Chicago, Illinois-based Northern Trust Corporation (NTRS) is a financial holding company with a market cap of $27.7 billion. It provides wealth management, asset servicing, asset management, and banking solutions for corporations, institutions, families, and individuals.

This asset management company has outpaced the broader market over the past 52 weeks. Shares of NTRS have soared 31.3% over this time frame, while the broader S&P 500 Index ($SPX) has gained 11.8%. Moreover, on a YTD basis, the stock is up 7.2%, while SPX has dropped marginally.

Zooming in further, NTRS has also outperformed the State Street Financial Select Sector SPDR ETF (XLF), which decreased marginally over the past 52 weeks and dropped 5.7% on a YTD basis.

Shares of NTRS gained 6% on Jan. 22, after it posted impressive Q4 results. The company delivered total revenue of $2.1 billion, up 8.4% from the year-ago quarter, and posted net income of $2.42 per share, rising 7.1% year-over-year. Mid-single-digit expansion in trust fees, a double-digit increase in net interest income, and disciplined cost management, contributed to its strong performance.

For fiscal 2026, ending in December, analysts expect NTRS’ EPS to grow 9.9% year over year to $9.90. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

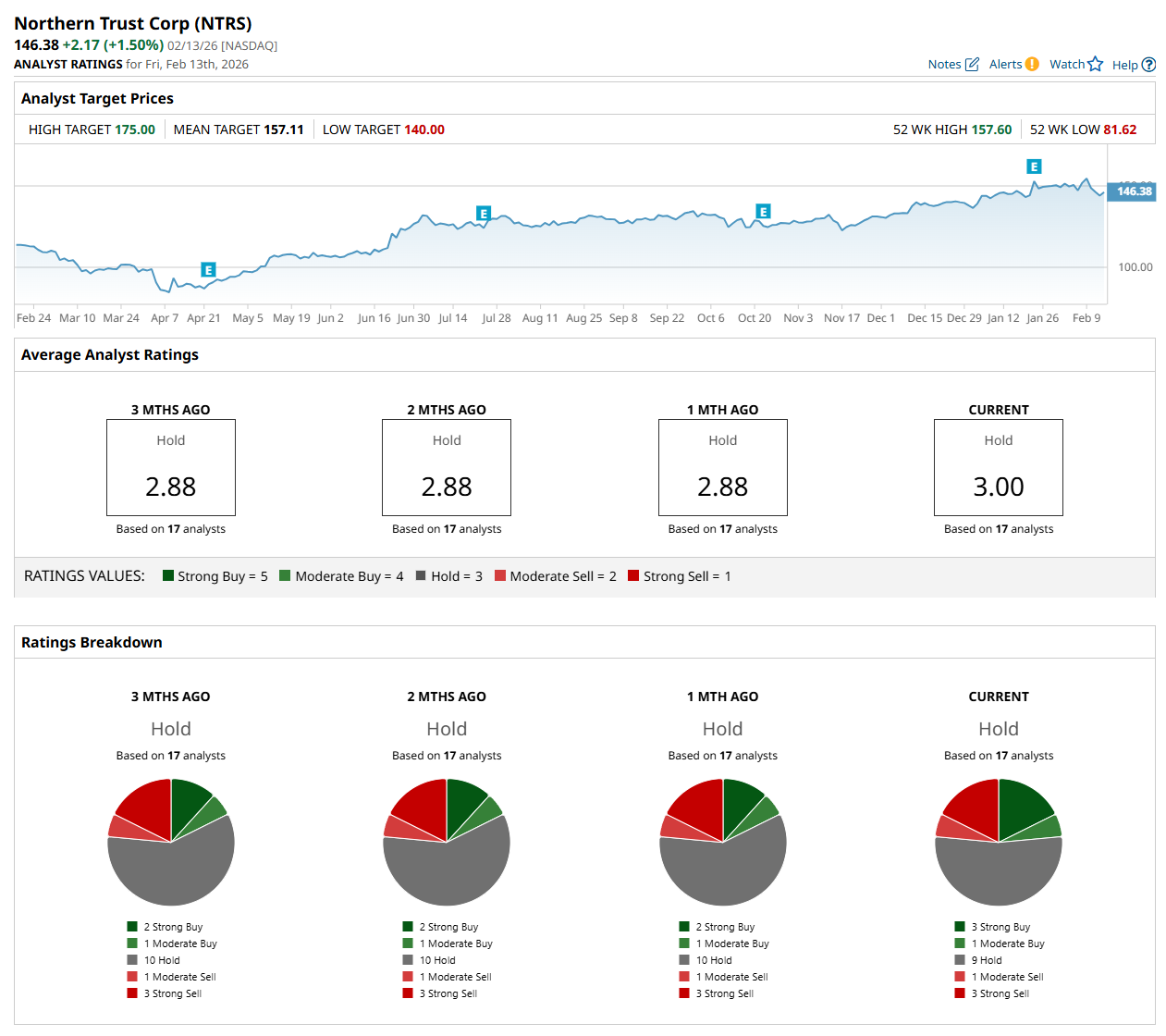

Among the 17 analysts covering the stock, the consensus rating is a "Hold,” which is based on three “Strong Buy,” one "Moderate Buy,” nine “Hold,” one "Moderate Sell,” and three “Strong Sell” ratings.

The configuration is less bearish than a month ago, with two analysts suggesting a “Strong Buy” rating.

On Feb. 12, JPMorgan Chase & Co. (JPM) analyst Vivek Juneja maintained a "Neutral" rating on NTRS and raised its price target to $153.30, indicating a 4.9% potential upside from the current levels.

The mean price target of $157.11 represents a 7.3% premium to its current price levels, while its Street-high price target of $175 suggests a 19.6% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart