Reston, Virginia-based VeriSign, Inc. (VRSN) provides internet infrastructure and domain name registry services that enable internet navigation for various recognized domain names. It is valued at a market cap of $20.1 billion.

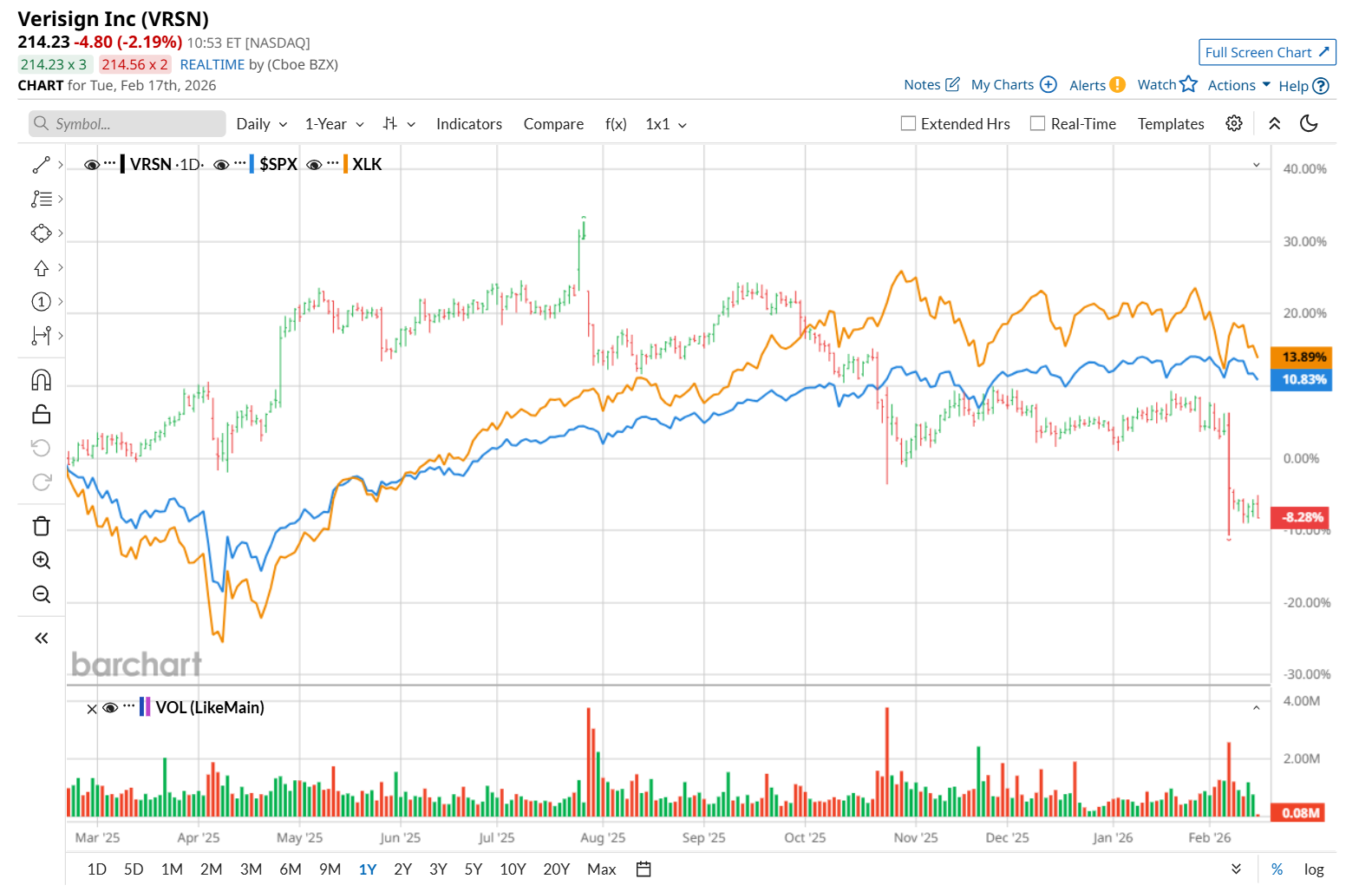

This tech company has lagged behind the broader market over the past 52 weeks. Shares of VRSN have declined 5.1% over this time frame, while the broader S&P 500 Index ($SPX) has gained 11.8%. Moreover, on a YTD basis, the stock is down 10.4%, compared to SPX’s marginal drop.

Narrowing the focus, VRSN has also underperformed the State Street Technology Select Sector SPDR ETF (XLK), which gained 14.8% over the past 52 weeks and dropped 4.3% on a YTD basis.

On Feb. 5, VRSN delivered its Q4 results, and its shares plunged 7.6% in the following trading session. The company’s revenue increased 7.6% year-over-year to $425.3 million, while its EPS grew 11.5% from the year-ago quarter to $2.23, but missed consensus estimates, which might have made investors jittery. It processed 10.7 million new domain name registrations for .com and .net, as compared to 9.5 million for the same quarter in 2024.

For fiscal 2026, ending in December, analysts expect VRSN’s EPS to grow 5.2% year over year to $9.27. In Q4, the company fell short of the consensus estimates by 2.6%.

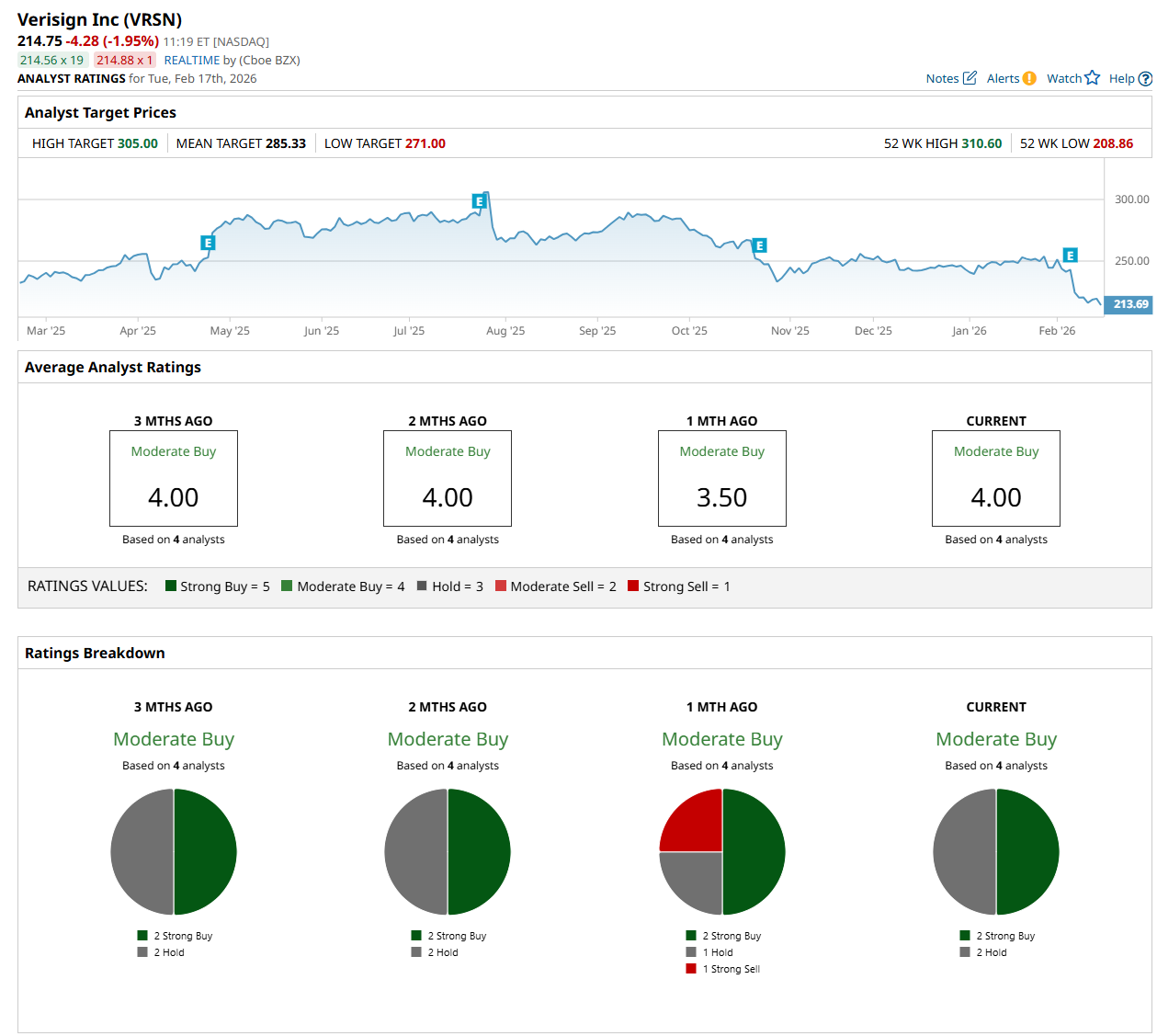

Among the four analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on two “Strong Buy” and two “Hold” ratings.

The configuration is more bullish than a month ago, with one analyst suggesting a “Strong Sell” rating.

On Feb. 9, Citigroup Inc. (C) maintained a "Buy" rating on VRSN but lowered its price target to $280, indicating a 30.4% potential upside from the current levels.

The mean price target of $285.33 suggests a 32.9% potential upside from the current levels, while its Street-high price target of $305 suggests a 42% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart