate IonQ's roadmap. The company now expects to begin functional testing of its 200,000-qubit quantum processing units (QPUs) in 2028, enabling more than 8,000 ultra-high-fidelity logical qubits. The 2-million-qubit chip could arrive up to a year earlier than originally planned.

For national security applications, the SkyWater deal is crucial. IonQ will have a fully domestic supply chain, making it the preferred quantum partner for the U.S. government and allies.

Building the Quantum Stack

IonQ's strategy is to own the entire quantum ecosystem. It now combines quantum computing, quantum networking, quantum sensing, and quantum security under one roof.

Previous acquisitions include:

- Capella Space for satellite capabilities.

- Lightsynq for quantum memory technology.

- Oxford Ionics for advanced ion trap control.

- ID Quantique for quantum encryption.

Each piece fits into a larger puzzle.

Market Potential

IonQ uses trapped-ion technology, which the company believes allows for longer, more sophisticated calculations with fewer errors than competing approaches.

Quantum computing is expected to transform industries from drug discovery to financial modeling to cybersecurity. Experts predict the total addressable market (TAM) could hit $65 billion by 2030.

IonQ's systems are currently available on all major cloud platforms, including Amazon (AMZN) Web Services, Microsoft (MSFT) Azure, and Google (GOOG) (GOOGL) Cloud. This accessibility gives the company an edge in reaching developers across different sectors.

The quantum computing company has inked partnerships with major players like AstraZeneca (AZN) for quantum-accelerated computational chemistry and contracts with government agencies, including the Air Force Research Lab.

The Bottom Line on IONQ Stock

IonQ expects to deliver full-year 2025 revenue at the high end or above its previously announced range of $106 million to $110 million when it reports earnings next month.

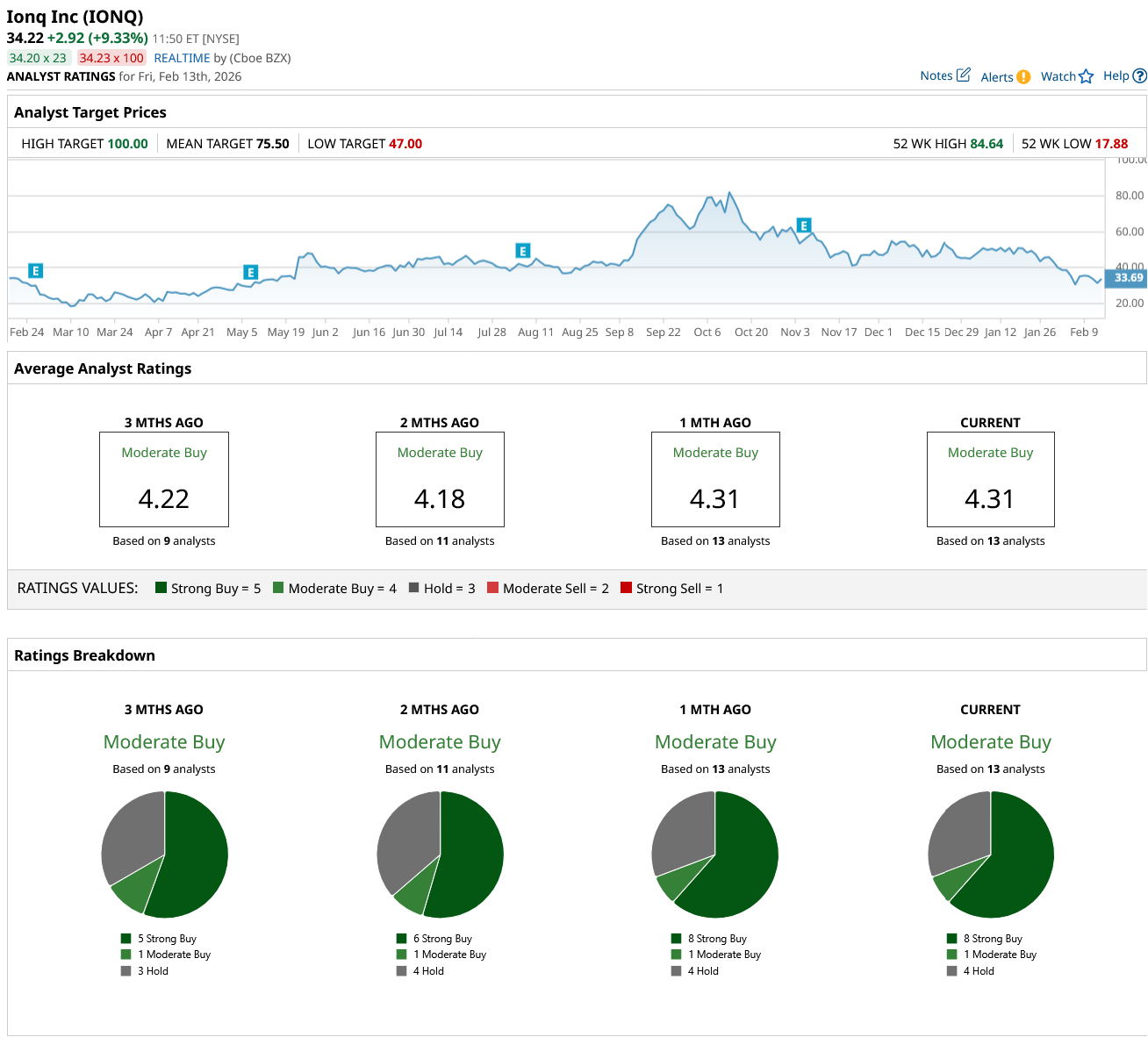

Out of the 13 analysts covering IONQ stock, eight recommend “Strong Buy,” one recommends “Moderate Buy,” and four recommend “Hold.” The average IONQ stock price target is $75.50, above the current price of $34.22.

Norway's investment validates what many in the industry have long believed: quantum computing is transitioning from science experiment to commercial reality. The fact that the world's most sophisticated sovereign wealth fund is putting real money into multiple quantum companies suggests the technology's potential is becoming harder to ignore.

For investors, the key question is whether IonQ's aggressive acquisition strategy will pay off or if the company is moving too fast. With Norway's vote of confidence and a clear path to more powerful quantum systems by 2028, IonQ is betting big that the quantum revolution is closer than most people think.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Dear Cipher Mining Stock Fans, Mark Your Calendars for February 24

- Why Wedbush Thinks Norway Could Be Key for This Quantum Computing Stock -- and the Entire Industry

- The Saturday Spread: Maximizing First-Order Analytics to Help Even the Odds

- Is This Metal the Next Big Thing After a Record Silver Rally? 1 ETF to Buy Now.