With a market cap of $58.1 billion, Vistra Corp. (VST) is a leading U.S. integrated retail electricity and power-generation company that produces, markets, and sells electricity and related energy services to residential, commercial, and industrial customers. Headquartered in Irving, Texas, Vistra operates one of the country’s largest competitive generation fleets alongside a major retail energy business serving multiple deregulated power markets.

Shares of the electricity retailer have underperformed the broader market over the past 52 weeks. VST stock has soared 3.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 11.9%. However, shares of the company are up 7.7% on a YTD basis, outpacing SPX's marginal drop.

Looking closer, shares of Vistra have underperformed the State Street Utilities Select Sector SPDR Fund's (XLU) 17.3% rise over the past 52 weeks and 8.6% return in 2026.

On Jan. 16, Vistra shares fell more than 7% as power-generation stocks broadly declined following reports that President Trump was pushing for an emergency wholesale electricity auction and measures to shift rising power costs onto large technology customers.

For FY2025 that ended in December 2025, analysts expect VST's EPS to decline 25% year-over-year to $5.25. The company's earnings surprise history is mixed. It beat or met the consensus estimates in three of the last four quarters while missing on another occasion.

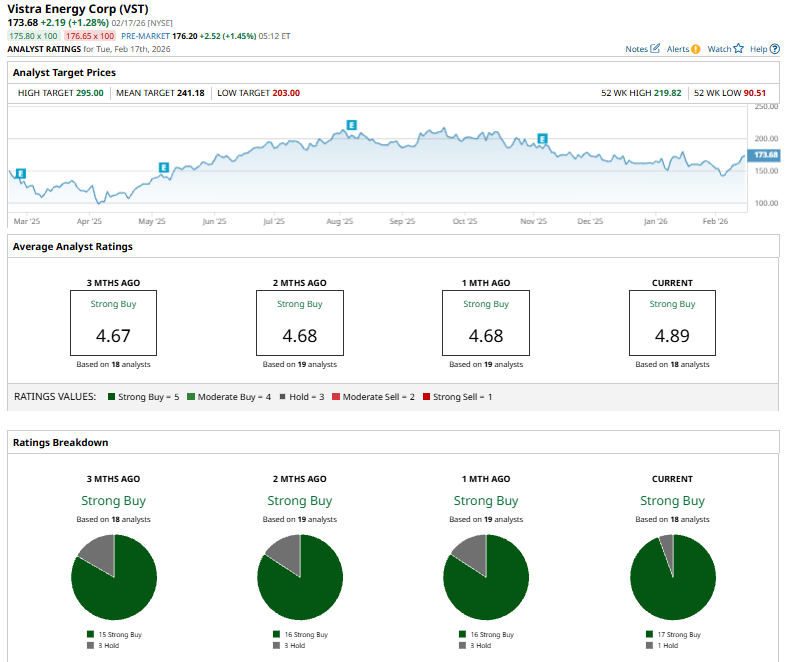

Among the 18 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 17 “Strong Buy” ratings and one “Hold.”

This configuration is more bullish than one month ago, with 16 “Strong Buy” ratings on the stock.

On Feb. 10, Jefferies analyst Julien Dumoulin-Smith upgraded Vistra to “Buy” from “Hold” and raised the price target to $203 from $191, citing a more attractive risk-reward after the stock’s roughly 25% decline since September. The firm argues the selloff overlooks positives such as newly announced Texas data-center power contracts and the attractively priced Cogentrix acquisition, and believes current valuation fails to reflect additional future data-center opportunities.

The mean price target of $241.18 represents a premium of 38.9% to VST's current price. The Street-high price target of $295 suggests a 69.9% potential upside.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Goldman Sachs Is Pounding the Table on This 1 Rare Earths Stock: New Price Target Implies 50% Upside

- 3 Option Ideas to Consider this Wednesday for Income and Growth

- Stock Index Futures Climb as AI Jitters Ease, FOMC Minutes and U.S. Economic Data in Focus

- Earn While You Sleep: 3 High-Yield Dividend Stocks to Buy and Hold Forever