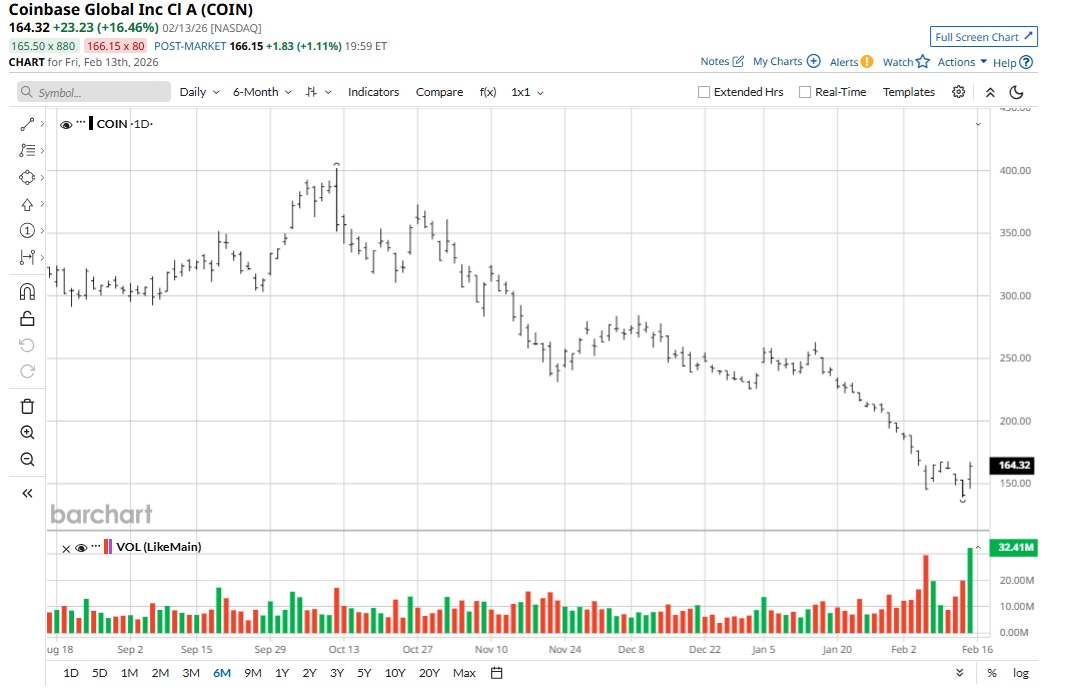

The sharp correction in Bitcoin (BTCUSD) has impacted trading volumes in the cryptocurrency space. This negative is reflected in Coinbase (COIN) stock declining by 45% in the last 52 weeks.

However, it seems that the correction is overdone, and COIN stock is poised for a comeback. One of the key catalysts for positive price-action is CLARITY crypto market structure legislation. Coinbase CEO Brian Armstrong is optimistic that the act is likely to be passed in the “next few months.”

Further, U.S. Treasury Secretary Scott Bessent commented that it’s “important for Congress to pass a bill” and get it “onto President Donald Trump's desk to sign into law this spring.” With an impending catalyst, it might be a good time to consider exposure to COIN stock.

About Coinbase Stock

Headquartered in New York, Coinbase provides a platform for crypto assets in both the U.S. and international markets. Using the platform, individuals and institutions can engage in trading, staking, safekeeping, spending, and global transfer of assets.

For FY25, Coinbase reported total trading volume of $5.2 trillion and implied a trading volume market share of 6.4%. For the same period, the company reported revenue of $7.2 billion while paid subscribers for “Coinbase One” swelled to 971,000.

While FY25 results were strong, Bitcoin has corrected by 23% for year-to-date (YTD). With fears of lower trading volumes impacting growth, COIN stock has corrected by 26% for the same period. However, with strong fundamentals and diversification plans, the correction provides an attractive entry opportunity.

Multiple Growth Triggers

While COIN stock has corrected sharply, there are multiple reasons to be bullish. First, Coinbase is moving beyond crypto into an “Everything Exchange.” This implies a single platform for crypto, derivatives, equities, and prediction markets, among others. Besides revenue growth acceleration, this diversification will ensure no significant decline in earnings if there is a bear market in one asset class.

The second growth trigger for Coinbase is global expansion. The company is focusing on all key markets like Singapore, the U.K., Brazil, India, and the European Union. This will help reduce dependency on U.S. operations. Further, as the addressable market expands with a broad portfolio of offerings, top line growth is likely to be robust.

Importantly, Coinbase ended Q4 with a cash buffer of $11.3 billion. With a strong balance sheet, the company is well positioned to improve its platform and invest in global expansion. Further, Coinbase reported operating cash flow of $2.4 billion for FY25. Healthy cash flows have also ensured that Coinbase creates shareholder value through aggressive share repurchase.

What Analysts Say About COIN Stock

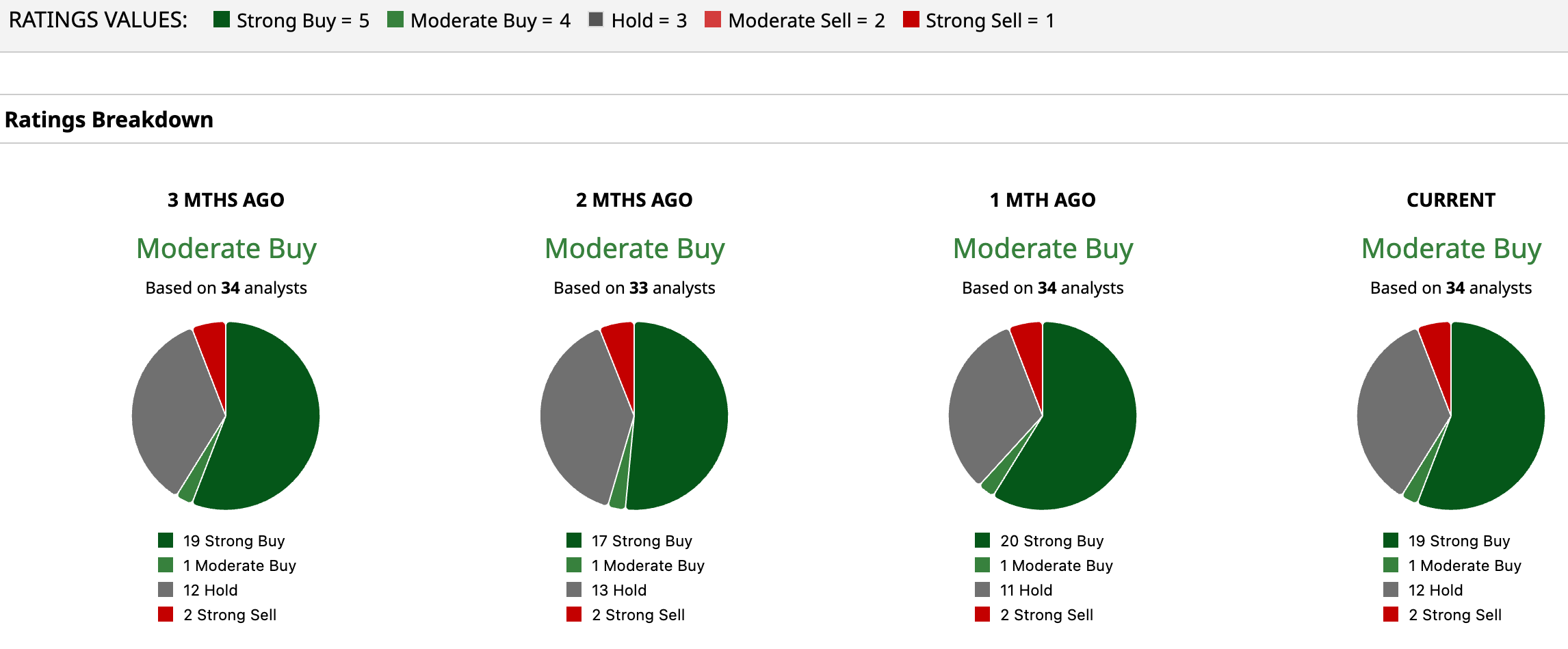

Given the ratings of 34 analysts, COIN stock is a consensus “Moderate Buy.” While 19 analysts assign a “Strong Buy” rating to COIN, one analyst opines that the stock is a “Moderate Buy.” Further, 12 analysts believe that the stock is a “Hold.” Finally, on the bearish side, two analysts have a “Strong Sell” rating.

Based on these ratings, analysts have a mean price target of $293.63 currently, which would imply an upside potential of 73.3%. Further, the most bullish price target of $479.3 suggests that COIN stock could rise as much as 183% from here.

Last month, BofA Securities upgraded COIN stock from “Neutral” to “Buy” with a price target of $340. BofA analysts believe that “company’s product velocity has increased and its TAM expanded in parallel.”

From a valuation perspective, COIN stock trades at a forward price-earnings ratio of 26. This seems attractive considering the point that analysts expect earnings growth for FY26 at 34.49%. The valuation underscores the optimistic view of analysts, and it’s likely that COIN stock will trend higher from current levels.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart