Alphabet (GOOG) (GOOGL) is Google's parent company, a tech powerhouse dominating search, advertising, cloud computing, and AI. It runs Google Search (90%+ global share), YouTube (2.5 billion users), Android (3 billion devices), Google Cloud, and moonshots like Waymo self-driving cars and Verily health tech. With AI woven into everything from Search to Workspace, Alphabet powers daily life for billions while innovating in entertainment, maps, and enterprise tools.

Created on Oct. 2, 2015, through Google's restructuring, Alphabet is headquartered in Mountain View, California. It operates worldwide in 200+ countries and territories.

Alphabet Stock Slows Down Slightly

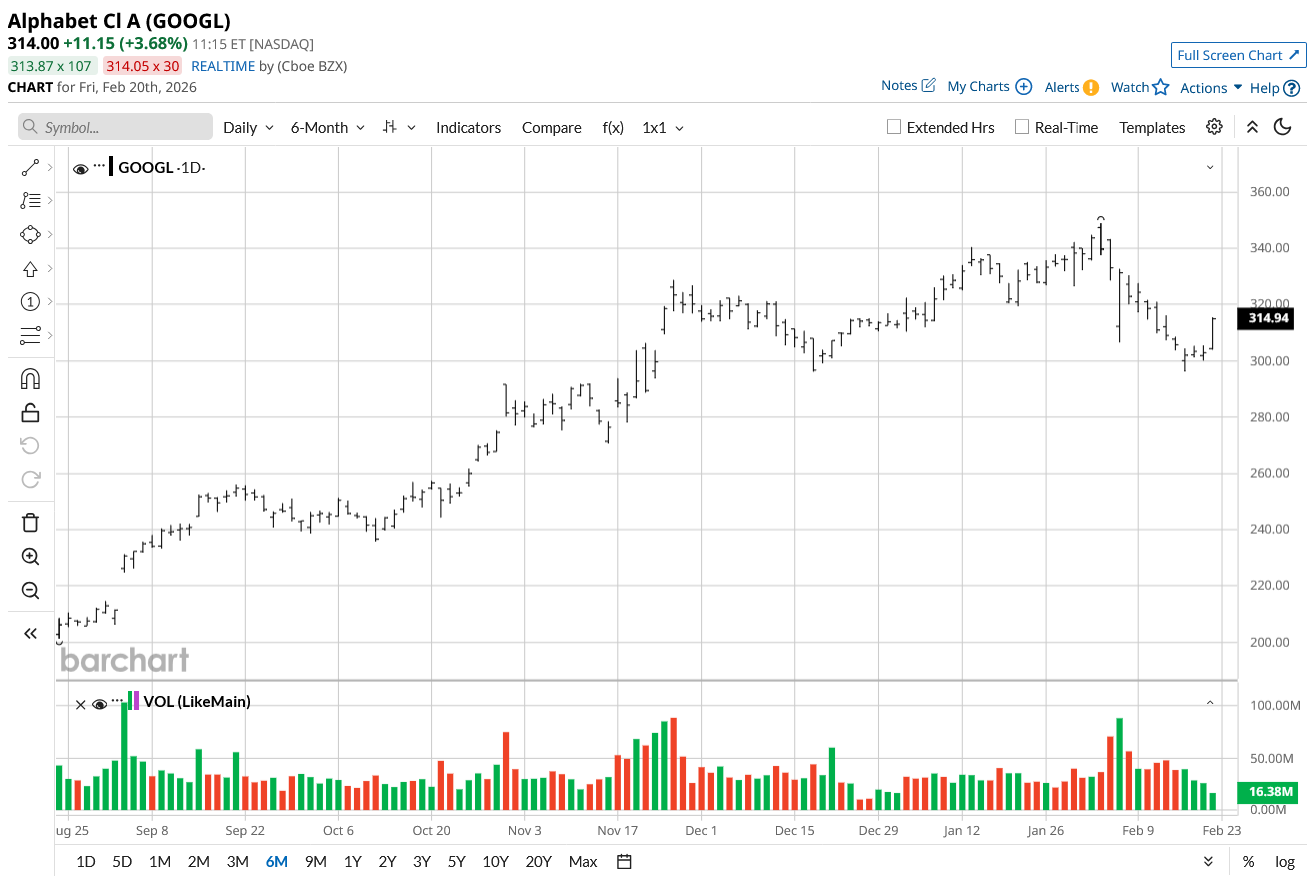

Alphabet's stock shows signs of a little short-term weakness amid concerns about AI spending. The five-day performance is up just 1.6%, one month is down 2.3%, but six months soared 57%; year-to-date (YTD) is just about flat, and 52-week is up 69% from $142.66 lows to $350 highs, and beta 1.09 tracks market swings.

Against the S&P 500 Communication Services Index ($SSPL) (up 15% yearly), GOOGL outperforms with 69% 52-week gains versus the sector's steadier pace, though the recent flat price action reflects broader tech pullbacks.

Alphabet Results Beat Estimates

Alphabet posted fourth-quarter 2025 results on Feb. 4, 2026, with total revenue of $113.8 billion, up 18% year-over-year (YoY) and beating analyst estimates of $111.4 billion by 2.2%. GAAP EPS reached $2.82, surpassing expectations of $2.61-$2.64 by 7-9.7%, driven by strong Search and Cloud growth.

Search & Other generated $63 billion (+10%), YouTube ads $11.38 billion (up from prior), but Google Cloud stole the show at $12.8 billion (+85%), flipping to $4.2 billion operating profit (421% surge) on enterprise AI demand. Operating income rose 31% to $30.8 billion (margin 31.6%), free cash flow margin dipped to 21% from capex ramp-up ($13 billion+), yet its cash pile exceeds $100 billion for buybacks/dividends. Other Bets (Waymo, Verily) grew modestly.

Alphabet guided 2026 capex to $75-85 billion, nearly double 2025 levels, for AI/cloud expansion. Management emphasized AI agents, Search upgrades, and enterprise wins amid competition.

Tudor Takes Alphabet

Paul Tudor Jones's Tudor Investment launched a fresh position in Alphabet Class C shares during Q4, snapping up 764,000 shares worth $238.9 million, a key bet on Big Tech.

The fund fully exited Meta Platforms (META) (194,000 shares) and Spirit AeroSystems (following the Boeing acquisition (BA)), while adding Sealed Air (SEE) (4.19 million shares, $173.4 million) and J.P. Morgan Chase (JPM) (301,000 shares, $96.8 million). Tudor ramped up iShares Core S&P 500 ETF (IVV) to 1.40 million shares ($956.7 million) from 19,000 and Exact Sciences (EXAS) to 1.98 million shares ($200.9 million), but trimmed State Street S&P 500 ETF (SPY) to 445,000 shares ($1.47 million) and iShares Bitcoin Trust (IBIT) to 577,000 shares ($28.6 million).

Should You Buy GOOGL Stock?

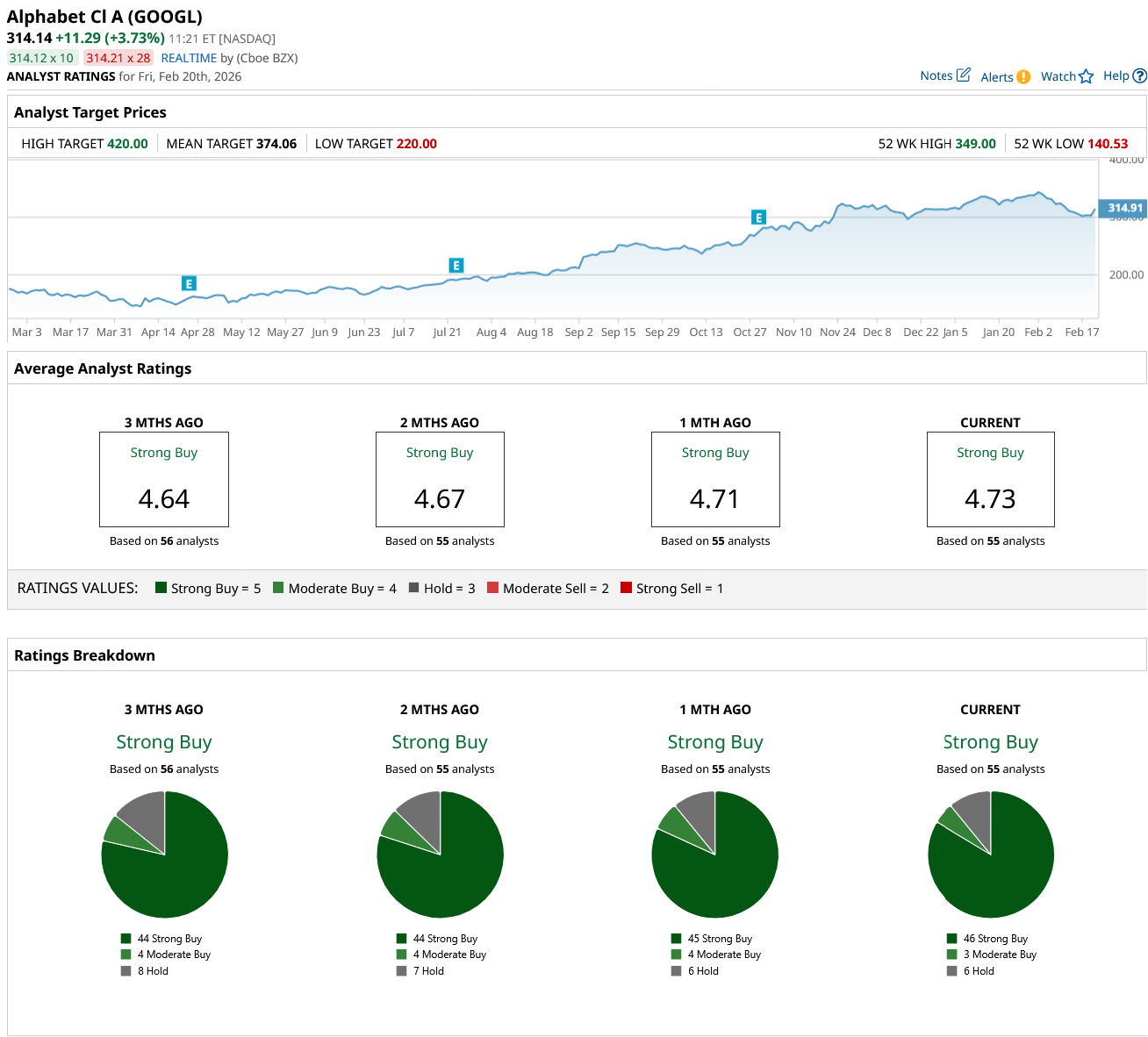

Alphabet’s recent dip does show some concerns, but market experts show confidence in the tech giant with a consensus “Strong Buy” rating and a mean price target of $374.06, reflecting an upside potential of 23% from the market rate.

GOOGL stock has a total of 55 ratings, which include 46 “Strong Buy” ratings, three “Moderate Buy” ratings, and six “Hold” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart