New York-based Moody's Corporation (MCO) operates as an integrated risk assessment firm. With a market cap of $76.1 billion, the company provides credit ratings and related research, data and analytical tools, quantitative credit risk measures, risk scoring software, and credit portfolio management solutions and securities pricing software and valuation models.

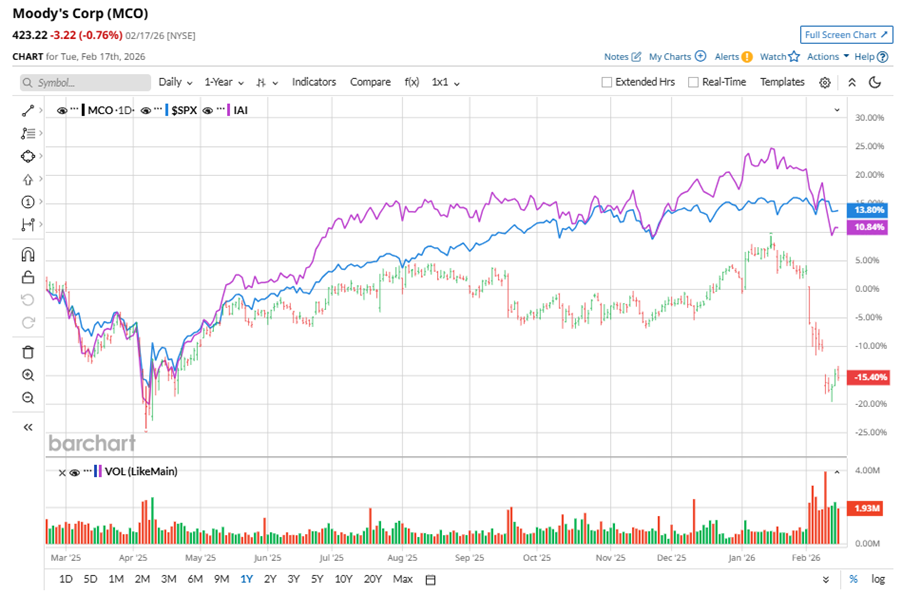

Shares of this credit rating giant have underperformed the broader market over the past year. MCO has declined 19.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 11.9%. In 2026, MCO stock is down 17.2%, compared to the SPX’s marginal fall on a YTD basis.

Narrowing the focus, MCO’s underperformance is also apparent compared to the iShares U.S. Broker-Dealers & Securities Exchanges ETF (IAI). The exchange-traded fund has gained about 6.5% over the past year. Moreover, the ETF’s 5.6% dip on a YTD basis outshines the stock’s double-digit losses over the same time frame.

Today, on Feb. 18, MCO reported its Q4 results. Its revenue stood at $1.9 billion, up 13% year over year. The company’s adjusted EPS grew 38.9% from the year-ago quarter to $3.64.

For fiscal 2025, ended in December, analysts expect MCO’s EPS to grow 18.5% to $14.78 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

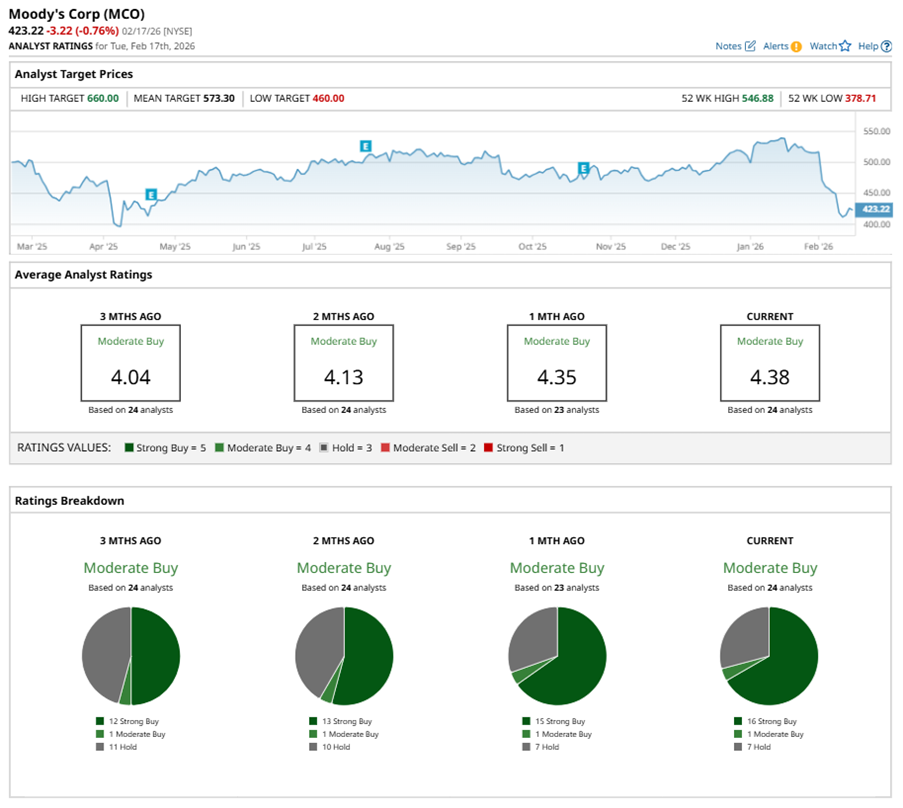

Among the 24 analysts covering MCO stock, the consensus is a “Moderate Buy.” That’s based on 16 “Strong Buy” ratings, one “Moderate Buy,” and seven “Holds.”

This configuration is more bullish than a month ago, with 15 analysts suggesting a “Strong Buy.”

On Feb. 10, RBC Capital analyst Ashish Sabadra maintained a “Buy” rating on MCO and set a price target of $610, implying a potential upside of 44.1% from current levels.

The mean price target of $573.30 represents a 35.5% premium to MCO’s current price levels. The Street-high price target of $660 suggests an ambitious upside potential of 55.9%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Warren Buffett Regrets Relarning This Lesson About Investing: It’s Important to Find Businesses ‘Where Tailwinds Prevail Rather Than Headwinds’

- Goldman Sachs Is Pounding the Table on This 1 Rare Earths Stock: New Price Target Implies 50% Upside

- 3 Option Ideas to Consider this Wednesday for Income and Growth

- Stock Index Futures Climb as AI Jitters Ease, FOMC Minutes and U.S. Economic Data in Focus