With a market cap of $93.8 billion, Marriott International, Inc. (MAR) is a global hospitality company engaged in the operation, franchising, and licensing of hotels, residential, timeshare, and lodging properties across the Americas, Europe, the Middle East & Africa, Greater China, and Asia Pacific. It operates a diverse portfolio of luxury, premium, and select-service brands, along with residences, timeshares, and yachts.

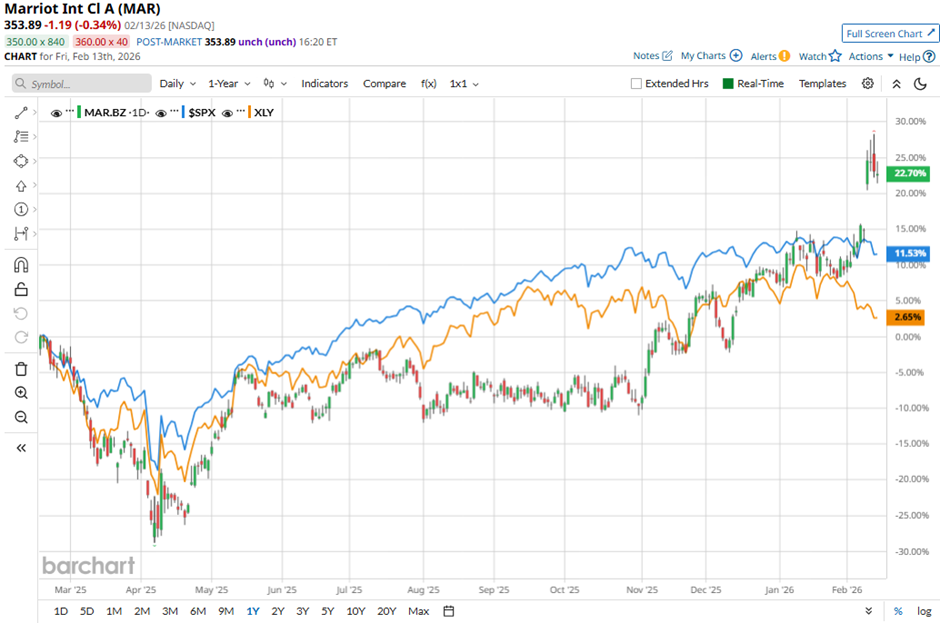

Shares of the Bethesda, Maryland-based company have outperformed the broader market over the past 52 weeks. MAR stock has returned 22.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 11.8%. Moreover, shares of the company are up 14.1% on a YTD basis, compared to SPX’s marginal decline.

Focusing more closely, shares of the hotel company have outpaced the State Street Consumer Discretionary Select Sector SPDR ETF’s (XLY) 2.3% gain over the past 52 weeks.

Despite reporting weaker-than-expected Q4 2025 adjusted EPS of $2.58, shares of MAR climbed 8.5% on Feb. 10 as the company posted revenue of $6.69 billion, exceeding Street forecasts. The rally was reinforced by strong operating momentum, including adjusted EBITDA of $1.40 billion, up 9% year-over-year, and an upbeat 2026 outlook calling for adjusted EPS of $11.32 - $11.57 and adjusted EBITDA growth of 8% - 10%. Investor confidence was further supported by expectations for worldwide RevPAR growth of 1.5% - 2.5% in 2026 and net rooms growth of 4.5% - 5%, underpinned by a record development pipeline of nearly 610,000 rooms.

For the fiscal year ending in December 2026, analysts expect Marriott International’s adjusted EPS to grow 15.9% year-over-year to $11.61. The company's earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

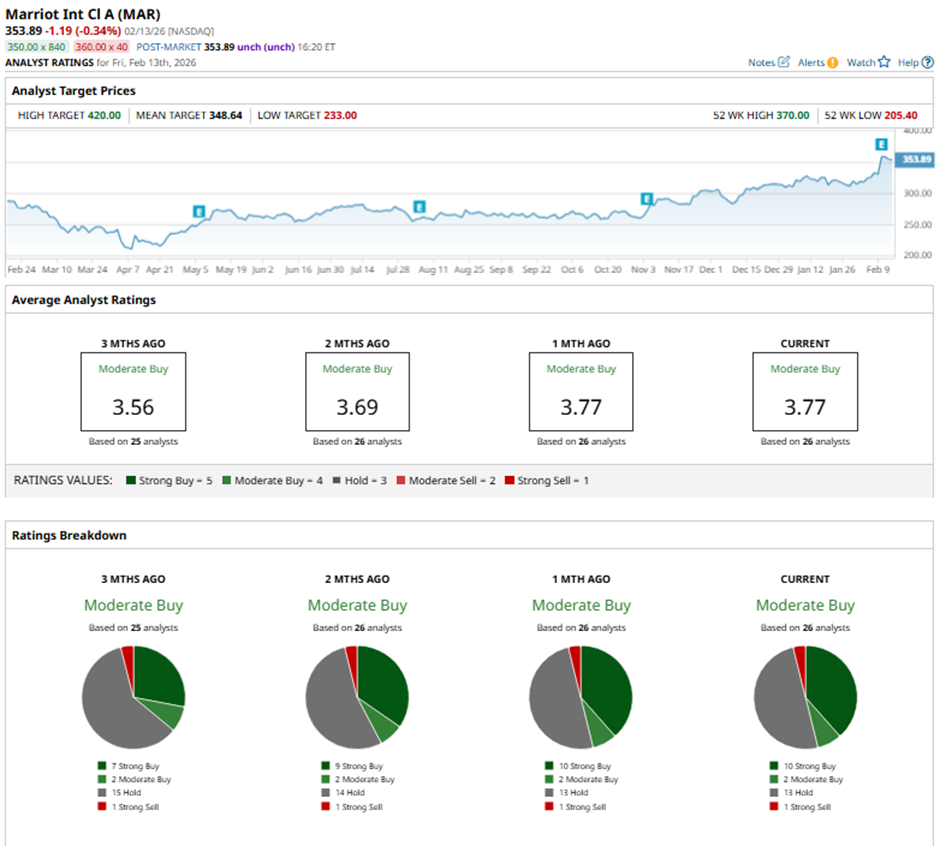

Among the 26 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 10 “Strong Buy” ratings, two “Moderate Buys,” 13 “Holds,” and one “Strong Sell.”

On Feb. 11, BMO Capital raised its price target on Marriott International to $400 and maintained an “Outperform” rating.

As of writing, the stock is trading above the mean price target of $348.64. The Street-high price target of $420 implies a potential upside of 18.7% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart