Artificial intelligence (AI) is no longer a side project for Big Tech. It's the main engine of growth. Demand is rising fast, and the world’s largest companies are investing billions to build the computing power needed to stay ahead.

Against this backdrop, Nvidia (NVDA) and Meta Platforms (META) announced a sweeping, multi-year partnership for the social media giant’s AI infrastructure expansion. Under the deal, Meta will significantly expand its use of Nvidia’s Grace CPUs in its data centers, marking the first large-scale Grace-only deployment. The companies are also preparing for the future rollout of Nvidia’s upcoming Vera CPUs, expected to scale next year.

Meta will further integrate Nvidia’s Spectrum-X Ethernet to improve network efficiency and throughput, deploy GB300 systems across its infrastructure, and rely on Nvidia’s cloud partner network to streamline operations. In addition, the social media giant has adopted Nvidia’s Confidential Computing for WhatsApp to enhance AI capabilities while protecting user privacy.

This is not a small upgrade. It's a deep, full-stack collaboration across chips, networking, and software. Both stocks, which are members of the “Magnificent Seven,” moved higher on the news. So, which one is the stronger long-term buy? Let’s take a closer look.

The Case for Meta Platforms Stock

Meta’s story started in a Harvard dorm room in 2004. What began as Facebook — a simple way to connect students — has evolved into a global ecosystem that includes Instagram, WhatsApp, Messenger, and Threads. Today, billions rely on Meta’s platforms daily. But the company is not standing still. It is pouring resources into AI, augmented reality, and its long-term metaverse vision to build the backbone of how people interact in a more intelligent digital world. Meta now carries a market capitalization of about $1.62 trillion.

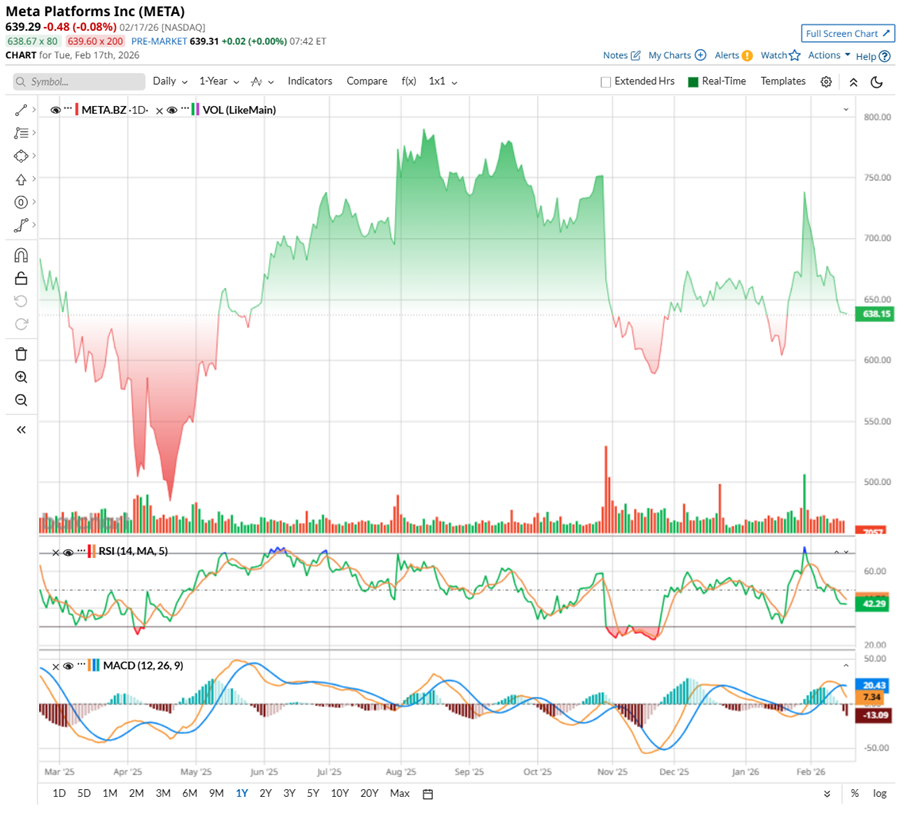

That ambition is reflected in META stock’s trajectory, but lately the momentum has cooled, proving that even market giants need to catch their breath. After a powerful multi-year rally, META has entered a cooling phase. Although the stock reached a year-to-date (YTD) high near $744 in late January after its fourth-quarter report, shares are down about 3% on a YTD basis, extending volatility that followed a sharp post-Q3 earnings drop last October. Over the longer 52-week period, META stock is down 9%.

Technically, the 14-day RSI sits near 43, drifting below the neutral 50 mark after flashing overbought conditions earlier. This suggests momentum has softened but is not yet deeply oversold. Meanwhile, the MACD line remains above zero, indicating the broader trend is still steady, yet it has crossed below the signal line, with red histogram bars emerging. That combination implies fading short-term momentum within a still-positive longer-term structure.

In essence, META stock is digesting prior gains. The long-term AI narrative remains intact, but near-term concerns around spending and ad demand are keeping investors cautious.

In terms of valuation, META does not scream “bargain.” Priced at about 21 times forward earnings and 8 times sales, it trades above sector averages. But investors are paying for a company with massive scale, strong cash flow, and bold bets in AI, robotics, and the metaverse. If those investments start driving faster profits, today’s price tag may not look stretched at all.

Plus, Meta now pays investors to stick around, with a $2.10 annualized dividend per share, yielding roughly 0.33%.

Meta Rises After Stellar Q4 Numbers

Meta Platforms reported fourth-quarter and full-year 2025 results on Jan. 28. Shares jumped 10% in response, signaling that investors liked what they heard. Revenue climbed 24% year-over-year (YOY) to $59.9 billion, powered by strong ad demand across Meta’s Family of Apps. That segment delivered $58.9 billion in revenue, up 25%, with ad revenue alone rising 24% to $58.1 billion. Reality Labs, while still smaller, brought in $955 million. Net income increased 9% to $22.8 billion, and EPS rose 11% to $8.88, beating expectations. Operating margin landed at 41%, slightly narrower than last year’s quarter as AI infrastructure and investment costs moved higher.

Zooming out, full-year 2025 revenue hit $201 billion, up 22% YOY. Net income declined by 3% to $60.5 billion, while EPS dipped 2% to $23.49 as expenses tied to AI expansion weighed on profitability.

Meta’s balance sheet remains sturdy. It ended the year with $81.59 billion in cash, cash equivalents, and marketable securities. Q4 operating cash flow was $36.2 billion, and free cash flow reached $14.08 billion. For the full year, operating cash flow totaled $115.8 billion, with free cash flow at $43.59 billion. The company repurchased $26.26 billion of stock and paid $5.32 billion in dividends.

AI is clearly the centerpiece. Management highlighted plans for new models and products, and sales of AI-powered glasses tripled, making them one of the fastest-growing consumer electronics categories.

Looking ahead to 2026, the company expects Q1 revenue between $53.5 billion and $56.5 billion. Full-year expenses are projected between $162 billion and $169 billion, with capital expenditures expected to surge between $115 billion and $135 billion to build out data centers, custom silicon, and AI infrastructure. Despite the heavy spending, management remains confident that operating income in 2026 will exceed last year’s levels. That’s a clear signal that Meta believes today’s investment wave will fuel tomorrow’s profitability.

Analysts predict EPS to be around $29.67 for fiscal 2026, down slightly YOY, before rising by 14% annually to $33.79 in fiscal 2027.

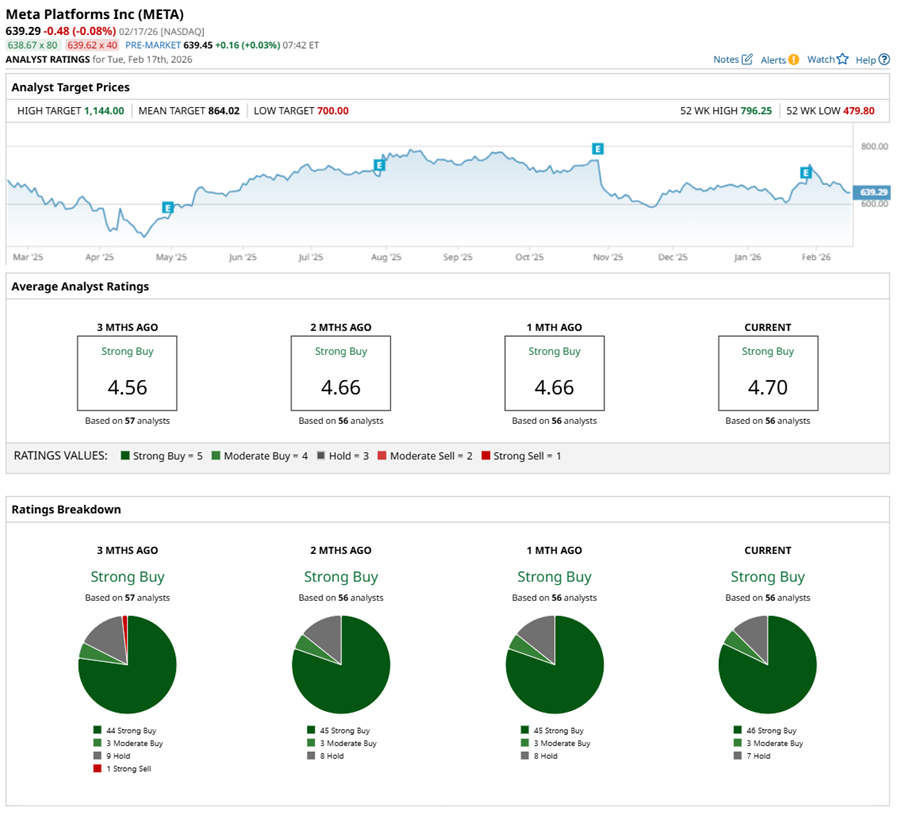

Considering the above, Wall Street is upbeat on META. Overall, META stock has a consensus “Strong Buy” rating. Of the 56 analysts covering the stock, 46 recommend a “Strong Buy,” three suggest a “Moderate Buy,” and the remaining seven analysts have a “Hold” rating.

The average analyst price target for is $864.02, which indicates potential upside of 34% from here. The Street-high target price of $1,144 suggests that META stock could rally as much as 77% from current levels.

The Case for Nvidia Stock

Valued at roughly $4.56 trillion by market capitalization and based in Santa Clara, California, Nvidia has become the nerve center of modern computing. Its chips, systems, and software power everything from hyperscale data centers to the most advanced AI models worldwide. Quarter after quarter, Nvidia has posted blockbuster results, tightening its grip on the AI infrastructure stack and cementing its status as the industry’s undisputed leader.

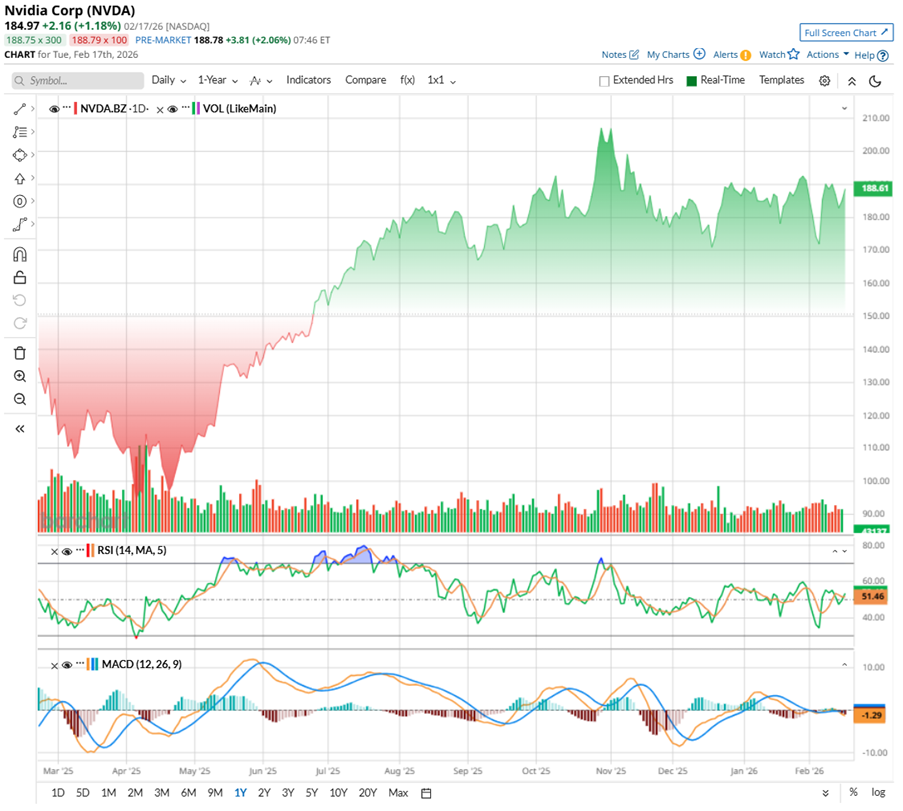

That leadership shows up clearly on the chart. Over the past year, NVDA stock has climbed 35%, with pullbacks looking more like breathers than breakdowns. Shares peaked around $212.19 in late October before easing roughly 11% — a reset that cooled momentum without damaging the broader uptrend. Even after that pullback, the stock remains comfortably elevated and holding onto most of its prior gains.

Technically, the 14-day RSI sits near 53, right around neutral territory. That’s a notable shift from October, when the RSI pushed above 80, flashing overbought conditions. The reset suggests momentum has cooled without turning negative. Meanwhile, the MACD line remains slightly below the signal line, indicating short-term momentum is soft. However, with both lines hovering near the zero level, the signal reflects digestion, not collapse.

At first glance, NVDA stock doesn’t come cheap. Trading around 26.3 times forward adjusted earnings, it sits above most peers and is notably richer than Meta. Still, it’s below Nvidia’s own historical average, which adds context. The company continues to post strong double-digit growth and healthy margins, helping justify the premium. And while the yield is modest, Nvidia has quietly delivered 13 consecutive years of dividend payments.

Nvidia’s Q3 Earnings Snapshot

When the chipmaker released its Q3 numbers on Nov. 19, NVDA stock climbed nearly 3% as investors absorbed another quarter of outsized growth paired with confident guidance. Revenue surged 62% YOY to $57 billion while adjusted EPS jumped 60% to $1.30, both beating projections.

The data center segment once again carried the load, soaring 66% to $51.2 billion as AI demand remained relentless. Networking turned into a breakout story of its own, with revenue skyrocketing 162% to $8.2 billion, driven by strong adoption of NVLink, InfiniBand, and Spectrum-X Ethernet. Gaming delivered a solid 30% growth, while automotive quietly expanded 32% YOY, showing that Nvidia’s reach goes well beyond AI servers.

Financially, the company remains in a powerful position. In the first nine months of fiscal 2026, Nvidia returned $37 billion to shareholders through buybacks and dividends, with $62.2 billion still authorized. Cash and marketable securities climbed to $60.6 billion, while long-term debt declined to $7.5 billion.

Looking ahead, Nvidia is scheduled to report its Q4 results on Feb. 25. Management has guided for revenue of approximately $65 billion, plus or minus 2%, signaling continued strength in AI-driven demand. With Blackwell Ultra ramping and cloud GPU capacity effectively sold out, expectations remain elevated. The upcoming report will be closely watched to see whether Nvidia can once again outperform and extend its remarkable growth trajectory.

Analysts tracking the AI chip giant project its Q4 fiscal 2026 revenue to be $65.68 billion, while EPS is anticipated to grow 70% YOY to $1.45. For fiscal 2026, the bottom line is projected to grow by 51% YOY to $4.43 per share, before surging by another 59% to $7.03 in fiscal 2027.

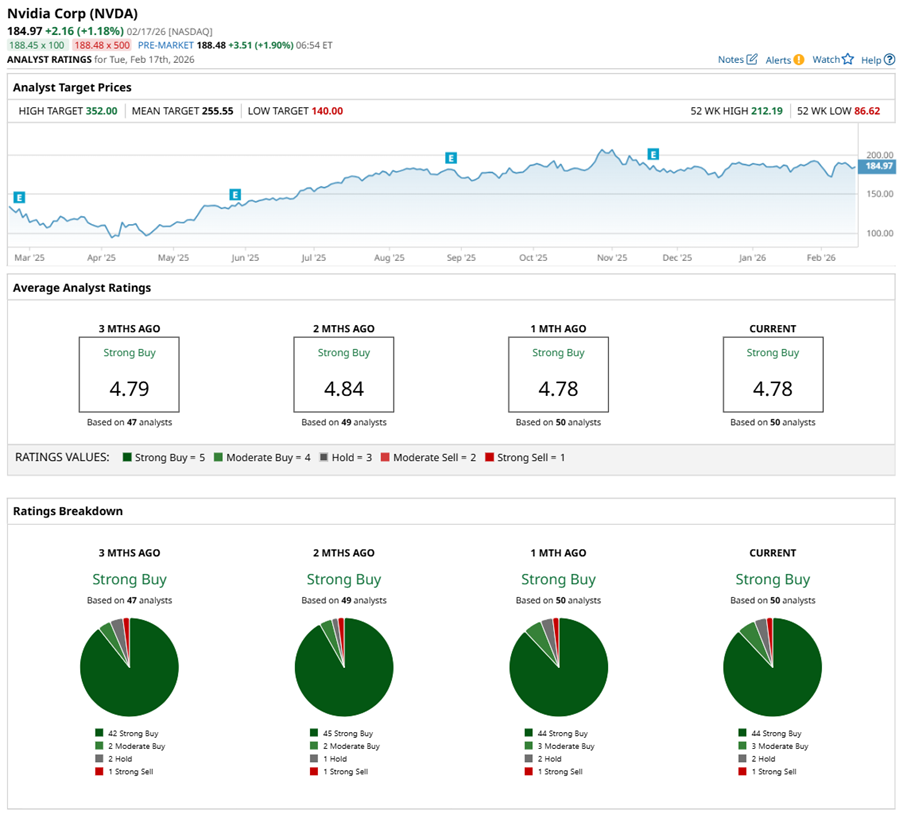

Analysts are bullish about NVDA stock’s growth prospects, giving it a consensus rating of “Strong Buy." Of the 50 analysts covering the stock, 44 advise a “Strong Buy,” three suggest “Moderate Buy,” two have a “Hold” rating, and one suggests a “Strong Sell.”

The average analyst price target is $255.55, indicating potential upside of 36%. Meanwhile, the Street-high target of $352 suggests that shares could rally as much as 87% from here.

META or NVDA: Which Stock Is the Better Buy?

The new multi-year partnership strengthens the link between Meta Platforms and Nvidia, but it does not make the investment decision simple — it sharpens the contrast.

For Nvidia, the deal reinforces its position as a critical supplier of CPUs and networking gear, boosting revenue visibility and deepening customer lock-in. The company benefits immediately — selling the infrastructure, collecting cash, and reinforcing its ecosystem. Meanwhile, Nvidia already generates massive revenue from high-performance chips, and with the compute market set to expand sharply in the coming years, its growth momentum remains strong.

Meta’s upside is more layered. The partnership strengthens its computing backbone, potentially improving efficiency, engagement, and long-term monetization across its platforms. But returns depend on execution. Meta Platforms is absorbing the spending today in pursuit of a future payoff. The good news is that META trades at a lower valuation than NVDA and pays a higher-yielding dividend, providing some cushion while investors wait. But Meta is building now — pouring billions into AI to sharpen its advertising engine and chase broader AI leadership. That spending has made some investors uneasy.

Beyond the headlines, the real comparison lies in financial strength, consistency, and shareholder returns, ultimately hinging on timing and individual risk appetite. There's no question — both stocks could be solid buys in the AI era, boasting proven track records. But Meta’s relative valuation may offer the more attractive risk-reward balance today.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Goldman Sachs Says MP Materials Stock Can Gain More Than 30% From Here. Should You Buy MP Stock?

- Anthropic’s CEO Warns Humans Face a ‘Critical Test as a Species’ as AI Ramps Up. What’s Behind the Stark Message?

- Down 24% in 2026, Where Is Palantir Stock Headed Next and Should You Buy PLTR Here?

- As Meta and Nvidia Announce a Huge, Multi-Year Partnership, Which Is the Better Stock to Buy?