Stock buybacks have become the preferred method of returning value to shareholders over the last decade, almost tripling in value for the top 1200 companies globally during this period. So when companies announce a new buyback program, it sounds like just another development. Investors reacted differently, however, when Coinbase (COIN) announced it had bought back about 8 million shares in the previous quarters in an attempt to reduce share dilution. The stock went up 16% on the news as investors welcomed the news.

Some of the positivity also stems from increasing momentum on the progress of the US Clarity Act. CEO Brian Armstrong is confident the regulatory approval will materialize soon. Such a move will further enable institutional access to the digital assets industry, one that Coinbase has already positioned itself as a leading platform for.

About Coinbase Stock

Coinbase operates a cryptocurrency exchange, allowing people to buy, sell, transfer, and store different types of digital currencies. The company was founded in June 2012 by Brian Armstrong and Fred Ehrsam.

COIN is down 36% over the last 12 months, mirroring the broader cryptocurrency market decline. During the same period, the COIN50 Index, an index that tracks the 50 biggest and most liquid digital assets, is down 34.6%.

Coinbase looks overvalued considering its forward price-to-earnings ratio of 37.87x. It looks even more overvalued when one looks at the five-year PEG ratio of 10x, significantly overvalued considering a ratio of 1x is considered fair value.

The digital assets industry is not only new, but it also has question marks hanging over its long-term viability. Quantum computing could significantly alter the crypto space, rendering blockchain technology and many other coins built upon it obsolete. Regulatory hurdles and legal issues continue to hinder progress, resulting in investors staying away from investing in the space. Bitcoin (BTCUSD) may be the best asset class of the last decade, but statistics like these do not necessarily strengthen the regulatory case.

For now, crypto remains an uncertain space, and therefore investors would need a significant discount to put their money into this industry’s progress. Currently, Coinbase does not offer the margin of safety investors are looking for. However, it must also be added that those who believe in this industry are happy to pay a premium and aren’t necessarily looking for attractive valuations.

Coinbase Reports Declining Revenues

Coinbase announced its earnings report on Feb. 12, reporting revenue of $1.8 billion for the quarter. This was down 5% quarter-over-quarter (QoQ), with transaction revenue down 6% QoQ to $983 million. Subscription and services revenue also went down sequentially to $727 million. Higher USDC rewards and Deribit and Echo acquisitions drove operating expenses up to $1.5 billion. The company now sits on $11.3 billion in cash and cash equivalents.

The subscription and services revenue should continue to fall in the ongoing quarter, expected to come in somewhere between $550 million and $630 million. This isn’t great news for investors, but the downtrend is likely going to continue if crypto prices stay depressed.

The management also downplayed the significance of the technical outages during the quarter, reassuring analysts that those problems were resolved. While the company focuses on growth in a volatile crypto market, it is well supported by a strong balance sheet and an aggressive buyback strategy.

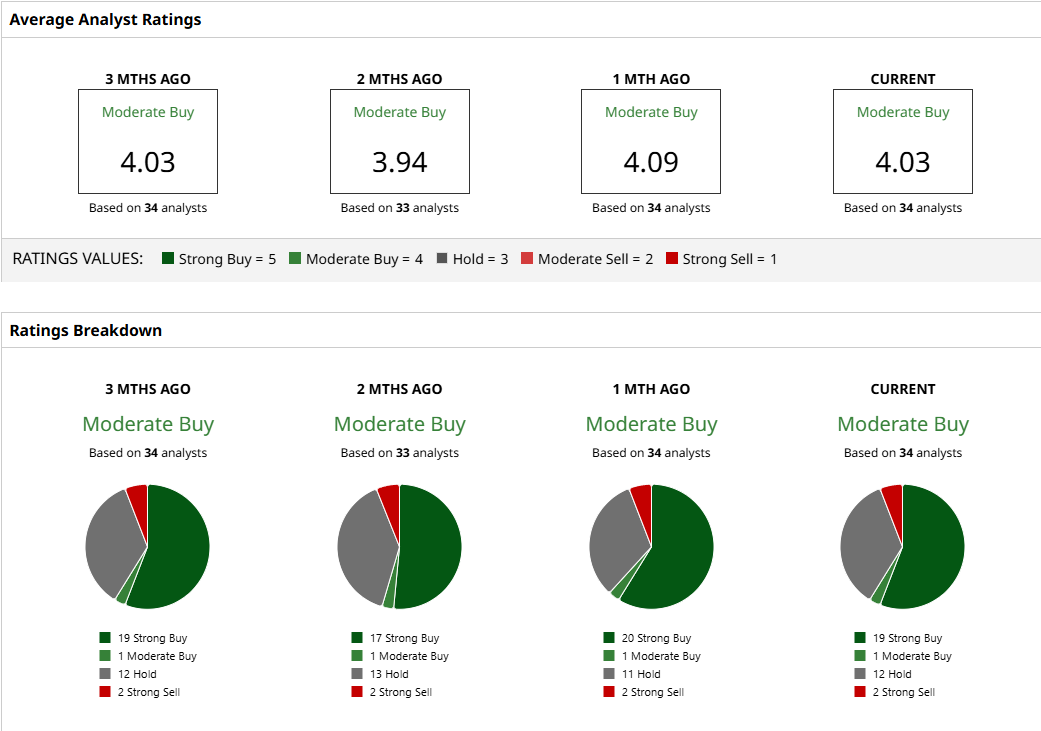

What Are Analysts Saying About COIN Stock?

On Feb 17, Mizuho lowered Coinbase's price target from $280 to $170. The firm has said that the lower bitcoin prices and a negative sentiment in the crypto market are hurting the company’s fundamentals. They’ve gone one step further and called Robinhood (HOOD) a better company at this stage, but the rest of Wall Street is still bullish on COIN stock.

Of the 34 analysts that cover the stock, 19 still have a “Strong Buy” rating, with only two “Strong Sells.” The mean target price of $261.61 still offers 53% upside. However, it is clear to many investors that this turnaround is unlikely unless the broader digital assets market turns bullish.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart