It’s the final trading day of a holiday-shortened week. Volatility is rising -- the VIX has risen by over 43% since the beginning of the year -- with investors waiting to see what happens in Iran.

To make matters worse, the Commerce Department reported this morning that America’s GDP in the fourth quarter increased by 1.4%, 300 and 240 basis points lower than Q3 2025 and Q2 2025, respectively.

Add to this a 3.0% annualized increase in core prices in December, which excludes food and energy, and it’s becoming abundantly clear that tariffs are having some effect on prices, as companies can no longer avoid passing on the extra cost. A war in Iran would most certainly lead to higher gas prices, exacerbating an already sticky inflation rate.

Who knows what this means for the stock market? It seems to have a mind of its own.

In yesterday’s unusual options activity, three stocks with big gains over the past 12 months had call and put options with Vol/OI (volume-to-open-interest) ratios above 7.0.

If you bought them a year ago or earlier, you might want to consider implementing a Protective Collar options strategy. Here's why.

Have an excellent weekend.

What Is a Protective Collar Strategy?

As the name suggests, you are creating a collar around your existing long stock position by selling a put with a strike price below the share price and buying a call with a strike price above it.

By doing so, you’re providing downside protection for your shares, while capping the future upside. It’s an appropriate strategy when you’re unsure about the near-term direction of the stock price.

Let’s go to the stocks themselves. All recognizable businesses, I would think.

Caterpillar (CAT)

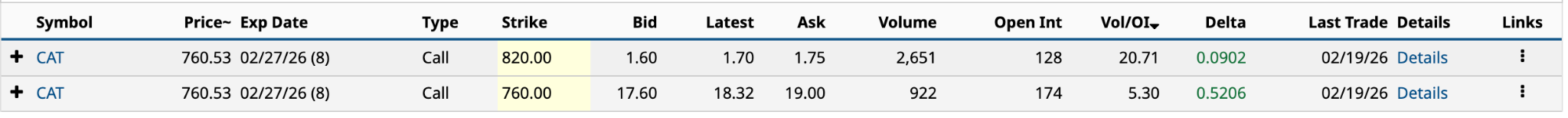

Caterpillar’s (CAT) stock is up 118% over the past 12 months. Although it had two unusually active options yesterday, it is the Feb. 27 $820 strike that will form one part of the protective collar. Based on yesterday’s closing price, you’re capping the gains over the next week at 7.8%. The expected move is less than half that.

So, now we must select a long put to protect on the downside—ideally, something ATM (at-the-money) or slightly OTM (out-of-the-money). Ultimately, you want to give yourself the best chance of making money over the next week while protecting against a significant price drop.

The odds of this happening are low. The expected move is 3.61% or $27.27 based on a share price of $765.36. So, you’ll want a put strike price of $740 or higher while keeping the cost of this protection reasonable.

Based on the $740 put strike, the net debit or cost of the protective collar is $9.55 ($955), or $1.3% of the $755.76 share price. That’s more than reasonable, while giving the bet a 41.2% chance of making money. Your maximum profit here is more than double the maximum loss.

If you paid $34,000 for 100 shares of CAT stock in February 2025 and the share price is $740 next Friday, your maximum loss is $2,531 [$740 put strike price -$755.76 share price - $9.55 net debit]. If the share price is $728.49 at expiration [$755.76 share price - $27.27 expected move], you still are only out $2,531.

However, net-net, you’re still up about 114% from a year ago.

Wayfair (W)

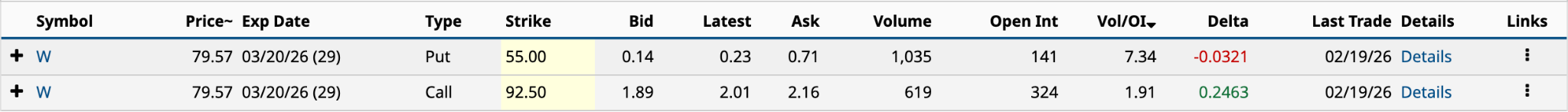

The $55 put combined with the $92.50 call could be a ready-made protective collar for Wayfair (W) bulls. The DTE (days to expiration) of 29 days is much better than Caterpillar’s DTE. Generally, 30-90 days is better because it balances downside protection with a reasonable cost.

Wayfair’s stock is up 73% over the past 12 months. That said, it’s given back 34% since hitting a 52-week high of $119.98 in mid-January. Yesterday, it lost 13% after reporting poor Q4 2025 results. As I write this late morning Friday, it’s gained some of that back.

I’ve never liked Wayfair’s business. It struggles to make money consistently -- the company reported an EBITDA (earnings before interest, taxes, depreciation and amortization) profit of $743 million on $12.46 billion in revenue in 2025 -- and now it wants to go on the offensive to take market share and grow the top line. Investors are right to be concerned.

If you bought W stock last February at $41, you’re probably wishing you’d put a protective collar in place in January. Hindsight is 20/20. But it’s not too late to do so.

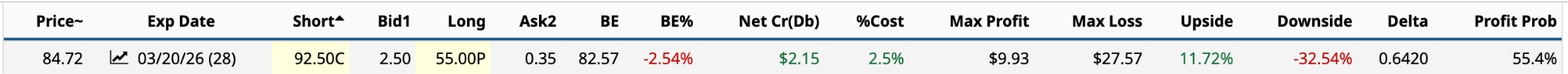

As you see above, the short $92.50 call combined with the long $55 put has a net credit of $2.15 ($215) or 2.5% of its share price. While the net credit is tempting, if you bought a year ago, you don’t want your profits to evaporate over the next month after what’s already taken place since mid-January.

As you see above, the short $92.50 call combined with the long $55 put has a net credit of $2.15 ($215) or 2.5% of its share price. While the net credit is tempting, if you bought a year ago, you don’t want your profits to evaporate over the next month after what’s already taken place since mid-January.

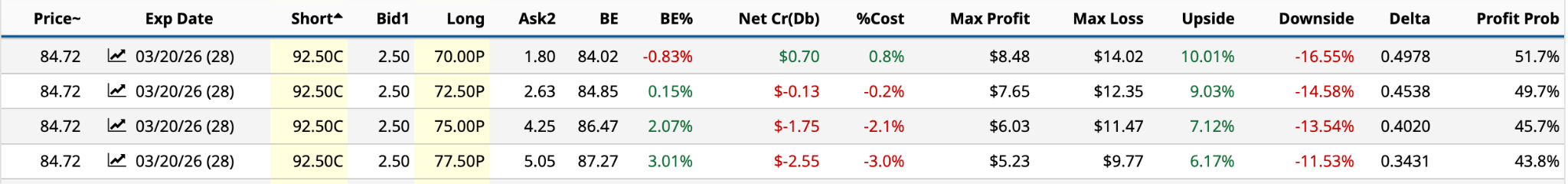

So, I would go for a put strike price of $70 or higher.

When you think about it, the $77.50 put’s net debit of $2.55 isn’t a high price to pay to stem the bleeding. In mid-January, based on a $41 purchase price, you were up 193% at the 52-week high of $119.98. You’re now up 107%. If it were me, I’d be reluctant to let those gains fall below triple digits, especially given that W stock spent the better part of 3 years trading in the $40s before taking flight last April.

Protection costs. There’s no way around it.

Southwest Airlines (LUV)

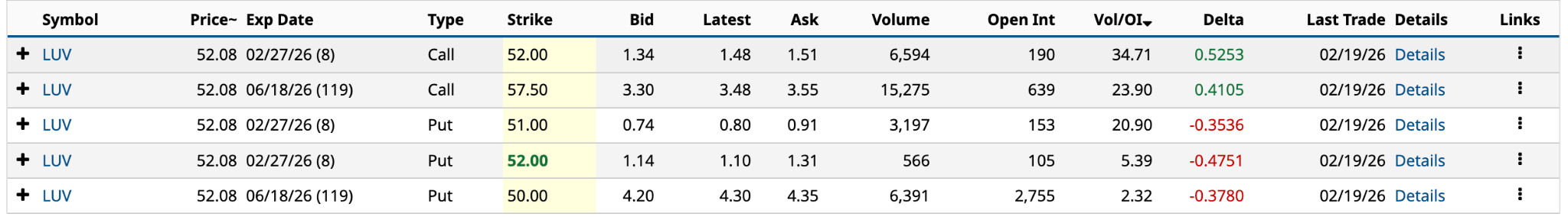

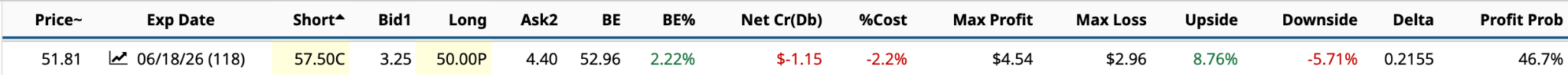

Of the five unusually active options yesterday, I’m focused on the $57.50 call and $50 put expiring in June. The risk with such a long DTE is that you could miss out on significant appreciation. The expected move over the next 119 days is $9.14 (17.64%), which puts the upper share price at $61.22.

If you bought Southwest Airlines (LUV) stock a year ago at $30, that’s about double over 16 months. That’s not insignificant. Not to mention, the Wall Street mean target price for Southwest’s stock is $48.07, below its current share price, so it’s not inconceivable that the shares drop $9.14 over the next 119 days rather than rise.

Based on the above, the $1.15 net debit is a reasonable 2.2% of the share price. Your maximum loss of $2.96 is just 5.7% of the current share price. So, even if you did hit your maximum loss, if you bought a year ago at $30, you’d still be up 63%.

Now, if you believe in letting your winners run, and the airline is making major changes to how it operates, you might be reluctant to cap your upside.

“‘Our detailed work suggests potential for upside to LUV’s previous targets on extra legroom and assigned seating,’ analysts led by Atul Maheswari wrote. ‘Other initiatives such as checked bag fees, increased share of corporate travel, and loyalty enhancements, among others should also drive strong earnings accretion over the next couple of years,’” Barron’s reported the analyst’s recent comments.

As they say, execution is everything. Southwest hasn’t operated at maximum efficiency for several years. I’m skeptical they can match a well-run airline like Delta Air Lines (DAL).

I guess we’ll find out soon enough.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Unusual Options Activity Alert: If You Own These 3 Stocks, It’s Time for a Protective Collar

- Palo Alto Networks Stock Has Tanked But Its Free Cash Flow is Strong - Time to Buy PANW?

- 3 Steps to a Simple Trading System

- 21,000 Reasons Cogent Communications’ Unusual Options Activity Screams Bull Call Spread