Consolidated Edison, Inc. (ED), headquartered in New York, engages in the regulated electric, gas, and steam delivery businesses. With a market cap of $41 billion, the company is committed to providing safe and reliable energy services to millions of customers across its service territories.

Shares of this leading utility have outperformed the broader market over the past year. ED has gained 18.9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 11.8%. In 2026, ED’s stock rose 14.5%, surpassing the SPX’s marginal drop on a YTD basis.

Narrowing the focus, ED has outpaced the State Street Utilities Select Sector SPDR Fund (XLU). The exchange-traded fund has gained about 17.1% over the past year and 8.9% on a YTD basis.

On Jan. 27, Consolidated Edison shares edged marginally higher after the company declared a quarterly dividend of $0.8875 per share, payable Mar. 16, 2026. The increase lifts the annualized dividend to $3.55 per share, marking Con Edison’s 52nd consecutive year of dividend growth and maintaining its target payout ratio of 55%–65% of adjusted earnings.

For the current fiscal year, ending in December, analysts expect ED’s EPS to grow 4.8% to $5.66 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

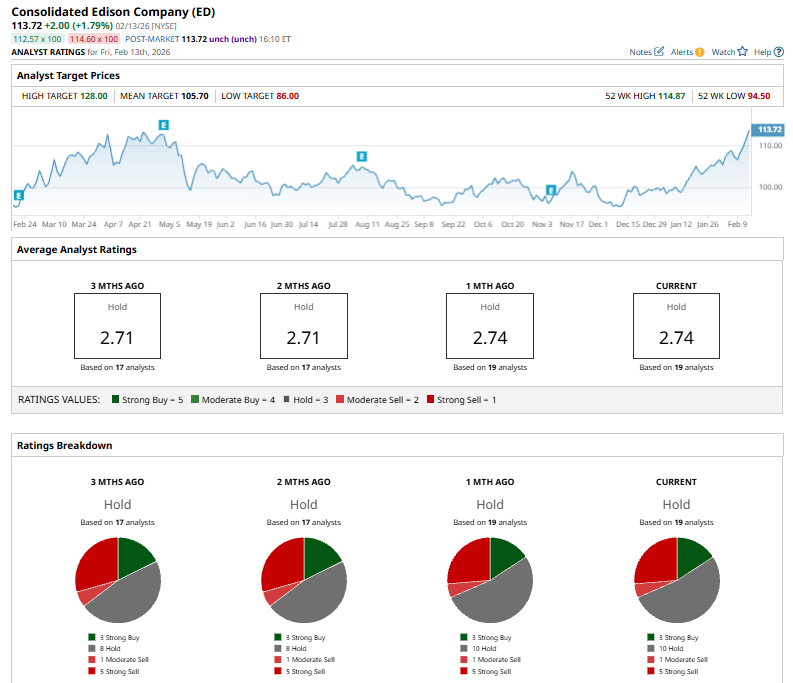

Among the 19 analysts covering ED stock, the consensus is a “Hold.” That’s based on three “Strong Buy” ratings, ten “Holds,” one “Moderate Sell,” and five “Strong Sells.”

On Jan. 23, UBS analyst William Appicelli raised his price target on Consolidated Edison to $112 from $108 while maintaining a “Neutral” rating on the stock.

While the stock currently trades above the mean price target of $105.70, the Street-high price target of $128 suggests an upside potential of 12.6%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- What are Global Markets Watching Monday?

- Markets Don’t Bottom On Fear. They Bottom When Forced Sellers Are Done

- AI Disruption Fear, FOMS and Other Key Things to Watch this Week

- Warren Buffett Says Only Buy Stocks You’re Comfortable Holding For Ten Years, Otherwise Don’t Bother Even ‘Owning it for Ten Minutes’