In the world of tech stocks, we're starting to see some serious bifurcation take hold among companies across different sectors. Whether we're talking about semiconductor manufacturers, memory companies, power and utility players, or application-focused enterprises and consumer-focused companies, there are plenty of different options to choose from as ways to play a rising tide (driven by artificial intelligence) that has raised most boats in the tech sector over the course of the past three years.

That said, within these technology sub-sectors, memory companies have become one of my core focal points. That's because we're seeing a divergence in performance among certain sectors with shortages and those without. In some areas of the chips market (for example), supply gluts are leading investors to reconsider their profitability and earnings growth metrics for these companies, particularly if investors are growing increasingly concerned about future profitability and margins from the mega-cap hyperscalers and data center operators, which continue to drive the narrative forward.

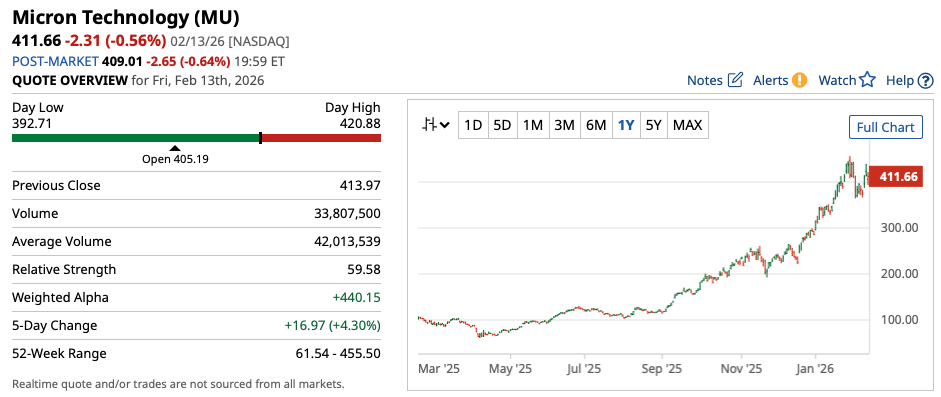

Among the memory companies that I think have increased upside in this environment is Micron (MU). Here's why analysts at Morgan Stanley agree and have increased their price target by about 30% on the memory maker, due to a focus on just that: shortages. These shortages are certainly one of the reasons why MU stock has taken off over the course of the past year, surging roughly 300% over this time frame.

Let's dive into why this particular company is worth considering due to its improving fundamentals.

Why the Upgrades?

Micron's status as a leading memory maker positions the company well, particularly if the sorts of supply shortages we've seen in recent years continue. Morgan Stanley analyst Joseph Moore noted that he expects Micron and its competitors to ratchet up production in 2026. However, his view is also that demand should far outstrip new supply coming onto the market, further bolstering the operating and net margins of companies like Micron.

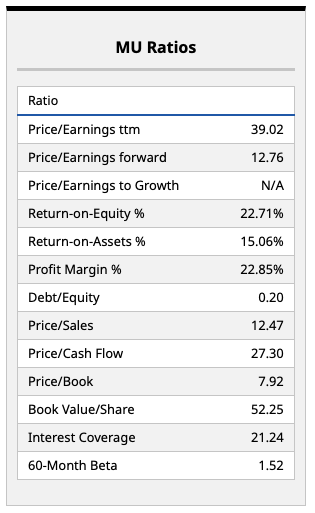

Looking at Micron's underlying fundamental ratios shown above, it's clear that many of the key metrics long-term investors often consider are moving in the right direction. With an operating margin of nearly 23%, a return on equity figure that's right around the same, and a forward price/earnings ratio of less than 13 times, one could make the argument that MU stock still looks very cheap at current levels. That's despite the aforementioned dizzying run this stock has been on of late.

Indeed, if the company's margins and revenue growth continue to expand as many believe, I think Micron is a company that could have plenty of room to run from here. Let's dive into what other Wall Street analysts think of Micron's improving prospects and where this stock could be headed over the next year to 18 months.

Other Analysts Are Also Bullish

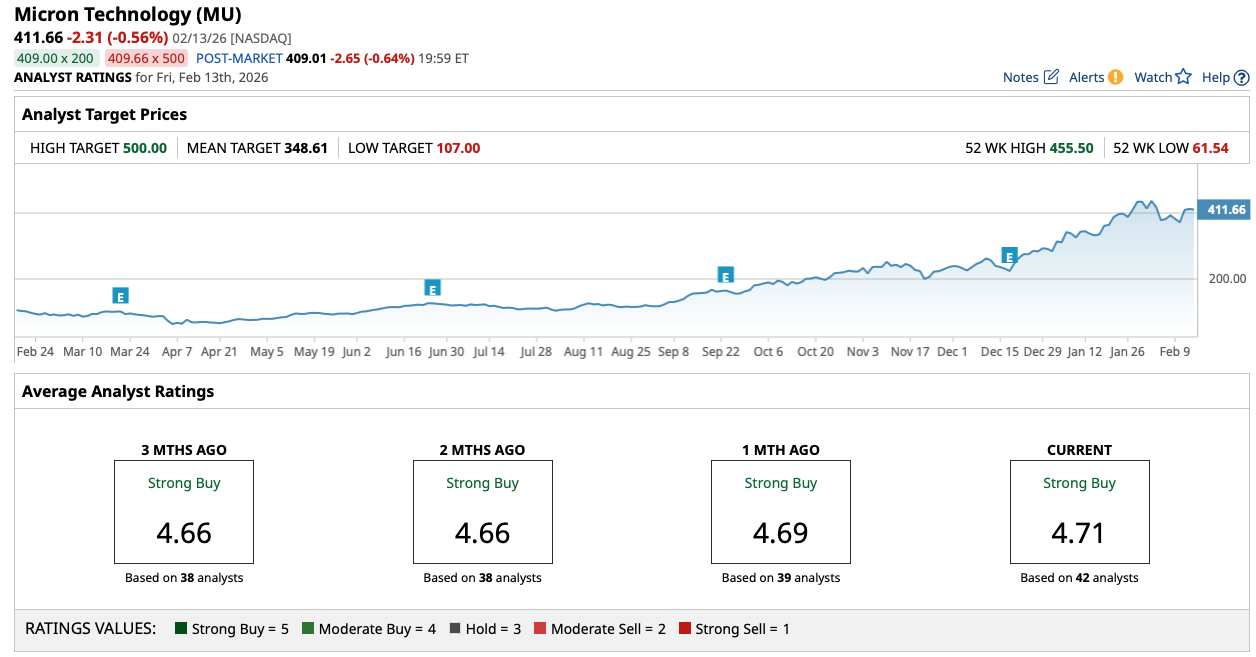

Wall Street analysts collectively appear to be a little more cautious than those at Morgan Stanley. With a consensus average price target of $348.61, MU stock does look overvalued when one considers the aggregate total of the expert analysis done on this name.

However, as I've pointed out in the past, stock prices can rise much faster over a short period of time than analysts can update their models. I think this is a similar situation we've seen with other high-flying tech stocks supported by strong fundamentals. The market catches on, a given stock catches fire in the market, and analysts have to scramble to increase their targets to account for the fundamental changes market participants have already seen in particular names. That does appear to be what's going on in this case, at least in my view.

I think other Wall Street analysts are likely to catch up in their assessments of Micron, particularly if we see another earnings blowout on the horizon. I think this earnings season is poised to be a big one, and MU stock should stand out as a winner in this regard.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart