California-based Broadcom Inc. (AVGO) is a global technology leader that designs, develops, and supplies various semiconductor devices, with a focus on complex digital and mixed-signal complementary metal-oxide-semiconductor-based devices and analog III-V-based products. Boasting a market cap of $1.5 trillion, the company offers storage adapters, controllers, networking processors, motion-control encoders, and optical sensors, as well as infrastructure and security software to modernize, optimize, and secure the most complex hybrid environments.

AVGO has gained 37.9% over the past year, outshining the broader S&P 500 Index’s ($SPX) 11.8% rise. In 2026, AVGO stock is up 5.2%, surpassing the SPX’s marginal drop on a YTD basis.

Zooming in further, AVGO has trailed the Street State SPDR S&P Semiconductor ETF (XSD), which has gained 50% over the past year and 12.7% on a YTD basis.

Broadcom shares surged 7.6% on Feb. 6, after investors absorbed the sizable AI-driven growth opportunity tied to Alphabet Inc.’s (GOOGL) newly announced $175 billion–$185 billion 2026 AI infrastructure spending plan. Broadcom has already secured about $21 billion in orders from Google for custom TPU accelerators and expects its own AI revenue to reach $8.2 billion in Q1 2026, doubling year over year.

For the current fiscal year, ending in October, analysts expect AVGO’s EPS to grow 54.5% to $8.70 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in two of the last four quarters while missing the forecast on two other occasions.

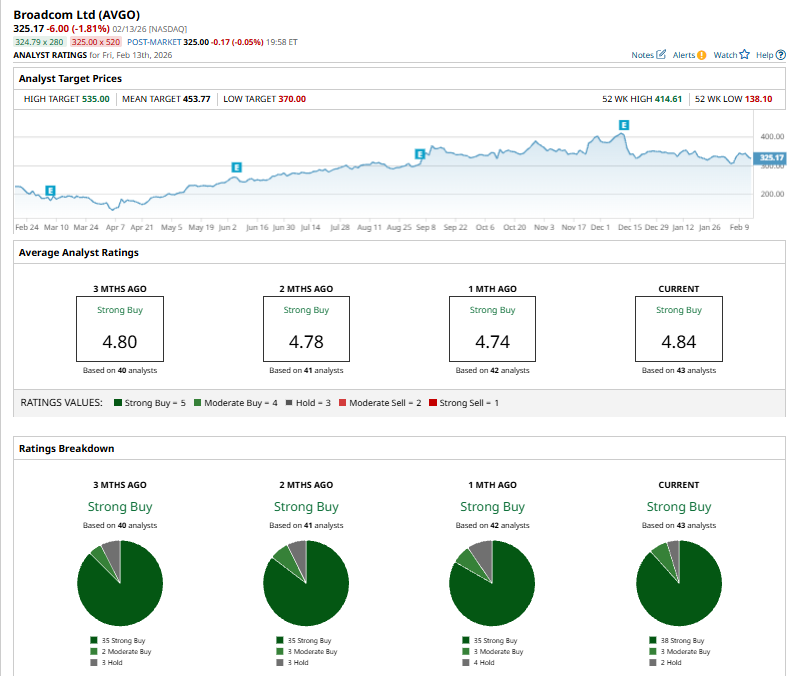

Among the 43 analysts covering AVGO stock, the consensus is a “Strong Buy.” That’s based on 38 “Strong Buy” ratings, three “Moderate Buys,” and two “Holds.”

This configuration is more bullish than two months ago, with 35 analysts suggesting a “Strong Buy.”

On Feb. 13, DA Davidson initiated coverage on Broadcom with a “Neutral” rating and a $335 price target, roughly in line with the current share price, noting the stock’s strong ~46% one-year return despite trading near estimated fair value. While acknowledging Broadcom’s robust fundamentals, the firm flagged risks to the durability of its AI ASIC leadership, warning that major hyperscale customers could increasingly internalize chip design and supply chains over time, potentially pressuring long-term supplier economics.

The mean price target of $453.77 represents a 39.5% premium to AVGO’s current price levels. The Street-high price target of $535 suggests an ambitious upside potential of 64.5%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- What are Global Markets Watching Monday?

- Markets Don’t Bottom On Fear. They Bottom When Forced Sellers Are Done

- AI Disruption Fear, FOMS and Other Key Things to Watch this Week

- Warren Buffett Says Only Buy Stocks You’re Comfortable Holding For Ten Years, Otherwise Don’t Bother Even ‘Owning it for Ten Minutes’