New Jersey-based Verisk Analytics, Inc. (VRSK) sits at the heart of the global insurance ecosystem, serving as a trusted data analytics and technology partner to insurers around the world. The company equips its clients with powerful insights that sharpen underwriting, streamline claims processing, detect fraud and enhance overall operating efficiency.

By blending advanced analytics, purpose-built software, scientific research and deep industry expertise, Verisk helps insurers navigate complex global risks, from climate change and catastrophic events to sustainability and geopolitical challenges. In doing so, it plays a critical role in helping businesses, communities and individuals better understand risk and build long-term resilience.

Currently carrying a market capitalization of roughly $25.3 billion, Verisk hasn’t exactly been keeping pace with the broader market. Over the past year, the stock has tanked 38.7%, but that performance still trails the benchmark S&P 500 Index ($SPX), which climbed 11.8% during the same stretch. The weakness has continued into 2026.

Verisk shares are down nearly 19% year to date, underperforming the SPX, which has posted only a marginal decline so far this year. Zooming in further, the underperformance becomes even more apparent when compared to its sector peers. The Industrial Select Sector SPDR Fund (XLI) advanced 26.3% in 2025 and added another 12.3% in 2026, leaving VRSK trailing both the broader market and its industrial counterparts.

Verisk Analytics’ recent underperformance stems from a mix of moderating organic growth, softer-than-expected Q3 2025 revenue, and margin pressure tied to acquisitions. Adding to the headwinds, demand for property claims solutions cooled amid lower severe weather activity, while elevated debt levels and concerns that prior growth expectations were too ambitious have weighed on investor sentiment.

Looking forward to the fiscal year, which ended in December 2025, analysts expect VRSK’s EPS to rise 4.4% year-over-year to $6.93. The company has a strong history of earnings surprises. It beat the consensus estimates in each of the last four quarters.

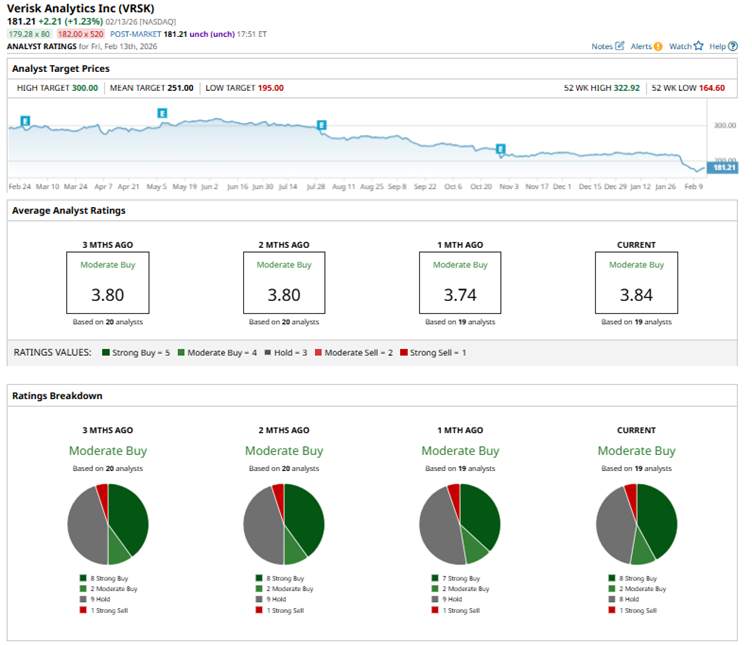

Wall Street is still leaning bullish on Verisk Analytics, but the enthusiasm isn’t unanimous. The stock holds a consensus “Moderate Buy” rating from 19 analysts, with eight “Strong Buys” and two additional “Moderate Buy” anchoring the optimistic camp. Meanwhile, eight analysts sit on the sidelines with “Hold” ratings, and one has turned outright cautious with a “Strong Sell.” This configuration has remained largely the same over the past three months.

Earlier this month, BMO Capital Markets upgraded Verisk Analytics to “Outperform,” arguing that the market may have been overly harsh in pricing in worries about insurance rate cycles and the potential impact of generative AI. The firm believes those concerns have created a compelling entry opportunity, with the stock now trading at more attractive levels.

The mean price target of $251 represents a premium of 38.5% to VRSK's current levels, while the Street-high price target of $300 implies a potential upside of 65.6% from the current price levels.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart